Understanding the Economic Context

As we enter the second quarter of 2025, the global economy is facing increasing headwinds. After a period of uneven recovery post-pandemic and major policy shifts in the US and other key regions, concerns about a broad-based recession are growing louder. According to BCA Research, both the US and several major economies are likely to slip into a recession this year. A major contributor is tariff-induced inflation, which has made it harder for central banks to ease monetary policy—prolonging the economic pain instead of resolving it.

1. Global Economy

According to BCA Research, the US and many big economies are expected to fall into a recession in 2025. Due to tariffs, inflation will stay high, and central banks may not be able to help much by cutting interest rates. This means the recession might last longer.

2. Stock Market (Equities)

BCA expects the S&P 500 index to drop to 4450 by the end of 2025.

Defensive stocks (like healthcare and utilities) will perform better than riskier ones.

Stocks outside the US will also face challenges during the recession but may bounce back stronger than US stocks when the economy improves.

3. Bonds

Due to high inflation and government spending (without enough revenue), interest rates will remain high for some time.

But later, the Federal Reserve will likely cut rates aggressively, bringing the 10-year US Treasury yield down to 3.25%.

4. Currency Outlook

The US Dollar is expected to stay strong for now, but may start a long decline afterward.

The Japanese Yen is BCA’s top currency pick for the rest of 2025.

5. Commodities

A global slowdown will push Brent oil prices down to $50 per barrel and copper to $3 per pound in the short term.

Over the long term, copper looks more promising.

Gold’s bull market still has room to grow, according to BCA.

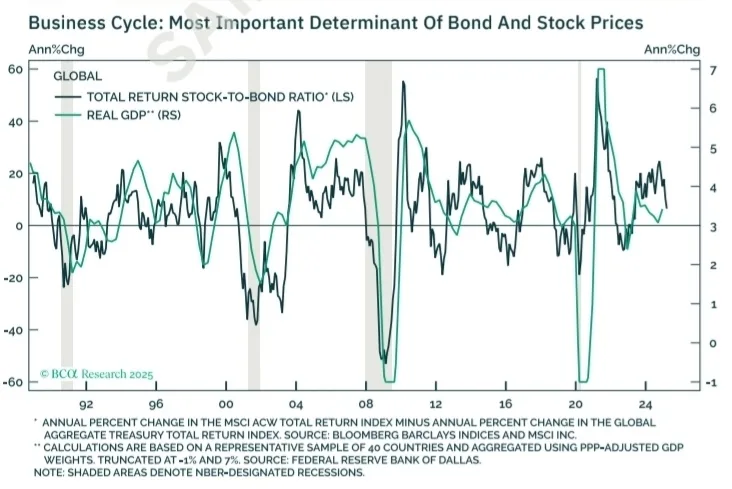

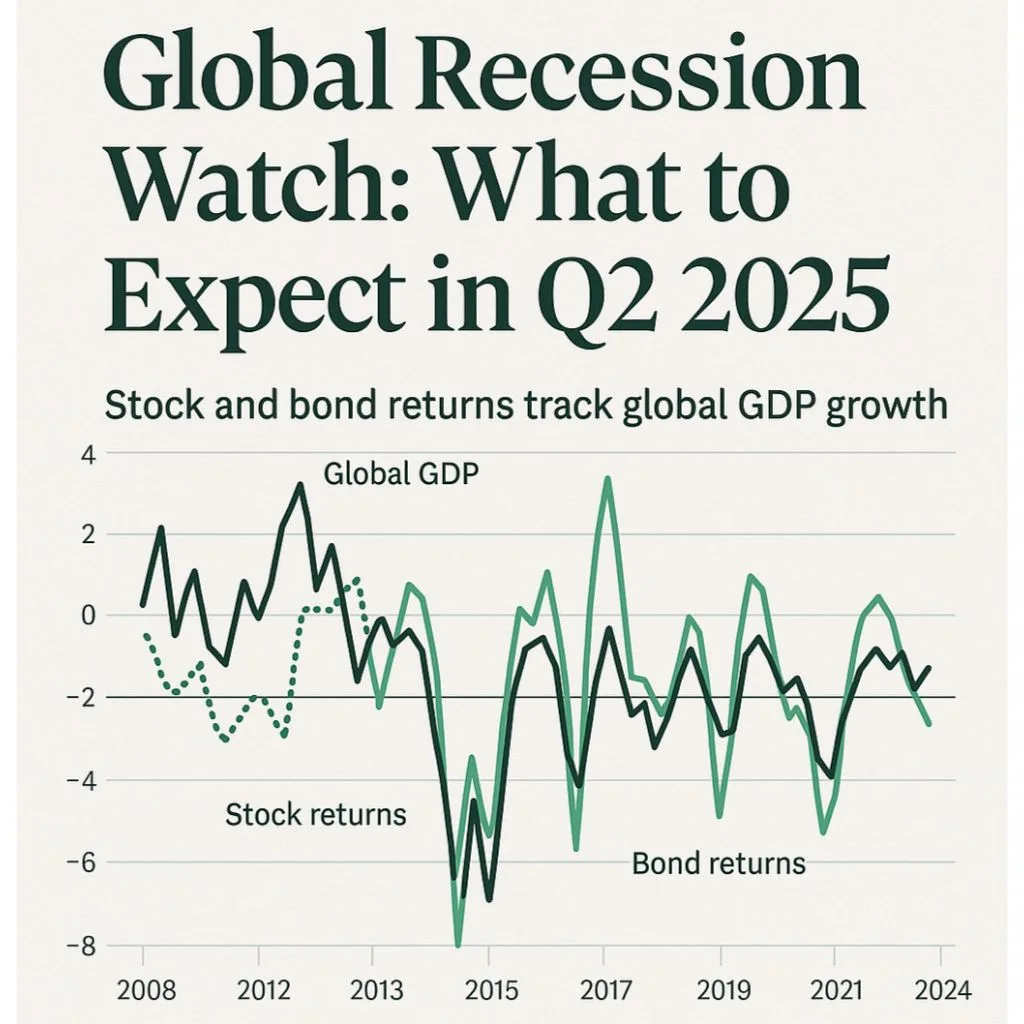

Chart Insight

A graph in the report shows that stock and bond returns are closely tied to how fast economies grow. When global GDP (economic growth) drops, both stock and bond returns usually fall too.

Final Note from BCA Research

BCA had earlier disagreed with the popular belief that there would be a recession in 2022. But now, after the 2024 US elections, they are confident a recession is coming in the next few months.

Source: BCA Research

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment