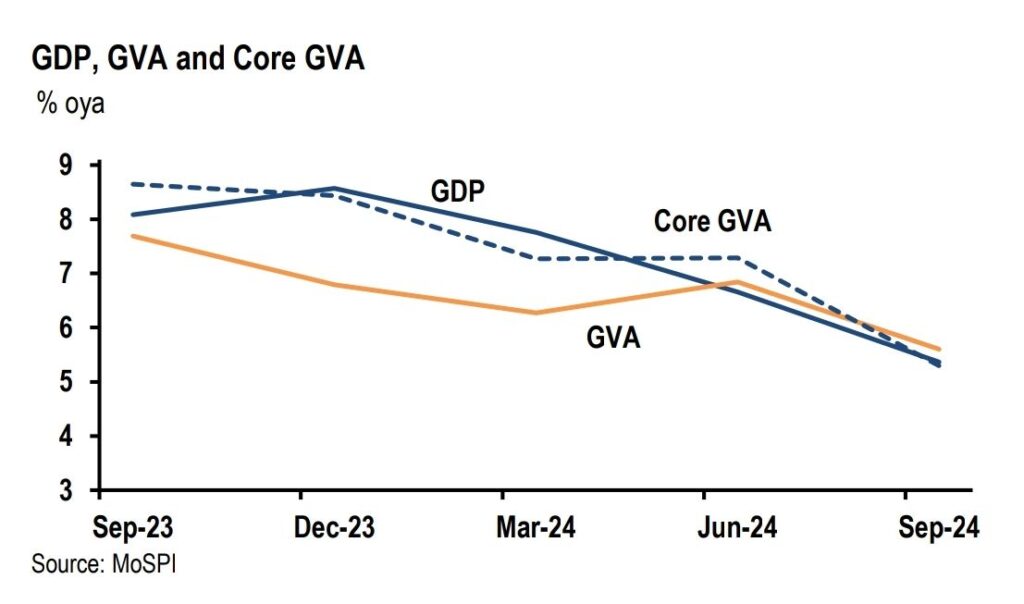

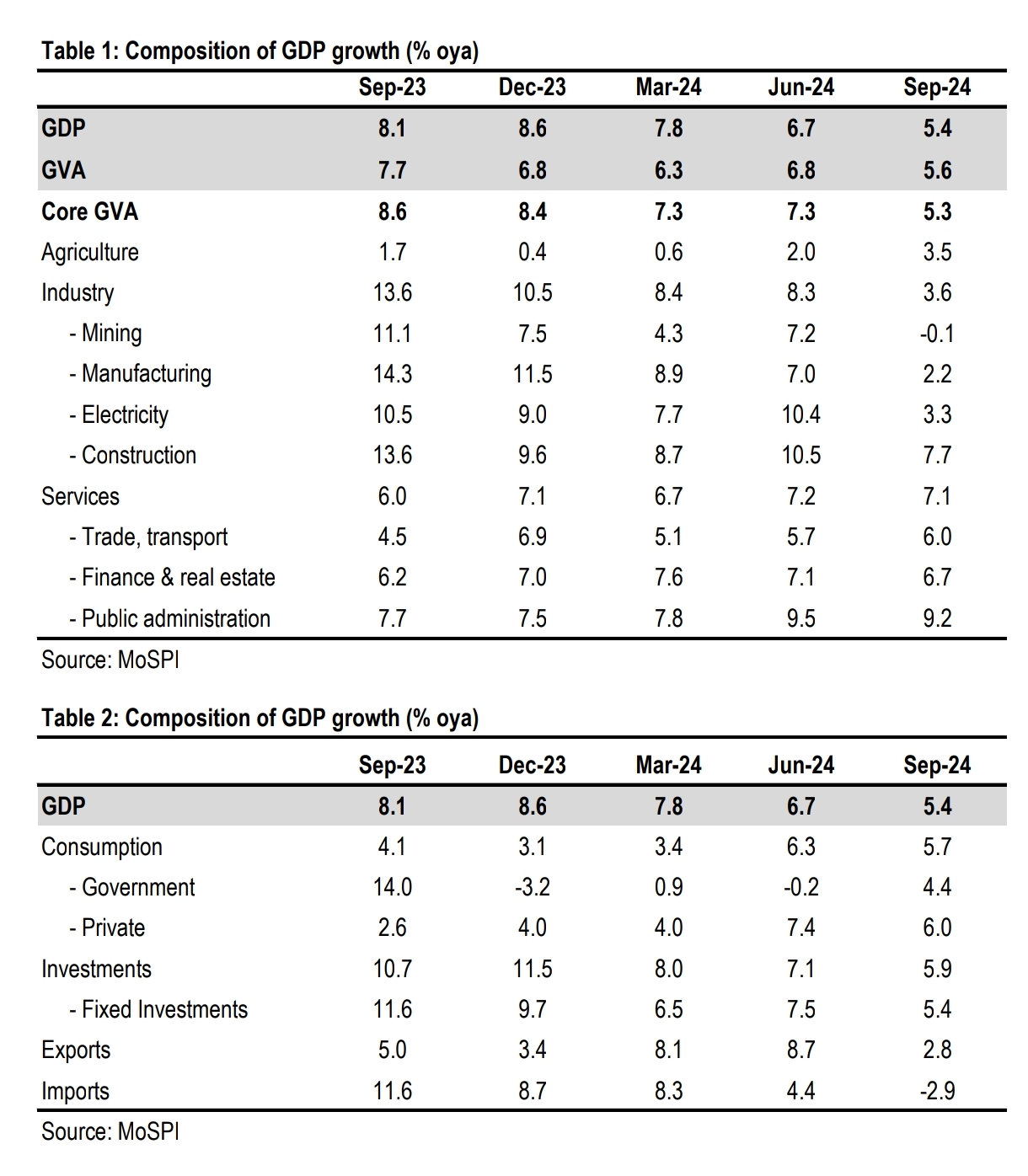

India’s GDP growth for the July-September quarter slowed to 5.4% year-on-year, the lowest in seven quarters. This was below expectations, with J.P. Morgan predicting 6.4% and the consensus at 6.5%, compared to 6.7% in the previous quarter. Core Gross Value Added (GVA), which excludes agriculture, public administration, and subsidies, also slowed to 5.3%, marking the lowest growth in seven quarters. Nominal GDP growth dropped to 8%, the lowest since December 2020. While this lower growth came as a surprise, the trend of slowing growth in recent quarters was expected. This slowdown follows a pattern of growth being artificially boosted last year by factors like deflators and subsidies. For this reason, the growth forecast for 2024-25 was set at 6.5%, while most others predicted 7% or higher. Due to this combination of fading statistical supports and cyclical slowdowns, full-year growth is now expected to be around 6.4%.

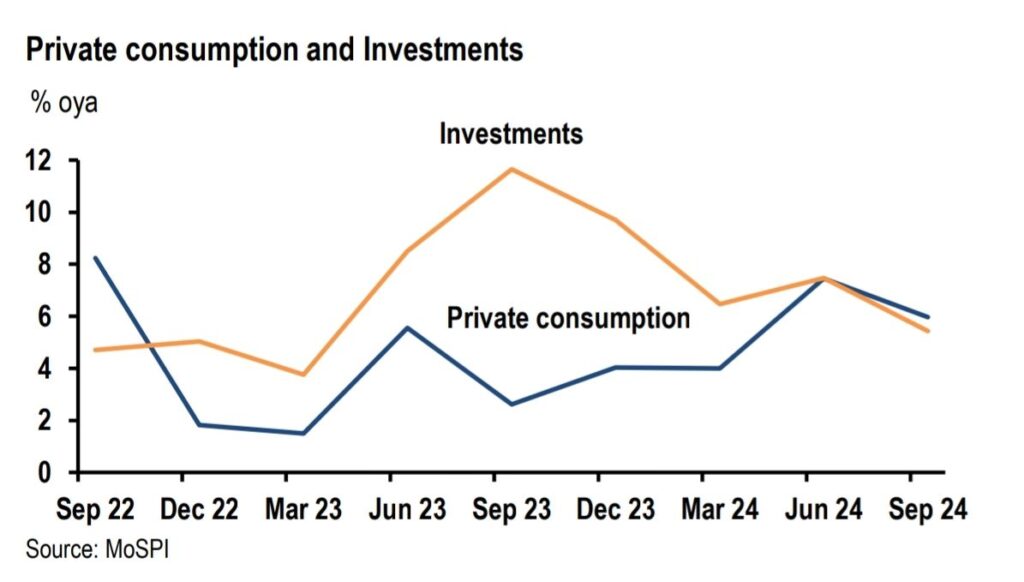

Concerns about the economy have been long-standing. Consumption was mainly driven by the wealthiest households, which was not enough to generate overall strong consumption growth. The lack of domestic demand also meant private investment was limited, with the economy overly reliant on public investment. If public investment slows, as it has in the past two quarters, the weaker private sector demand becomes apparent. Service exports have been strong, but merchandise exports have been more volatile and are facing a tougher global environment.

This dynamic has been evident in the last two quarters. Due to the upcoming general election, government capital expenditure has been slow to begin this year, resulting in slower growth in gross fixed investment, averaging just 6.5% compared to 9.1% in the previous four quarters. In Q3 of 2024, it slowed further to 5.4%. Private consumption growth also slowed to 6% from 7.4% in the previous quarter. Despite this, average private consumption growth of 6.7% over the past two quarters is a significant improvement compared to just 3.2% in the previous six quarters, showing a long-awaited recovery in rural consumption. However, urban consumption is slowing as the supports (like excess savings and strong urban wage growth) have faded, which could continue to weigh on consumption. Exports grew only 2.8%, mainly due to weak merchandise exports. Meanwhile, indirect taxes (GST) softened, and subsidies were front-loaded, leading to net indirect taxes growing at just 2.7%, which pulled down GDP growth below GVA.

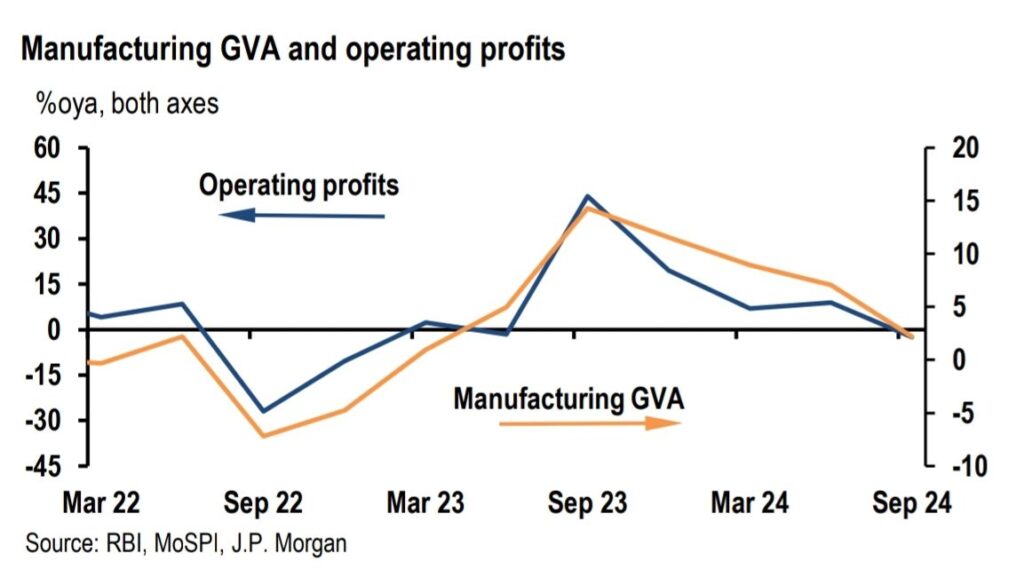

On the production side, industry growth slowed sharply, but this was not unexpected. The slowdown in mining (-0.1%) and electricity (3.3%) growth was due to excess rains, and these are expected to recover in the coming quarters. The main concern is manufacturing growth, which slowed to just 2.2%, the weakest in six quarters. This was expected, given the weak earnings and slower industrial production in the manufacturing sector. Surprisingly, services growth did not boost the economy, likely due to slowing GST collections and credit growth.

The good news is that this likely represents the quarterly growth trough. Government spending is expected to rise sharply, agricultural growth should pick up due to a strong monsoon, and lower crude oil prices should help improve earnings. Mining and electricity production are expected to normalize, and lower subsidies growth in the coming quarters should support GDP growth. As a result, growth is expected to average around 6.7% in the second half of the fiscal year, bringing the full-year 2024-25 GDP growth to 6.4%.

For policy, fiscal policy is clear. Government spending was slow to start this year due to the election, but it’s crucial for both the central and state governments to increase spending to meet budget targets and avoid unintended fiscal tightening. The monetary policy outlook is more complex. Normally, such weak growth would suggest a rate cut, but headline inflation has been impacted by rising food prices, with October CPI at 6.2%, and November CPI expected to remain at 5.6%. Therefore, the first rate cut is expected in February, once the Reserve Bank of India (RBI) is more confident that inflation is coming down. However, the sharp GDP surprise has increased the possibility of a rate cut at the upcoming review. For now, the base case is that the RBI will hold rates steady next week but may signal or announce measures to ease liquidity, such as a cut in the Cash Reserve Ratio (CRR), to prepare for tighter liquidity in the future.

India’s Q2 GDP Slows to 5.4%, Downgraded by Goldman Sachs, Barclays

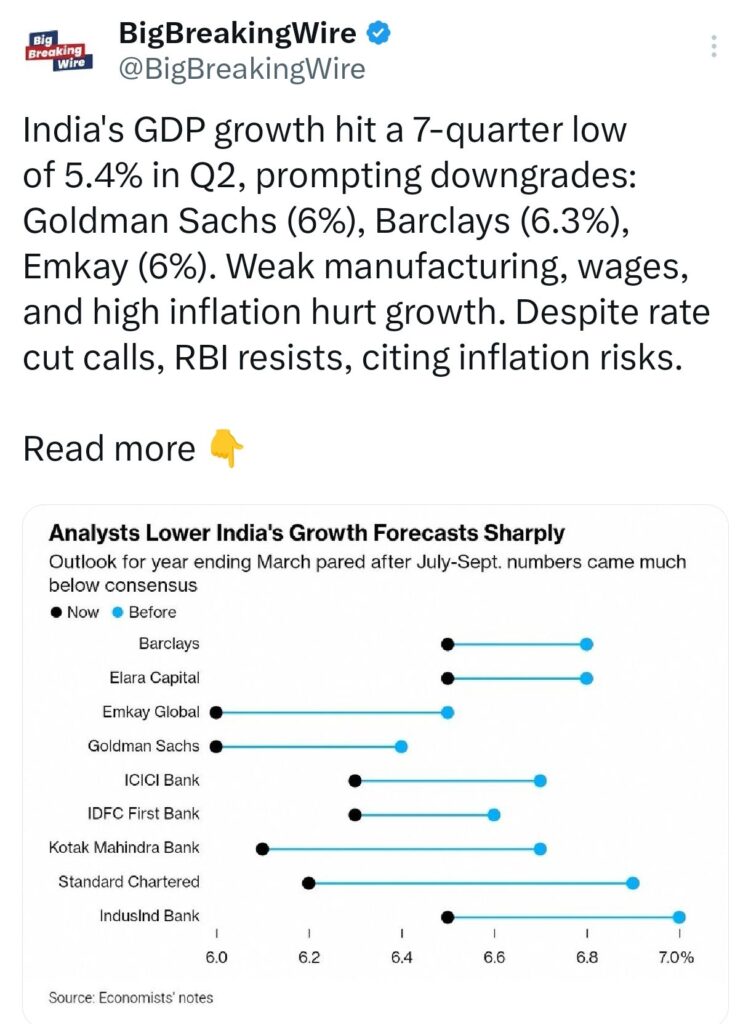

India’s GDP growth fell to a 7-quarter low of 5.4% in Q2, leading to downgraded forecasts from Goldman Sachs (6%), Barclays (6.3%), and Emkay (6%). Weak manufacturing, stagnant wages, and high inflation weighed on growth. Despite calls for rate cuts, the RBI remains cautious, citing inflation risks.

India’s GDP Slowdown Not Alarming, CEA Says

India’s Chief Economic Adviser acknowledged that while the real GDP growth for July-September was disappointing, it is not a cause for alarm. The slowdown is mainly due to weak manufacturing, which has been affected by global excess capacity and import dumping in India. However, some positive factors are expected to help sustain growth, including a strong agricultural performance in Q2 and a resilient rural demand, which is expected to continue supporting the economy. Additionally, net exports are likely to make a positive contribution in FY25, with agriculture remaining strong from October to March.

The economy continues to show resilience, driven by steady demand and strong performance in the manufacturing and services sectors. However, risks remain, including fragile geopolitical conditions that could impact inflation, supply chains, and capital flows. High global asset prices also pose a potential risk. On the positive side, low global crude oil prices are expected to persist, with the new US administration likely maintaining low energy costs, which should help support the economy.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

3 Comments