Introducing This Week in Economy (in Charts)—a new weekly update where we’ll highlight the most important economic events from the past week, explained through easy-to-follow charts. Stay tuned for clear insights and visual breakdowns of key trends and data!

India’s Retail Loan Defaults Rise, Impacting Lenders and Consumer Demand

India is seeing an increase in defaults on retail loans, mainly due to aggressive lending practices. This is having a negative impact on stocks, especially for lenders like Kotak and IndusInd, which have reported problems with unsecured loans. Smaller lenders are facing even bigger declines, and analysts warn that the situation could worsen if consumer demand doesn’t pick up.

In August, the growth rate of personal loans dropped to 14%, down from more than 30% during the same time last year. Banks like Ujjivan Small Finance Bank and IIFL Finance are expecting continued struggles in the loan sector. Additionally, stocks of microfinance companies such as Fusion Finance and Spandana Sphoorty have fallen by more than 60%, which is also affecting consumer spending on big-ticket items.

Investors Eye Trade Tariffs; Europe, China, and Emerging Markets Most Affected

Investors are closely watching trade tariffs after Trump’s election, as European, Chinese, and emerging markets are particularly affected by these changes. US stocks are less impacted and show lower volatility. In Europe, countries like those in the Nordic region, along with sectors such as machinery, pharmaceuticals, and chemicals, are the most vulnerable to the effects of new tariffs.

Americans Hold Record Share of Assets in Stocks, Cash Allocations at Record Low

As of October 15, US households held a record 48% of their assets in stocks. Meanwhile, their cash holdings have dropped to a near-record low of 15%. Goldman Sachs predicts that in 2025, households will invest an additional $50 billion in equities, driven by the continued strength of the economy.

U.S. stocks now account for 49% of the global market value, a level last seen before the Dot Com Bubble. Bob Elliott, CEO of Unlimited, warns that this high concentration could mean unrealistic expectations for future earnings and U.S. wealth dominance.

Record Inflows and Currency Trading After Trump’s Election Win

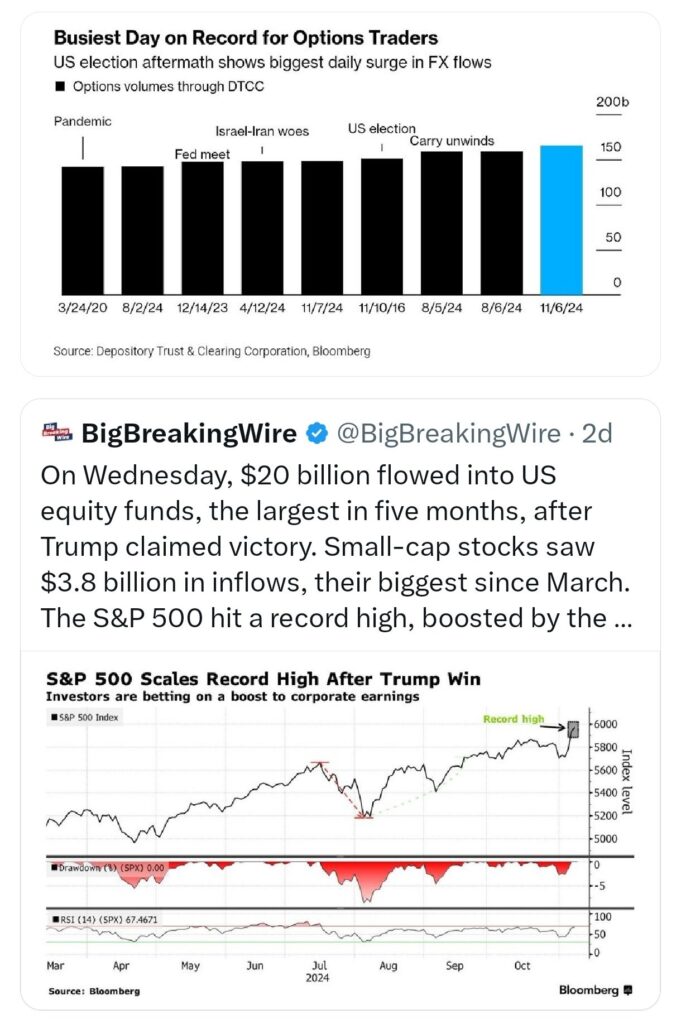

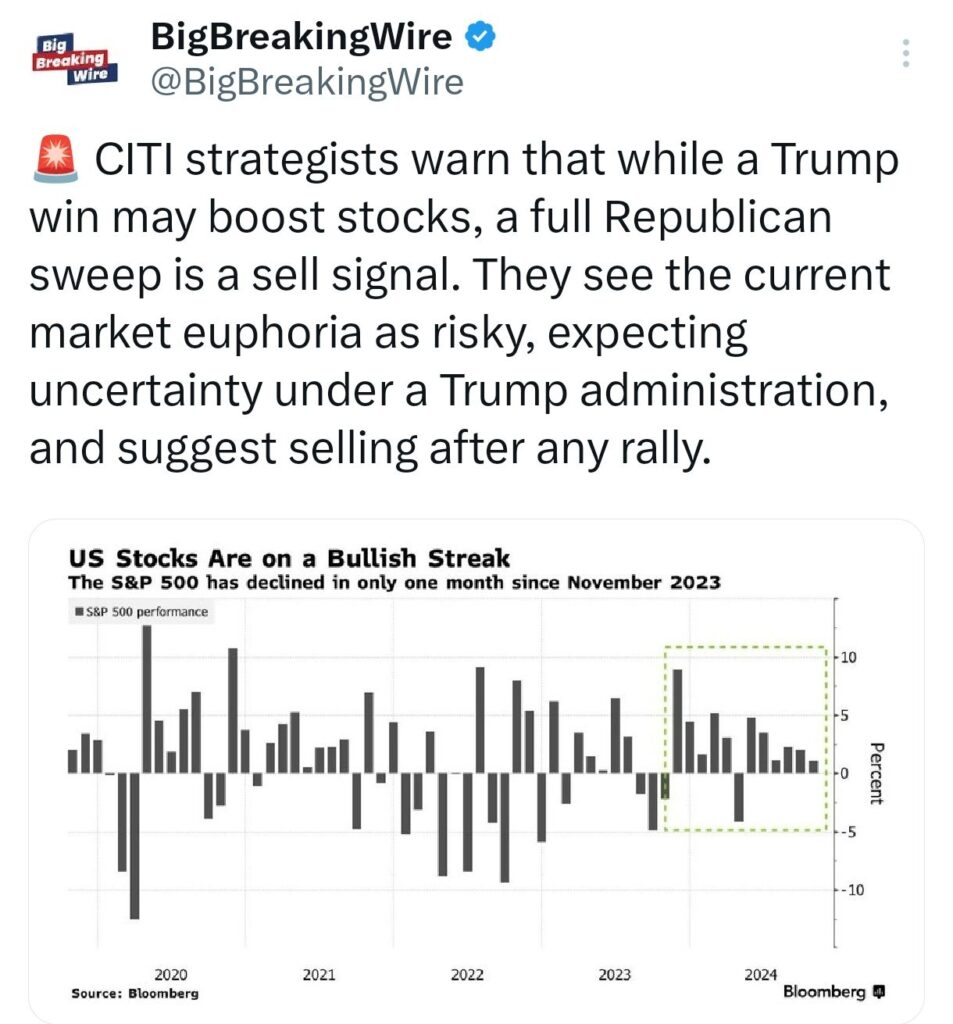

On Wednesday, US equity funds saw a massive $20 billion in inflows, the highest in five months, following Trump’s election win. Small-cap stocks attracted $3.8 billion, the largest amount since March. The S&P 500 reached an all-time high, driven by the election results and a Federal Reserve rate cut.

After Trump’s victory, currency options trading hit record levels, with $160 billion in contracts being traded in a single day, according to DTCC. The US dollar strengthened, while options for the euro and renminbi surged. CME reported $275 billion in foreign exchange trades. Analysts expect the dollar to continue strengthening, especially with ongoing trade tensions.

CITI strategists caution that although a Trump win could boost stocks, a complete Republican sweep would signal a good time to sell. They view the current market excitement as risky, anticipating uncertainty under a Trump administration, and recommend selling after any rallies.

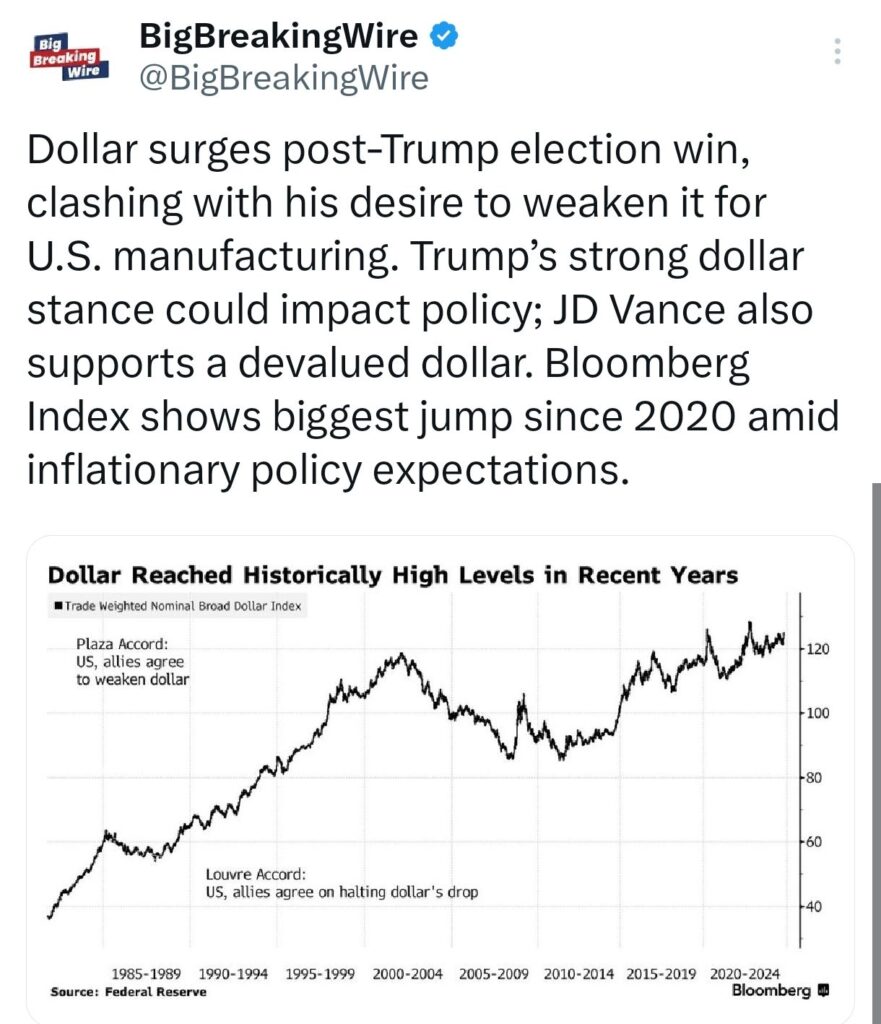

The US dollar has surged following Trump’s election win, which conflicts with his earlier desire to weaken the dollar to benefit US manufacturing. Trump’s strong dollar stance may influence future policy decisions, and JD Vance also supports a weaker dollar. The Bloomberg Index has shown its biggest increase since 2020, driven by expectations of inflationary policies.

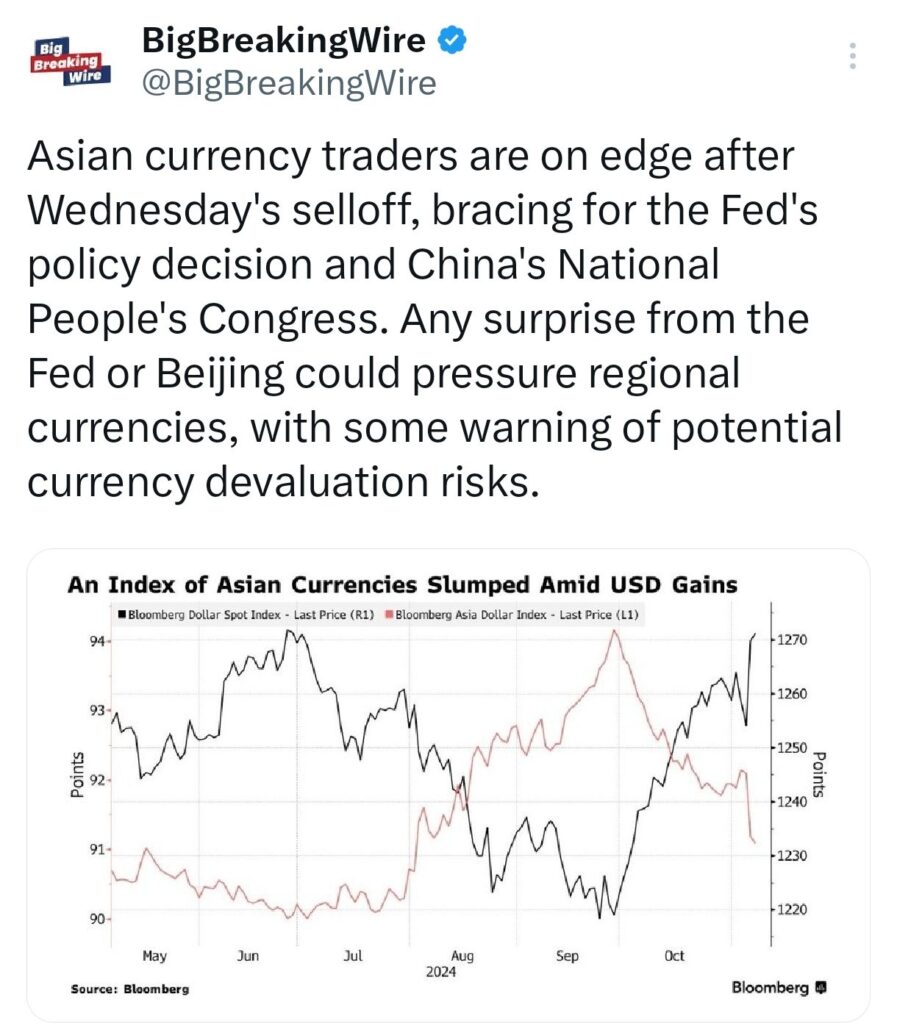

Asian currency traders are nervous after Wednesday’s selloff, preparing for the Fed’s policy decision and China’s National People’s Congress. Any unexpected moves from the Fed or Beijing could put pressure on regional currencies, with some warning of the risk of currency devaluation.

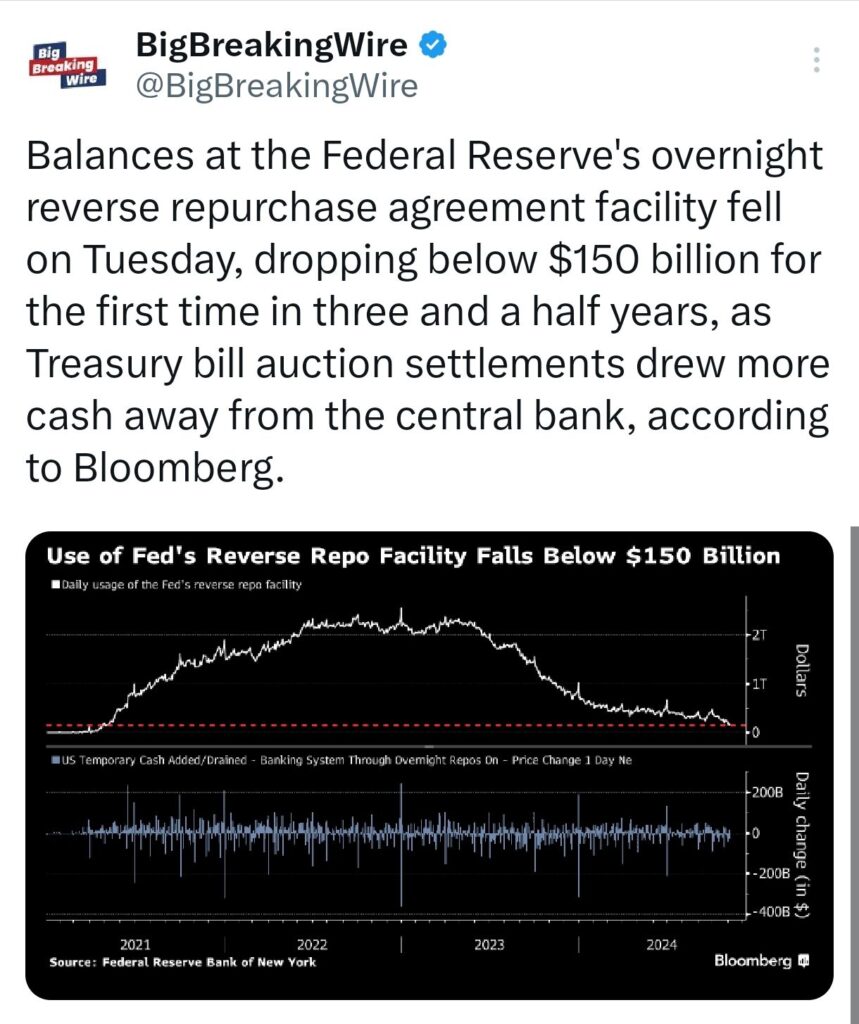

Balances at the Federal Reserve’s overnight reverse repurchase agreement facility dropped below $150 billion on Tuesday, marking the first time in three and a half years. This decline occurred as cash from Treasury bill auctions moved away from the central bank, according to Bloomberg.

China Approves $839B Debt Swap to Address Local Government Debt

China’s top legislative body has approved a plan from the State Council to increase local government debt limits in order to replace hidden debts. According to the Vice Chairman of the NPC Financial and Economic Affairs Committee, the debt limit may rise by 6 trillion yuan.

To help local governments refinance their debt, China has introduced an $839 billion (6 trillion yuan) debt swap plan. This move aims to support the economy, which is facing challenges from Donald Trump’s reelection. The plan was approved by the National People’s Congress Standing Committee.

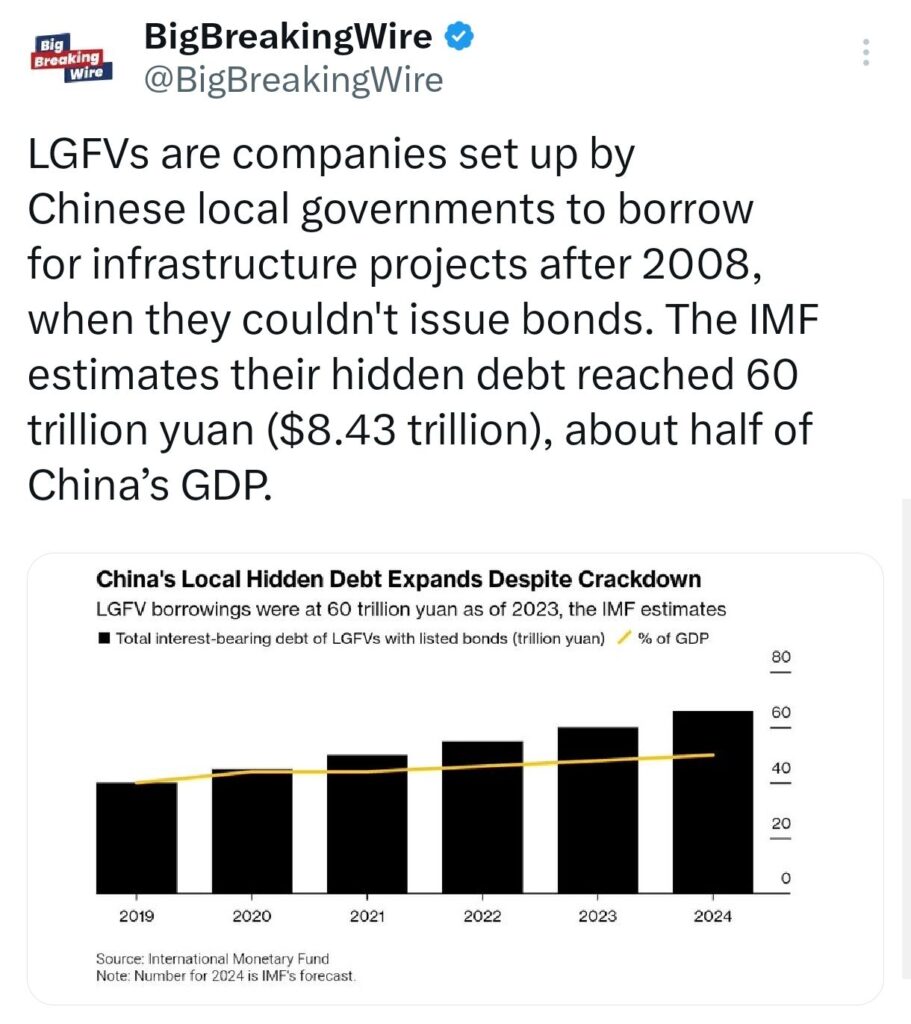

Local Government Financing Vehicles (LGFVs) are companies set up by Chinese local governments to borrow money for infrastructure projects after 2008, when they were not allowed to issue bonds. The IMF estimates these hidden debts have reached 60 trillion yuan ($8.43 trillion), which is about half of China’s GDP.

Foreign Investors Cut NSE Listed Stock Stake to 12-Year Low; Reliance Loses $50B

In October, foreign investors reduced their stake in the NSE to 15.98%, the lowest in 12 years. Their equity assets dropped by 8.8% to ₹71.08 lakh crore. Meanwhile, mutual funds increased their stake to a record 9.58%, holding ₹42.36 lakh crore, while domestic institutional investors (DIIs) reached ₹76.80 lakh crore by September.

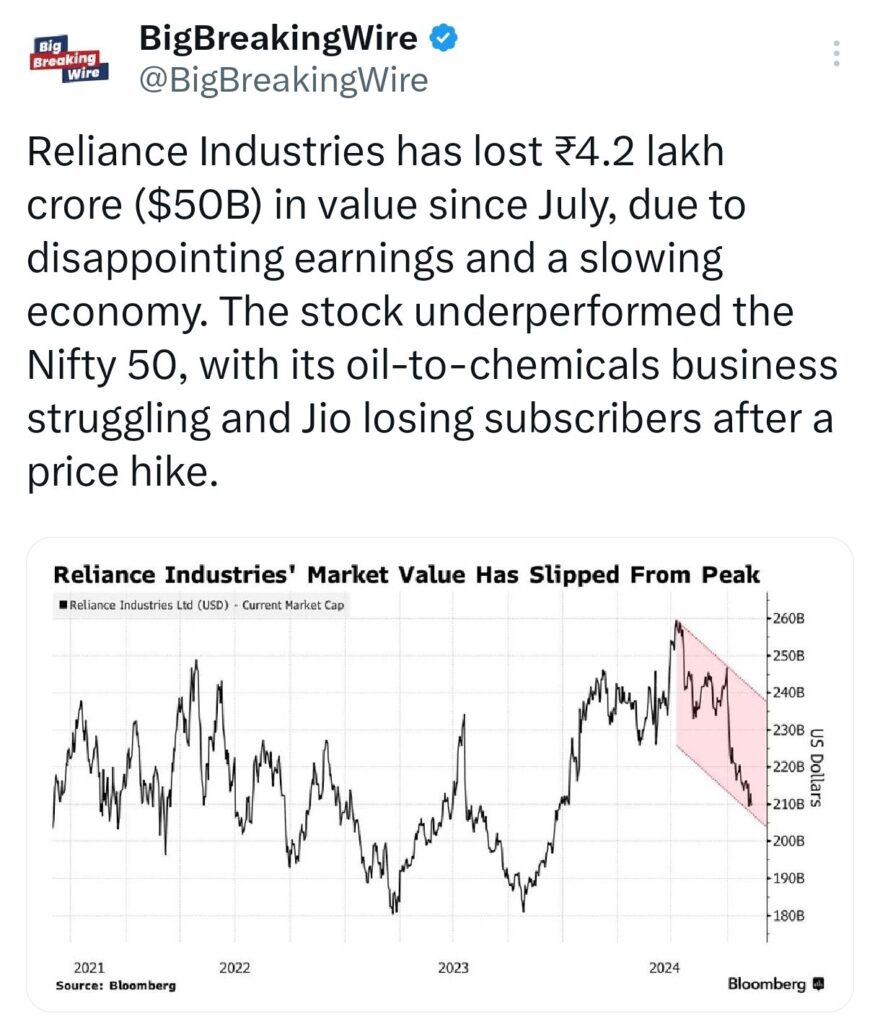

Reliance Industries has lost ₹4.2 lakh crore ($50 billion) in value since July, mainly due to disappointing earnings and a slowing economy. The stock has underperformed the Nifty 50 index, with its oil-to-chemicals business struggling and Jio losing subscribers after a price increase.

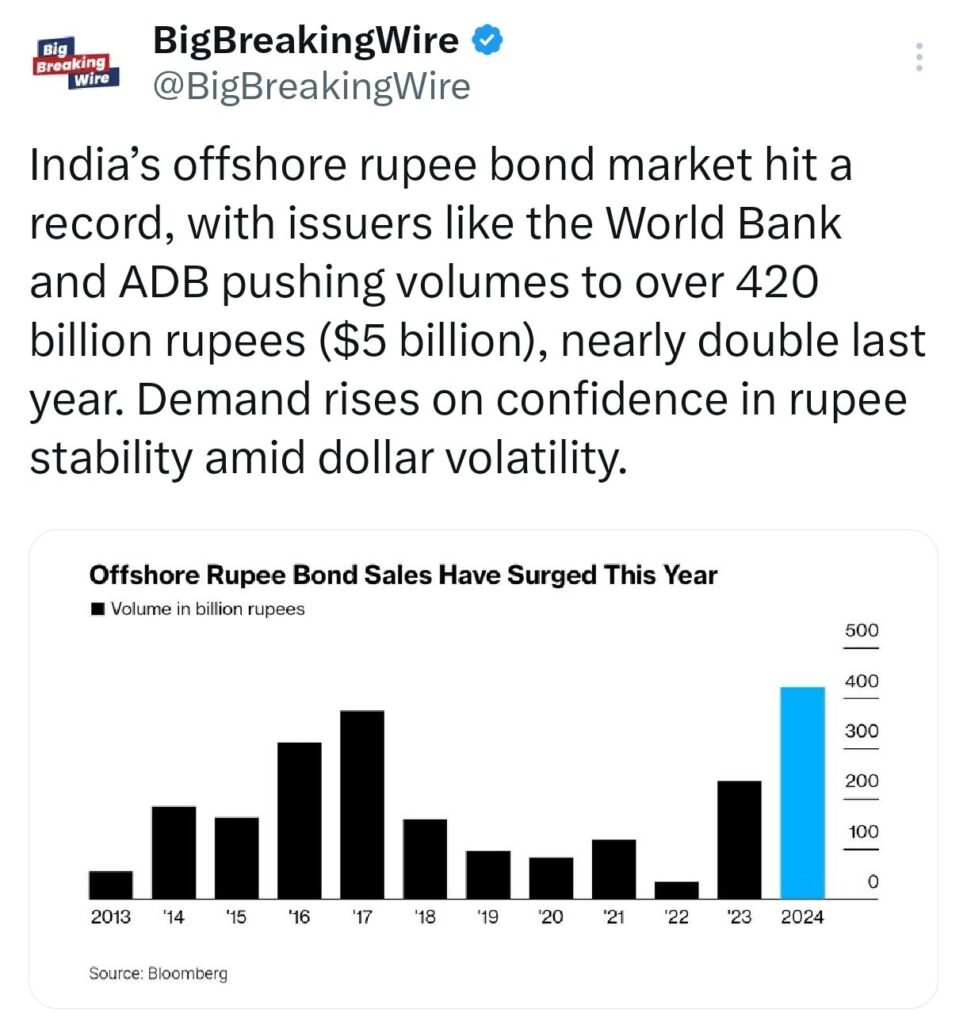

India’s offshore rupee bond market has reached a new record, with issuers such as the World Bank and the Asian Development Bank (ADB) contributing to a surge in volumes, which have exceeded 420 billion rupees ($5 billion). This represents nearly double the volume from last year. The increase in demand for these bonds is driven by growing confidence in the stability of the Indian rupee, especially amid ongoing volatility in the US dollar.

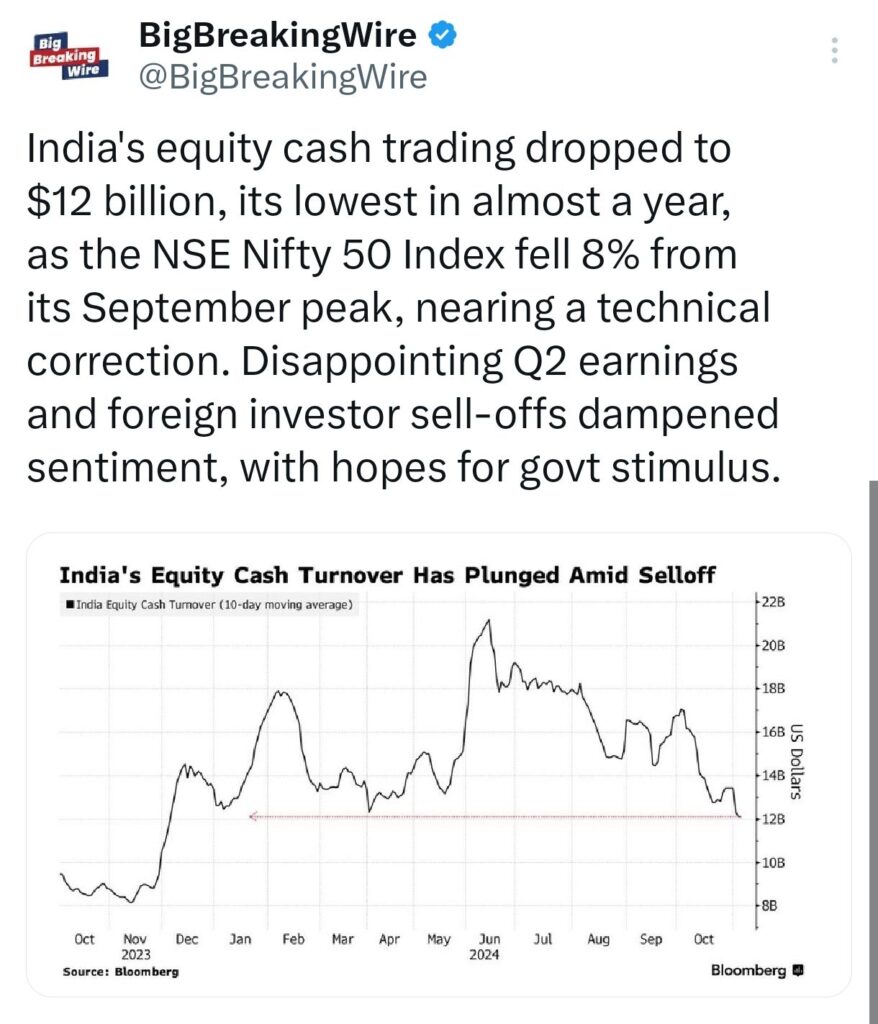

India’s equity cash trading dropped to $12 billion, the lowest in nearly a year, as the NSE Nifty 50 Index fell 8% from its peak in September, approaching a technical correction. Disappointing Q2 earnings and foreign investor sell-offs hurt market sentiment, while investors are hoping for government stimulus to boost the economy.

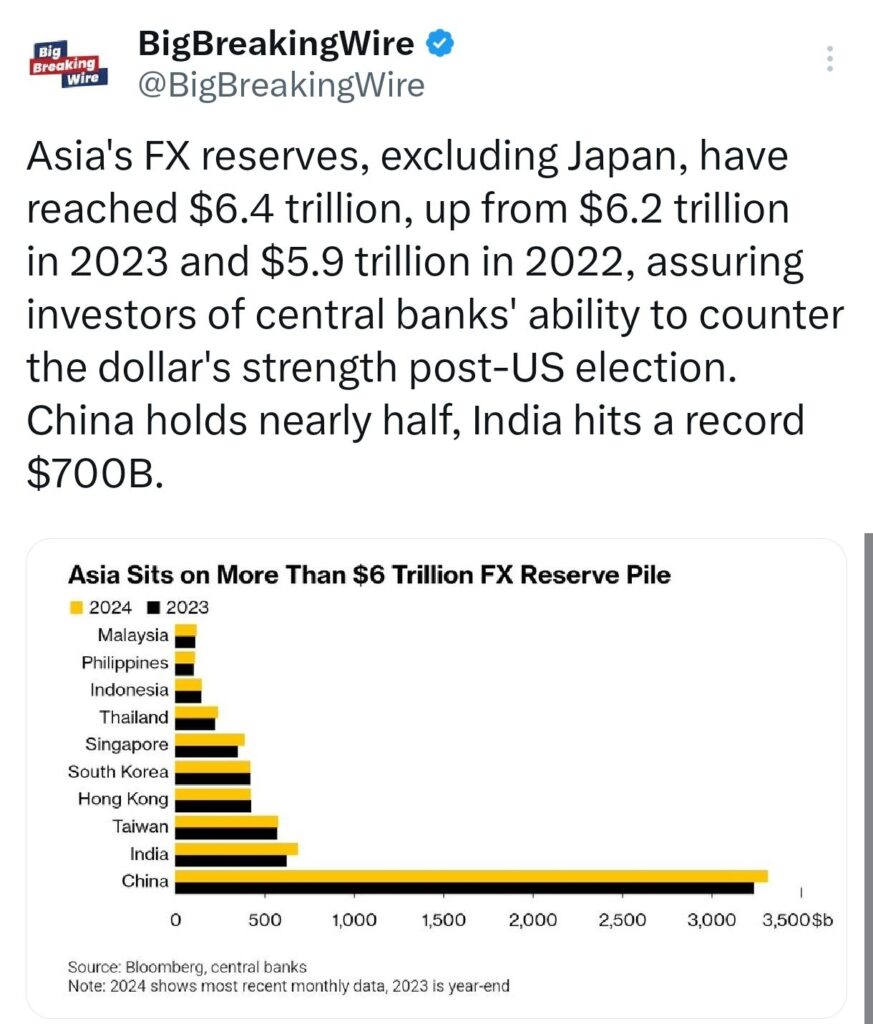

Asia’s FX Reserves Rise to $6.4 Trillion; India Hits Record $700B

Asia’s foreign exchange reserves, excluding Japan, have risen to $6.4 trillion, up from $6.2 trillion in 2023 and $5.9 trillion in 2022, reassuring investors about central banks’ ability to manage the strength of the dollar following the US election. China holds nearly half of these reserves, while India reached a record $700 billion, though it dropped to $682 billion for the week ending November 8th, possibly due to interventions in the foreign exchange market to support the rupee.

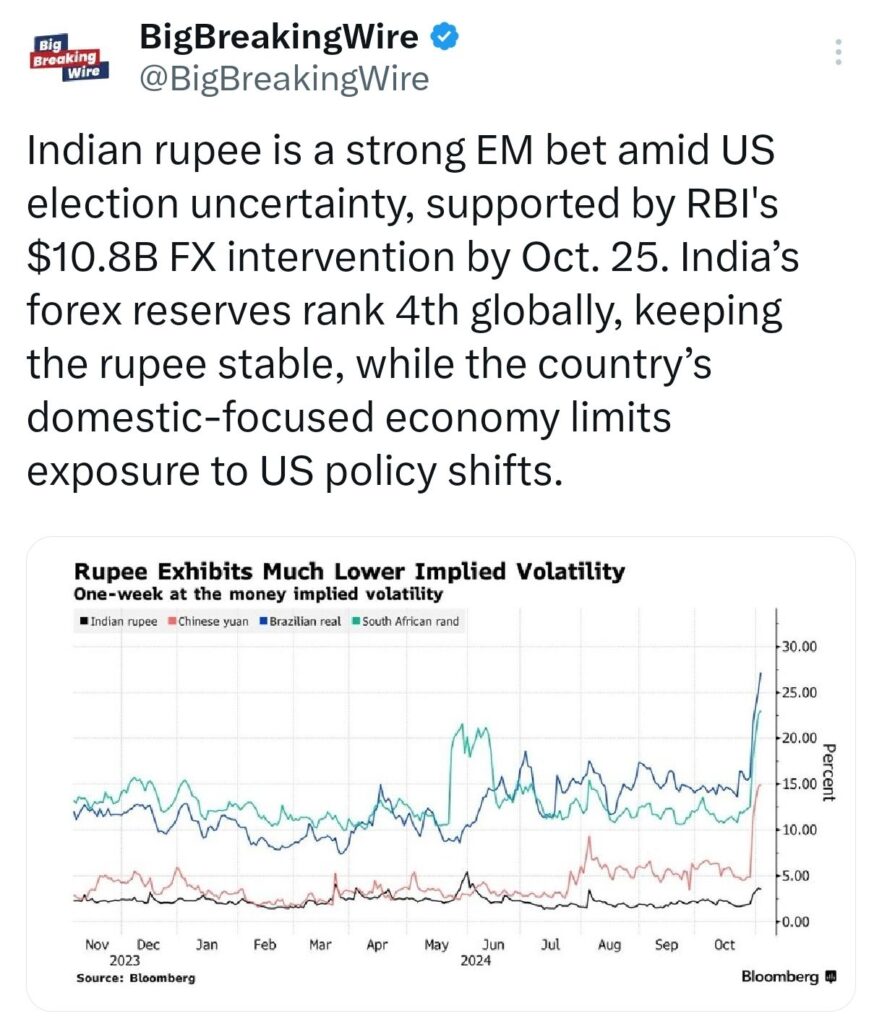

The Indian rupee is seen as a strong bet among emerging market currencies amid uncertainty around the US election, helped by the RBI’s $10.8 billion foreign exchange intervention by October 25. India’s forex reserves rank 4th in the world, supporting the rupee’s stability, while the country’s economy, which is focused more on domestic growth, reduces its exposure to changes in US policies.

Foreign Investors Pull Out ₹20,000 Crore from Indian Equity in November, Bonds Face Outflows

Foreign portfolio investors (FPIs) continued withdrawing from Indian equity markets, pulling out nearly ₹20,000 crore between November 4-8, mainly due to high stock valuations and shifting investments to China. This brings the total FPI outflow in 2024 to ₹13,401 crore.

October saw a record outflow of ₹94,017 crore, the largest monthly withdrawal, surpassing the ₹61,973 crore pulled out in March 2020. However, FPIs were net buyers in most months of 2024, except January, April, May, and October.

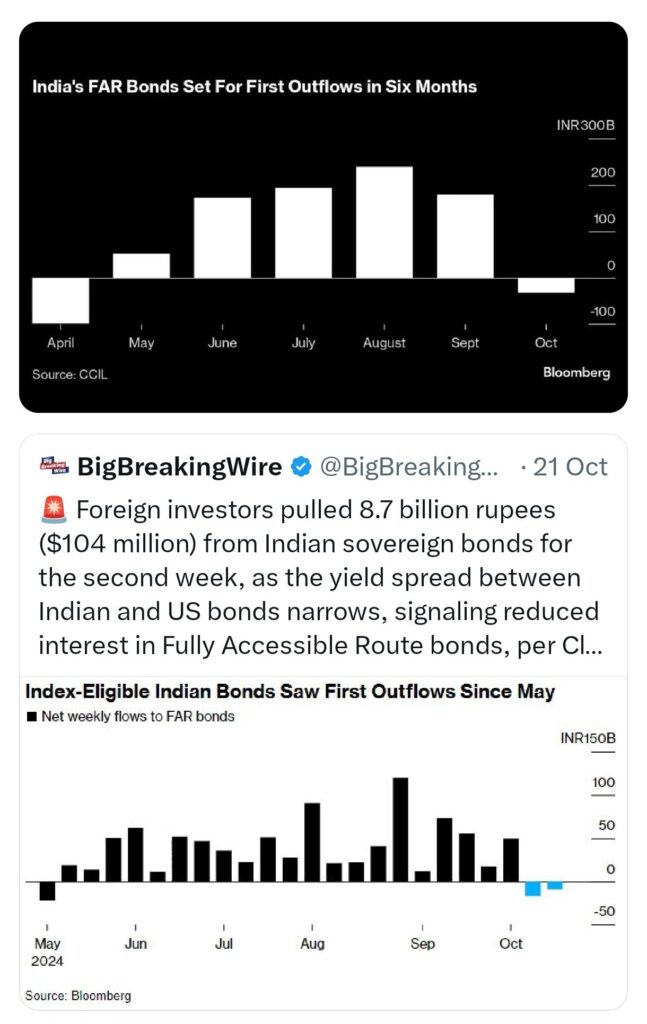

Foreign investors also pulled ₹8.7 billion ($104 million) from Indian sovereign bonds for the second consecutive week as the yield spread between Indian and US bonds narrows. Additionally, India’s bond market saw its first monthly outflow in six months, with $476 million leaving Fully Accessible Route bonds in October.

Over 60% of Indian Firms Lower Earnings Forecasts as Loan Defaults Rise

Corporate earnings in India are weakening, with Jefferies reporting that more than 60% of 98 companies have lowered their earnings forecasts, the most since early 2020. Increased defaults on unsecured loans are worrying, leading lenders to tighten credit, which could affect stock prices.

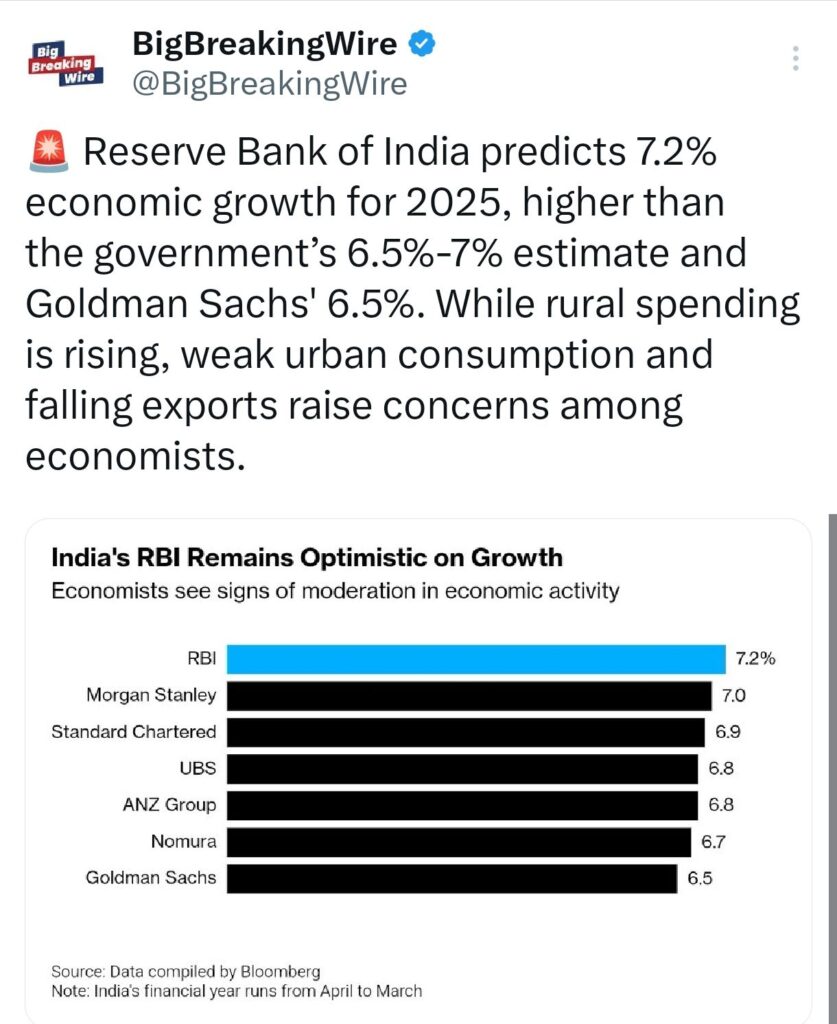

Reserve Bank of India forecasts 7.2% economic growth for 2025, higher than the government’s 6.5%-7% estimate and Goldman Sachs’ 6.5%. While rural spending is increasing, weak urban spending and falling exports worry economists.

China Leads in Tech Exports, But Growth May Not Boost Incomes, Reports Bloomberg

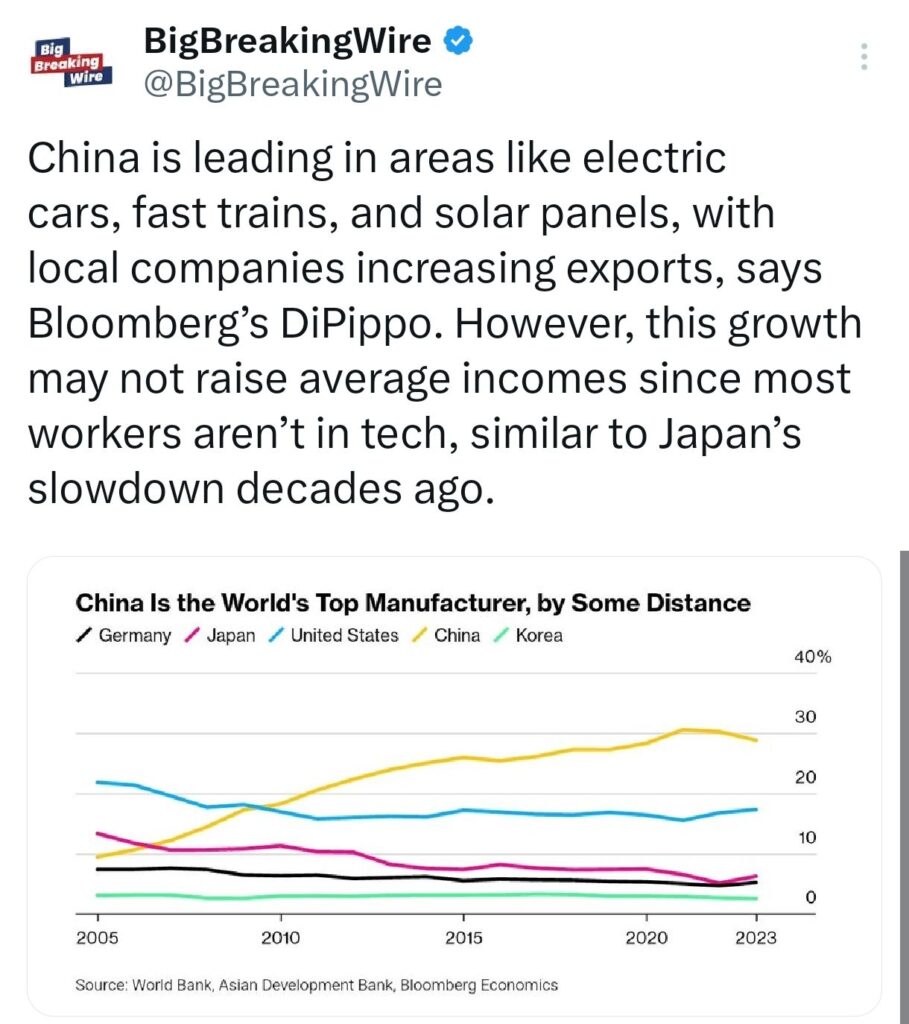

China is ahead in electric cars, fast trains, and solar panels, with local companies exporting more, according to Bloomberg’s DiPippo. However, this growth might not increase average incomes because most workers aren’t in tech, similar to Japan’s slowdown years ago.

US Corporations Issue Over $1.4 Trillion in Bonds in 2024, Record-Breaking Year

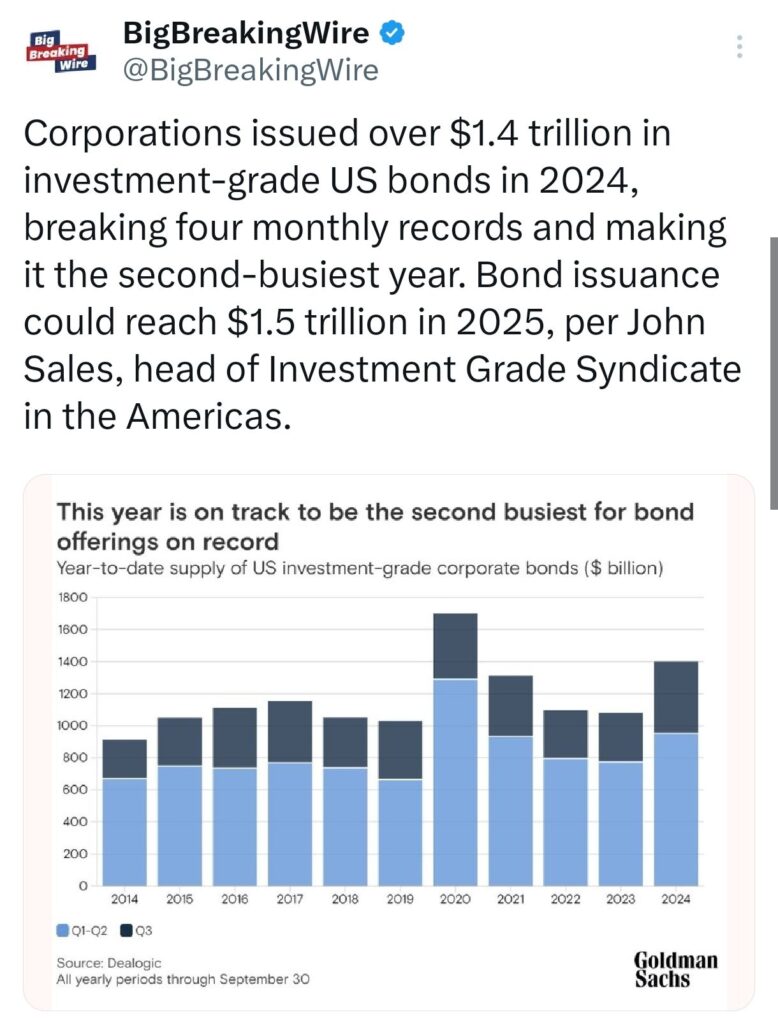

In 2024, corporations issued more than $1.4 trillion in investment-grade US bonds, breaking four monthly records and making it the second-busiest year. Bond issuance could hit $1.5 trillion in 2025, according to John Sales, head of Investment Grade Syndicate in the Americas.

Current P/E Ratios of US, India, and China: High Valuations in the US and India, Undervaluation in China

The table displays the current P/E ratios for the US, India, and China, along with their historical averages. High P/E ratios in the US and India suggest their stocks are highly valued, while China’s lower ratio indicates it may be undervalued.

Thank you for reading! We’d love to hear your thoughts on our new series, “Economy in Charts.” If you found it useful, feel free to share it with your friends and community. Your feedback helps us improve!

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

7 Comments