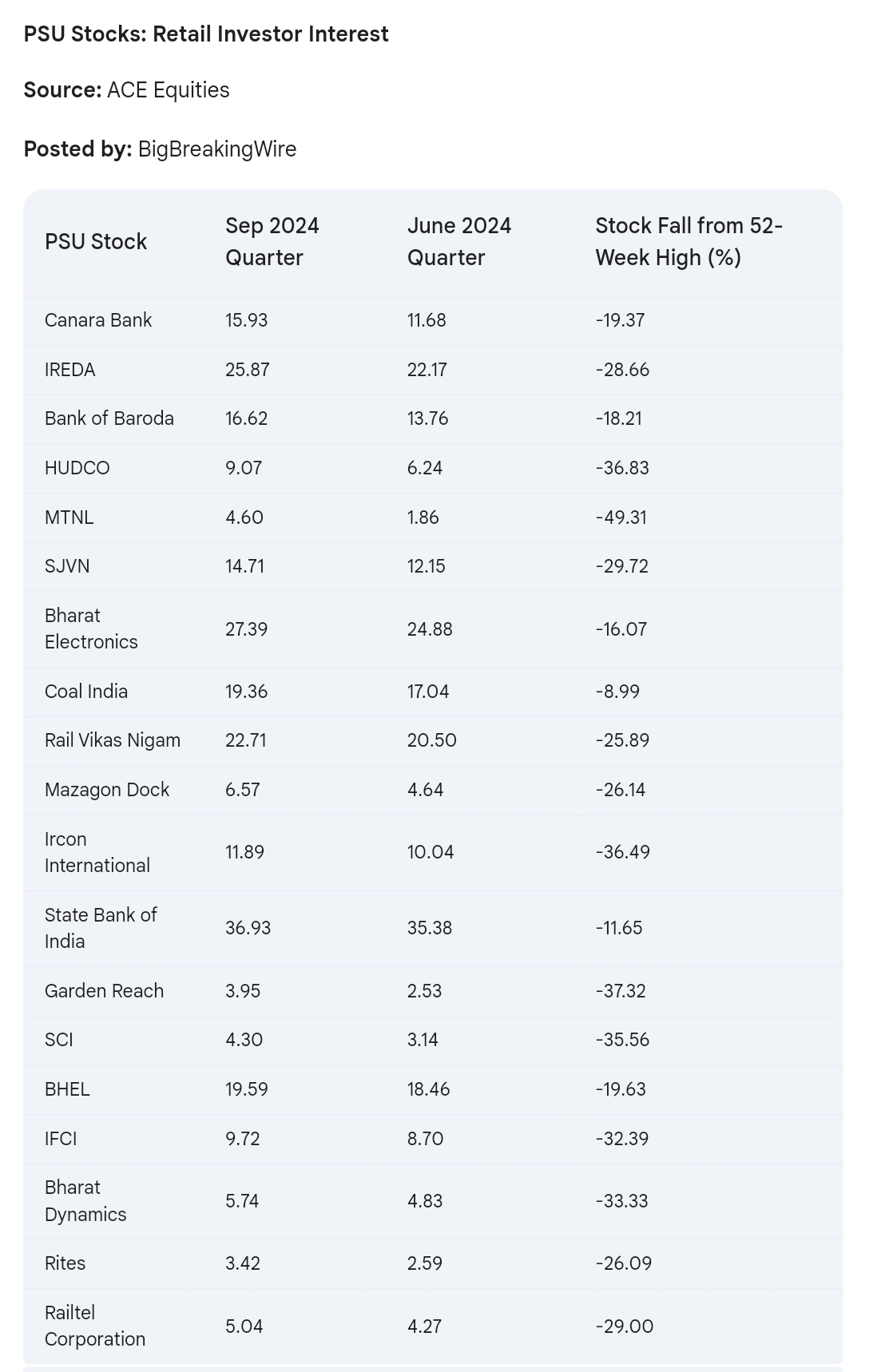

In the September quarter, most PSUs saw an increase in retail shareholders, with over 55 out of 68 companies reporting a rise, even as many shares declined. Canara Bank led with an addition of 446,000 new retail investors, followed by IREDA with 374,000, Bank of Baroda with 300,000, and HUDCO with 287,000. Despite these increases, these stocks fell between 20-30% from their respective 52-week highs.

Other PSUs like SJVN gained 268,000, MTNL added 254,000 new investors, Bharat Electronics 253,000, Coal India 247,000, and State Bank of India 179,000. However, MTNL and SJVN saw significant share price declines of over 38% and 50%, respectively.

Since July, PSU stocks have entered a correction phase due to overvaluation following a significant rally. Retail interest has also risen in other PSUs, including Garden Reach Shipbuilders, Shipping Corporation of India, and BHEL. However, some stocks, like LIC, which dropped 23%, experienced a decline of 150,000 retail shareholders, with similar trends seen in NALCO and BPCL, where retail investors fell by 40,000 and 20,000, respectively, due to declines of around 8% each.

Stocks of several government-backed companies in India, especially in the railway and defense sectors, have recently declined after a significant rise. This downturn is primarily attributed to foreign investors offloading their shares. Currently, 14 companies in the Nifty CPSE Index have seen their prices fall over 10% from their peak levels in the past year, while another seven are down about 5%.

In the past 11 trading days, foreign investors have sold more than ₹74,800 crore worth of Indian stocks, whereas domestic investors have bought around ₹75,200 crore in stocks during the same timeframe, though it remains unclear if any of these purchases included PSU stocks. Despite a 15% rise in the Nifty 50 compared to last year, the index has faced a decline over the past month, with nearly 40% of its constituents currently in correction mode.

While the Nifty 50 has experienced only a 6% drop in the last nine trading days, numerous major stocks are already correcting. Approximately 20 stocks have fallen by 10%, and five have seen declines exceeding 15% from their highest prices over the past year.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment