In recent days, China has taken drastic measures to counteract a severe economic downturn, announcing a massive stimulus package as its economy shows signs of significant distress. The country is experiencing challenges not seen in over a decade, with the real estate market collapsing and deflation taking hold.

China’s blue-chip CSI300 index surged a record 25% over five trading sessions, marking its largest daily increase since 2008.

What’s Happening in China?

China is going through some big problems right now. The government has announced a new plan to help its struggling economy.

The Real Estate Crisis

The trouble started with the real estate market. Evergrande, a big property company in China, went bankrupt. Now, the real estate market is worse than it was in 2008, and prices have fallen more than 80%. Many people are worried and are saving their money instead of spending or investing it.

Falling Prices

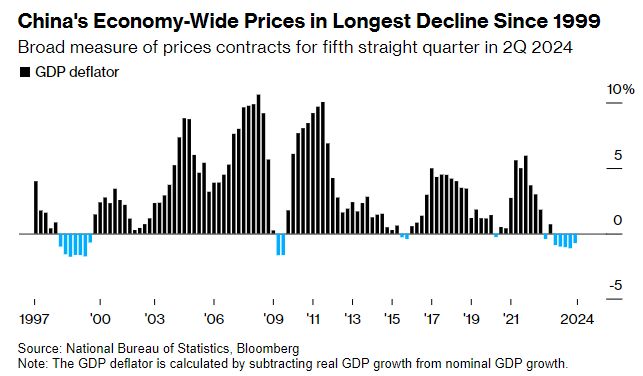

While many countries are seeing prices go up (this is called inflation), China is seeing prices go down (this is called deflation). Prices have been dropping for five quarters in a row, which shows how serious the situation is. Investor Ray Dalio says China’s problems are similar to Japan’s problems in the 1990s. He believes China needs major changes to fix its economy.

Government Actions

To help the economy, the Chinese government has announced several steps:

1. Lowering Bank Requirements: Banks will keep less money in reserve, so they can lend more.

2. Cutting Interest Rates: The government has lowered interest rates to encourage people to borrow money.

3. Reducing Mortgage Rates: Lower mortgage rates will help more people buy homes.

4. Injecting Money into Banks: The government is giving $142 billion to banks to make sure they have enough money to lend.

5. More Rate Cuts: These cuts are meant to encourage people to spend and borrow money.

These actions made stock prices in China go up a lot, like what happened in early 2020 when the government announced stimulus plans. The Chinese stock market had its biggest rise since 2008, and U.S. stock markets also reacted positively, with the S&P 500 getting close to 5800.

New Investors Joining

Many regular people in China are now buying stocks. Some trading companies are even staying open all day and night to help the many new traders, just like during previous times of economic help.

Challenges Ahead

Even though these new actions have excited the stock market, experts warn that this won’t fix the bigger problems. The real estate market is still in trouble, and big changes are needed. People and businesses must feel confident again to stop the falling prices.

Experts believe that China’s overall economy might shrink, which could lead to a recession by 2026. The amount of money in the economy is also going down because people aren’t borrowing much.

Conclusion

China’s economic situation is serious. While recent actions have given a short boost to stock prices, the main problems are still there. Major changes are needed for the economy to recover. Without these changes, China could face long-term issues.

Investors and analysts should watch what happens next in China. This situation shows how hard it can be to manage a big economy with serious challenges.

Update

Chinese futures were halted today due to high volatility in the market.

1. Chinese stocks rose 8% today and have increased 25% over the past five days.

2. The Beijing 50 index experienced a record intraday jump of 16%.

3. A record 1 trillion Chinese Yuan was traded in just 30 minutes.

4. Brokerages are now open 24/7 to support retail traders.

5. The Commerce Ministry announced plans to “improve policy effectiveness.”

6. Many Chinese brokerages are experiencing crashes due to the high traffic.

Despite recently facing five consecutive quarters of deflation—the longest streak since 1999—capital is now flowing back into the equity markets as stimulus measures are implemented.

Update

China’s stock markets have seen significant gains since the government introduced a series of stimulus measures last week to boost the struggling economy.

On Monday, the CSI300 blue-chip index rose 8%, reaching its highest point in over a year after experiencing its best weekly performance in nearly 16 years.

Experts are noting a significant change, with strong policies aimed at halting the decline in housing prices and supporting the stock market.

BNP Paribas referred to this moment as a “whatever it takes” approach for China, highlighting that the unexpected stimulus from the People’s Bank of China and clear indications from the Politburo meeting signal a move toward stronger economic support.

The Politburo’s announcement indicates a decisive shift, promising fiscal stimulus and commitments to stabilize property markets and support the stock market. This is expected to increase market confidence and lead to further gains in Chinese equities.

Update

On Monday, China’s central bank announced it purchased 200 billion yuan ($28.52 billion) in government bonds during September. Last week, long-term bond yields rose sharply after hitting record lows, following major stimulus announcements aimed at boosting the struggling economy. The People’s Bank of China (PBOC) stated that the bond purchase was intended to improve monetary policy adjustments and ensure sufficient liquidity in the banking system.

Turnover in China’s Shanghai and Shenzhen markets reached 2.59 trillion, setting a new record.

The Shanghai Composite Index rose by 248.97 points, or 8.06%, closing at 3,336.5.

The Shenzhen Component Index increased by 1,014.89 points, or 10.67%, finishing at 10,529.76.

The CSI 300 Index gained 314.17 points, or 8.48%, to end at 4,017.85.

The ChiNext Index jumped by 289.6 points, or 15.36%, closing at 2,175.09.

Update

Traders who bet against US-listed Chinese stocks have lost about $6.9 billion, according to a report from S3 Partners.

China’s main stock index, the CSI 300, has gone up by over 27% since hitting a low on September 13, thanks to several policy changes aimed at boosting the market. Similarly, the Nasdaq Golden Dragon index, which tracks US-listed Chinese stocks, has jumped more than 36%.

This increase has wiped out about $3.7 billion of gains made earlier in the year, leaving short sellers with around $3.2 billion in potential losses, according to the market analysis firm.

Update

A top economist Xiong Yuan, the chief economist at Guosheng Securities in China mentioned that the country could increase its financial support for the economy by issuing up to $1.4 trillion in special debt.

Recent readings of the Purchasing Manager’s Index (PMI) show a decline in business activity, with both manufacturing and overall PMIs falling below the 50-point mark that indicates whether the economy is growing or contracting. This slowdown is caused by a mix of factors, including hot weather, heavy rain, and weak demand in some areas.

Update

Over the past 15 years, China’s economic growth has dropped from a high of 14.2% in 2007 to around 5.0% in recent years.

In 2023, China’s debt-to-GDP ratio reached 311%, more than double the approximately 150% recorded in 2008.

Update

Chinese investment-grade companies are preparing to offer $10 billion to $15 billion in offshore bonds this quarter, driven by Beijing’s economic stimulus measures that lower fundraising costs and increase demand from borrowers, according to financial advisers.

This amount positions Chinese firms to raise the highest offshore debt in the fourth quarter in three years. Last week alone, they raised approximately $5.9 billion in dollar and euro bonds, marking the busiest week for offshore debt fundraising in 2024, according to Dealogic data.

Xixi Sun, Citigroup’s head of greater China bond syndicate, noted that the positive effects of the stimulus measures and anticipated Federal Open Market Committee (FOMC) rate cuts could encourage agile issuers to enter the market quickly, taking advantage of upcoming opportunities.

Source: Reuters

Update

Investors should prepare for a potential downturn in China’s stock market after a significant rally, according to Nomura Holdings Inc. They warn that the economy is weaker now than before the pandemic, and a market frenzy could lead to a crash, similar to the one in 2015.

China’s main stock index recently had its largest gain since 2008 and entered a bull market, driven by measures to boost the struggling economy. Despite this, Nomura remains skeptical, suggesting that while investors may be enjoying the current boom, a more cautious approach is needed.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment