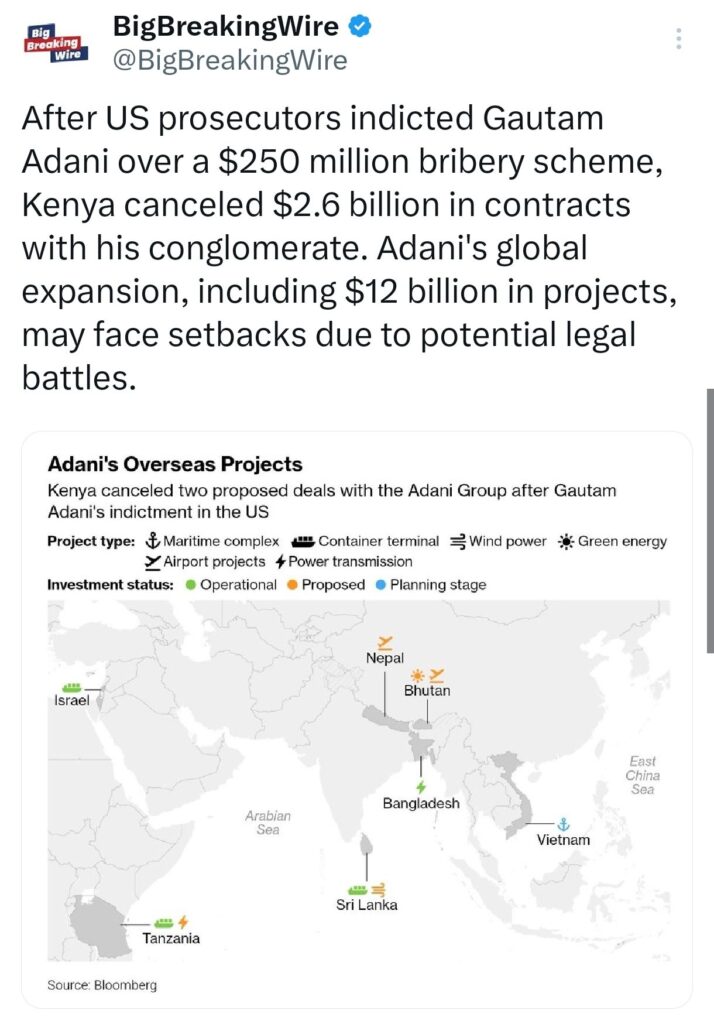

Gautam Adani’s global ambitions have taken a significant hit following U.S. federal prosecutors’ indictment of the billionaire, his nephew Sagar Adani, and associates in a $250 million bribery scheme to secure Indian solar energy contracts. The fallout has been swift, with countries and companies canceling or reconsidering deals with the Adani Group.

Key Developments:

Kenya: Kenya canceled contracts worth $2.6 billion for projects to upgrade its main airport and expand power transmission. The agreements included a 30-year lease for Nairobi’s Jomo Kenyatta International Airport and a $736-million energy deal signed just last month.

Sri Lanka: The U.S. International Development Finance Corp is reviewing a $550 million loan for Adani Group’s Colombo port project. Sri Lanka, already scrutinizing Adani’s involvement, may reconsider the deal amidst the allegations.

Bangladesh: A government committee is investigating power generation contracts signed under former Prime Minister Sheikh Hasina, including one with Adani Power. The committee has suggested hiring global legal experts to ensure a fair review.

India: Andhra Pradesh is weighing the cancellation of a power supply agreement with Adani Group, as the U.S. indictment claims $228 million in bribes were directed to officials in the state.

TotalEnergies: French oil giant TotalEnergies, which holds stakes in Adani Green Energy (20%) and Adani Total Gas (37.4%), has announced it will halt further investments in the group. This decision has hit Adani Green Energy hard, with shares plunging over 11%, while Adani Total Gas dropped 1.4%.

Adani Green Energy has assured stakeholders that TotalEnergies’ decision to pause new financial commitments will not impact its ongoing operations or growth plans. Despite this reassurance, the company’s stock fell by 5.8% today, extending its decline to over 21% since TotalEnergies’ announcement. The drop reflects growing investor concerns amid escalating legal challenges and the cancellation of planned U.S. bond offerings.

Market Impact:

Since the indictment, Adani Group’s ten listed companies have lost $33 billion in market value. Adani Green Energy has been the hardest hit, shedding $9.7 billion.

Growing Concerns:

Some nations and investors were already uneasy about Adani’s contracts, which were viewed as heavily favoring the conglomerate. The U.S. bribery charges now provide an easy justification for exiting unpopular agreements. Additionally, international partners may fear being implicated in a broader U.S. investigation under the Foreign Corrupt Practices Act.

Adani Group has denied all allegations, calling them baseless, but the crisis raises questions about the future of its global expansion plans, which included $12 billion in infrastructure investments across Asia and $10 billion in planned U.S. investments.

Fitch Puts Adani Energy and Ports Under Negative Watch Amid Bribery Allegations

Fitch Ratings has placed the default ratings of Adani Energy Solutions and Adani Electricity Mumbai under negative watch, citing concerns stemming from bribery allegations against Adani Group executives filed by U.S. prosecutors. The agency also issued a warning on Tuesday that Adani Ports’ dollar bonds face the risk of being downgraded to junk status due to the potential financial and reputational fallout from these allegations.

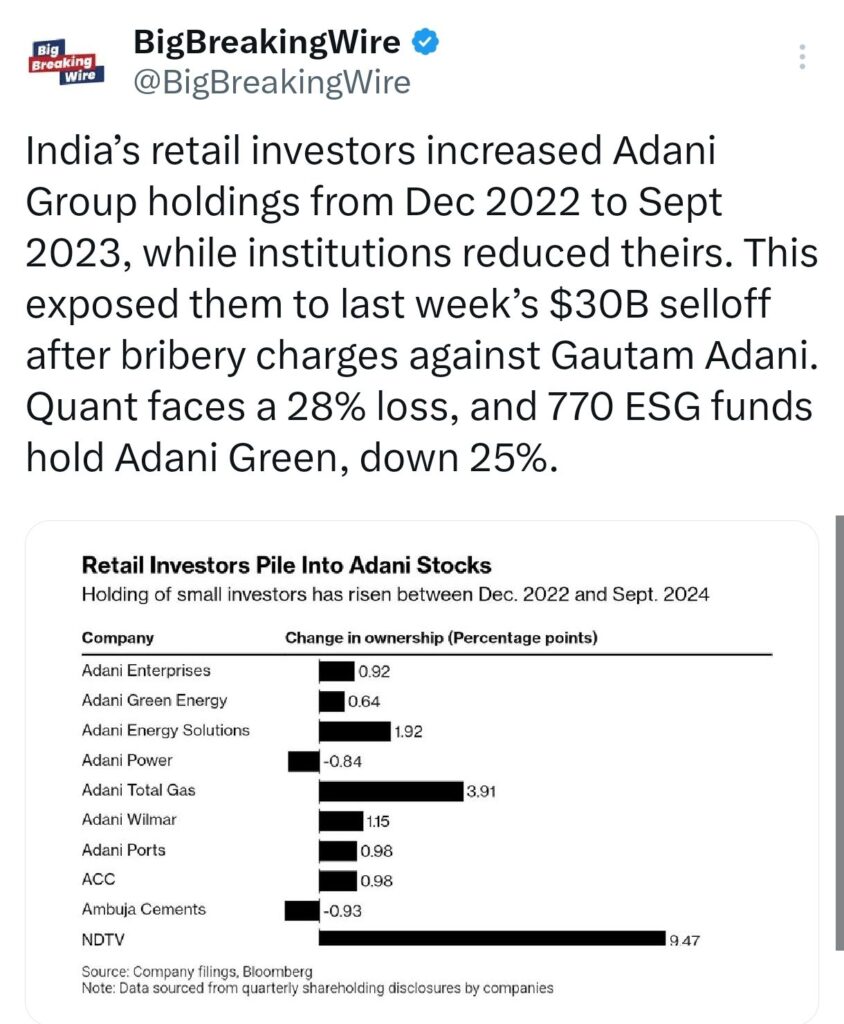

Retail Investors Bear the Brunt of Adani’s $30B Crash Amid Bribery Allegations

From December 2022 to September 2023, retail investors in India significantly increased their stakes in the Adani Group, even as institutional investors reduced their holdings. This shift left retail investors vulnerable to last week’s $30 billion market selloff following bribery allegations against Gautam Adani. The decline has notably impacted several stakeholders, including Quant funds, which are now facing a 28% loss, and 770 ESG-focused funds that hold positions in Adani Green Energy, whose stock has plunged by 25%.

GQG Partners Downplays Impact of Bribery Charges on Adani Group’s Operations

GQG Partners stated that the bribery charges are directed at individual employees rather than the Adani Group as a whole. They clarified that the allegations are specific to Adani Green Energy and do not extend to other companies within the Adani portfolio. GQG emphasized that corruption charges are a common occurrence for many global corporations and executives. They also noted that regulatory investigations of this nature typically take years to conclude and may result in lesser penalties. As a result, GQG does not anticipate these events will have a major impact on the overall operations of Adani’s businesses.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment