India’s private sector saw the fastest growth in four months, driven by strong demand in both services and manufacturing, along with record job growth. Despite a slower 5.4% economic growth in the last quarter, easing inflation is expected to boost private sector demand in 2025.

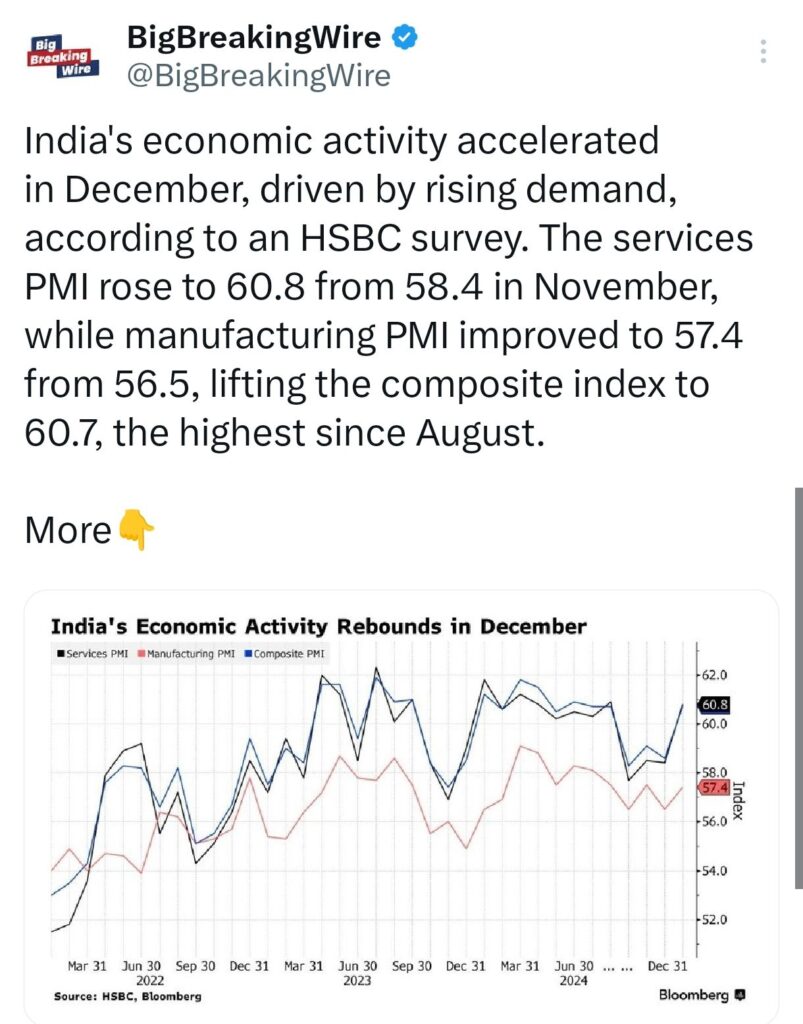

HSBC’s December flash India Composite PMI, compiled by S&P Global, rose to 60.7, matching the August reading, up from 58.6 in November. The PMI indicates strong private sector expansion, similar to the levels seen during the global financial crisis in 2008.

The manufacturing PMI saw slight improvement, reflecting gains in production, new orders, and employment. Meanwhile, the services PMI reached a four-month high of 60.8, with services leading the sales growth. International demand for both goods and services helped drive this upturn.

Falling wages and weak corporate profits slowed India’s growth to its lowest pace in nearly two years during the July-September period. However, high-frequency indicators have shown signs of recovery since October, driven by strong festive demand and increased rural activity. The Reserve Bank of India has maintained steady interest rates for almost two years, but analysts anticipate easing to begin next year.

Optimism for 2025 increased, leading to the highest rate of job creation since the survey began in 2005, with both sectors setting new employment records. While inflation pressures eased in December, businesses still raised prices, though not as sharply as in previous months.

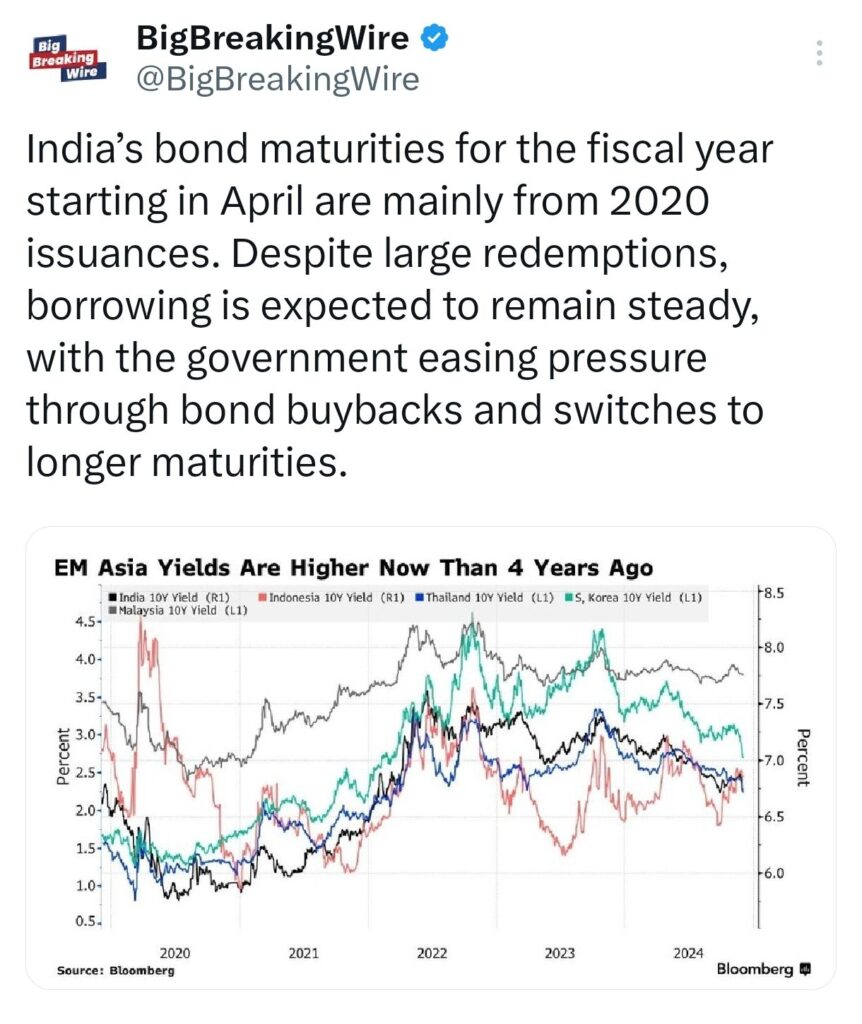

India’s Bond Maturities in FY24: Buybacks, Swaps

In the upcoming fiscal year starting in April, India will face significant bond maturities, primarily stemming from bonds issued in 2020. Although these large redemptions may create pressure, the government’s borrowing plans are expected to remain stable. To manage this, the government is likely to ease the burden by conducting bond buybacks and switches, transitioning to longer-maturity bonds. This approach is designed to smooth out repayment schedules and reduce the immediate financial strain.

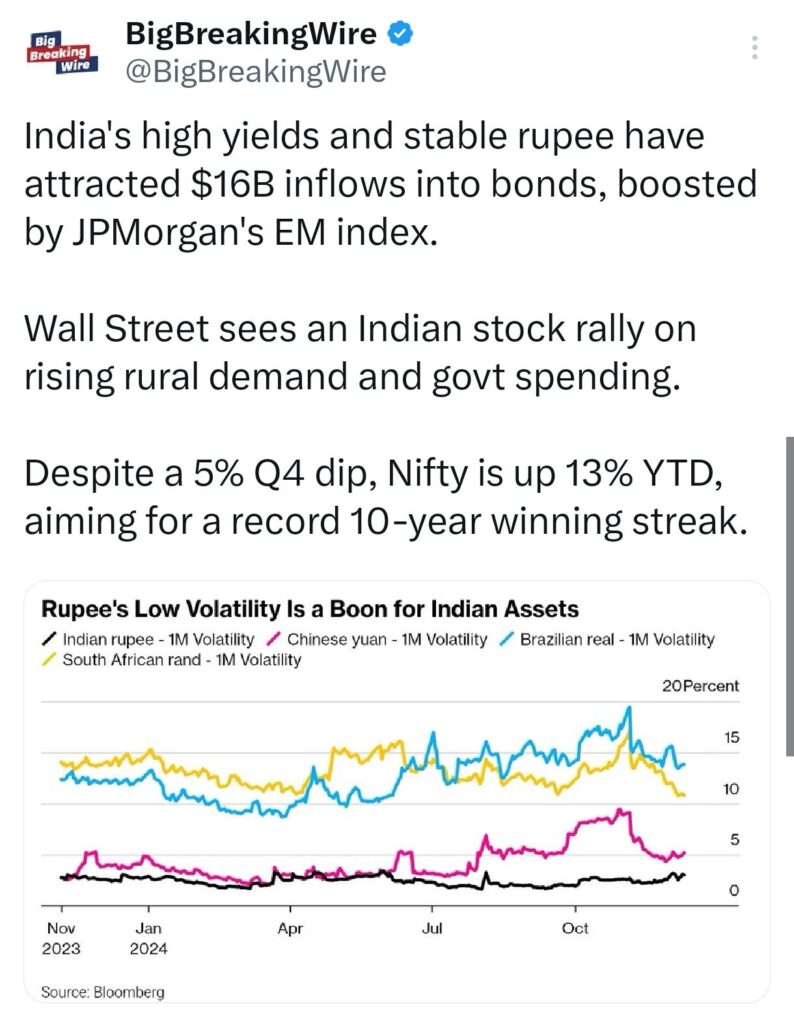

India’s high bond yields and a stable rupee have attracted $16 billion in inflows, further strengthened by JPMorgan’s inclusion of India in its emerging markets index. On the stock market front, Wall Street is predicting an Indian stock rally, driven by growing rural demand and increased government spending.

While the Nifty saw a 5% dip in Q4, it has risen 13% year-to-date and is on track to achieve its 10th consecutive year of gains, setting a record for the index.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

One Comment