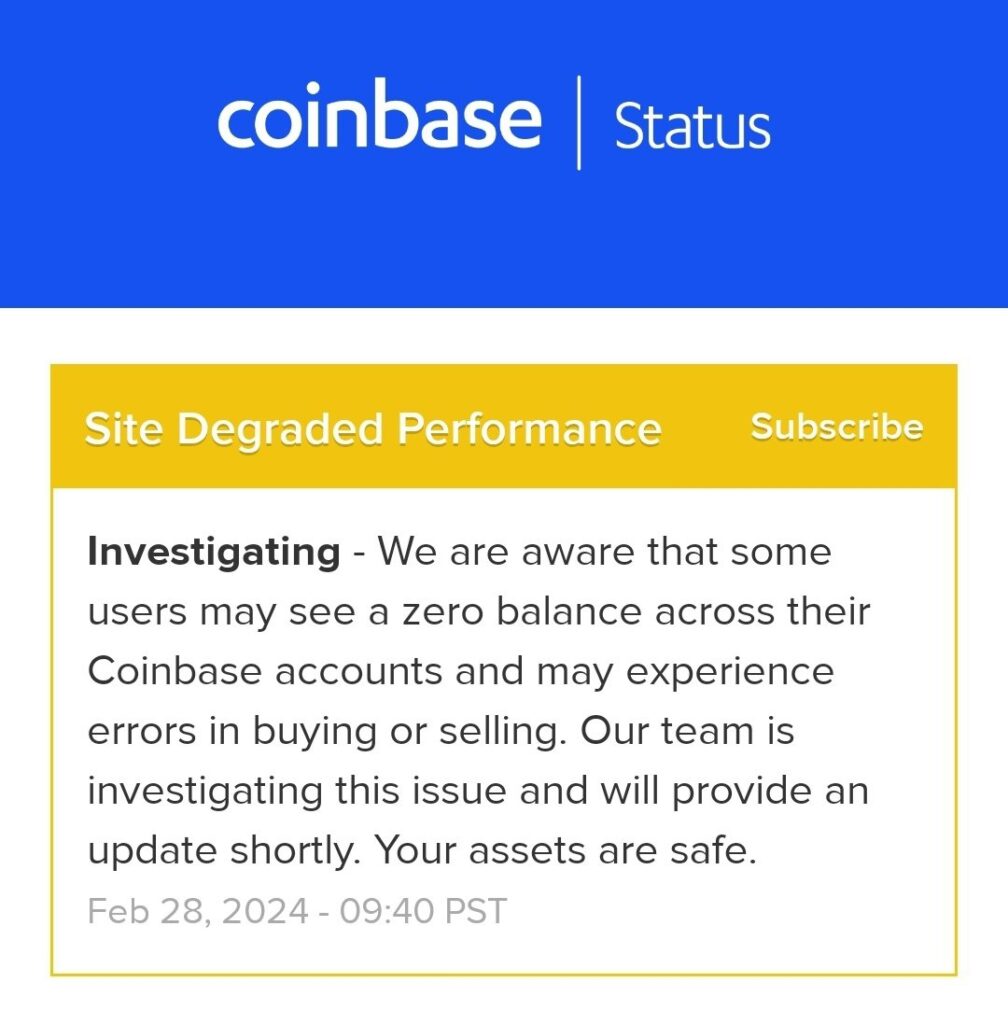

Coinbase, the popular cryptocurrency exchange, faced a significant disruption as its platform crashed amid Bitcoin’s surge to $64,000. Users reported seeing a sudden drop to a $0 balance, causing concerns about the safety of their assets. In response, Coinbase reassured its users that their funds are secure and that the team is actively investigating the issue. Despite the reassurance, some users continued to witness a zero balance in their accounts.

The crash had a swift impact on Bitcoin’s value, causing it to plummet by $4,000 within few minutes, ultimately settling below $60,000. This marked Bitcoin’s highest level since November 2021. The cryptocurrency, which was on the verge of reaching a new all-time high, experienced a nearly 9% decrease during the crash. Coinbase promptly released a statement emphasizing the safety of users’ assets and pledging to provide updates as the investigation unfolds.

In a swift 15-minute plunge between 12:15 PM ET and 12:30 PM ET, the Coinbase ($COIN) crash wiped out $100 billion in Bitcoin market cap, causing a nearly 9% drop from $64,000 to $59,000. This abrupt swing coincided with numerous Coinbase users witnessing $0 balances, and it transpired as Bitcoin was on the brink of a new all-time high, less than 10% away.

Meanwhile CEO of Coinbase stated, “We’re experiencing significant traffic surges that have led to the exchange crashing.”

On the other side, in the first half of today’s trading session, all nine Bitcoin ETFs have surpassed their daily trading volume records, accumulating a remarkable total of $2.6 billion. Should the current level of activity persist, we are on track to experience the inaugural day with over $5 billion in Bitcoin ETF volume.

Notably, four Bitcoin ETFs have secured positions within the top 20 based on volume, as reported by Bloomberg’s Eric Balchunas. This trend indicates a notable surge in popularity for Bitcoin ETFs, catapulting them into some of the most sought-after ETFs globally.

Remarkably, every one of the nine #Bitcoin ETFs presently ranks among the top 100 most active ETFs, dispelling any previous concerns about insufficient demand for ETFs linked to Bitcoin.

Today marked a historic milestone for Bitcoin Exchange-Traded Funds (ETFs) as the total trading volume soared to an unprecedented $7.5 billion, demonstrating a remarkable 2.5-fold increase from its previous record of $3 billion. Notable players in this surge include BlackRock, leading the pack with a substantial $3.3 billion in trading volume, others are:

1. BlackRock ETF: $3.3 billion

2. Grayscale ETF: $1.8 billion

3. Fidelity ETF: $1.4 billion

4. ARK Invest ETF: $425 million

5. Bitwise ETF: $252 million

6. Invesco ETF: $162 million

7. WisdomTree ETF: $59 million

8. VanEck ETF: $52 million

9. Franklin ETF: $32 million

10. Valkyrie ETF: $15 million

Bitcoin itself is experiencing a noteworthy trajectory, boasting a 290% increase from its recent low and standing just 15% away from achieving a new all-time high. Despite an initial period of substantial outflows following approval, Bitcoin ETFs are staging a comeback, indicating a growing investor interest and suggesting that it might only be a matter of time before new all-time highs are reached in the world of Bitcoin. The impressive volumes and renewed interest reflect a dynamic market, with institutional players and diverse ETFs contributing to the cryptocurrency’s ongoing narrative.

Renowned investor Mike Novogratz predicts a bullish future for Bitcoin, anticipating a surge within the next year. Novogratz highlights Bitcoin as a harbinger of a “new army of buyers” and underscores the significant demand for the cryptocurrency. While expressing optimism, he acknowledges the possibility of corrections, suggesting that Bitcoin might experience a dip to the mid-$50,000 range. Novogratz’s positive outlook on Bitcoin reflects a broader sentiment in the market, as the cryptocurrency continues to attract attention and interest from investors.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment