India’s financial sector is expected to remain strong in the coming years, supported by ongoing improvements in the banking system and promising economic growth. S&P Global Ratings’ 2025 banking outlook highlights that asset quality is projected to stabilize, with non-performing loans expected to drop to about 3% of total loans by March 2025. This improvement is driven by solid corporate balance sheets and better risk management strategies.

While retail loan standards remain high and delinquency rates are under control, the rapid rise in unsecured personal loans could pose some risks. S&P Global also forecasts that loan growth will slightly outpace India’s nominal GDP, especially in the retail sector, though deposit growth may not keep up, potentially affecting credit-to-deposit ratios.

Credit costs are expected to rise from a decade-low of 0.8% in FY 2024, reaching 0.8%–0.9%, but profitability should remain robust. Returns on average assets are expected to be around 1.2% in fiscal year 2025. Additionally, the Reserve Bank of India’s stronger regulatory oversight will likely raise compliance costs but should contribute to overall financial stability.

The Indian financial system has proven resilient, benefiting from the nation’s broader economic stability. The banking sector remains well-capitalized, with a healthy balance sheet that increases its ability to absorb risks. Both the Non-Banking Financial Companies (NBFC) sector and Urban Cooperative Banks are also showing signs of improvement.

A report from the Reserve Bank of India (RBI) emphasized that the financial system’s strength is further bolstered by the Insolvency and Bankruptcy Code (IBC). This law has significantly improved asset quality by facilitating large debt settlements, which have helped strengthen the banks since its introduction in 2016.

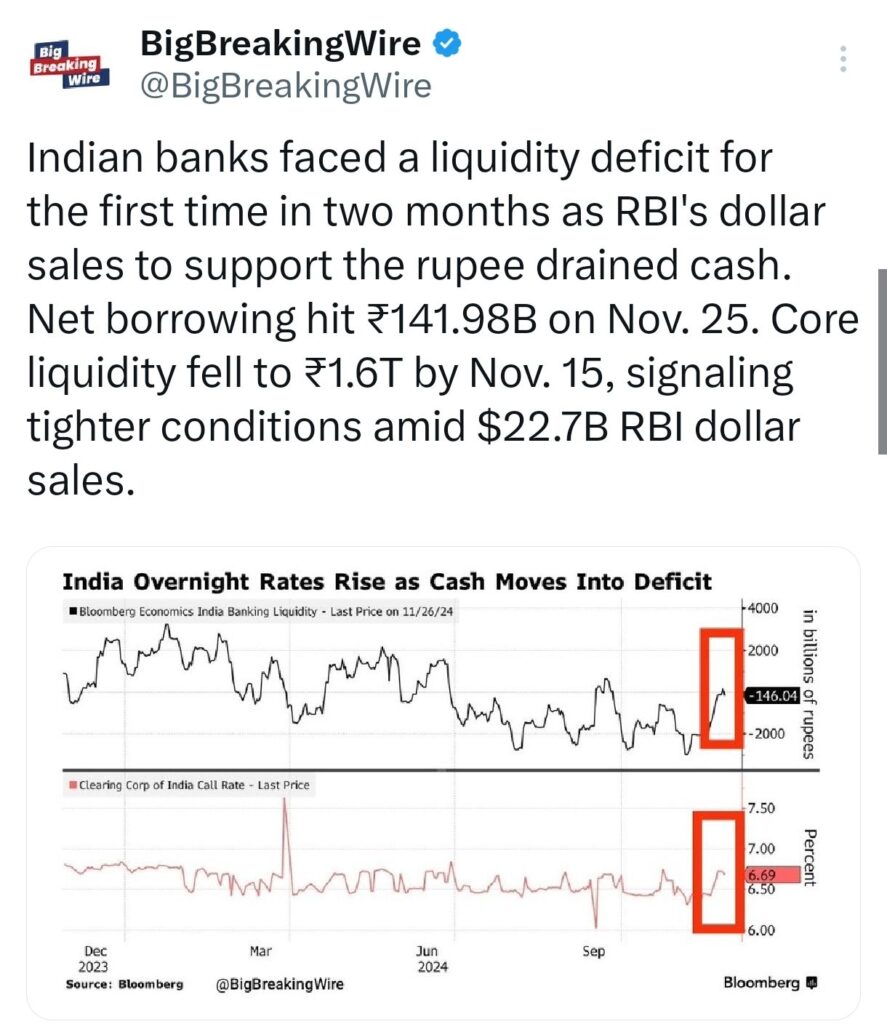

Indian Banks Face Liquidity Shortage as RBI Sells Dollars

Indian banks experienced a liquidity shortage for the first time in two months, as the Reserve Bank of India (RBI) sold dollars to support the rupee, which drained cash from the banking system. By November 25, net borrowing by banks reached ₹141.98 billion, and core liquidity had fallen to ₹1.6 trillion by November 15, indicating tighter financial conditions. This drop in liquidity came amidst the RBI’s substantial $22.7 billion worth of dollar sales.

In a notable development, State Bank of India (SBI) is in the process of securing a ¥30 billion ($197 million) loan, which is being led by Mitsubishi UFJ Financial Group. This five-year loan, raised in the Gujarat International Finance Tec-City (GIFT City), will carry a margin of 60 basis points over the Tokyo Overnight Average (TONA) rate. Additionally, other Indian banks are also working on securing a syndicated loan totaling $1.25 billion.

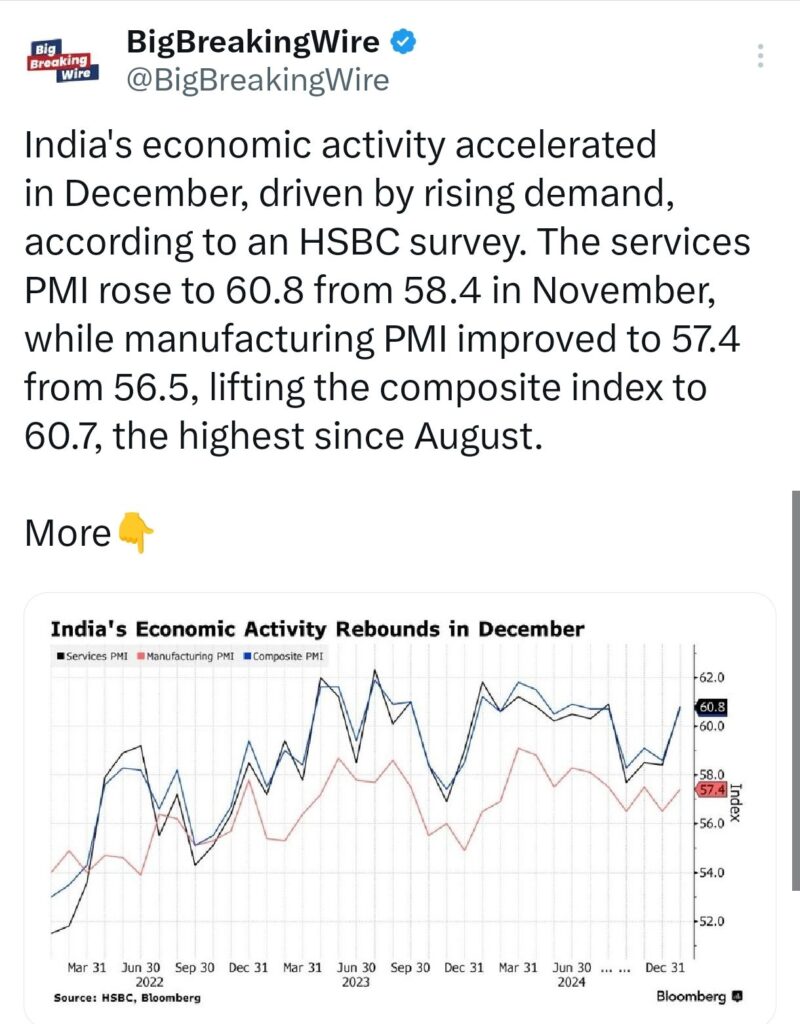

India’s Economic Activity Strengthens in December

India’s economic activity picked up pace in December, fueled by increased demand, as indicated by an HSBC survey. The services Purchasing Managers’ Index (PMI) surged to 60.8, up from 58.4 in November, reflecting a significant expansion in the services sector. Meanwhile, the manufacturing PMI rose to 57.4 from 56.5, signaling continued growth in manufacturing output. As a result, the composite PMI, which combines both sectors, reached 60.7, marking its highest level since August, indicating strong overall economic momentum.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment