In the fourth quarter, Snowflake reported earnings per share (EPS) of $0.35, surpassing the estimated $0.17. The revenue for the quarter reached $774.7 million, exceeding expectations of $760.4 million. Notably, product revenue was $738.1 million, surpassing the estimated $723.3 million.

– Earnings Report: Snowflake, a company specializing in cloud data management, had a strong fourth quarter.

– EPS: They earned $0.35 per share, beating the expected $0.17.

– Revenue: Snowflake made $774.7 million, surpassing the expected $760.4 million.

– Product Revenue: This specifically was $738.1 million, also exceeding expectations.

– Leadership Change: Sridhar Ramaswamy is now the new CEO, replacing Frank Slootman.

– Q1 Guidance: They expect product revenue to be between $745 million to $750 million, falling short of the estimated $769.5 million.

– Other Notable Points:

– Net Revenue Retention Rate: This was 131%, showing that existing customers are spending more.

– CEO Transition: Frank Slootman steps down as CEO but remains as Chairman.

– Summary of Fiscal 2024 by Frank Slootman:

– Snowflake had a 38% increase in product revenue compared to the previous year, totaling $2.67 billion.

– Their adjusted free cash flow saw a 56% year-over-year growth, reaching $810 million.

– Snowflake is gaining traction with large enterprises globally, as more companies adopt their Data Cloud for AI and data strategies.

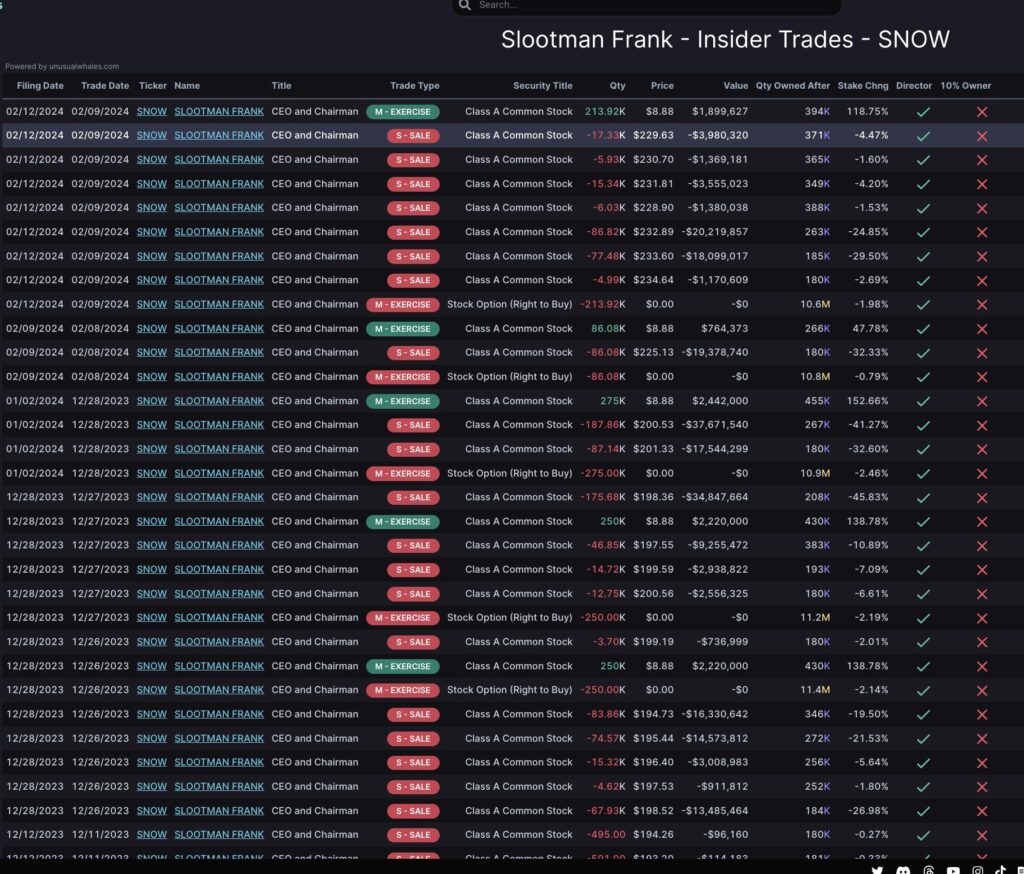

On February 28th, the CEO of Snowflake resigned, resulting in a 20% decline in the stock during after-hours trading. Over the course of 2022 and 2023, the CEO had engaged in pre-planned sales, offloading more than $200 million worth of $SNOW stock in 2023 alone.

Brokerages Price Targets on Snowflake $SNOW

• Bank of America lowered their target for Snowflake ($SNOW) to $212 from $265, maintaining a Neutral rating.

• Morgan Stanley downgraded Snowflake and reduced the target to $175 from $230.

• Piper Sandler adjusted their target to $240 from $250, maintaining an Overweight rating.

• Deutsche Bank lowered the target to $220 from $250 but maintained a Buy rating.

• DA Davidson decreased their target to $230 from $260, while still maintaining a Buy rating.

• UBS cut their target to $185 from $225, maintaining a Neutral stance.

• JP Morgan reduced their target to $170 from $200.

• JMP Securities raised their target to $235 from $212, rating it as Market Outperform.

• Jefferies revised their target down to $210 from $265.

• RBC adjusted their target to $246 from $255.

11. Melius Research lowered their target to $185 from $202.

• Scotiabank reduced their target to $207 from $226.

Median Price Target:

– Current: $212 (down by $38)

– Previous: $250

Highest Price Target:

– Current: $246 (down by $19)

– Previous: $265

Lowest Price Target:

– Current: $170 (down by $30)

– Previous: $200

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment