Introduction

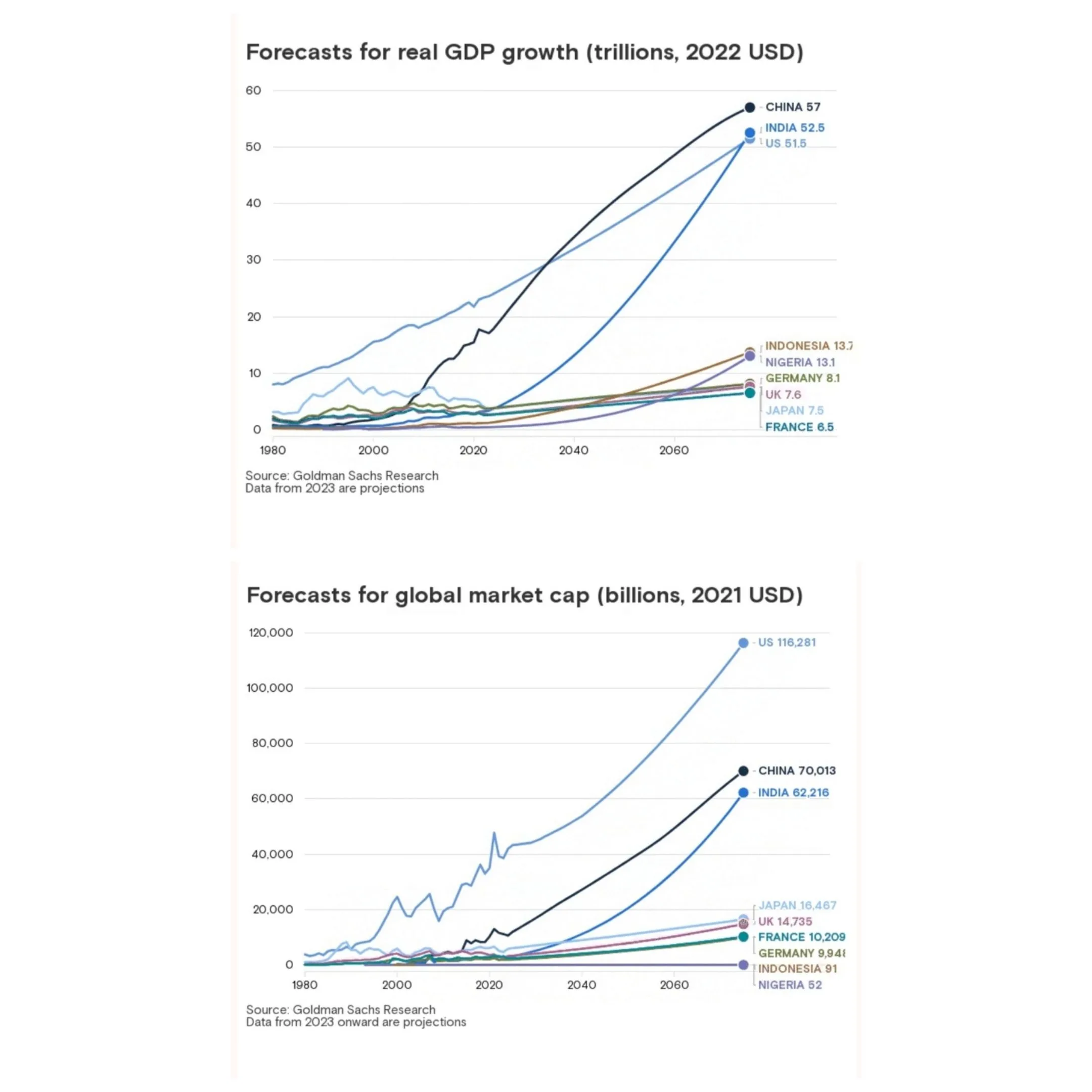

By 2075, the global economic landscape is expected to undergo a dramatic shift. While China and India may surpass the United States in terms of Gross Domestic Product (GDP), the US stock market is still projected to lead the world in market capitalization. According to a Goldman Sachs Research report, demographic trends and long-term productivity will play a crucial role in shaping the economies of the future.

The Rise of Asia: China and India Take the Lead

GDP Growth and Population Advantage

China and India, with their billion-plus populations, are poised to dominate global GDP rankings. China’s population is nearly four times that of the United States, meaning its GDP per capita only needs to reach a quarter of the US level to match its total GDP. This demographic advantage makes it highly probable that both Asian giants will surpass the US economy in size.

Emerging Market Expansion

Beyond China and India, emerging economies like Nigeria may also become major global players. As population growth and urbanization accelerate in Africa and Asia, economic power is expected to shift away from Western nations.

The US Economy: Still a Global Leader in Wealth

Higher GDP Per Capita

Despite potential GDP rankings, the US is likely to remain twice as wealthy as China and India in terms of real GDP per capita. Developed economies tend to maintain higher productivity levels, better infrastructure, and strong financial institutions, which contribute to sustained income advantages over emerging markets.

Stock Market Dominance

A key insight from Goldman Sachs Research is the strong correlation between a country’s wealth and the size of its stock market. While the US share of global market capitalization may decline, it is still expected to be around 60% larger than China’s by 2075. Wealthier nations typically have more developed financial markets, which gives the US a significant edge.

Conclusion: The Future of Global Economic Power

In the coming decades, the world’s largest economies will likely be dominated by China and India. However, when it comes to financial markets, the United States is expected to maintain its lead. The strong link between wealth and stock market size suggests that even as GDP rankings shift, the US will continue to play a crucial role in global finance.

As economic dynamics evolve, investors and policymakers will need to adapt to new global realities. Understanding these long-term trends can help businesses and individuals make informed decisions about the future of the global economy.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

2 Comments