Brokerages on India’s Q2 GDP Growth Projections

UBS

Revised FY25 GDP growth projection to 6.3%.

Believes achieving 6.5% growth will need strong monetary and fiscal support.

CITI

Reduced FY25 GDP growth forecast from 7% to 6.4%.

Expects no rate cut in December due to high inflation.

Suggests RBI might emphasize the need to support growth, increasing chances of a rate cut in February.

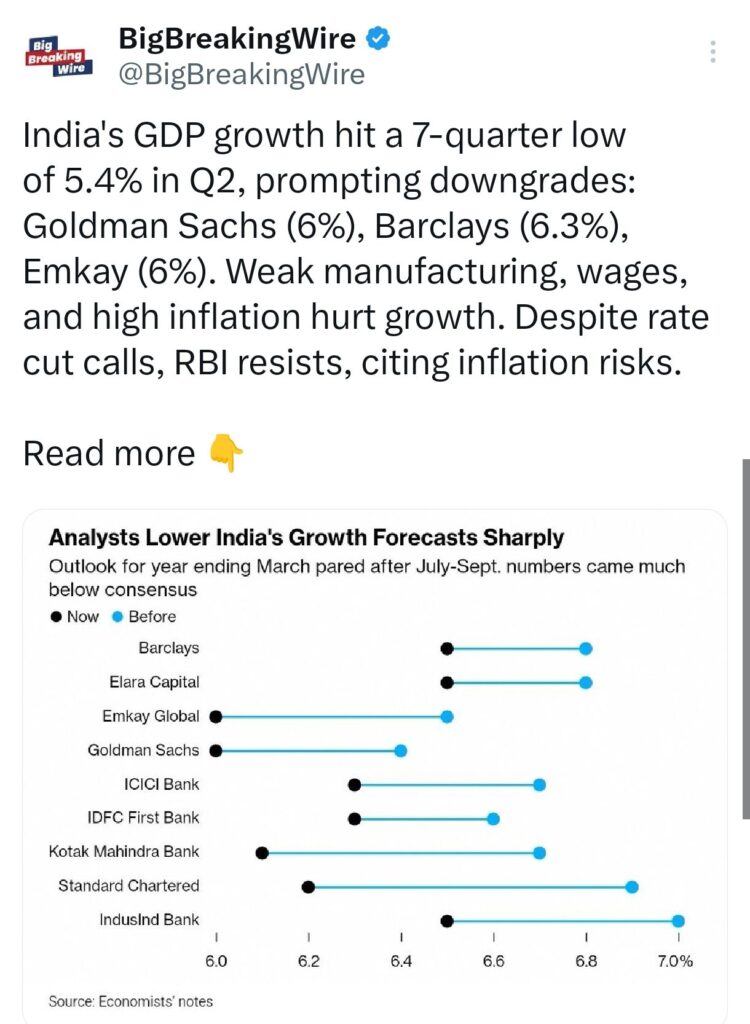

Goldman Sachs

Lowered CY24 and FY25 GDP growth forecasts to 6.4% and 6%, respectively.

Maintains CY25 and FY26 growth forecasts at 6.3% for both.

Morgan Stanley

Predicts GDP growth has bottomed out and anticipates recovery in H2FY25.

Adjusted FY25 growth estimate to 6.3%.

Describes slowing growth trajectory as expected, but notes the scale of the slowdown is surprising.

Still expects the first rate cut in February, but sees increased odds of a cut in December.

Base case remains a February rate cut, with possible liquidity measures from RBI.

Nomura

Views moderation in growth as partly due to temporary factors expected to reverse.

Revised FY25 GDP growth forecast to 6% (from 6.7%) and FY26 to 5.9% (from 6.8%).

Anticipates RBI to reduce rates by 100 basis points starting December.

Nuvama on Adani Ports

Rating: Buy; Target Price (TP): ₹1,960.

Key takeaways from its Vizhinjam port investor day:

Maintains guidance of 1 billion metric tons (bnt) handling volume by 2030.

Expects logistics to drive significant growth.

Highlights advancements in technology across ports and logistics.

Emphasizes strong balance sheet discipline.

Nomura on Dixon Technologies

Rating: Buy; TP: ₹18,654.

Company launched mass production of Google Pixel smartphones.

China+1 strategy could create long-term opportunities from Google.

Estimated revenue addition of ₹1,500 crore (~4% of FY26 smartphone sales).

Morgan Stanley on IndusInd Bank

Rating: Equal Weight (EW); TP reduced: ₹1,150 (from ₹1,400).

Stock has declined 30% post-earnings due to concerns over Microfinance Institution (MFI) asset quality.

Sees more EPS cuts; downside risks outweigh rewards.

Maintains a 30% probability of a bear case scenario.

HSBC on Titagarh Rail

Rating: Buy; TP reduced: ₹1,425 (from ₹1,980).

Expects metro rolling stock orders to resume post-state elections.

Notes slower execution of metro and Vande Bharat orders, leading to forecast cuts.

HSBC on Cable and Wire OEMs

Positive demand outlook for CY25 despite capacity growth outpacing demand.

Margins likely to improve, driven by the wires business.

Polycab: Buy, TP ₹7,750.

KEI Industries: Hold, TP ₹4,350.

RR Kabel: Hold, TP ₹1,700.

CITI on RBL Bank

Rating: Buy; TP: ₹255.

RBL and Bajaj Finance (BAF) to end co-branded credit card issuance.

BAF contributed 50-55% of sourcing; origination cost sharing to stop, but trail payouts to continue.

Management aims for 10-15% growth in the credit card portfolio.

Investec on RBL Bank

Rating: Hold; TP cut: ₹170.

Termination of co-branded card agreement with BAF driven by stricter regulations.

Expects 200 basis points drop in FY25 credit growth to 13-14%, impacting net interest income (NII).

Morgan Stanley on RBL Bank

Rating: Underweight (UW); TP: ₹180.

Notes Bajaj Finance’s exit as a major setback for credit card issuance, constraining market share growth.

Tough earnings outlook due to MFI challenges; forecasts return on equity (RoE) below cost of equity (CoE).

Jefferies on Bajaj Finance

Rating: Buy; TP: ₹8,400.

Sees limited impact from ending the RBL co-branding partnership.

Lower origination fees could be offset by reduced costs and continued trail-based fees.

Citi on Bajaj Finance

Rating: Buy; TP: ₹8,150.

Expects freed resources to strengthen other business segments.

Strengthens case for credit card license reapplication.

Emkay on Anant Raj

Rating: Buy; TP: ₹925.

Well-positioned in the data center and cloud space.

Real estate segment to drive an 18% CAGR in bookings and 39% CAGR in collections for FY24-27.

Deleveraged balance sheet supports data center growth.

India’s Q2 GDP Slows to 5.4%, Growth Downgraded

India’s GDP growth for Q2 dropped to a 7-quarter low of 5.4%, leading to downward revisions in growth forecasts. Goldman Sachs lowered its projection to 6%, Barclays to 6.3%, and Emkay to 6%. The weak performance in manufacturing, stagnant wages, and persistent high inflation were significant factors impacting the growth rate. Despite calls for a rate cut to stimulate the economy, the Reserve Bank of India (RBI) has held off on such measures, citing concerns over inflationary pressures that could hinder economic recovery.

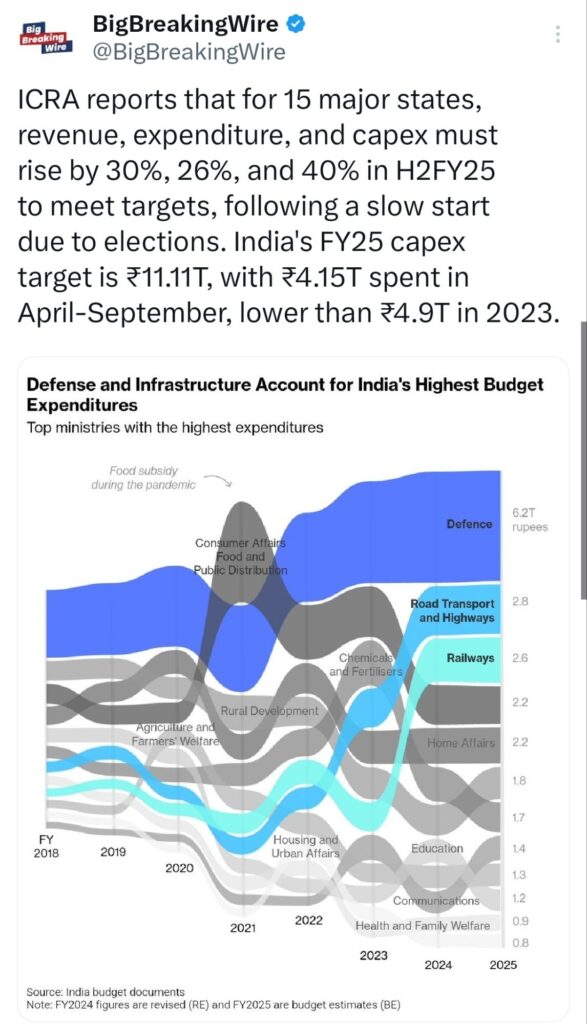

ICRA: 30% Revenue, 26% Expenditure, and 40% Capex Growth Needed in H2FY25 for 15 Major States to Meet Targets.

ICRA reports that for 15 major states, there is a need for a 30% increase in revenue, a 26% rise in expenditure, and a 40% boost in capital expenditure (capex) during the second half of FY25 to meet their annual targets. This follows a slower-than-expected start to the fiscal year, primarily due to disruptions caused by elections. India’s overall capex target for FY25 is ₹11.11 trillion, with ₹4.15 trillion already spent during the first half (April-September). This amount is lower compared to the ₹4.9 trillion spent during the same period in FY23.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment