The Indian stock market is moving toward greater self-reliance, marked by a significant increase in domestic investors’ share. As of June 30, 2024, the shareholding of domestic investors in Indian markets reached an all-time high of 25.85%. In contrast, the share of foreign investors (FIIs) has declined to a 12-year low, according to a report from PRIME Database.

Domestic Institutional Investors (DIIs), along with retail investors and High Net Worth Individuals (HNIs), have been playing a strong counterbalancing role, with their collective share reaching an all-time high of 25.85% as of June 30, 2024. This is a notable shift, as FIIs have historically been the largest non-promoter shareholder category in the Indian market. Pranav Haldea, Managing Director of PRIME Database Group, emphasized that the share of DIIs is expected to overtake that of FIIs in the next few quarters.

During the quarter ending June 2024, the share of DIIs increased to 16.23% from 16.07%. In contrast, FIIs withdrew ₹7,693 crore from the Indian stock market during this period, leading to a decrease in their share to 17.38%, down from 17.72% in March 2024. This has narrowed the gap between FII and DII holdings to the lowest level ever, with DII holdings now just 6.60% lower than FII holdings. The FII to DII ownership ratio has also fallen to an all-time low of 1.07, down from an all-time high of 1.99 in the quarter ending March 31, 2015.

Additionally, the share of domestic mutual funds (MFs) in NSE-listed companies rose to an all-time high of 9.17% as of June 30, 2024, up from 8.93% in March 2024. This increase was fueled by strong net inflows of ₹1.09 lakh crore during the quarter.

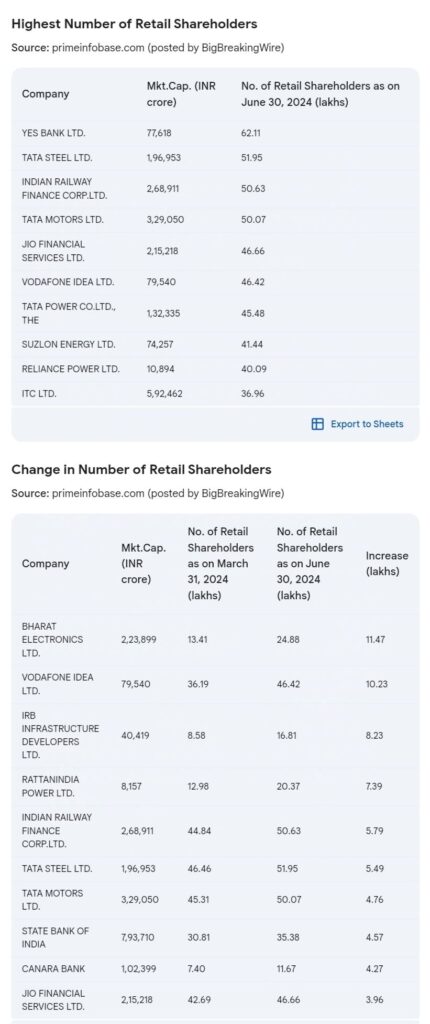

Retail share by value in companies listed on the NSE increased to 7.64% as of June 30, 2024, up from 7.52% on March 31, 2024. In terms of value, retail holdings amounted to ₹33.01 lakh crore on June 30, representing a 15.31% increase from the previous quarter.

When considering only free float (non-promoter holdings), the retail share by value rose to 15.77% in the quarter ending June 2024, compared to 15.46% the quarter before. However, in terms of ownership by the number of shares or volume (calculated as the average of retail holdings as a percentage of total share capital across all NSE-listed companies), the retail share decreased to 16.41% as of June 30, 2024, down from 16.57% on March 31, 2024.

Life Insurance Corporation of India (LIC), the largest institutional investor in India, saw its share across 282 companies (where its holding exceeds 1%) decrease to an all-time low of 3.64% in Q1 FY25, down from 3.75% in the previous quarter. Despite net buying of ₹12,400 crore during the quarter, LIC’s share decreased, which also contributed to a decline in the overall share of insurance companies from 5.40% to 5.23%.

The government’s stake as a promoter increased to a seven-year high of 10.64% as of June 30, 2024, benefiting from the strong performance of several public sector undertakings (PSUs). Conversely, the share of private promoters fell to a five-year low of 40.88% during the same period. This decline is attributed to stake sales by promoters aiming to capitalize on the bullish markets and the overall institutionalization of the market.

In summary, the Indian stock market is experiencing a notable transition towards greater self-reliance, as domestic investors gain prominence and foreign investors reduce their presence. This shift signifies a growing confidence in domestic participation and a changing landscape in the market’s dynamics.

Nifty indices have declined between 3% and 21% from their 52-week highs, while the Nifty PSU Bank has entered bear market territory.

Nifty Indices and Fall from 52-Week High 🚨

In the September quarter, promoters of nearly 600 companies (597 to be exact) reduced their holdings, significantly outpacing the 210 firms where promoters increased their stakes. Data from Ace Equities reveals that about 3,300 companies have reported their shareholding patterns for the quarter, with approximately 2,500 firms maintaining unchanged promoter holdings. However, among those that did see changes, the number of firms with declining holdings greatly exceeded those with rising stakes.

Stay informed with our financial updates, stocks, bonds, commodities. Get global & political insights. Follow us & enable notifications for the latest updates.

[…] Indian Stock Market Insights: DII Share Hits Record High of 25.85%, Retail Investors at 7.64%, LIC Holdings at All-Time Low of 3.64%, Government Stake Reaches Seven-Year High of 10.64%, and FII Share Declines to 17.38% […]

[…] of the September quarter, DII share in NSE companies reached a high of 16.2%, slightly up from 16.15% in the previous quarter. FII stakes also saw a slight rise to 16.44% from […]

[…] Indian Retail Loans, US Elections, Indian Economy, China’s Economic Package & More Indian Stock Market Insights: DII Share Hits Record High of 25.85%, Retail Investors at 7.64%, LIC H… Foreign Investors’ Stake in NSE Falls to 15.98% (12-Year Low); Mutual Funds Rise to Record […]