Japan remained the top foreign holder of U.S. Treasury securities in September 2025, with holdings rising to $1.189 trillion. This marks Japan’s highest level since August 2022, when its Treasury stockpile reached $1.196 trillion. Japan has now increased its U.S. debt holdings for nine consecutive months, reflecting strong demand for safe assets.

China’s Treasury Holdings Continue a Long-Term Decline

China’s position slipped slightly to $700.5 billion in September from $701 billion in August. In July, China’s total fell to $696.9 billion, the lowest since October 2008. The gradual decline shows China’s ongoing diversification away from U.S. debt.

Foreign Investors Boost U.S. Equity Buying

Foreign investors purchased a significant $132.9 billion in U.S. equities in September. This is a sharp jump from $89.4 billion in August and a strong reversal from the $16.2 billion outflow seen in July.

Net Capital Inflows Strengthen

The United States recorded a net capital inflow of $190.1 billion in September, up from $187.1 billion in August. July had posted a net capital outflow of $6.6 billion. This steady inflow highlights strong global confidence in U.S. financial markets.

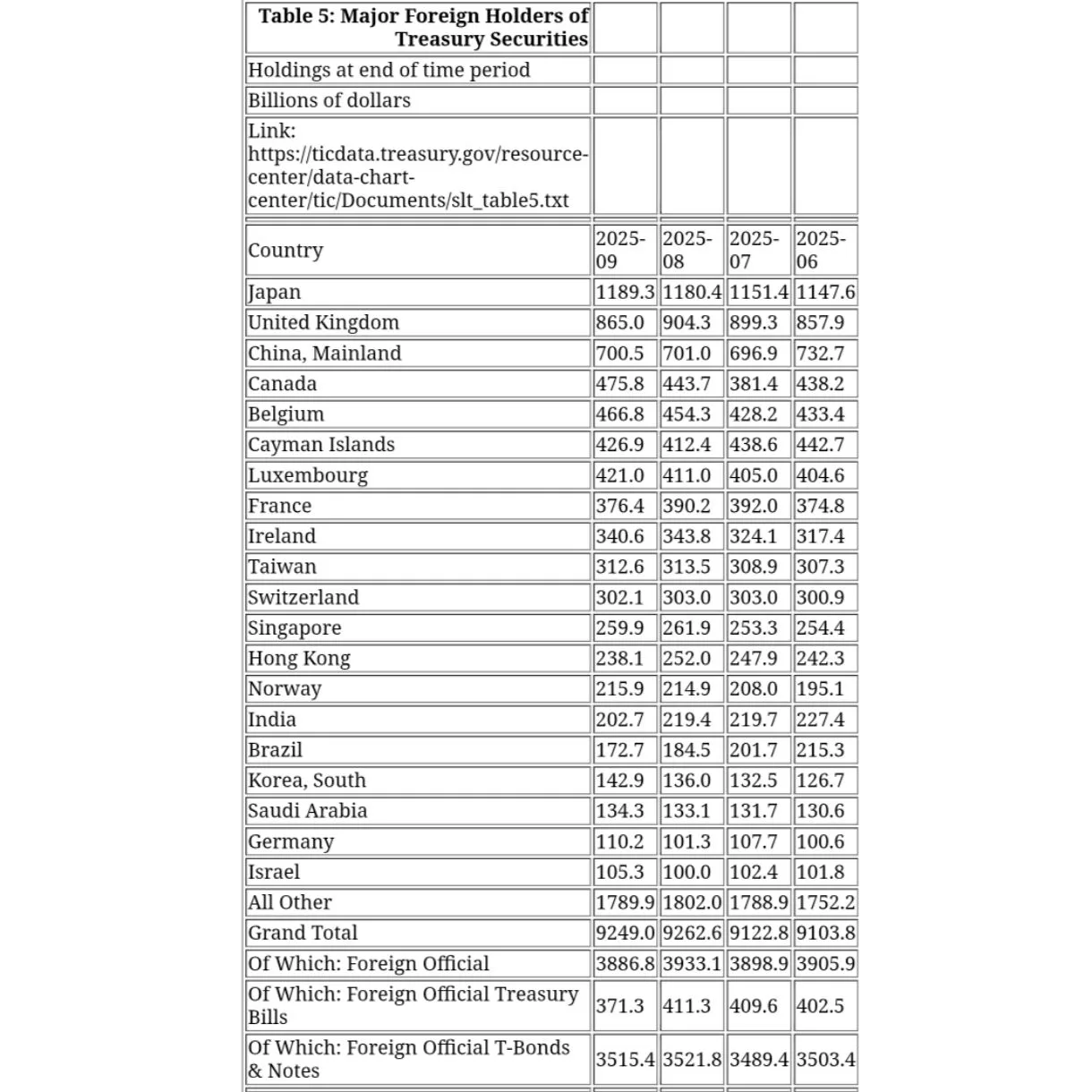

Full Data: Major Foreign Holders of U.S. Treasuries (June–September 2025)

| Country | 2025-09 | 2025-08 | 2025-07 | 2025-06 |

|---|---|---|---|---|

| Japan | 1189.3 | 1180.4 | 1151.4 | 1147.6 |

| United Kingdom | 865.0 | 904.3 | 899.3 | 857.9 |

| China, Mainland | 700.5 | 701.0 | 696.9 | 732.7 |

| Canada | 475.8 | 443.7 | 381.4 | 438.2 |

| Belgium | 466.8 | 454.3 | 428.2 | 433.4 |

| Cayman Islands | 426.9 | 412.4 | 438.6 | 442.7 |

| Luxembourg | 421.0 | 411.0 | 405.0 | 404.6 |

| France | 376.4 | 390.2 | 392.0 | 374.8 |

| Ireland | 340.6 | 343.8 | 324.1 | 317.4 |

| Taiwan | 312.6 | 313.5 | 308.9 | 307.3 |

| Switzerland | 302.1 | 303.0 | 303.0 | 300.9 |

| Singapore | 259.9 | 261.9 | 253.3 | 254.4 |

| Hong Kong | 238.1 | 252.0 | 247.9 | 242.3 |

| Norway | 215.9 | 214.9 | 208.0 | 195.1 |

| India | 202.7 | 219.4 | 219.7 | 227.4 |

| Brazil | 172.7 | 184.5 | 201.7 | 215.3 |

| Korea, South | 142.9 | 136.0 | 132.5 | 126.7 |

| Saudi Arabia | 134.3 | 133.1 | 131.7 | 130.6 |

| Germany | 110.2 | 101.3 | 107.7 | 100.6 |

| Israel | 105.3 | 100.0 | 102.4 | 101.8 |

| All Other | 1789.9 | 1802.0 | 1788.9 | 1752.2 |

| Grand Total | 9249.0 | 9262.6 | 9122.8 | 9103.8 |

| Foreign Official | 3886.8 | 3933.1 | 3898.9 | 3905.9 |

| Foreign Official Treasury Bills | 371.3 | 411.3 | 409.6 | 402.5 |

| Foreign Official T-Bonds & Notes | 3515.4 | 3521.8 | 3489.4 | 3503.4 |

Key Highlights

- Japan leads with $1.189 trillion — highest since 2022.

- China declines to $700.5 billion — near 17-year lows.

- Foreign equity inflows jump to $132.9 billion.

- Net capital inflow rises to $190.1 billion.

- Total foreign holdings reach $9.249 trillion.

This report is based on the latest TIC (Treasury International Capital) data.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment