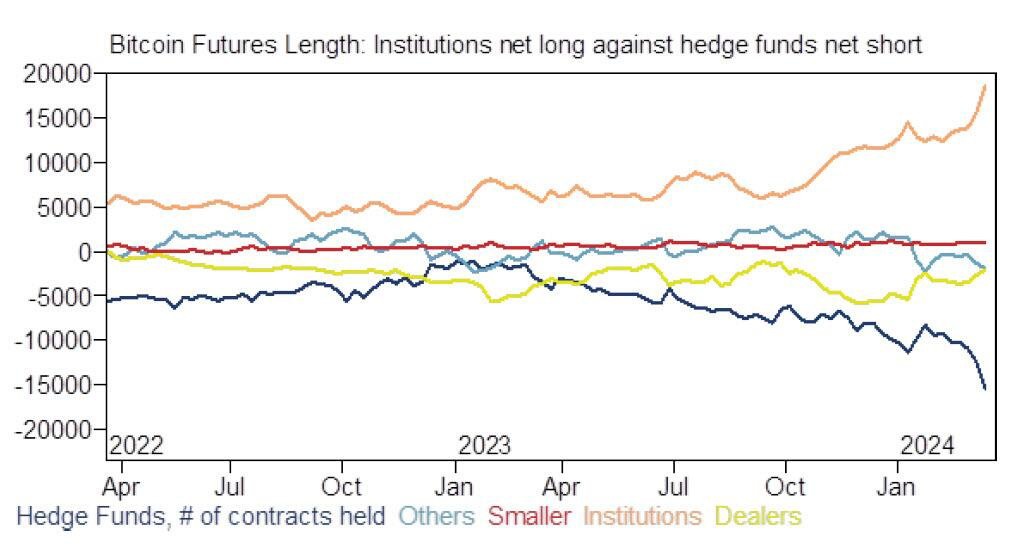

The current dynamics in the Bitcoin market suggest the potential for a significant short squeeze.

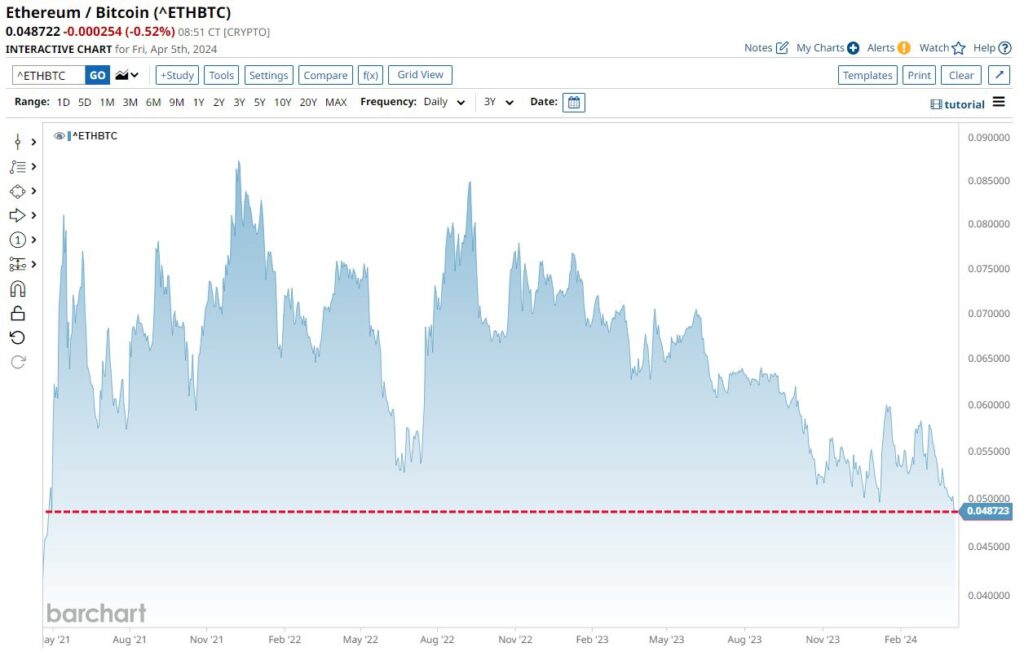

Ethereum’s value drops to its lowest level against Bitcoin in three years, as per Barchart.

The gap between institutional long positions and hedge fund short positions has reached unprecedented levels.

Hedge funds are holding nearly 15,000 net short contracts, while institutions maintain nearly 20,000 net long positions.

This stark contrast in positions is contributing to the erratic price movements witnessed in recent days.

Institutional investors are steadfast in their long positions, with each new Bitcoin price record being driven by widespread short covering.

The duration of price dips in Bitcoin is decreasing, while rallies are becoming more prolonged and rapid.

These trends indicate a classic scenario of shorts being squeezed as Bitcoin continues to reach fresh all-time highs.

Disclaimer: This is not financial advice. It is recommended to conduct your own research or consult with a financial analyst before making any investment decisions. Cryptocurrency carries significant risk.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment