According to a report by Jefferies, the Central government’s capital expenditure (capex) is expected to rise significantly by 25% in the second half of FY 2024-2025, compared to the same period last year. This robust increase is part of the government’s strategic focus on boosting economic growth and job creation through large-scale infrastructure projects. While populist policies have gained popularity in some states, the Centre’s spending priorities emphasize a balanced approach, aiming to create long-term economic assets.

The total central government expenditure, which includes social welfare schemes, is projected to grow by about 15% year-on-year in the second half of FY 2024-2025. This indicates the government’s ongoing commitment to supporting major infrastructure initiatives alongside its focus on welfare programs.

However, the report also highlights concerns over the rising popularity of welfare schemes in state elections, such as Maharashtra’s Rs 46,000 crore annual welfare program, which represents 1.1% of the state’s GDP. Similar schemes are already implemented in 14 out of 28 Indian states, covering about 120 million households at a combined cost of 0.7-0.8% of India’s GDP. While these initiatives raise concerns about potential populism, the Centre remains focused on creating long-term growth through infrastructure.

The report also addresses recent trends in the Indian stock market, suggesting that it may be stabilizing after a recent correction, particularly in mid-cap stocks. Despite foreign investors selling over $12.5 billion worth of Indian equities in the last two months, strong domestic investment has absorbed these outflows. October saw record inflows into equity mutual funds, signaling confidence in the Indian market and providing reassurance amid the correction.

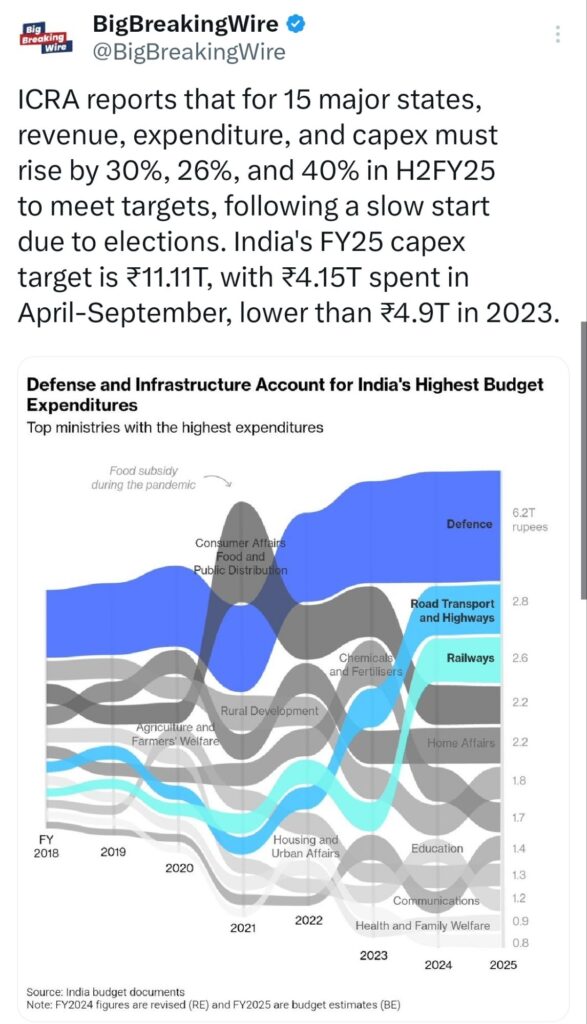

ICRA: States Need 30%-40% Growth in H2FY25

ICRA has reported that for 15 major states, revenue, expenditure, and capital expenditure (capex) must increase by 30%, 26%, and 40%, respectively, in the second half of FY25 to meet their targets. This follows a slow start to the fiscal year, largely attributed to the impact of state elections. India’s overall capex target for FY25 is ₹11.11 trillion, with ₹4.15 trillion already spent in the first half of the year (April-September). This is lower than the ₹4.9 trillion spent during the same period in FY2023, indicating a need for significant acceleration in the second half to meet the target.

Overseas Investors Eye India’s Growth

Despite $2 billion in outflows by mid-November, overseas investors continue to view India as a promising market. Sectors such as industrials, healthcare, and telecom attracted $3 billion each, highlighting their strong growth prospects. In contrast, sectors like banks, energy, and consumer goods have lagged behind in terms of investment. As earnings growth slows and the supply of shares increases, investor focus is shifting towards areas with higher growth potential, signaling a more selective approach in the Indian market.

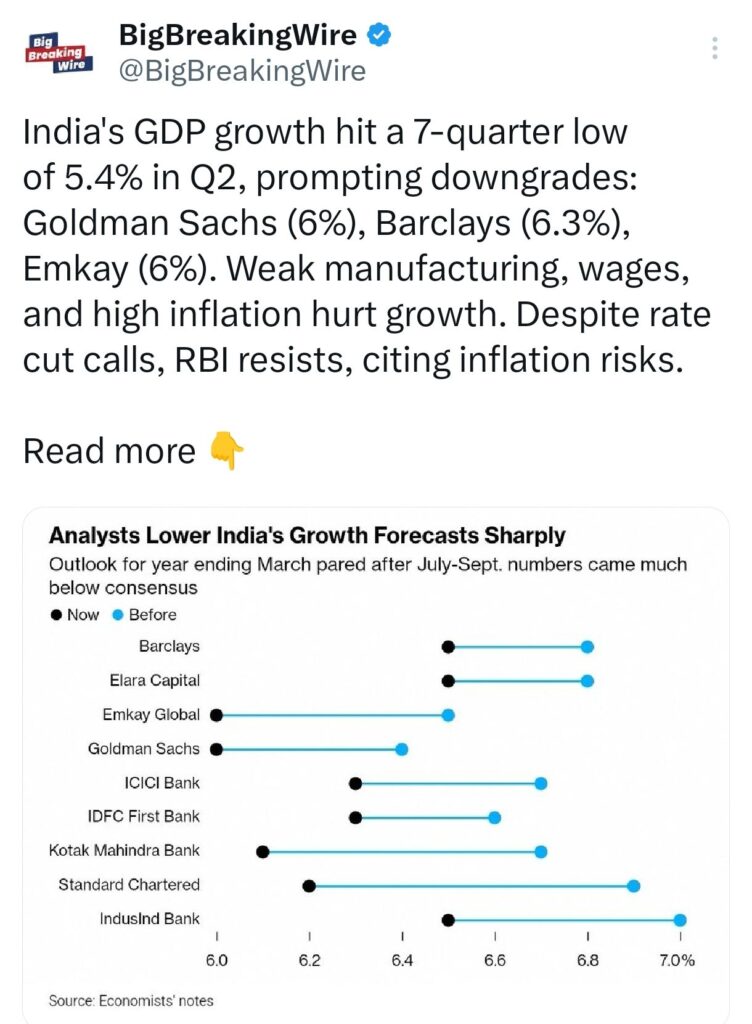

India’s Q2 GDP Growth Slows to 5.4%

India’s GDP growth for the second quarter (Q2) of the fiscal year slowed to 5.4%, falling short of expectations set by J.P. Morgan, which had projected a growth rate of 6.4%. The weaker-than-anticipated growth can be attributed to sluggish private consumption and a slowdown in investment activities. Additionally, slower government expenditure, a dip in export performance, and reduced Goods and Services Tax (GST) collections further dampened the overall economic expansion. Despite the slowdown in Q2, the government is still forecasting a full-year GDP growth rate of 6.4%.

India’s Q2 GDP fell to a 7-quarter low of 5.4%, prompting growth downgrades by Goldman Sachs (6%), Barclays (6.3%), and Emkay (6%). Weak manufacturing, high inflation, and stagnant wages contributed to the slowdown.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment