The market rally after the election is fading. The S&P 500 has dropped below 6,000, Treasury yields are near four-month highs, and the Fed isn’t planning to cut rates soon.

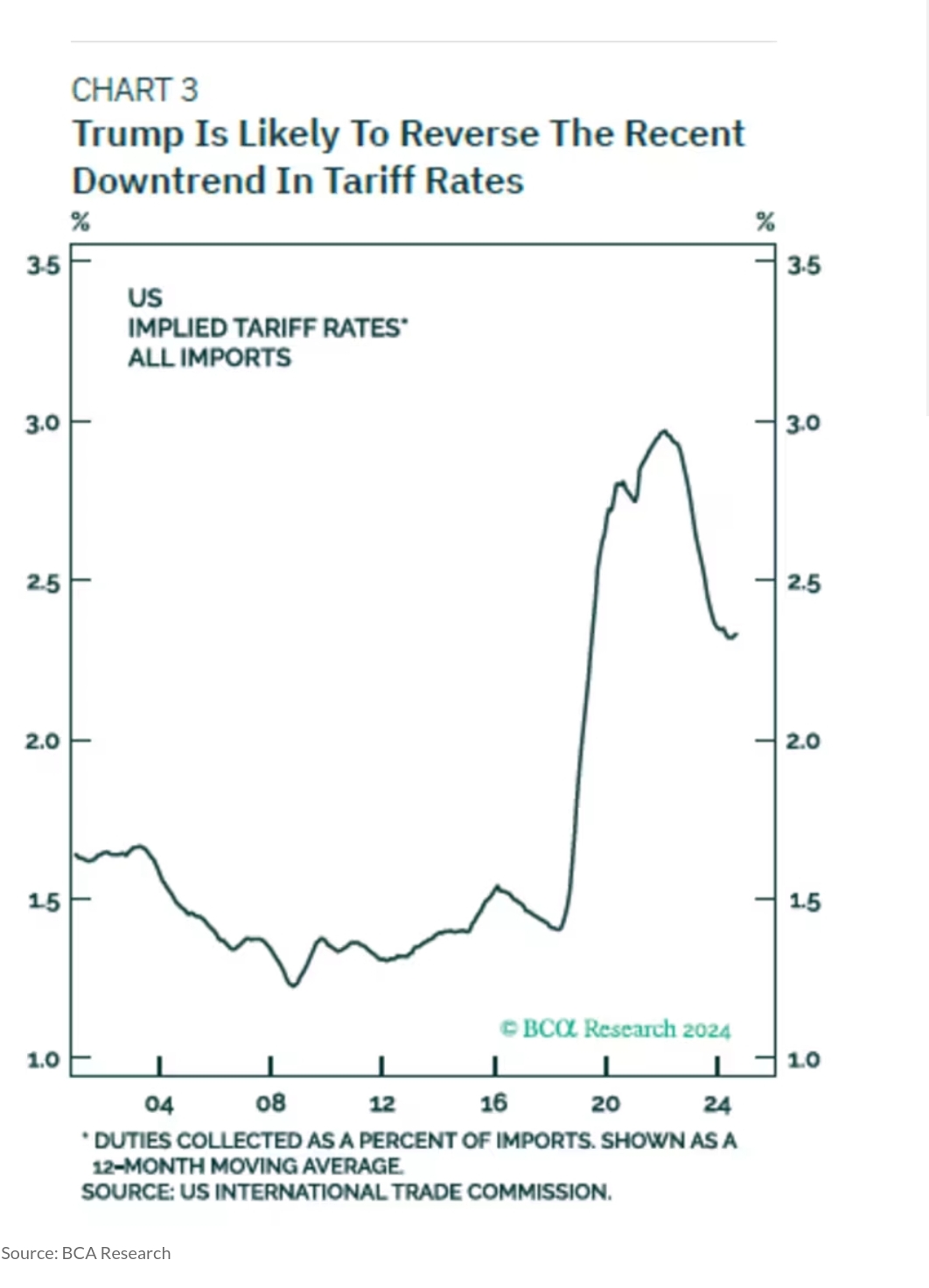

Peter Berezin, chief global strategist at BCA Research, now sees a 75% chance of a U.S. recession in the next year. He believes Trump’s tax cuts and deregulation might help a bit, but spending cuts and tariffs could cause more harm than good.

Tariffs are a big worry. Berezin thinks they’re not just a strategy but a long-term plan. A Yale study says these tariffs could reduce household income by $1,900 to $7,600, hitting low-income families hardest. Even tax cuts wouldn’t make up for the damage.

Proposed cuts to programs like Medicaid and food stamps could also hurt the economy. These programs create a lot of economic activity because recipients spend most of what they receive.

Berezin also warns that extending Trump’s tax cuts could increase federal debt by $5.35 trillion in the next decade. This could lead to higher borrowing costs and Treasury yields. The Fed, already cautious about inflation, might keep interest rates high, making the slowdown worse.

For businesses, lower corporate taxes could slightly boost earnings, but tariffs could wipe out those gains. Higher costs and trade conflicts might reduce profits, capital spending, and productivity.

Berezin advises being careful with investments. He suggests a small shift away from stocks and towards bonds. If signs of a recession grow stronger, he plans to recommend moving heavily into bonds.

In short, Berezin believes Trump’s policies could do more harm than good, and investors should prepare for tougher times ahead.

Additionally, U.S. equity funds saw a major surge in investor demand during the week ending Nov. 13, with $37.37 billion in net purchases, marking the largest weekly inflow since at least January 2014. This surge was driven by optimism that a potential return of Donald Trump to office would boost U.S. corporate earnings. Investors believe Trump’s policies, including lower taxes, reduced regulations, and more mergers, will benefit U.S. companies.

Small-cap equity funds experienced strong demand, attracting $7.43 billion in net inflows, the highest in four months. Large-cap funds also saw $18.89 billion in inflows, the largest in six weeks, while multi-cap and mid-cap funds received $2.66 billion and $633 million, respectively. Financial sector funds saw $4.42 billion in inflows, the biggest in a decade, while industrials and consumer discretionary sectors drew $1.28 billion and $453 million, respectively.

U.S. bond funds continued to perform well, with $5.71 billion in net inflows for the 24th consecutive week. Taxable domestic fixed income funds and loan participation funds attracted $2.5 billion and $2.15 billion, respectively. Money market funds also saw strong interest, with $76.56 billion in net purchases over two weeks.

In emerging markets, foreign investors withdrew $25.5 billion from equities in October, marking the largest outflow since March 2020. However, emerging market debt posted a $27.4 billion inflow. Overall, emerging market debt and equity portfolios saw a combined $1.9 billion in net inflows in October.

Bonus

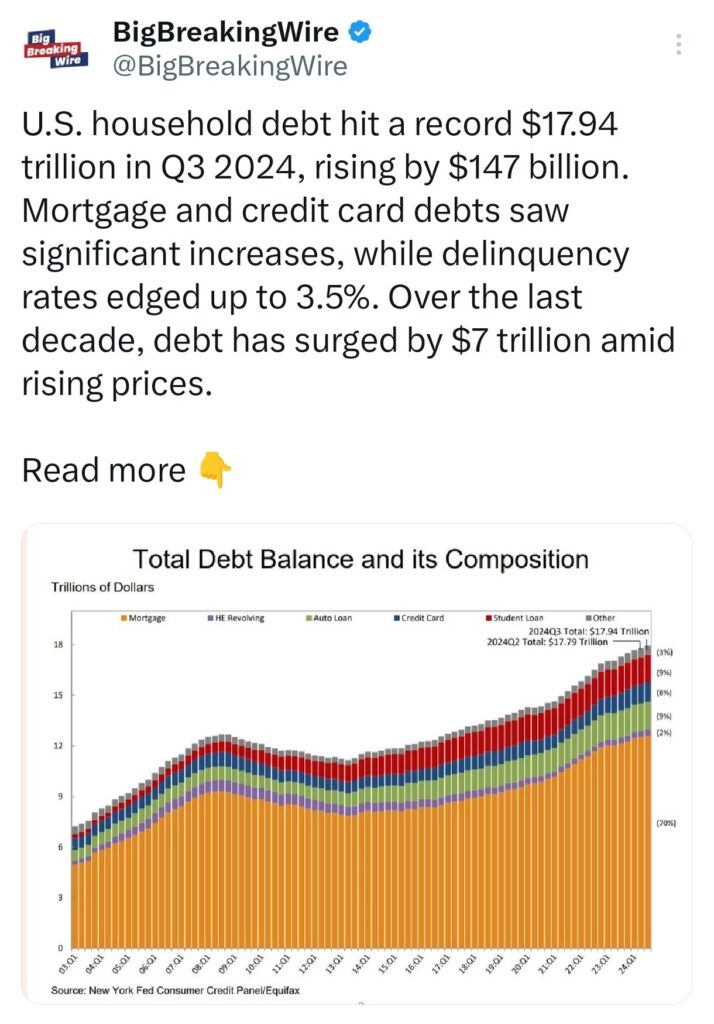

Household debt in the U.S. reached a record high of $17.94 trillion in Q3 2024, rising by $147 billion. Over the past year, debt has increased by $778 billion, driven by rising prices. Mortgage debt rose by $75 billion to $12.98 trillion, while credit card debt increased by $24 billion to $1.17 trillion. Auto loans and home equity lines of credit (HELOCs) also saw growth. Delinquency rates edged up to 3.5% of total debt, showing signs of financial strain for many households, even though income growth has outpaced debt growth. Over the last decade, household debt has surged by $7 trillion.

Europe’s stock market is significantly lagging behind the US, experiencing its widest underperformance in nearly three decades. As of 2024, the S&P 500 has surged by 25%, while Europe’s benchmark Stoxx 600 has risen only 5%. This marks the largest performance gap between the two since 1995. The disparity is largely driven by a global shift towards US assets, a trend that began following Donald Trump’s victory in the 2016 US presidential election. The preference for US equities over European stocks has continued to widen the gap, reflecting investor confidence in the US market.

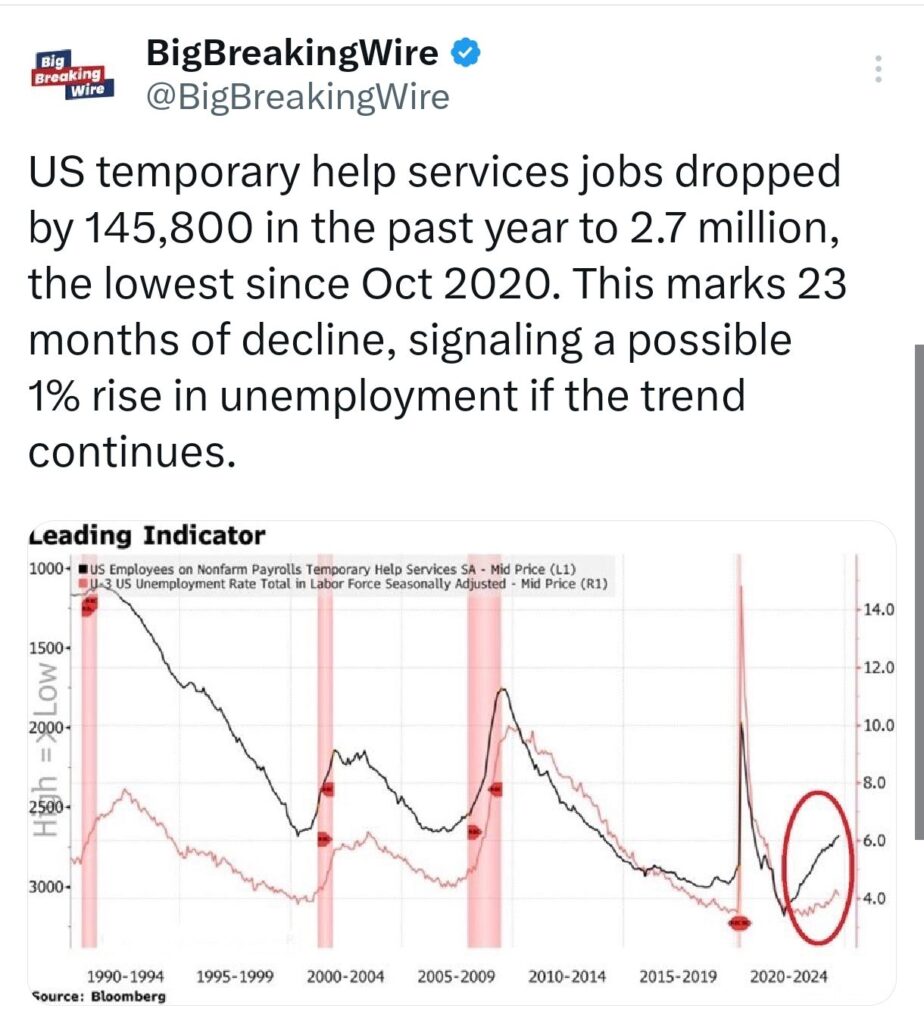

In the past year, temporary help services jobs in the United States have decreased by 145,800, bringing the total to 2.7 million. This marks the lowest level since October 2020 and reflects a 23-month ongoing decline in these positions. If this downward trend persists, it could result in a potential increase of 1% in the national unemployment rate.

As of October 15, U.S. households held a record 48% of their assets in stocks, marking the highest share ever. In contrast, their cash allocations have dropped to a near-record low of just 15%. Goldman Sachs predicts that in 2025, households will purchase $50 billion worth of equities, driven by continued economic resilience and strength.

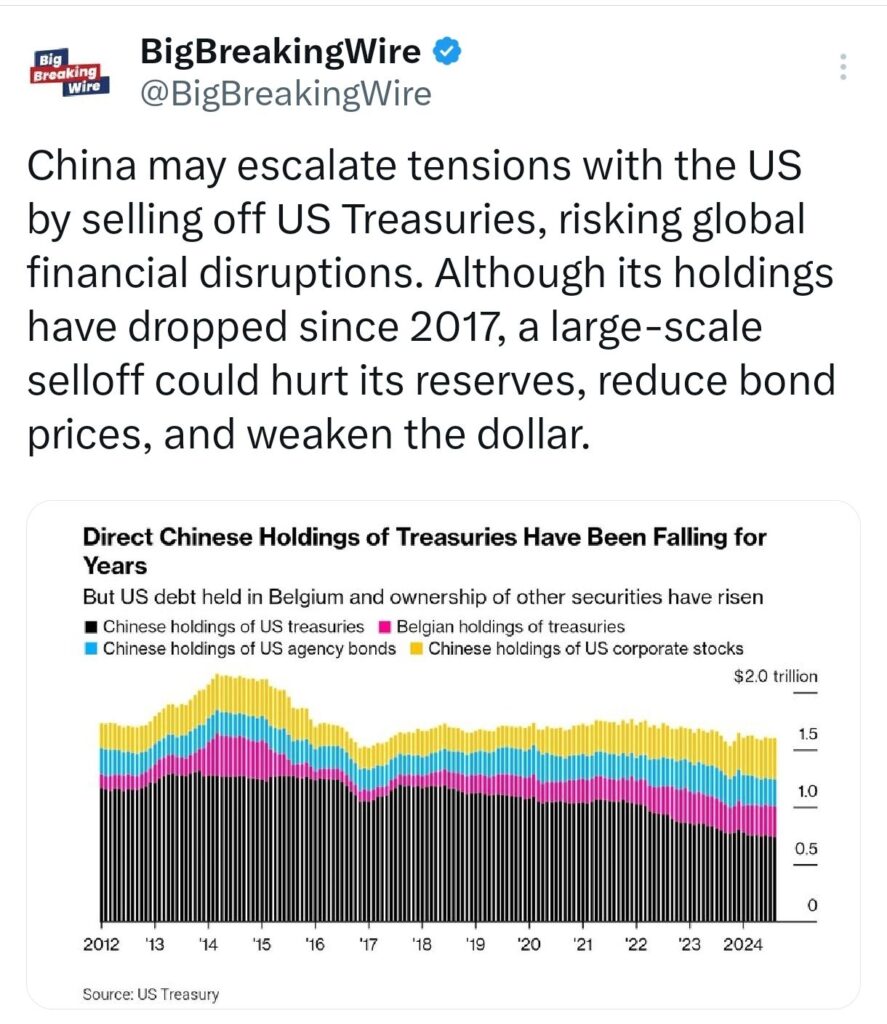

China could escalate tensions with the US by selling off US Treasuries, which would reduce its reserves, lower bond prices, and weaken the dollar. This could cause disruptions in global financial markets.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

One Comment