S&P Global Ratings has downgraded the outlook for key Adani Group companies—Adani Ports and SEZ Ltd, Adani Green Energy Ltd (AGEL RG2), and Adani Electricity Mumbai Ltd—to “negative.” The decision stems from concerns about governance, funding access, and cash flow stability following bribery allegations against founder Gautam Adani in the United States.

The charges accuse Gautam Adani and two other board members of being involved in a $250 million bribery scheme tied to solar power contracts in India. S&P affirmed its ‘BBB-‘ ratings for Adani Ports and Adani Electricity and its ‘BB+’ issue rating for AGEL RG2. However, the agency flagged potential risks of deteriorating investor confidence, higher borrowing costs, and funding challenges if the allegations gain traction.

The indictment has raised fears of restricted funding options for the group, as Adani’s founder plays a central role across multiple entities. S&P cautioned that lenders, including international banks and bond investors, could tighten their exposure limits, which may disrupt the group’s ability to secure capital.

While the three entities face no immediate debt repayments, their growth and refinancing needs heavily rely on consistent access to equity and debt markets. S&P emphasized that any proven misconduct could further damage the group’s governance credibility, noting its promoter-heavy ownership structure.

These developments come amid heightened scrutiny following the Hindenburg Research report earlier this year, which questioned the group’s governance and financial practices. Investigations by the Supreme Court of India and the country’s capital market regulator added to the pressure. S&P warned that renewed governance concerns could harm the group’s reputation and affect its ability to attract lenders and investors.

Despite AGEL RG2 being insulated from its parent company’s operations, its outlook was revised due to its association with the broader Adani Group. The potential for reduced cash flow, increased funding costs, and reputational damage influenced the decision.

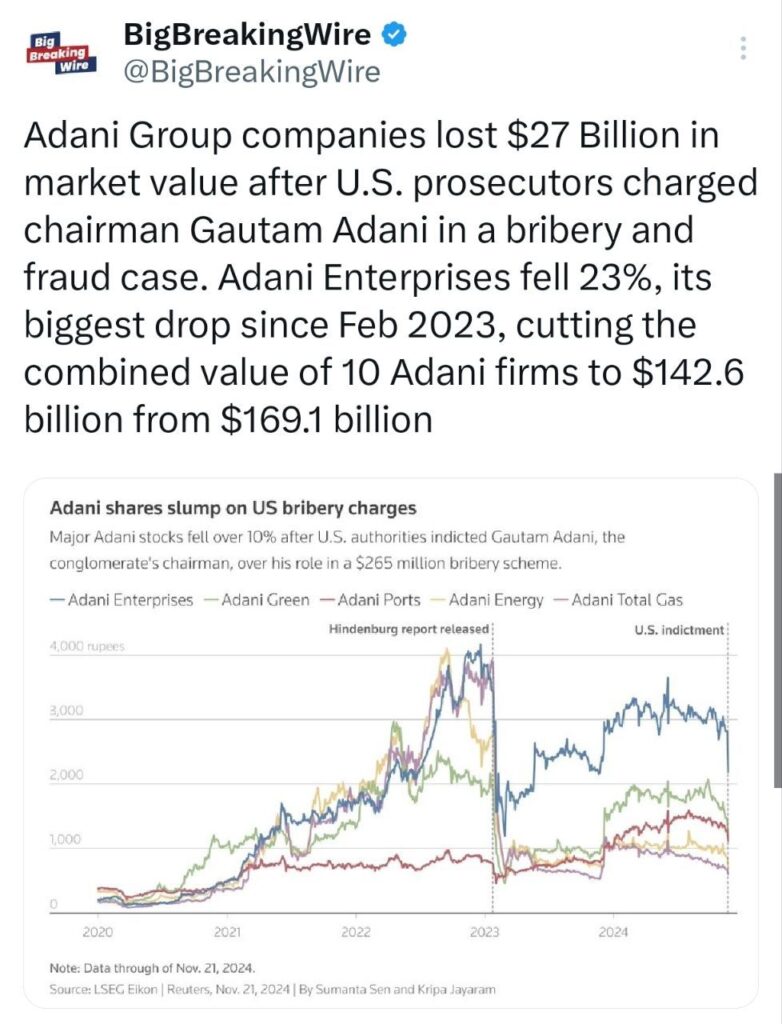

The fallout has been significant. On November 21, Adani Group companies collectively lost Rs 2.2 lakh crore in market value. Adani Enterprises dropped 23% that day, and losses extended further on November 22. Adani Green Energy and Adani Energy Solutions also tumbled 20% each, while international bonds issued by Adani entities hit record lows.

S&P underscored the critical importance of investor confidence for the group’s ambitious expansion plans. If the allegations are substantiated, it could lead to further downgrades in governance assessments and investor trust.

Adani Group Loses $27 Billion in Market Value Following Bribery Charges Against Gautam Adani

Adani Group companies saw their market value plunge by $27 billion after U.S. prosecutors filed bribery and fraud charges against the group’s chairman, Gautam Adani. The accusations have dealt a significant blow to investor confidence, leading to sharp declines in the group’s stock prices.

Adani Enterprises, the group’s flagship company, suffered its steepest drop since February 2023, falling 23% in a single day. This sell-off contributed heavily to the overall decline in the combined market capitalization of the group’s 10 listed entities, which dropped from $169.1 billion to $142.6 billion.

Adani Group Market Crash Hits Mutual Funds, Quant Faces 28% Loss

Quant Mutual Fund, which bought Adani Enterprises shares at ₹2,962 in October, is now facing a 28% loss as the stock dropped 24% to ₹2,155 after bribery allegations. The fund is also under investigation for front-running trades.

As of October 31, 2024, Indian mutual funds had invested ₹43,455 crore in 10 Adani Group companies, including major holdings in Adani Ports, Ambuja Cements, and Adani Enterprises. By November 21, 2024, the Adani Group’s market value fell by ₹2.2 lakh crore.

Adani Group Denies Bribery Allegations, SECI Dismisses Investigation Claims

Adani Group has denied the bribery charges, calling them unfounded and reaffirming their commitment to full legal compliance. They also stated they will take all necessary legal actions to address the allegations.

The head of the Solar Energy Corporation of India (SECI) has dismissed the claims, stating there is no basis for an investigation following reports that Gautam Adani is charged in the U.S. over an alleged bribery scheme involving solar energy.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

4 Comments