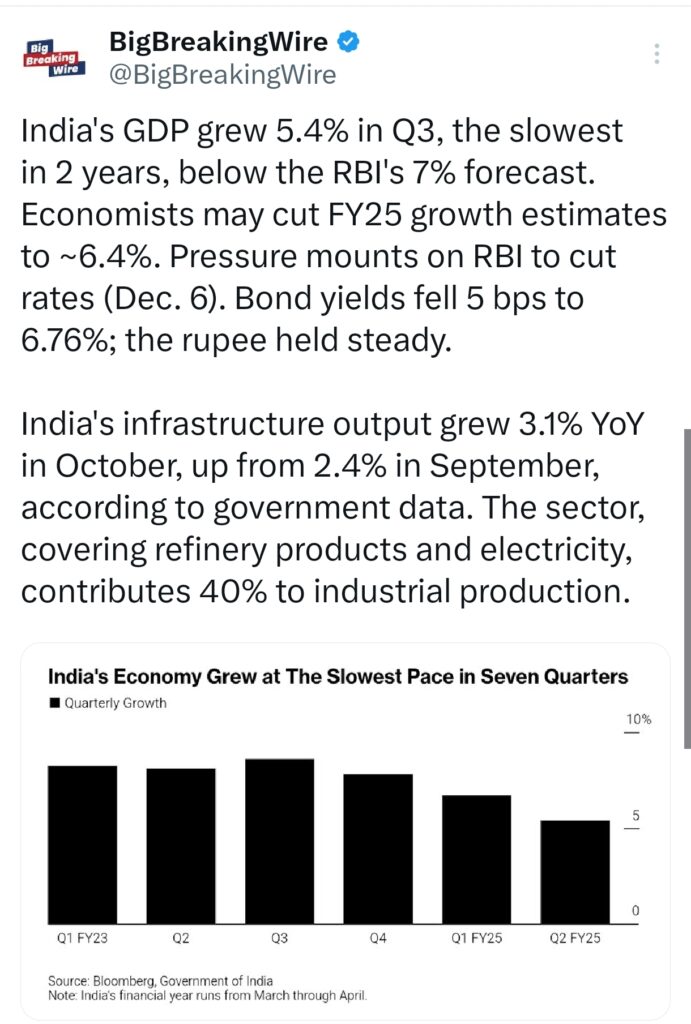

India’s GDP expanded by 5.4% year-on-year in Q3, marking the slowest pace of growth in two years and falling short of the Reserve Bank of India’s (RBI) forecast of 7%. Analysts anticipate this underperformance could prompt downward revisions to FY25 growth projections, potentially lowering them to approximately 6.4%. This economic slowdown increases pressure on the RBI to consider a rate cut during its upcoming monetary policy meeting on December 6. Following the GDP announcement, bond yields eased by 5 basis points, settling at 6.76%, while the Indian rupee remained stable against the dollar.

Meanwhile, infrastructure output showed improvement in October, growing 3.1% year-on-year compared to 2.4% in September, as per official data. This sector, which includes key industries like refinery products and electricity, accounts for 40% of India’s overall industrial production, reflecting a slight rebound in core economic activity.

A senior government official announced on Friday that the revised base years for national accounts, including GDP and other key indicators like the consumer price index (CPI), will take effect in February 2026. Saurabh Garg, Secretary of the Ministry of Statistics and Programme Implementation (Mospi), mentioned that the fiscal year 2022-23 will be used as the new base year for calculating GDP data.

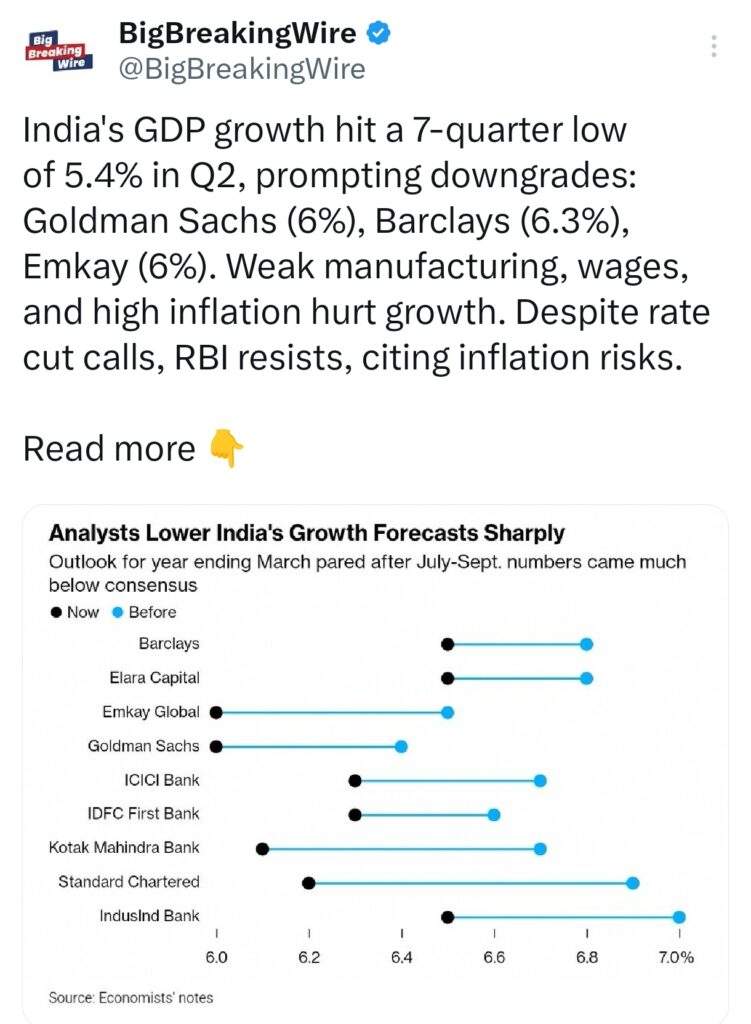

India’s Growth Slows to 5.4%, Economists Cut FY24 Forecast to 6%

India’s GDP growth fell to a seven-quarter low of 5.4% in Q2 FY24, below RBI’s 7% projection. Goldman Sachs and Emkay Global cut full-year growth estimates to 6%, citing weak manufacturing and urban consumption. Falling wages, high inflation, and slumping profits have hurt activity. Calls for rate cuts grow, but RBI’s Shaktikanta Das warns against risks amid high inflation.