Foreign investors’ share in NSE-listed companies dropped to 15.98% in October, reaching its lowest point in twelve years. The value of foreign investors’ assets in Indian equities fell to Rs 71 lakh crore, marking an 8.8% decline from Rs 78 lakh crore in September — the sharpest drop since March 2020.

In contrast, mutual fund holdings hit a record high of 9.58%, up from 9.32% a month earlier. Mutual funds held stocks worth Rs 42.36 lakh crore, while domestic institutional investors (DIIs) owned stocks valued at Rs 76.80 lakh crore by the end of the September quarter.

Foreign investors have withdrawn 8.7 billion rupees ($104 million) from Indian sovereign bonds for a second consecutive week, driven by a narrowing yield spread between Indian and U.S. bonds. This shift has signaled waning interest in Fully Accessible Route (FAR) bonds, according to data from the Clearing Corporation of India.

Foreign holdings in Indian debt are also declining, with index-eligible bonds recording their first monthly outflow in six months. In October, FAR bonds—which allow unrestricted foreign investor access—experienced significant outflows of 40 billion rupees ($476 million), impacting India’s $1.3 trillion bond market.

The FII and mutual fund shares are calculated by comparing October’s assets under custody (AUC) data from NSDL with the average market cap of NSE-listed firms. Although October’s DII AUC data isn’t yet available, analysts expect DII stakes to surpass FIIs, supported by over Rs 1 lakh crore in domestic inflows during the month. This shift signals a major milestone for India’s capital markets.

As of the September quarter, DII share in NSE companies reached a high of 16.2%, slightly up from 16.15% in the previous quarter. FII stakes also saw a slight rise to 16.44% from 16.27%, buoyed by net inflows of Rs 97,408 crore, with Rs 67,059 crore in secondary market inflows and Rs 30,349 crore in the primary market.

Retail investors, DIIs, and High Net Worth Individuals (HNIs) combined to hold a record 26.04% of the market as of September 30. Although FIIs remain influential, their grip on the Indian market has loosened. Even with significant FII selling in October, benchmark indices only dropped by 6%, said Haldea.

The FII-to-DII ownership ratio hit a record low of 0.24 on September 30, 2024, compared to March 2015, when DII share was 10.09% lower than FII holdings.

India is projected to see $2.5 billion in passive foreign inflows following the MSCI Emerging Markets Index reshuffle in November 2024, which raises India’s weight in the index to 19.8%. This adjustment, effective November 25, also reduces China’s weight to 26.8%. Investment firm Nuvama remains optimistic about India’s growth prospects.

The MSCI reshuffle has added five Indian companies to its Global Standard Index, lifting India’s weight to nearly 20% and further closing the gap with China. The new additions—Voltas, Oberoi Realty, BSE, Kalyan Jewellers, and Alkem Laboratories—bring the total count of Indian stocks in the index to 156, about one-fourth of China’s 598 stocks, indicating room for further Indian inclusions.

HDFC Bank now holds the highest weight among Indian stocks at 7.08%, overtaking Reliance Industries, which stands at 6.08%.

Asia’s foreign exchange reserves, excluding Japan, have climbed to $6.4 trillion, increasing from $6.2 trillion in 2023 and $5.9 trillion in 2022. This growth reassures investors of Asian central banks’ capacity to manage the dollar’s strength following the U.S. election. China holds nearly half of these reserves, while India’s reserves have reached a record high of $700 billion.

India’s equity cash trading volume has dropped to $12 billion, marking its lowest level in nearly a year. This decline coincides with an 8% fall in the NSE Nifty 50 Index from its September peak, pushing it close to a technical correction. Market sentiment has been impacted by weaker-than-expected Q2 earnings and ongoing sell-offs by foreign investors, who have reduced their stakes. Amid this downturn, there is growing anticipation for potential government stimulus measures to help stabilize the market.

Life Insurance Corporation of India (LIC), India’s largest institutional investor, saw its stake drop to a record low of 3.64% in Q1 FY25 across 282 companies where it holds more than 1%. This was a decline from 3.75% in the previous quarter, despite LIC’s net investment of ₹12,400 crore during this period. This reduction also contributed to the overall share of insurance companies decreasing from 5.40% to 5.23%.

Meanwhile, the government’s promoter stake rose to a seven-year high of 10.64% as of June 30, 2024, driven by the strong performance of various public sector undertakings (PSUs). In contrast, private promoter share fell to a five-year low of 40.88%, largely due to promoter stake sales aimed at leveraging bullish market conditions and the increasing institutionalization of the market.

The October sell-off by FIIs was driven by several factors, including geopolitical tensions, expectations around U.S. Fed rate decisions, potential Chinese stimulus, and the upcoming U.S. elections. High valuations of Indian stocks compared to emerging markets, along with slowed earnings growth and more downgrades than upgrades, added to the pressure.

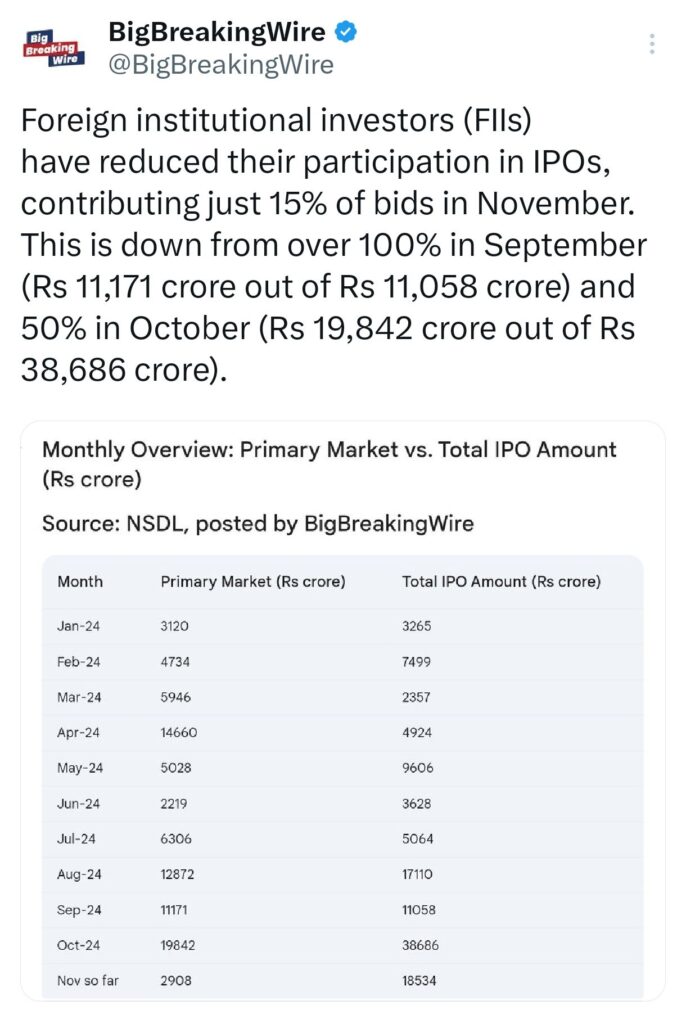

Foreign institutional investors (FIIs) have reduced their involvement in IPOs, making up just 15% of the bids in November. This is a big drop from September, when they contributed more than the total amount, bidding Rs 11,171 crore out of Rs 11,058 crore. In October, they made up 50% of the bids, investing Rs 19,842 crore out of Rs 38,686 crore.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

7 Comments