India is set to raise Rs 8 trillion ($93.34 billion) through bond sales in the first half of the upcoming fiscal year, according to the finance ministry. The borrowing plan, spanning April to September, outlines the government’s strategy for debt issuance across various maturities to support fiscal operations.

Bond Sale Breakdown for April-September

The bond issuances will be spread across different tenures, ensuring a balanced mix to attract diverse investor interest.

Maturity-Wise Distribution:

Short-term bonds (Less than 10 years): 25% of the total issuance

Benchmark 10-year bonds: 26.2% share

Ultra-long bonds (30-50 years): 35%, down from 38% last year

Green bonds: Rs 100 billion worth of issuance

The government has increased the auction size of 10-year bonds to Rs 300 billion per sale, up from Rs 220 billion in the previous October-March period.

RBI’s Liquidity Boost and Bond Market Impact

The Reserve Bank of India (RBI) has injected over $60 billion into the system over the past two months to address a severe liquidity deficit. This move contributed to a three-year low in the 10-year bond yield, which dropped to 6.58% on Thursday.

In the upcoming fiscal year, the RBI is expected to purchase Rs 1 trillion worth of bonds, further easing market conditions and stabilizing yields.

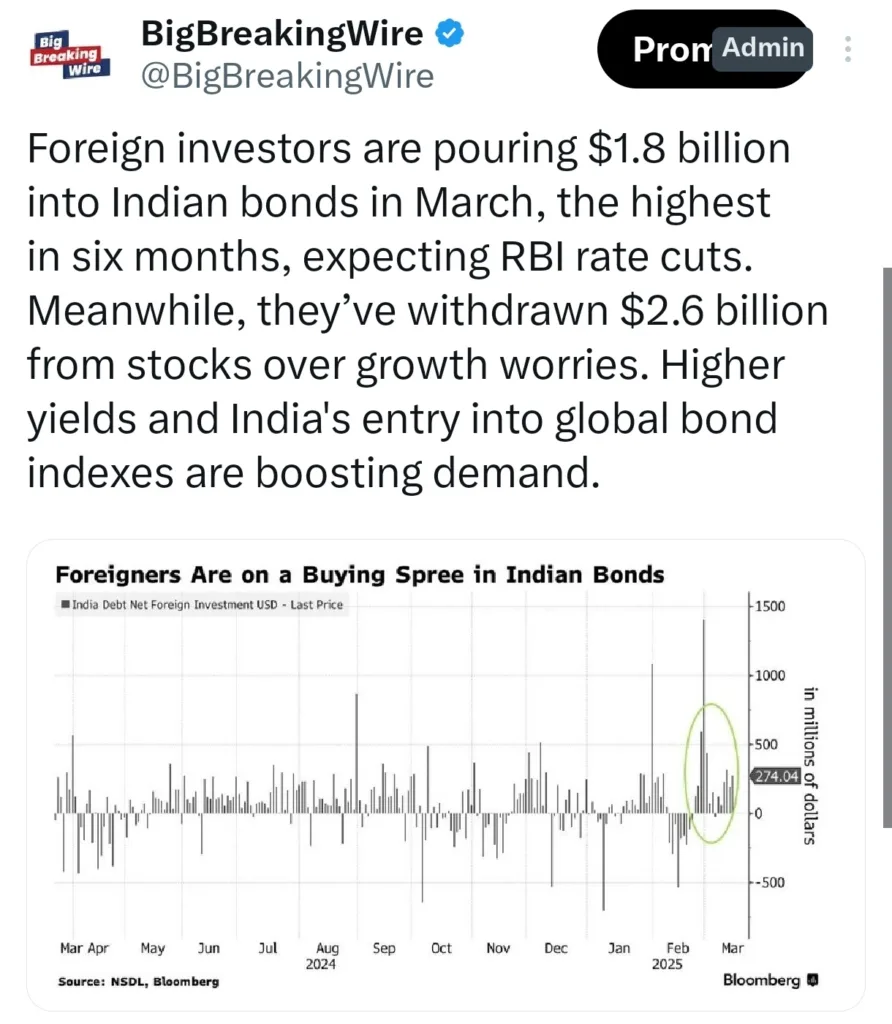

Foreign Investment in Indian Bonds on the Rise

Foreign investors have shown strong confidence in India’s bond market, with $3 billion in inflows this month—the highest since 2017. The government has responded to investor feedback by reducing ultra-long bond issuances due to weak demand in recent auctions.

Treasury Bills and Short-Term Borrowing Plan

To manage short-term funding needs, India will issue treasury bills (T-bills) worth ₹19,000 crore per week in the April-June quarter, distributed as follows:

91-day T-bills: Rs 9,000 crore

182-day T-bills: Rs 5,000 crore

364-day T-bills: Rs 5,000 crore

Additionally, the Ways and Means Advances (WMA) limit has been set at Rs 1.5 trillion for the first half of FY26 to address temporary mismatches in government accounts.

Retail Investors and Auction Flexibility

To encourage broader participation, 5% of the total bond issuance will be reserved for specified retail investors under the non-competitive bidding mechanism. Moreover, the government retains the right to exercise the greenshoe option to accept additional bids of up to Rs 2,000 crore per auction.

Fiscal Deficit Target for FY26

India aims to contain the fiscal deficit at 4.4% of GDP in the next financial year. The government’s structured borrowing plan aligns with its fiscal consolidation strategy while maintaining adequate liquidity in the financial system.

Conclusion

India’s bond market is witnessing strong foreign inflows, lower yields, and an active RBI intervention, creating favorable conditions for upcoming debt issuances. With a structured borrowing calendar, strategic reduction in ultra-long bonds, and increased auction sizes for benchmark securities, the government aims to balance market demand and fiscal discipline effectively.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment