Welcome to the 2nd Edition of “Economy in Charts”!

This week, we’re diving into key economic trends and updates for the week ended November 11-17. From global market movements to macroeconomic indicators, we’ve captured the most insightful data in easy-to-understand visuals.

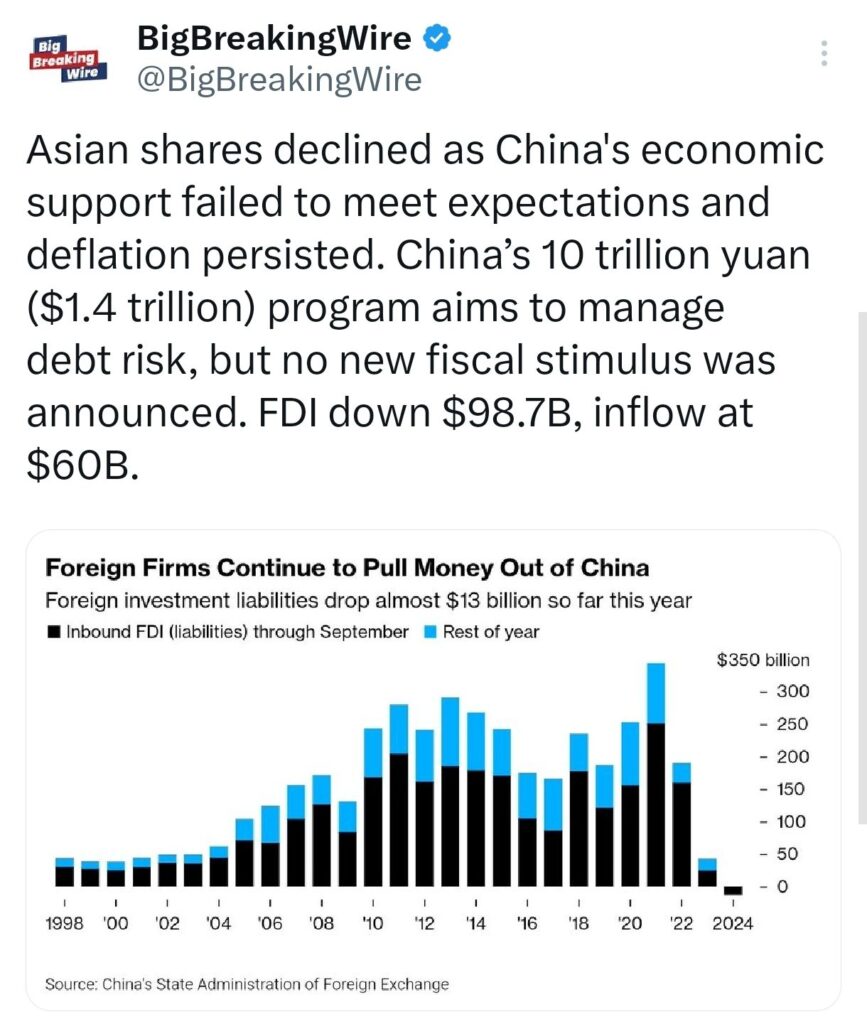

Asian Markets Slide as China’s Economic Support Falls Short

Asian markets fell as China’s economic support measures disappointed investors. While China introduced a 10 trillion yuan ($1.4 trillion) program to manage its debt, it didn’t announce any new spending plans, leaving concerns about deflation and weak growth. Foreign investments also dropped sharply, with $98.7 billion leaving the country and only $60 billion coming in, showing declining confidence in the economy.

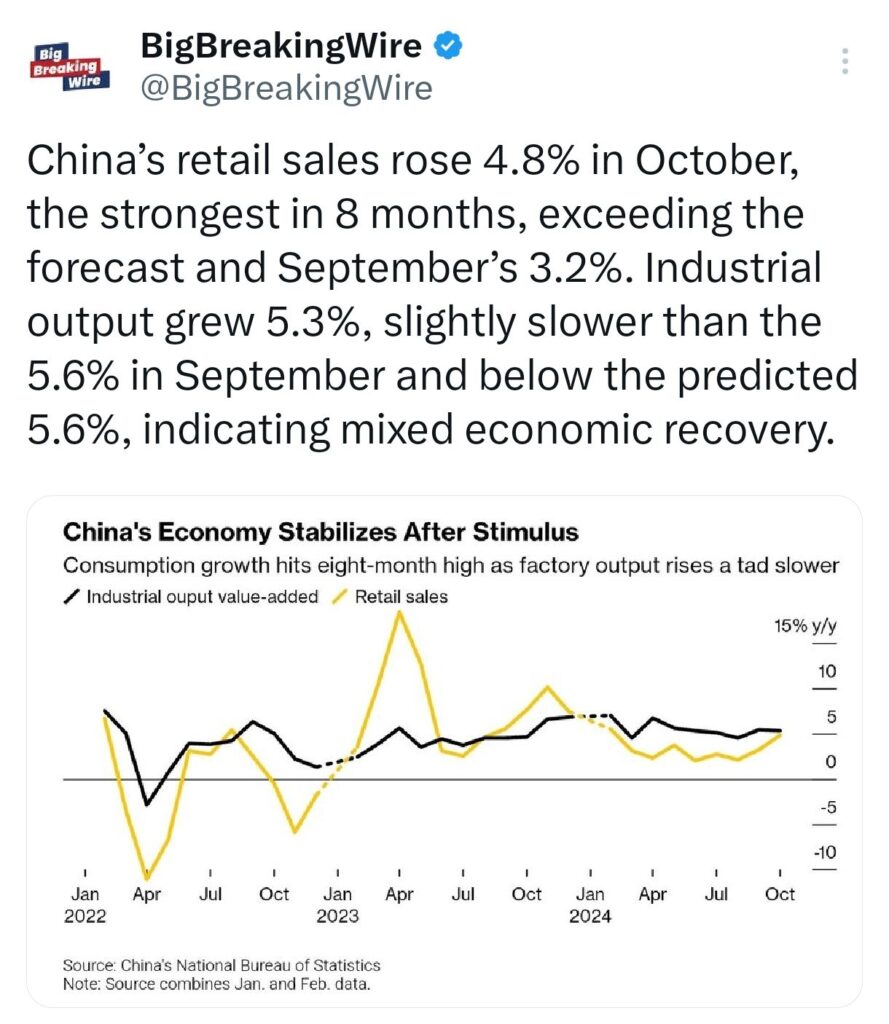

China’s retail sales increased by 4.8% in October, marking the fastest growth in eight months. This result is better than the forecast and higher than September’s 3.2% growth. Meanwhile, industrial production rose by 5.3% in October. This was slower than September’s 5.6% growth and fell short of the expected 5.6%, showing that the country’s economic recovery is progressing unevenly.

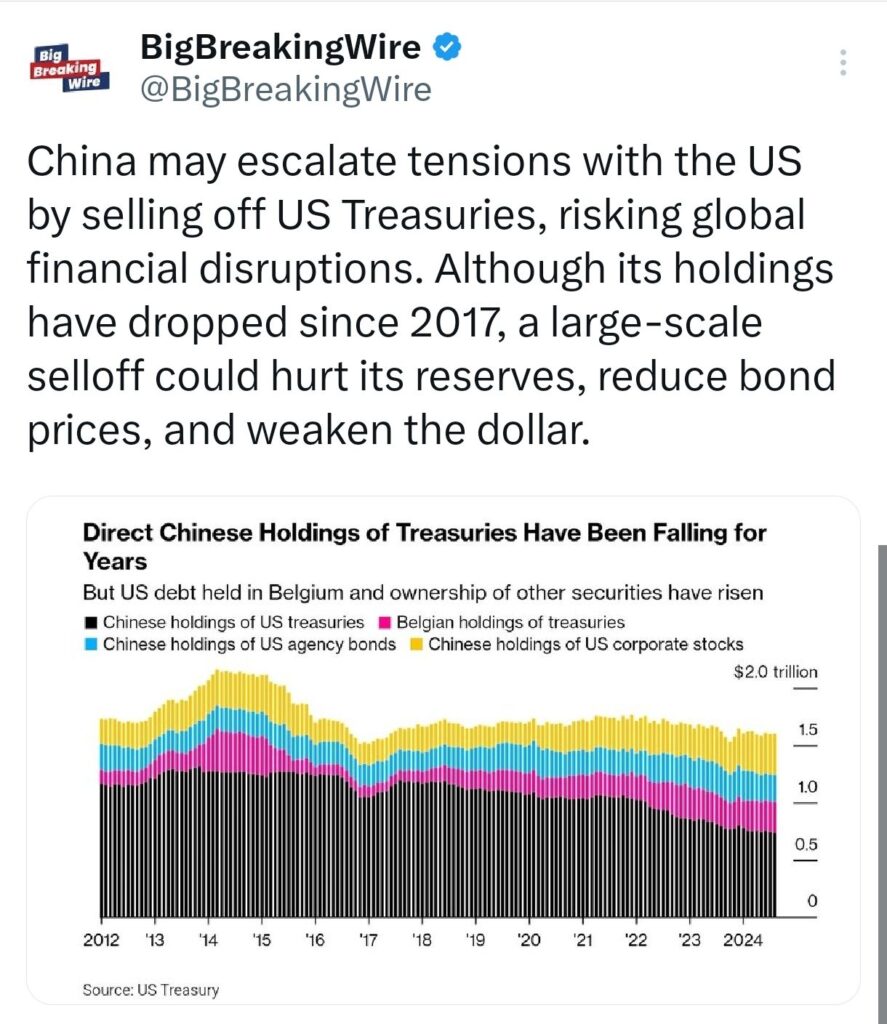

China might increase tensions with the US by selling a significant amount of US Treasury bonds. This move could create disruptions in global financial markets. Although China has been reducing its US Treasury holdings since 2017, a sudden and large selloff could have serious consequences. It could lower the value of US bonds, weaken the US dollar, and potentially harm China’s own foreign currency reserves.

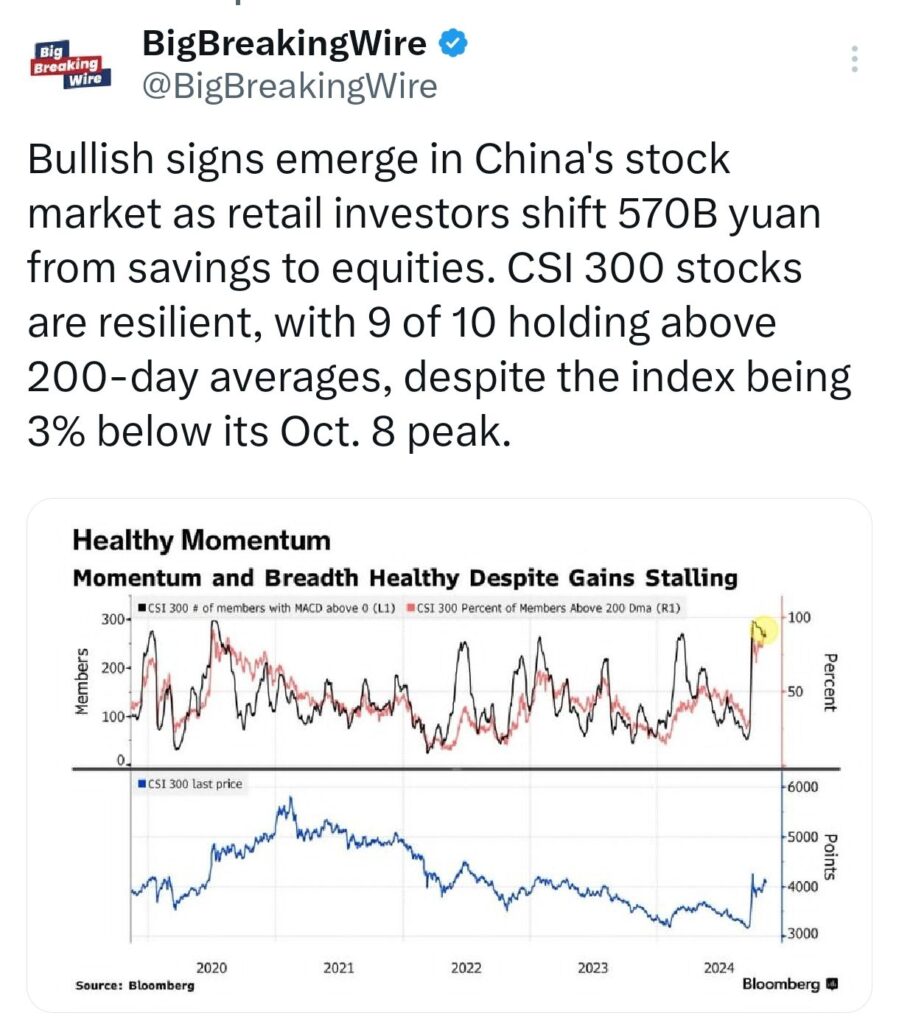

China’s household deposits dropped by 570 billion yuan ($78.8 billion) in October, a sharp contrast to the 11.85 trillion yuan saved in the first nine months of 2024. This brings the total deposit increase for the year to 11.28 trillion yuan. The decline in savings reflects a shift as retail investors moved their money into stocks and mutual funds, signaling growing confidence in the stock market.

Bullish trends are appearing in China’s stock market, with the CSI 300 index showing resilience. Nine out of ten stocks in the index are trading above their 200-day moving averages, even though the index is still 3% below its October 8 peak. This shift in household funds suggests rising optimism among retail investors about the equity market’s potential.

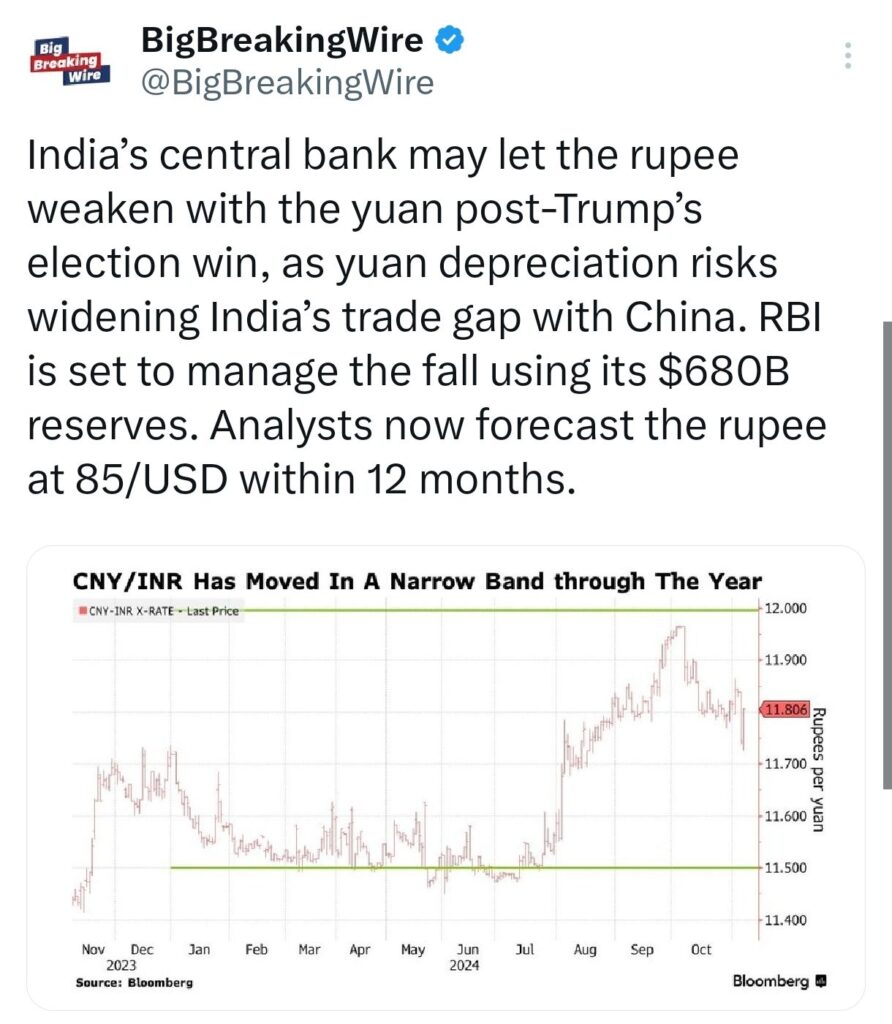

Indian Rupee Hits Record Low of 84.40; Analysts Predict 85/USD in 12 Months

The Indian rupee has plunged to a record low of 84.40 against the US dollar, prompting speculation about the Reserve Bank of India’s (RBI) strategy moving forward. Analysts suggest that the central bank may allow the rupee to depreciate further, mirroring the recent weakening of the Chinese yuan, especially in the aftermath of Trump’s election victory. However, this move could exacerbate India’s trade deficit with China due to the yuan’s devaluation. To manage the rupee’s decline, the RBI is expected to leverage its robust foreign exchange reserves, currently standing at $680 billion. Experts now predict that the rupee could weaken further to 85 per dollar over the next 12 months.

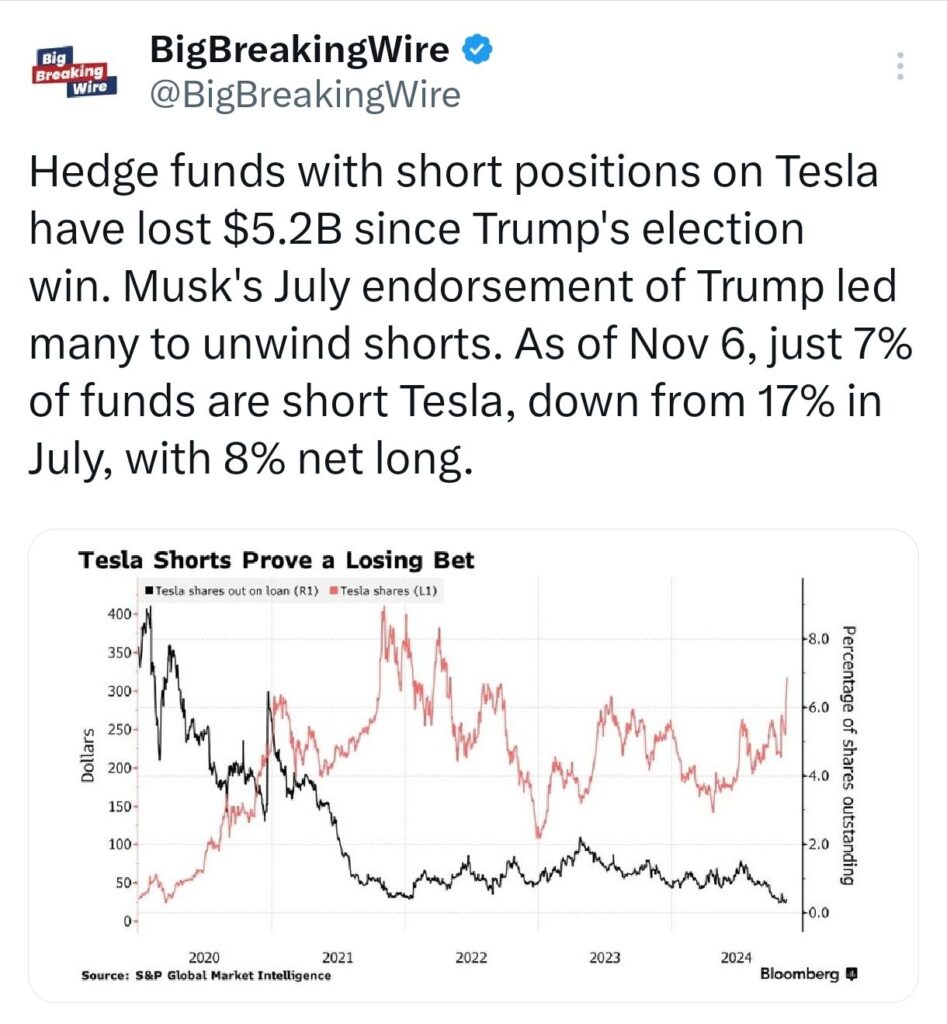

Tesla shorts lose $5.2B; S&P 500 hits 26.4% YTD, best election year in 88 years.

Hedge funds betting against Tesla have suffered significant losses, amounting to $5.2 billion since Donald Trump’s election victory. This shift was partly triggered by Elon Musk’s endorsement of Trump in July, prompting many to cover their short positions. As of November 6, only 7% of hedge funds remain short on Tesla, a sharp decline from 17% in July. Meanwhile, 8% of funds have taken net long positions on the stock, highlighting a notable reversal in sentiment.

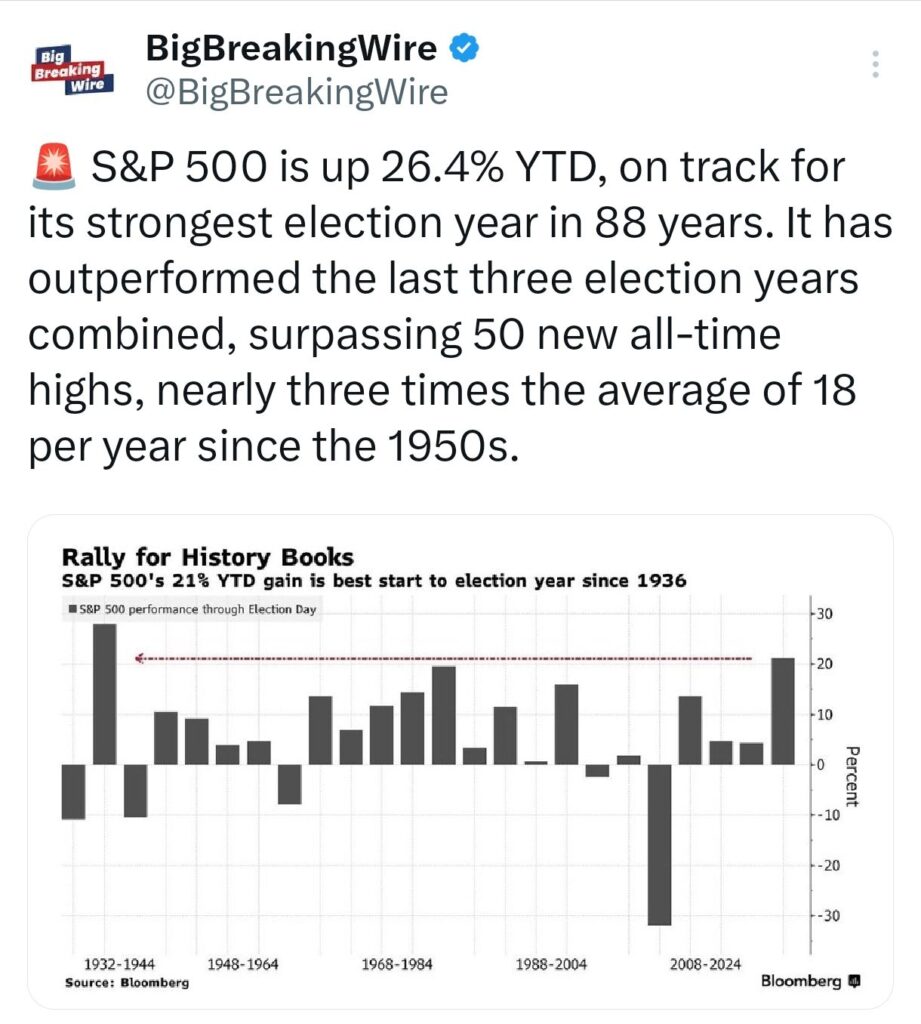

The S&P 500 has soared by 26.4% year-to-date, making it the best-performing election year in 88 years. This robust performance surpasses the combined gains of the last three election years. The index has achieved over 50 new all-time highs so far this year, nearly tripling the historical annual average of 18 new highs recorded since the 1950s.

India’s Trade Deficit Widens to $27.14B in October Amidst Strong Exports and Rising Imports

In October, India’s exports increased to $39.20 billion, up from $34.58 billion in September. However, imports saw a significant rise, reaching $66.34 billion, compared to $55.36 billion the previous month. This led to a widening of the trade deficit, which grew to $27.14 billion from $20.78 billion in September. The surge in imports, especially during the festival season, contributed to this higher deficit, despite strong export performance.

India’s gold imports in October amounted to $7.13 billion.

India’s Trade Secretary predicts that, based on current trends, exports are expected to surpass $800 billion this fiscal year. Over the past two decades, India’s exports have shown steady growth, with the exception of the COVID year, remaining resilient regardless of changes in the U.S. presidency.

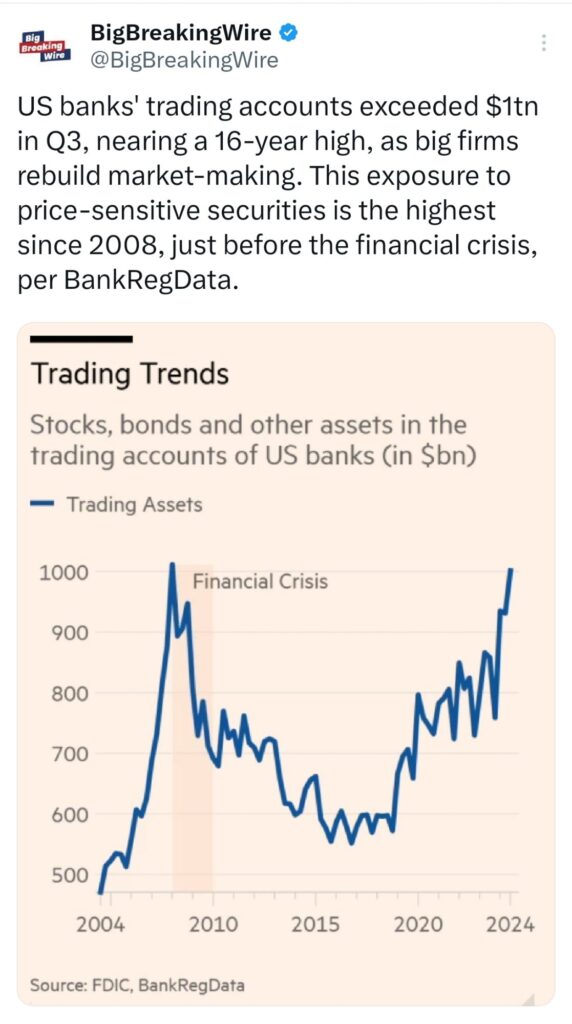

US Banks’ Trading Accounts Surpass $1 Trillion in Q3, Reaching 16-Year High

In the third quarter of this year, U.S. banks’ trading accounts surpassed $1 trillion, approaching a 16-year high. This increase is due to large companies rebuilding their market-making activities. The level of exposure to price-sensitive securities is now the highest it has been since 2008, just before the financial crisis, according to BankRegData.

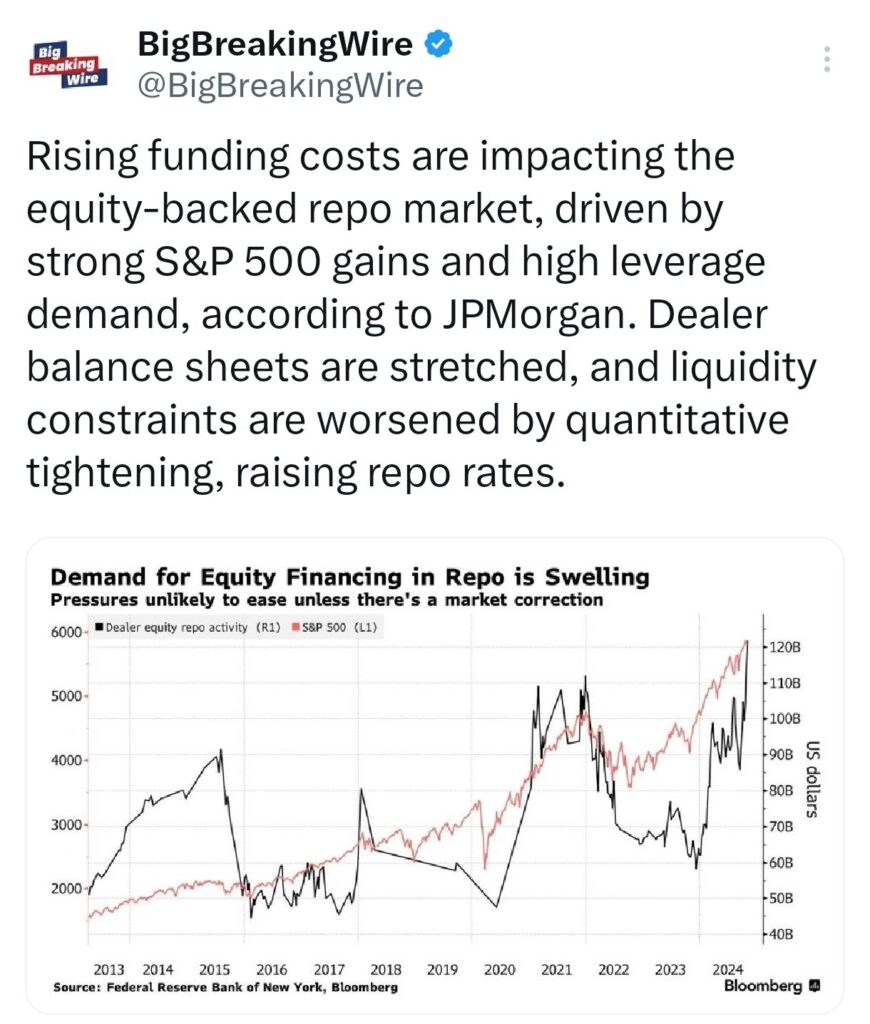

JPMorgan reports that rising funding costs are affecting the equity-backed repo market. This is mainly due to strong gains in the S&P 500 and increased demand for leverage. Dealer balance sheets are under pressure, and liquidity issues are getting worse because of quantitative tightening. As a result, repo rates are rising.

U.S. Recession Odds Rise to 75% Amid Inflation and Tariff Concerns; Household Debt Hits Record $17.94 Trillion

BCA Research has raised the probability of a U.S. recession happening within the next 12 months to 75%. This is mainly due to concerns about inflation and tariffs. On the other hand, U.S. equity funds experienced $37.37 billion in inflows, while emerging markets saw a $25.5 billion outflow in October.

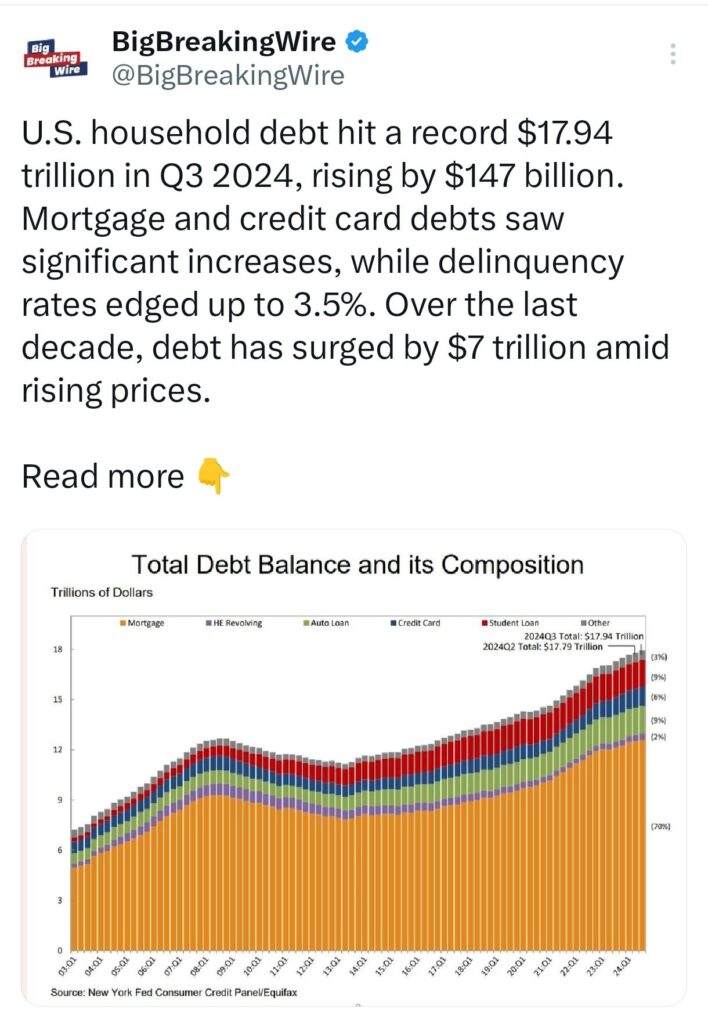

In Q3 2024, U.S. household debt reached a record high of $17.94 trillion, increasing by $147 billion. Significant rises in mortgage and credit card debts contributed to this surge. Additionally, the rate of people falling behind on payments slightly rose to 3.5%. Over the past ten years, the total debt has increased by $7 trillion, largely due to rising prices.

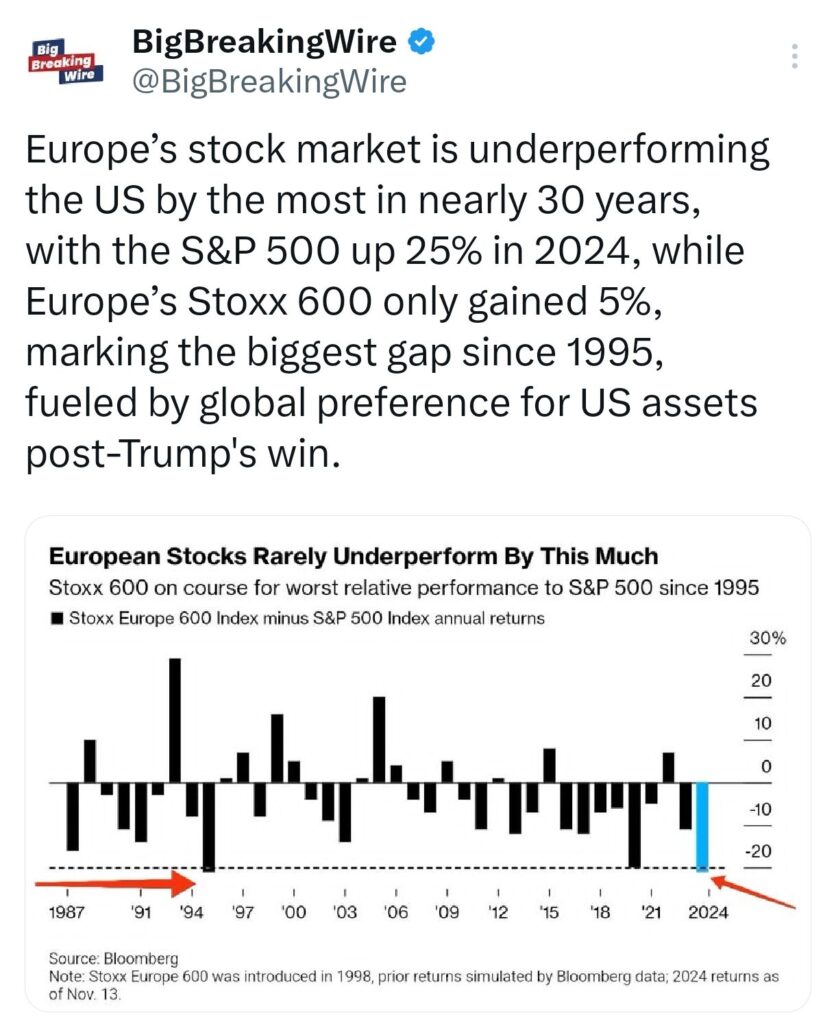

Europe’s stock market is trailing the US by the widest margin in nearly 30 years. In 2024, the S&P 500 rose 25%, while Europe’s Stoxx 600 gained only 5%. This marks the biggest gap since 1995, driven by a global shift toward US assets following Trump’s election victory.

Treasury yields rose, and the dollar hit a two-year high as markets await key inflation data, casting doubt on future Fed rate cuts. The 10-year Treasury yield jumped to 4.44%, its highest level since May 2024, climbing 85 basis points since the Fed started lowering rates.

Investor interest in US stocks has reached its highest level since 2013 following the election. According to a Bank of America survey covering $503 billion in assets, 29% of fund managers are now overweight on US stocks, up from 10% last month. Additionally, 23% of respondents expect global economic growth to improve.

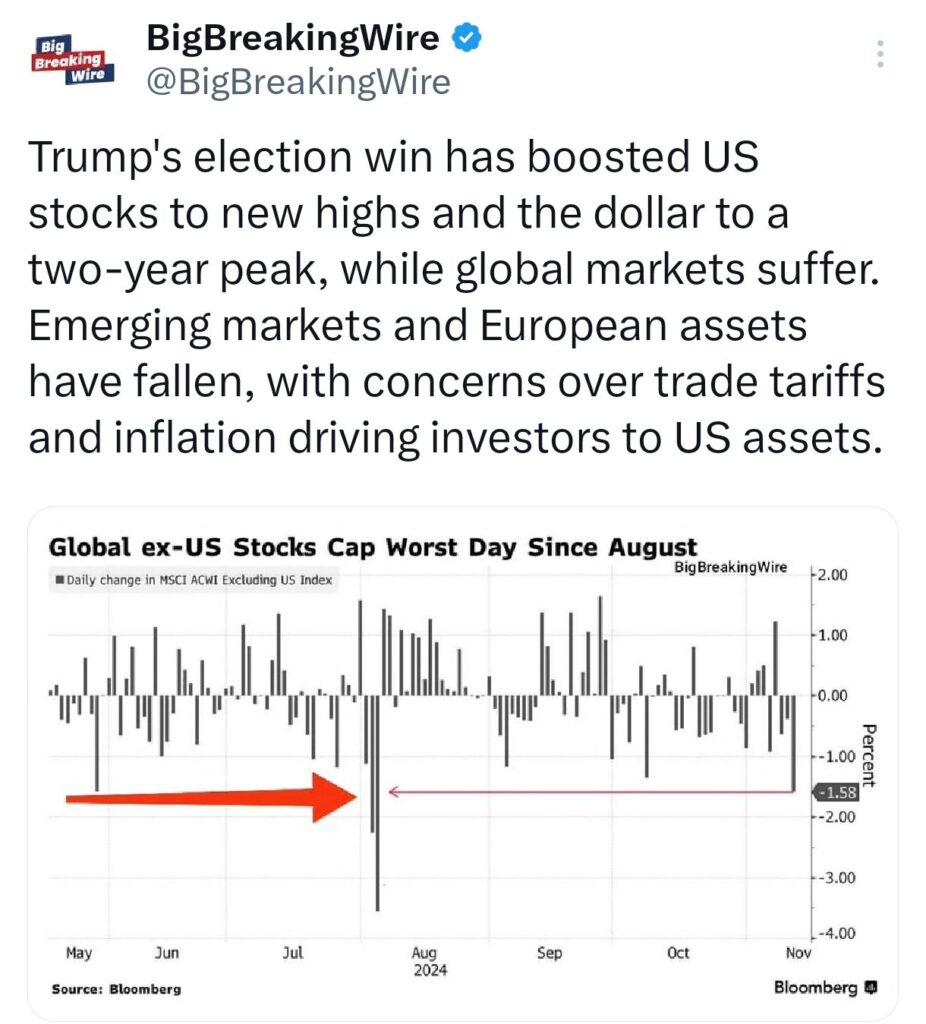

Trump’s election win has pushed US stocks to new highs and the dollar to a two-year peak, while global markets are struggling. Emerging markets and European assets have dropped, as worries about trade tariffs and inflation have led investors to favor US assets.

Trump’s tariff plan could strengthen the dollar and US stocks but may harm global economies, especially China. Worries about tariffs, the trade deficit, and the Fed’s policies are affecting Asian stocks. Treasury yields went up, and the Bloomberg Dollar Index reached its highest level in a year.

South Korean retail investors increased their US stock investments to $101.4 billion, a 64% rise compared to last year. This surge is largely due to growing interest in major tech companies, leading them to sell $3.2 billion worth of local stocks in 2024. Among their favorite US stocks are Tesla, Nvidia, Apple, and Microsoft.

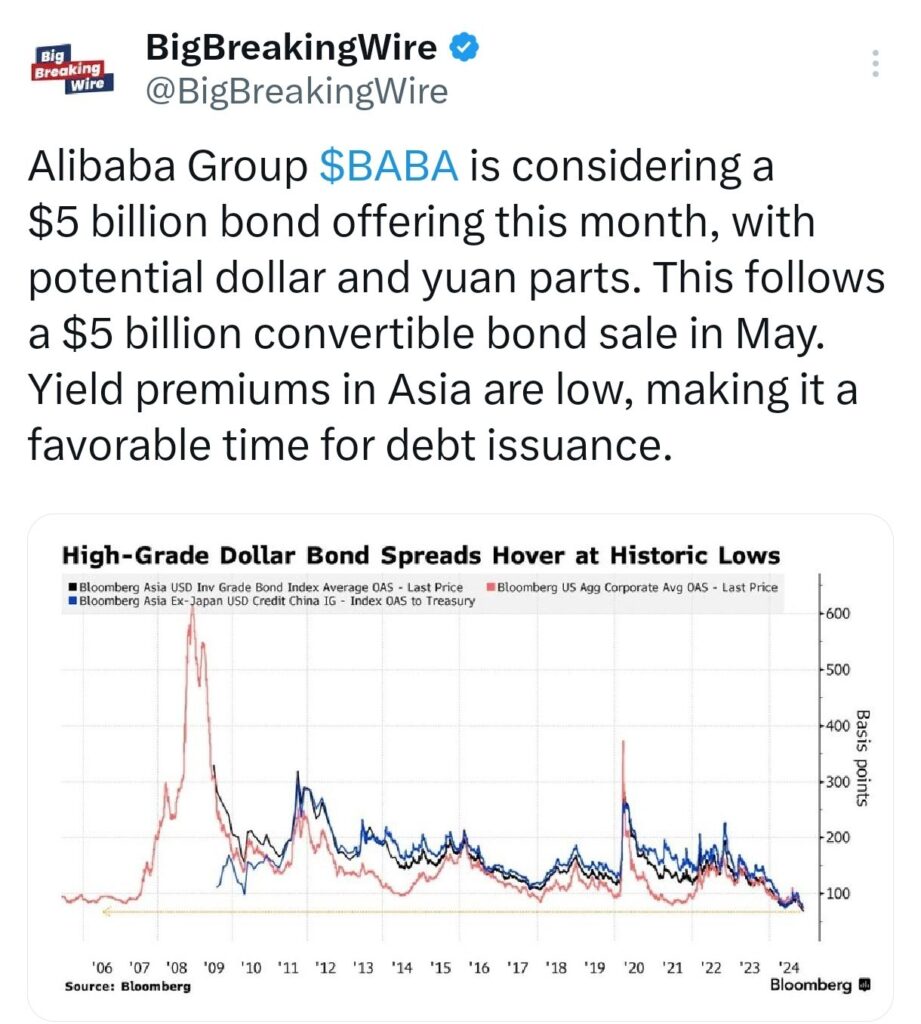

Alibaba Plans $5 Billion Bond Offering in Dollar and Yuan Amid Low Yield Premiums

Alibaba Group ($BABA) is thinking about offering $5 billion in bonds this month, with options in both dollars and yuan. This comes after a $5 billion convertible bond sale in May. The low yield premiums in Asia make it a good time for issuing debt.

CLSA Shifts Funds Back to India, AMFI Reports Surge in Equity Inflows and Cautious Investment Trends

CLSA has changed its strategy from October and is now shifting its funds back into India, increasing its investment allocation by 20%. This decision comes after China faced economic difficulties and market corrections during Trump’s re-election. Both the MSCI China and MSCI India indexes dropped by around 10%, but there were no significant losses.

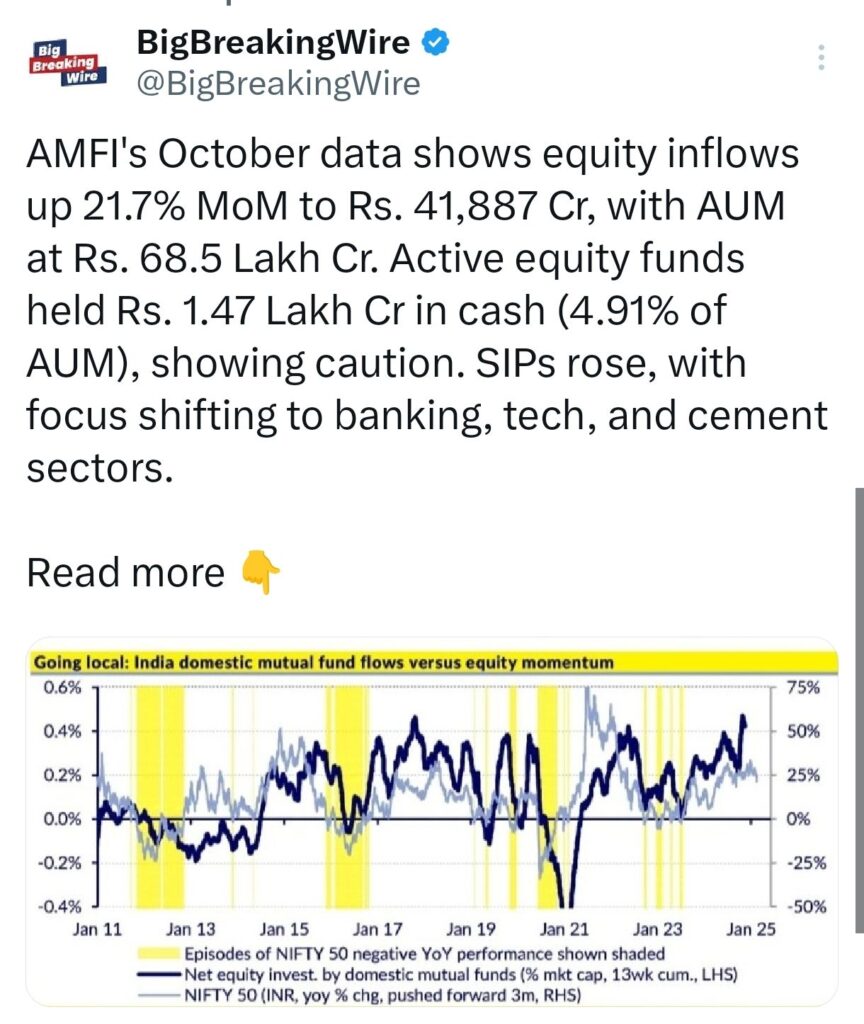

According to the Association of Mutual Funds in India (AMFI), October saw a 21.7% month-on-month rise in equity inflows, reaching Rs. 41,887 crore. The total assets under management (AUM) stood at Rs. 68.5 lakh crore. Active equity funds held Rs. 1.47 lakh crore in cash, which is about 4.91% of their AUM, indicating a cautious approach. There was also an increase in investments through Systematic Investment Plans (SIPs), with investors focusing on sectors like banking, technology, and cement.

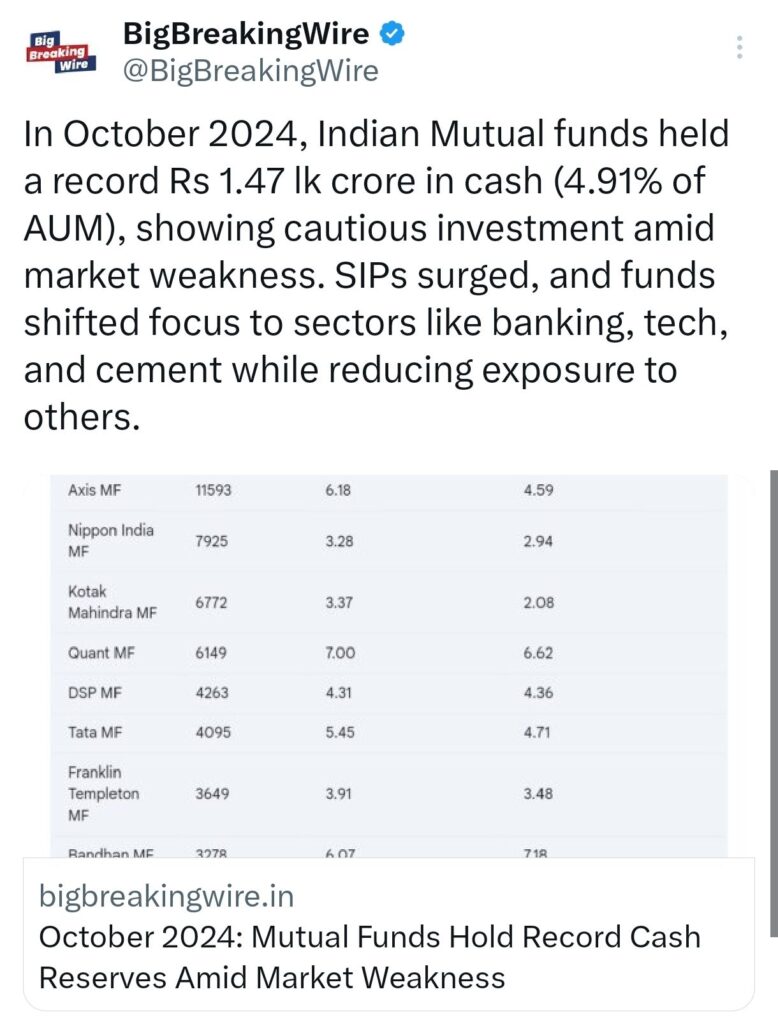

Indian Mutual Funds Hold Record Cash as SIPs Surge and Sector Shifts Occur Amid Market Weakness in October 2024

In October 2024, Indian mutual funds had a record Rs 1.47 lakh crore in cash, which made up 4.91% of their total assets under management (AUM). This reflects a cautious approach to investing due to weakness in the market. During this time, systematic investment plans (SIPs) saw a rise, and mutual funds shifted their investments toward sectors like banking, technology, and cement. At the same time, they reduced their exposure to other sectors.

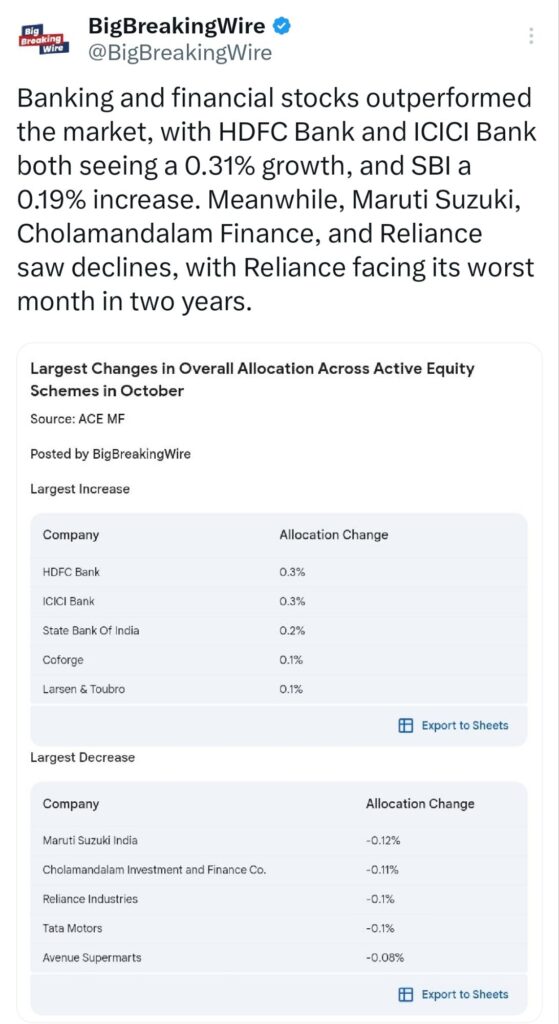

Banking and financial stocks performed better than the overall market, with HDFC Bank and ICICI Bank each showing a 0.31% increase in stock value, and SBI saw a 0.19% rise. However, some stocks like Maruti Suzuki, Cholamandalam Finance, and Reliance saw declines. Reliance, in particular, had its worst month in two years.

India’s Inflation Hits 14-Month High at 6.21%, Rate Cuts Unlikely

India’s inflation rate (CPI) rose to 6.21% in October, the highest in 14 months, surpassing expectations and the Reserve Bank of India’s target. In September, inflation was lower at 5.49%. This high inflation could delay any interest rate cuts by the RBI, making a December cut unlikely. The 10-year government bond yield increased slightly to 6.83%, reflecting the rising inflation concerns.

Industrial production improved in September, growing by 3.1% after hitting a 22-month low previously. Key industries like coal and refineries showed positive growth, but sectors such as crude oil and steel struggled.

With inflation staying above 6% and uncertainties like US policies, a strong dollar, and global pressures, the RBI may hold off on easing interest rates until April. Rising costs and lower incomes are reducing consumer spending, while foreign investors continue withdrawing money from India’s stock markets.

Chinese Copper Smelters Face Profit Pressure as Excess Capacity Threatens Global Market

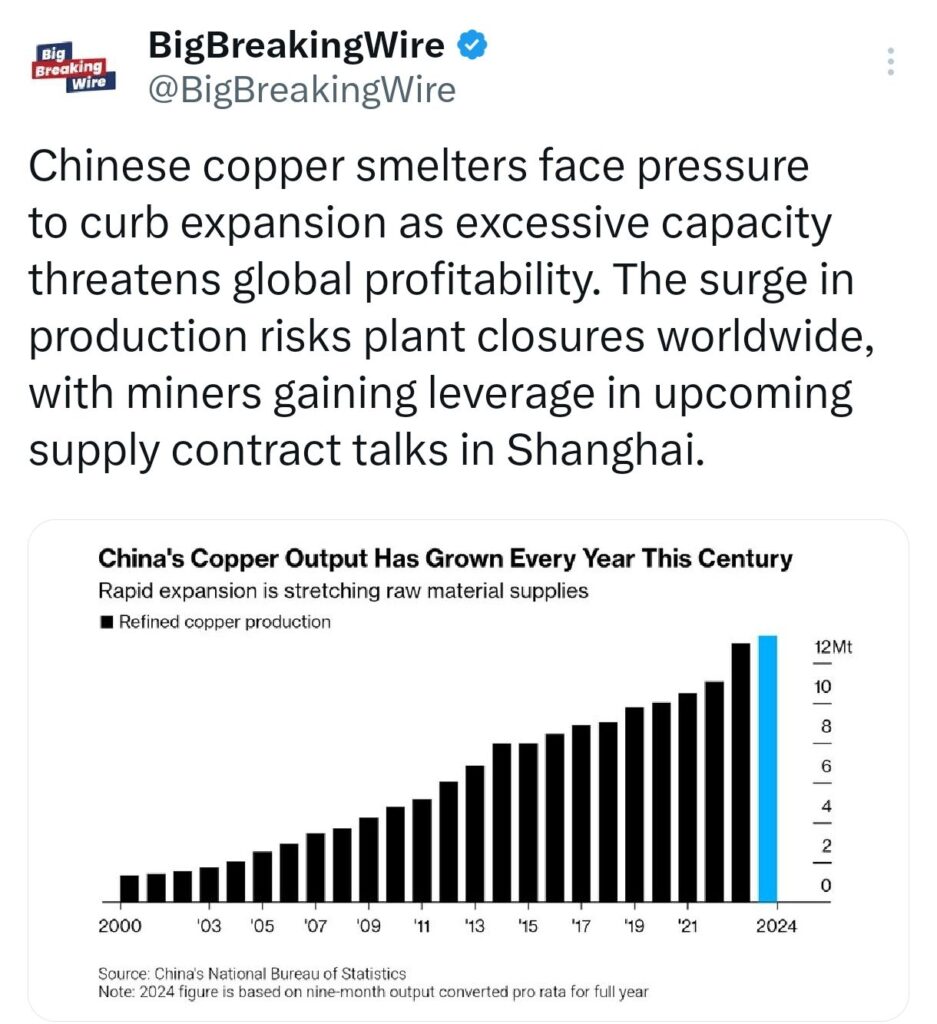

Chinese copper smelters are under pressure to slow down their expansion because too much capacity is reducing profits worldwide. The rapid increase in production could force some plants to shut down, and miners are expected to gain more control in supply contract negotiations during upcoming talks in Shanghai.

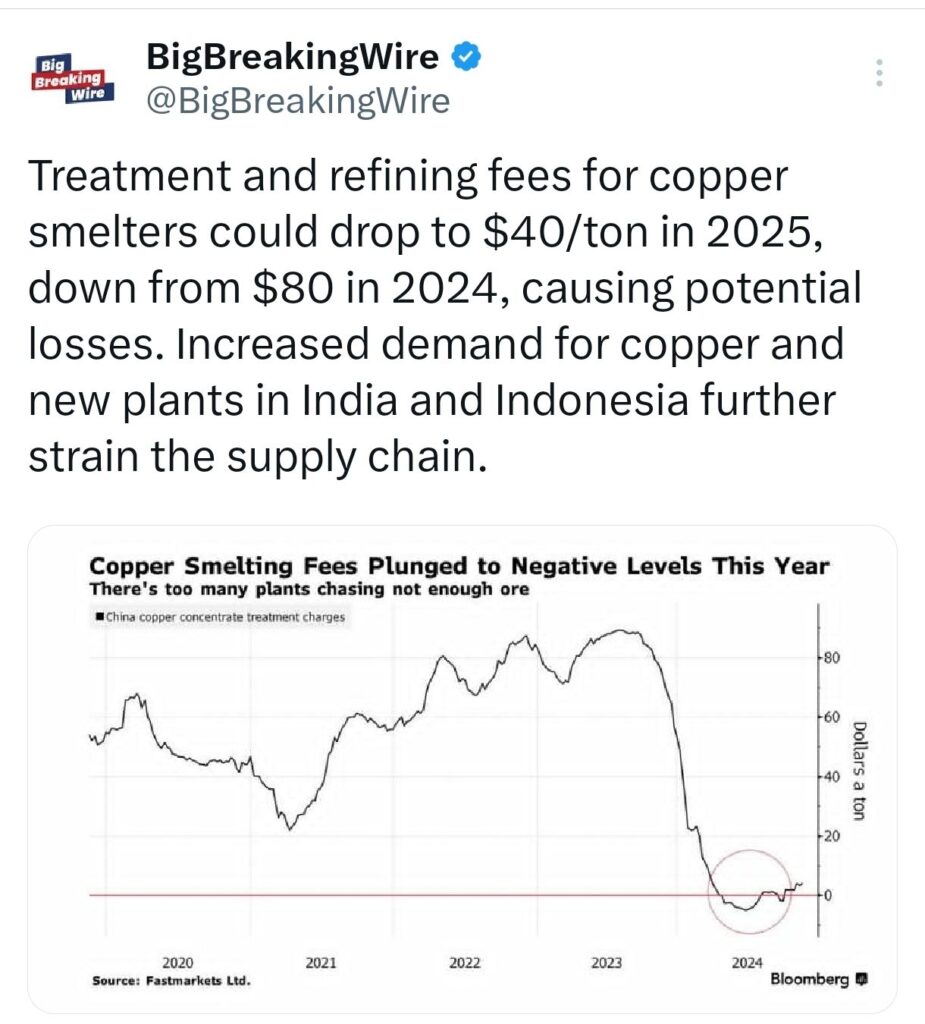

The fees that copper smelters earn for treatment and refining are predicted to fall sharply. By 2025, these fees could drop to $40 per ton, down from $80 per ton in 2024, leading to potential losses for smelters. At the same time, growing demand for copper and the opening of new plants in India and Indonesia are adding more strain to the supply chain.

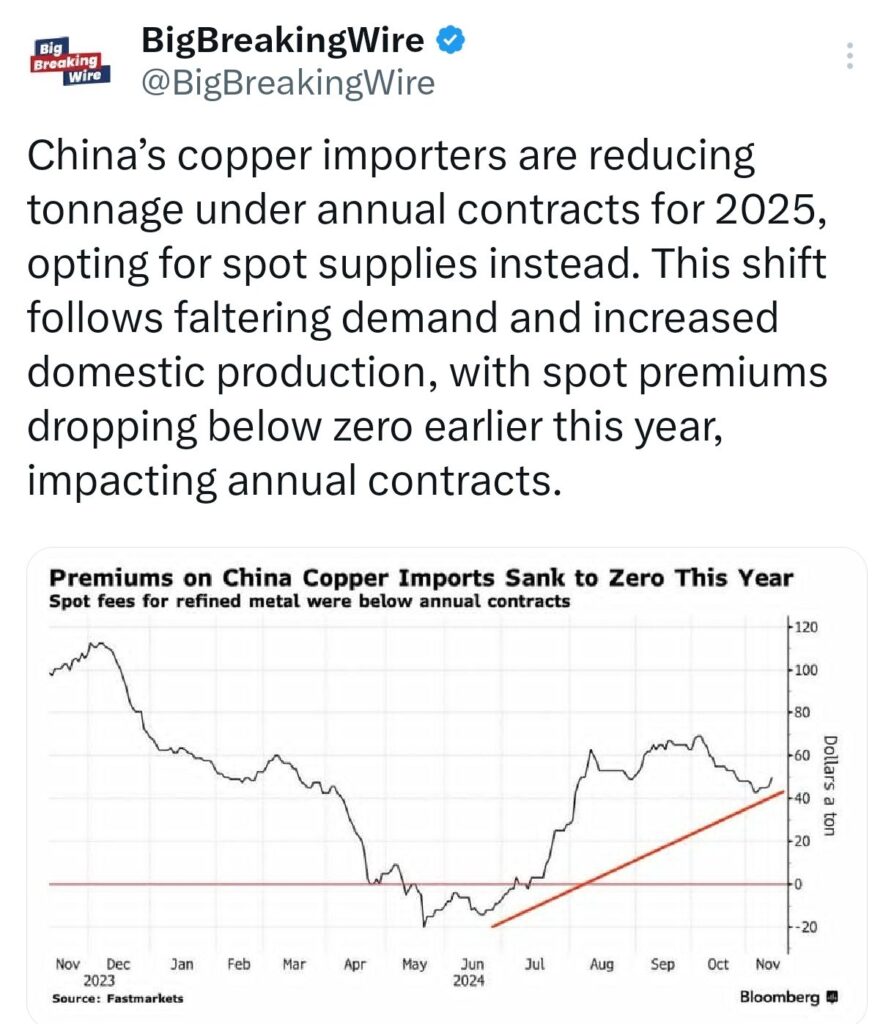

China’s copper importers are also changing their approach for 2025 contracts. Instead of signing large annual agreements, they are buying more copper on the spot market. This shift is due to weaker demand and increased local production in China. Earlier this year, spot premiums even fell below zero, which has affected the pricing of long-term contracts.

Thank you for reading! We’d love to hear your thoughts on our new “Economy in Charts” series. If you found it helpful, feel free to share it with your friends and community. Your feedback helps us improve!

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

2 Comments