In August, foreign investors increased their stakes in India’s information technology (IT) and pharmaceutical sectors, expecting a potential rate cut by the U.S. Federal Reserve, data revealed on Thursday. Both sectors, which generate a substantial portion of their revenue from the U.S., saw significant buying activity from foreign portfolio investors (FPIs).

Data from the National Securities Depository Ltd (NSDL) showed that FPIs also turned their attention to consumer stocks, driven by strong earnings momentum and hopes for a demand recovery, supported by stable monsoons in India.

IT and Pharma Investments Surge

After investing ₹117.63 billion ($1.40 billion) in IT stocks in July, the highest since a new classification in 2022, FPIs continued their buying spree, purchasing IT shares worth ₹40.36 billion in August. Healthcare stocks also saw substantial inflows, with FPIs buying ₹51.99 billion worth of shares.

As a result, both the IT and pharma sectors saw strong performance in August, with the IT sub-index rising by 4.7% and the pharma sub-index gaining 6.6%. These gains helped lift India’s benchmark Nifty 50 index by 1.1% for the month.

Consumer Stocks Attract Attention

Consumer durables, consumer services, and fast-moving consumer goods (FMCG) were also popular among FPIs, with inflows ranging from ₹36 billion to ₹50 billion. The FMCG index saw a 1.6% increase in August.

Foreign Investment Trends

Overall, FPI inflows into Indian equities turned positive in August after a volatile start to the month. In total, foreign investors poured ₹25,000 crore into eight sectors, reversing the outflows experienced in the first half of the month. Consumer durables saw the largest inflows, with foreign institutional investors (FIIs) purchasing around ₹5,297 crore, followed by IT (₹4,529 crore), services (₹4,251 crore), and financials (₹2,782 crore).

Sectors like oil & gas (₹2,518 crore), healthcare (₹2,369 crore), consumer services (₹1,962 crore), and FMCG (₹1,815 crore) also attracted FPI buying.

Sectors Facing Selling Pressure

Despite the positive momentum in many sectors, some industries faced significant selling pressure from FIIs. The power sector led the outflows, with over ₹2,305 crore in sales. Other sectors affected included metals & mining (₹1,105 crore outflows) and automobiles (₹751 crore outflows).

Market Recovery and Outlook

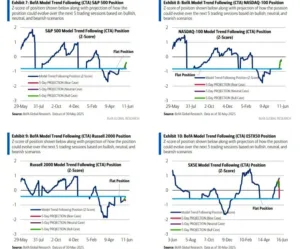

The Indian markets experienced volatility in early August, largely due to concerns over a potential U.S. market slowdown and the unwinding of the Yen carry trade. However, by the second half of the month, markets rebounded, driven by rising hopes of a U.S. Federal Reserve rate cut in September.

This shift in sentiment fueled FPI interest across multiple sectors, particularly those with strong links to U.S. economic conditions and domestic consumption growth.

JPMorgan experts, led by Mislav Matejka, said the FED is likely to start cutting interest rates soon. However, they warn that this may not lead to stock market gains because the cuts are due to slower economic growth, which could reduce the positive impact on stocks.

In summary, foreign investors’ increased appetite for IT, pharma, and consumer stocks in August reflects confidence in both India’s economic fundamentals and the likelihood of favorable U.S. monetary policy decisions, suggesting continued market optimism moving forward.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment