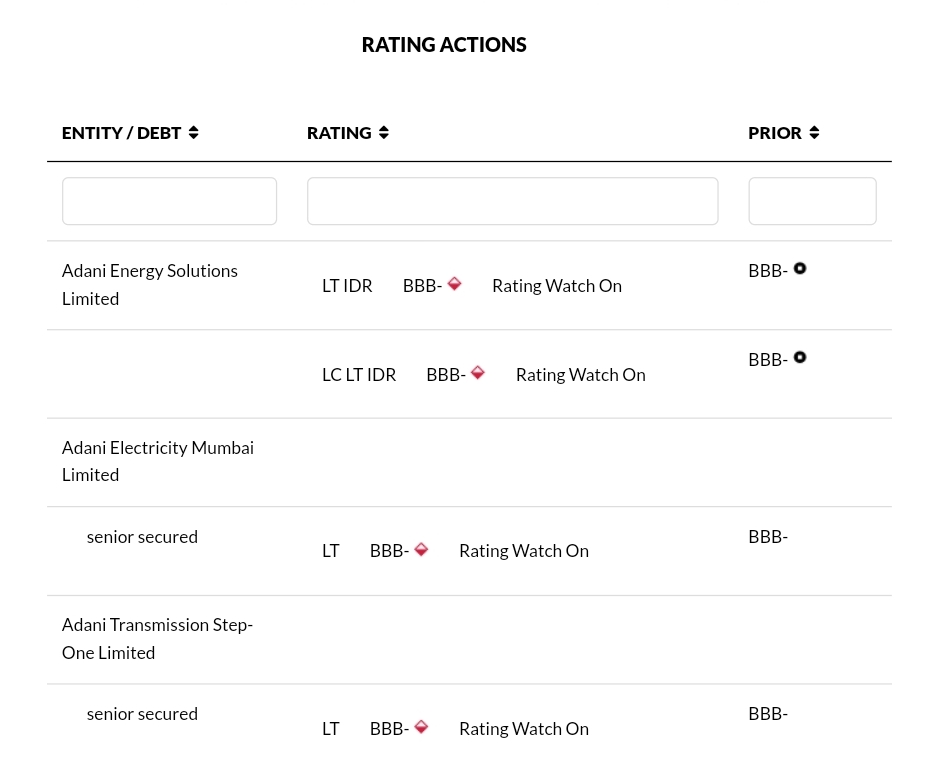

Fitch Ratings has placed the ratings of Adani Energy Solutions Limited (AESL) and Adani Electricity Mumbai Limited (AEML) under a “Rating Watch Negative” (RWN) due to bribery charges against certain board members of Adani Green Energy Limited (AGEL). This also affects the ratings of AESL’s subsidiary, Adani Transmission Step-One Limited. These actions were taken after the U.S. Securities and Exchange Commission and the U.S. Department of Justice indicted three AGEL board members for alleged bribery and misleading investors during a 2021 offshore note offering. Adani group has denied these charges.

The “Rating Watch Negative” reflects concerns about increased corporate governance risks and possible financial issues for other Adani companies, including AESL and AEML, because of the U.S. indictment. Two of the indicted directors are from the Adani family, which controls a majority of AESL and AEML shares. They also sit on the boards of other Adani companies, which increases the risk that the issues at AGEL could spread to other parts of the group.

Fitch will closely monitor how the investigation impacts the financial flexibility of AESL and AEML, especially their ability to secure new funding or roll over existing debt. Any problems in accessing funding or higher borrowing costs could negatively affect the companies.

Key Factors:

Liquidity Risk in the Short Term: AESL and AEML currently have enough liquidity to meet their financial needs. AESL has a cash balance that covers its near-term debt maturities, and AEML’s liquidity is supported by its long-term debt maturity.

Medium-Term Funding Access Risk: The bribery charges could make it harder for AESL and AEML to raise funds in the future, especially at favorable rates. This could impact AESL’s growth plans, but AEML is somewhat insulated due to regulatory protections that allow it to pass higher costs to consumers.

Corporate Governance Risks: The bribery allegations have raised concerns about the governance of Adani group companies. If the allegations lead to a conviction or expose weak governance practices, it could put further pressure on their ratings.

Source: Fitch Report

Fitch Places Adani Group Entities on Negative Rating Watch Amid Bribery Charges and Governance Concerns.

Fitch Ratings has placed several Adani group entities on a “Negative Rating Watch” due to bribery charges and the indictment of Adani Green Energy Limited (AGEL) board members by US authorities. These entities include Adani Ports (APSEZ), North Queensland Export Terminal (NQXT), and Mumbai International Airport (MIAL).

Fitch has maintained ratings for some other Adani entities, such as Adani International Container Terminal (AICTPL) and Adani Green Energy’s restricted groups (AGEL RG1, RG2, AESL RG), but downgraded their outlook to “Negative” due to risks of higher funding costs and corporate governance issues.

The rating changes reflect concerns about potential impacts on funding access, liquidity, and corporate governance due to the US charges. Despite these concerns, Fitch believes that some entities like AICTPL and AGEL RG groups have relatively stable cash flows and ring-fenced structures that limit immediate risks.

Fitch also withdrew ratings for a planned debt issuance by AGEL Hybrid RG1 as it is no longer expected to proceed.

Overall, there are concerns about the group’s ability to secure funding and maintain its credit ratings in the medium term.

Adani Dollar Bonds Hit Yearly Low Following Fraud and Bribery Charges Against Gautam Adani.

Adani’s dollar bonds plunged to their lowest levels in nearly a year after U.S. prosecutors filed fraud and bribery charges against Gautam Adani. Bonds from Adani Ports and Adani Transmission fell by 1-2 cents, while longer-term bonds saw a more significant decline, losing 8-10 cents in face value since the charges were announced last week.

TotalEnergies Halts Financial Contributions to Adani Group Amid U.S. Indictment, Adani Green Energy Shares Drop 16%

TotalEnergies SE has announced that it will suspend any new financial contributions to Adani Group investments until the allegations against its leaders, related to a U.S. federal indictment, are resolved. The company stated that it needs clarity on the situation before committing any further funds.

Following this announcement, shares of Adani Green Energy experienced a significant drop, falling more than 16% from a peak of 1141 to 955, and reaching a low of 933 on Monday. This decline occurred after TotalEnergies SE revealed its decision to halt additional financial support in light of the ongoing U.S. federal indictment involving the Adani Group’s chairman and his nephew.

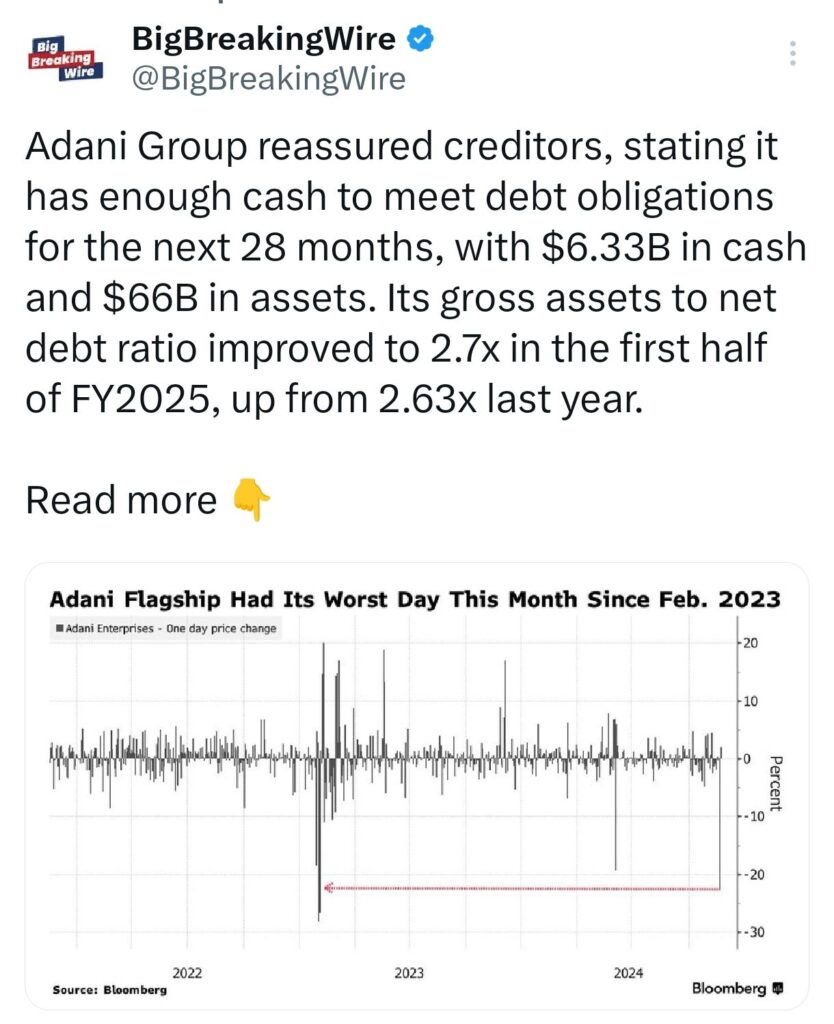

Adani Group Assures Creditors with Sufficient Cash and Improved Debt Ratio

Adani Group has reassured its creditors by confirming that it has sufficient cash reserves to meet its debt obligations for the next 28 months. The group currently holds $6.33 billion in cash and possesses $66 billion in assets. Additionally, the group’s financial position has strengthened, as reflected in the improvement of its gross assets to net debt ratio, which increased to 2.7 times during the first half of the fiscal year 2025, compared to 2.63 times in the same period last year. This indicates a better capacity to cover its debt with its available assets.

GQG Partners Downplays Impact of Adani Group Allegations, Highlights Employee-Only Charges

GQG Partners has provided its perspective on the ongoing allegations involving the Adani Group, emphasizing that the charges are directed at individual employees, rather than the company as a whole. The allegations are specific to Adani Green Energy Limited (AGEL) and do not extend to other Adani companies. GQG also pointed out that corruption charges are not uncommon, with many global corporations and executives facing similar accusations. Regulatory investigations of this nature often take several years to conclude and, in many cases, lead to reduced penalties. Given this context, GQG does not foresee any major impact on the overall business operations of the Adani Group as a result of these allegations.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment