Bitcoin has reached the $71,000 milestone for the first time since April 1st, marking a significant surge in its value.

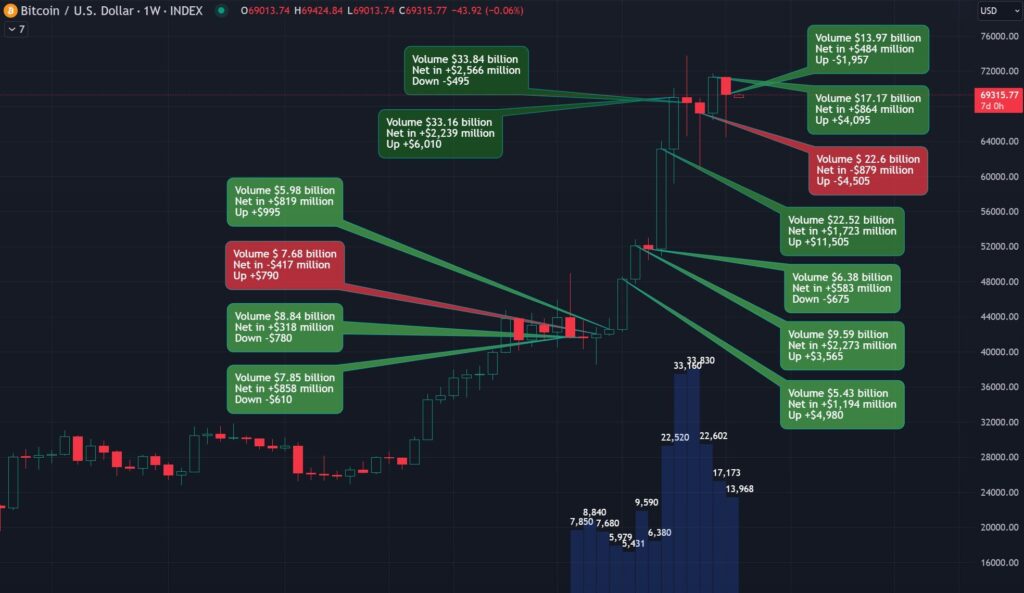

In Week 13 of Bitcoin Spot ETF trading:

The week had a low volume traded, indicating reduced activity in the market.

There was a slightly declining inflow, suggesting a cautious approach by investors.

The cash flow for the week was $484 million, showcasing some interest in the market despite the low volume traded.

The volume traded was $13,968 million, indicating a significant amount of trading activity despite the low volume week.

The open price of the week for BRTI was down by $1,957, while for BRRNY it was down by $3,745, reflecting a bearish sentiment in the market.

Wirehouses are in the process of adopting Bitcoin Spot ETFs, which could potentially increase the market’s liquidity and accessibility.

There’s an ongoing view on market correction, suggesting investors are expecting a price decrease in the near future.

If concerned about a potential decrease in Bitcoin Spot ETF prices, it’s advisable to research the sources of market supply to better understand the dynamics at play.

The gap between the market expectations and the current state is $68,040.

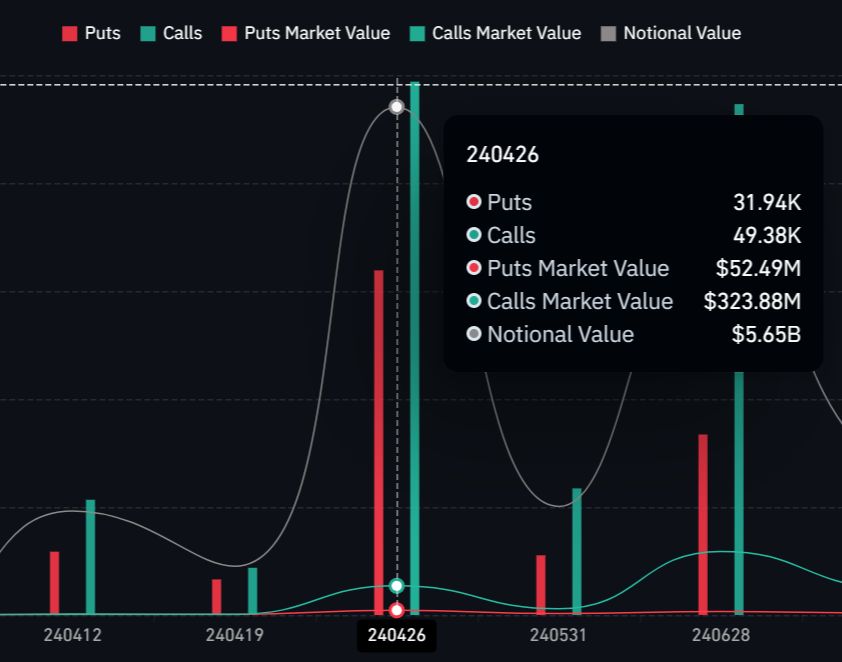

It appears that the Bitcoin option market isn’t heavily betting on an extreme price move on the day of the halving event, which is scheduled for April 19th, 2024. This can be observed through a few key indicators:

There is a noticeable lack of significant option positions being held specifically on April 19th. This suggests that the market participants are not anticipating a major price movement on that day.

The open interest in the Bitcoin options market for the period leading up to and including the halving day is relatively mediocre. Open interest is a measure of the total number of outstanding option contracts that have not been settled. A high open interest would suggest that market participants are expecting significant price movements, but the current levels indicate a more subdued outlook.

The open interest on April 26th, which is a week after the halving event, is also not indicating any major shifts in market dynamics. This further reinforces the view that the market is not expecting an extreme price move as a result of the halving event.

In summary, the Bitcoin option market does not seem to be betting on a significant price movement on the day of the halving event or in the immediate aftermath. This could be due to a variety of factors, including market participants taking a more cautious approach or having differing views on the impact of the halving on Bitcoin’s price.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment