Morgan Stanley analyst Adam Jonas has increased Tesla’s price target to $430 from $400 while maintaining an “Overweight” rating. The firm also outlined an ambitious $800 bull case, driven by Tesla’s growing leadership in autonomous vehicles (AVs) and embodied AI.

Jonas noted that Tesla’s advancements in AI, robotics, energy storage, and infrastructure give it a unique edge in the market. The analyst highlighted Tesla’s ability to leverage synergies across Elon Musk’s other ventures, such as SpaceX and xAI, to solidify its leadership in physical AI.

Key Highlights from the Report:

– Tesla’s robotaxi model has undergone a significant upgrade, reflecting the rising importance of AV technology.

– The firm’s recent share price gains highlight investor confidence in Tesla’s physical AI capabilities.

– Despite challenges in the 2025 EV market, Tesla’s addressable market is expected to grow into new areas not yet captured by current financial models.

Morgan Stanley sees Tesla’s skill set driving future growth, with its embodied AI initiatives expanding its reach beyond traditional auto markets. Jonas reaffirmed Tesla as a top pick, predicting its valuation will increasingly reflect these opportunities.

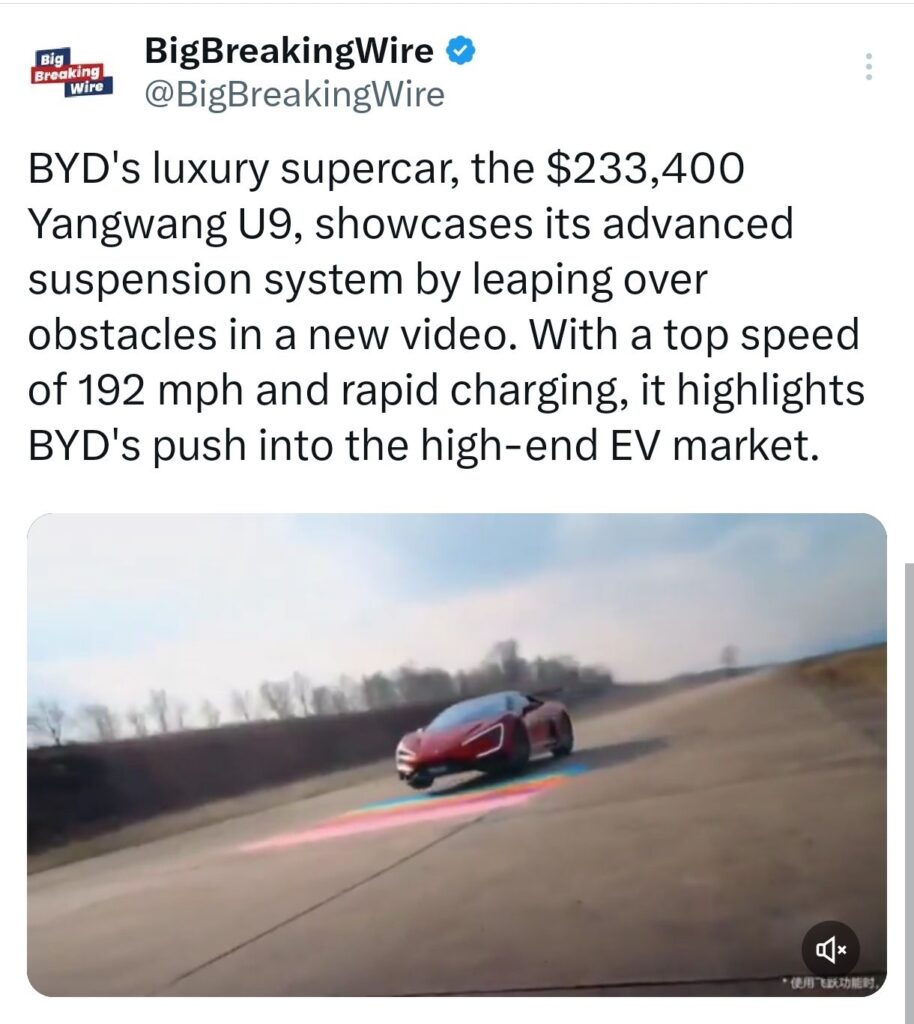

BYD’s $233K U9 Leaps Into Luxury EVs

BYD’s luxury electric supercar, the Yangwang U9, priced at $233,400, has made headlines with a video demonstrating its cutting-edge suspension system, capable of leaping over obstacles. Boasting a top speed of 192 mph and ultra-fast charging, the U9 represents BYD’s bold entry into the premium EV segment, showcasing its commitment to innovation and performance in the high-end automotive market.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

One Comment