Indian billionaire Gautam Adani and his nephew, Sagar Adani, have been summoned by the US Securities and Exchange Commission (SEC) to address allegations of paying over $250 million in bribes to secure solar-power contracts, according to the Press Trust of India (PTI). The summons, sent to their residences in Ahmedabad, requires a response within 21 days. Failure to respond could result in a default judgment, the notice from the New York Eastern District Court stated.

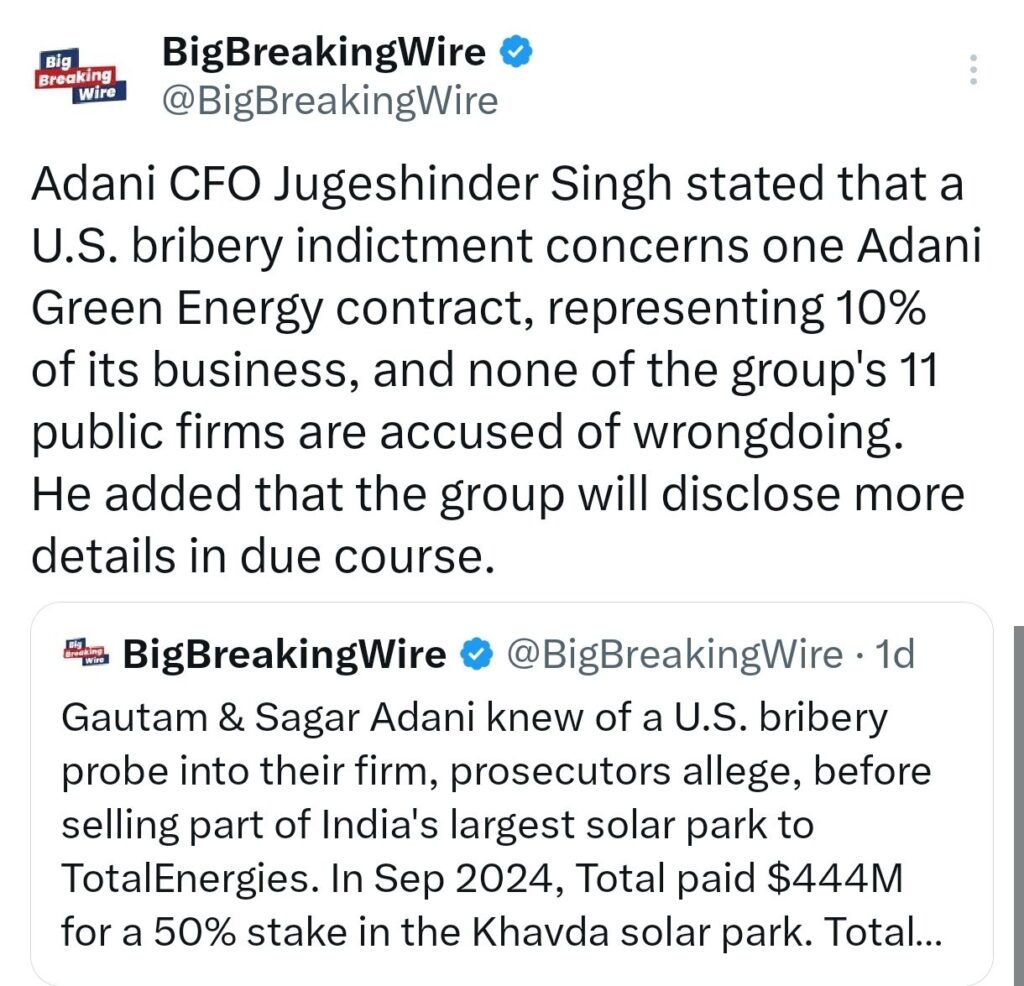

The allegations stem from a criminal indictment announced by US prosecutors on November 20, alongside a civil case filed by the SEC. The Adani Group has denied any wrongdoing. On Saturday, Chief Financial Officer Jugeshinder Singh stated on X that the group would respond after a detailed legal review, emphasizing that the allegations do not imply guilt.

Meanwhile, a new plea has been filed in India’s Supreme Court seeking a domestic investigation into the bribery claims, CNBC reported. Additionally, India’s market regulator is examining whether the Adani Group failed to disclose market-sensitive information, Bloomberg News revealed.

In March 2023, FBI agents reportedly approached Sagar Adani with a search warrant and a subpoena, during which they confiscated his electronic devices as part of their investigation. Despite this development, the Adani Group released a statement categorically denying any awareness of a U.S. investigation involving Gautam Adani. The company dismissed media reports on the matter as unfounded and lacking credibility, according to a Reuters report.

S&P Global Downgrades Adani Companies Following Bribery Allegations

S&P Global has downgraded the credit ratings of Adani Ports, Adani Green Energy, and Adani Electricity in response to recent bribery allegations against Gautam Adani. These allegations claim that Adani paid over $250 million in bribes to secure solar-power contracts.

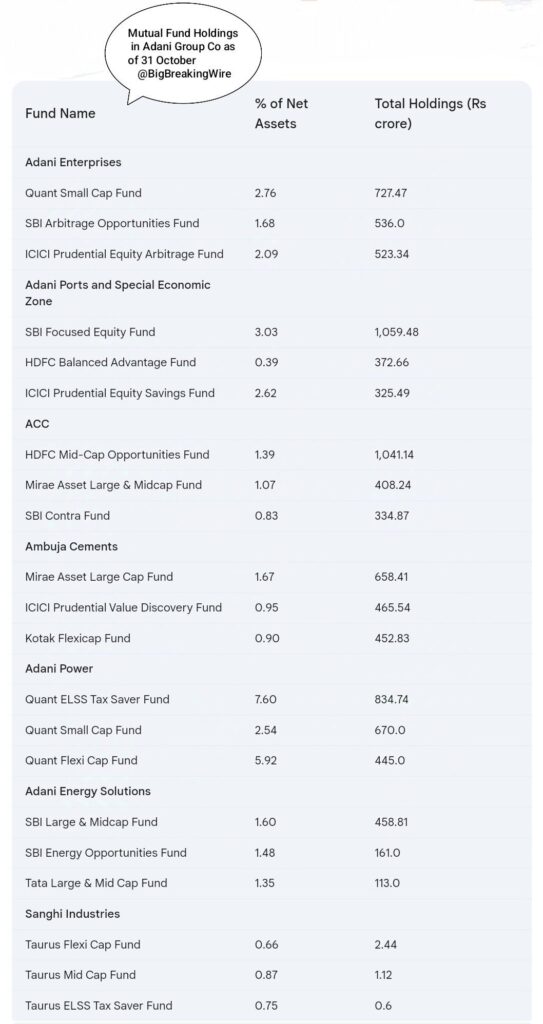

The impact of the controversy has also extended to investors, with Quant Mutual Fund reporting a 28% loss due to its exposure to Adani-linked stocks.

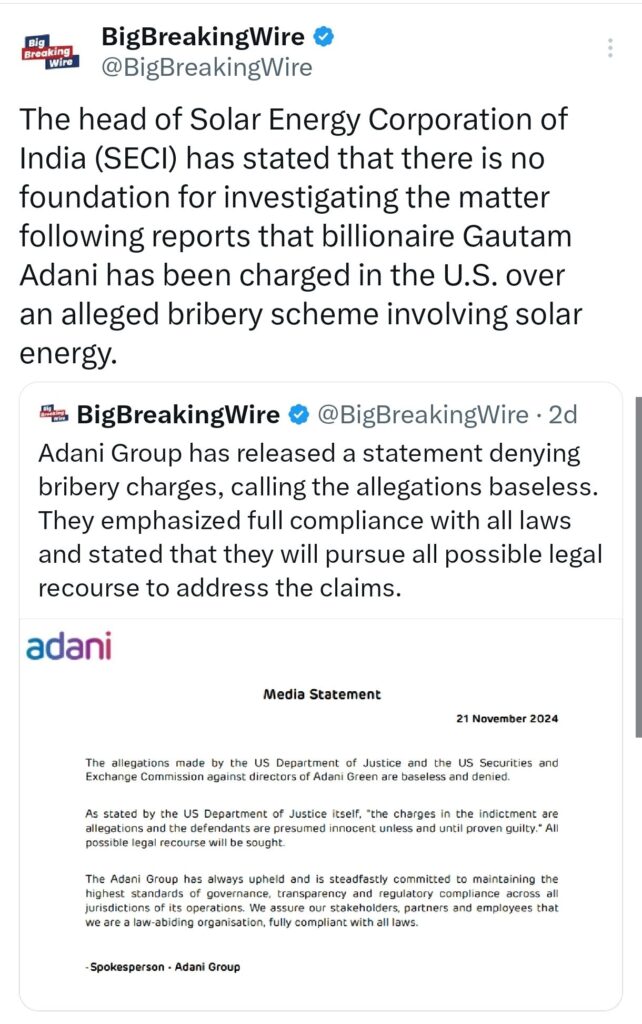

The Adani Group has strongly denied the allegations, maintaining that they are baseless and emphasizing the presumption of innocence. Meanwhile, India’s Solar Energy Corporation of India (SECI) has dismissed claims that it is investigating the group’s solar scheme contracts.

Quant Mutual Fund Faces Losses Amid Adani Stock Decline and Front-Running Probe

Quant Mutual Fund is facing a significant 28% loss on its investment in Adani Enterprises after purchasing shares at ₹2,962 in October 2024. The stock has since dropped 24%, closing at ₹2,155, following bribery allegations against Gautam Adani and his nephew, Sagar Adani. The mutual fund is also under scrutiny for alleged front-running trades, adding to its challenges.

As of October 31, 2024, Indian mutual funds collectively held ₹43,455 crore in investments across 10 Adani Group companies. Major holdings include Adani Ports, Ambuja Cements, and Adani Enterprises. However, the Adani Group’s market valuation has plunged by ₹2.2 lakh crore, driven by a sharp selloff that intensified by November 21, 2024, following these allegations.

Kenyan President William Ruto Cancels $736M Adani Energy Deal and Airport Expansion Bid

On November 21, Kenyan President William Ruto annulled the airport expansion bid and terminated a $736 million agreement with Adani Energy for power line construction. The deal, signed in October under a 30-year public-private partnership with Kenya Electrical Transmission, had already been suspended by the court earlier that month.

Adani Group Denies Bribery Charges, SECI Head Dismisses Investigation Claims on Solar Energy Allegations

The Adani Group issued a statement strongly rejecting the bribery allegations, labeling them as completely unfounded. The company emphasized its commitment to adhering to all relevant laws and regulations and affirmed its intention to take any necessary legal actions to refute the claims.

In response to reports suggesting that billionaire Gautam Adani has been charged in the U.S. in connection with an alleged bribery scheme related to solar energy, the head of the Solar Energy Corporation of India (SECI) has clarified that there is no basis for launching an investigation into the matter.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

3 Comments