What is Basis Trade?

The basis trade is a popular strategy used by hedge funds to profit from the price difference between U.S. Treasury bonds and their corresponding futures contracts. This price gap—known as the “basis”—exists due to supply-demand imbalances or regulatory constraints. Traders use high levels of leverage, sometimes up to 100x, to bet that the bond and futures prices will converge as the futures contract nears expiry. While this can generate small but steady profits, it also carries significant risks, especially during times of market stress or sudden economic shocks.

Why Basis Trade Matters

Something unusual happened in the financial markets recently. Long-term U.S. interest rates jumped by 20 basis points (0.20%) even though stock markets fell. Normally, bond yields fall when stocks drop, as investors seek safer assets. But this time, the opposite occurred. One likely reason? The unwinding of the basis trade.

The basis trade might sound technical, but it plays a big role in global finance—and it can become risky when markets turn volatile. Let’s break it down in simple terms.

What Is the Basis in Finance?

The basis is the difference in price between a Treasury bond (cash bond) and a Treasury futures contract with similar maturity and characteristics.

For example, suppose a 10-year U.S. Treasury bond is trading at a different price than a futures contract based on the same bond. This price gap creates an opportunity for traders to make money as the prices are expected to converge by the time the futures contract expires.

How Does the Basis Trade Work?

In a basis trade, hedge funds and institutional investors try to profit from this price difference. They do this by:

Buying the Treasury bond (the cash leg)

Selling the corresponding Treasury futures contract (the futures leg)

This trade is done using heavy leverage, sometimes up to 100 times the original investment. The idea is that as the futures contract nears expiration, its price will come closer to the bond’s price. When that happens, the hedge fund can close both positions and earn a small profit.

Because the leverage is so high, even a small price difference can generate significant returns—but it also comes with huge risks.

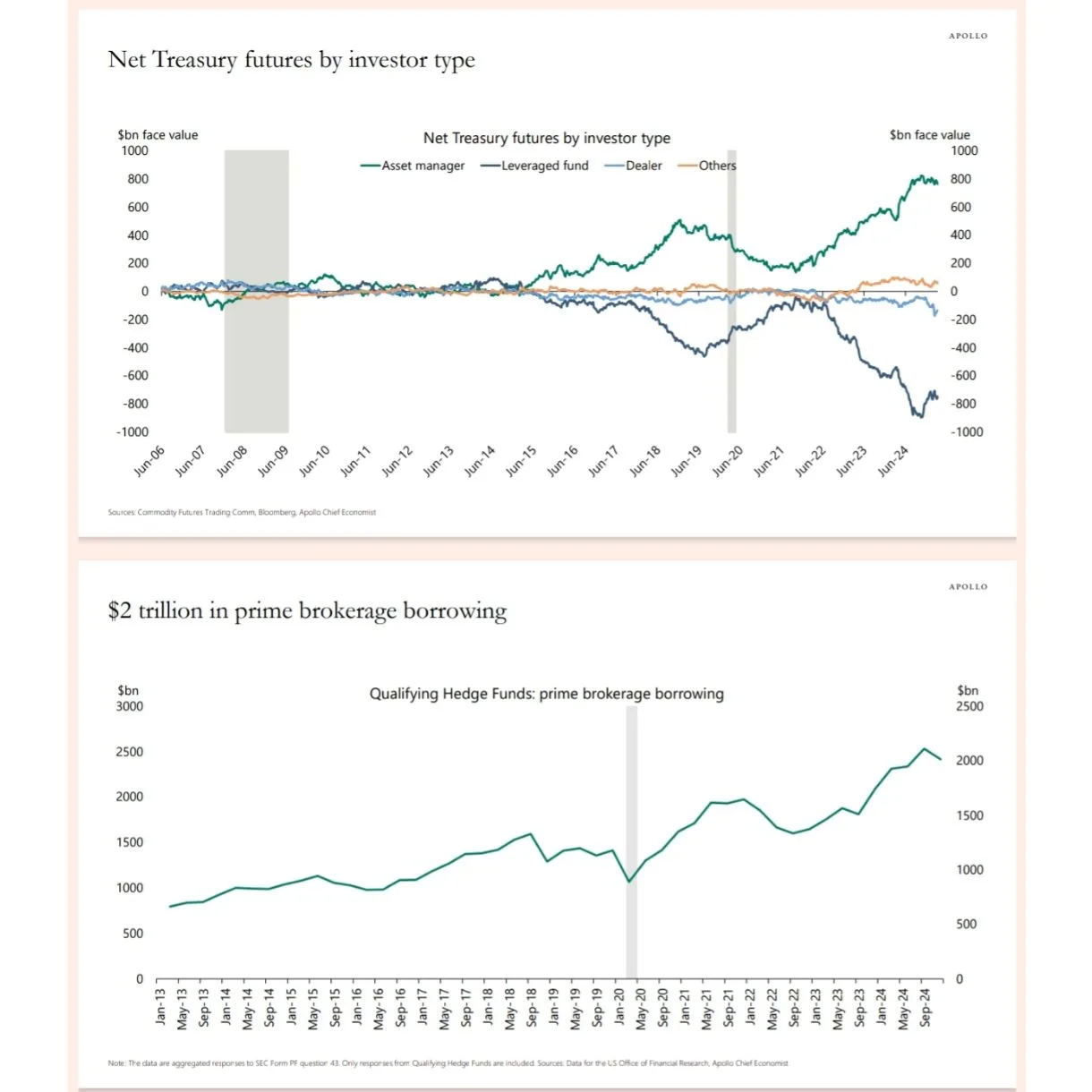

How Big Is the Basis Trade?

As of now, the size of the basis trade is estimated to be around $800 billion. It forms a large portion of the $2 trillion in prime brokerage balances. These are the loans and services that banks provide to hedge funds.

This trade is growing fast, especially as the U.S. government keeps issuing more debt. The more Treasury bonds there are in the market, the more opportunities there are for this kind of trading.

Why Is the Basis Trade Risky?

The cash-futures basis trade might seem harmless, but it’s actually a potential source of financial instability, especially during times of crisis. Here’s why:

Leverage Risk: Hedge funds use extreme leverage. If prices move against them quickly, they may be forced to unwind trades rapidly.

Liquidity Stress: Selling large amounts of Treasuries at once could create panic in the bond market.

Dealer Constraints: Broker-dealers who absorb these trades have limited balance sheets. In a crisis, they may not be able to manage the inflow of selling.

Repo Market Impact: The repo (repurchase agreement) market, where hedge funds borrow money using bonds as collateral, could freeze up if lenders pull back.

For example, during the early days of the COVID-19 pandemic, the Federal Reserve had to step in and buy $100 billion in Treasuries every day to stabilize the market. One key reason was the sudden unwind of basis trades.

What Happens If Treasury Supply Keeps Growing?

If the U.S. government issues even more debt—due to rising deficits or quantitative tightening by the Fed—it could push Treasury prices lower. That would hurt the “long” bond positions in basis trades and make funding in the repo market more expensive.

With limited room on dealer balance sheets, the financial system could face a chain reaction of selling, margin calls, and market stress.

Conclusion: A Quiet but Growing Threat

The basis trade is a complex but important financial strategy. While it can offer profits under normal conditions, it becomes risky during economic shocks or rapid policy changes.

As the U.S. debt continues to rise and hedge funds expand their leveraged positions, the risk of a sudden unwind becomes larger. Investors, policymakers, and regulators need to keep a close eye on this hidden corner of the financial system.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment