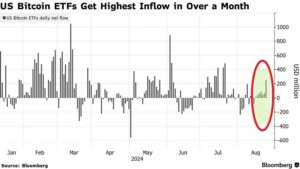

On Friday, U.S. Bitcoin ETFs saw a net inflow of $252 million, marking the highest level in over a month. This surge in inflows reflects growing investor confidence in the cryptocurrency market, especially as Bitcoin prices have risen sharply in recent weeks.

For seven consecutive days, the largest cryptocurrency funds have attracted inflows, signaling sustained interest from institutional and retail investors alike. The recent inflows coincide with comments from Federal Reserve Chair Jerome Powell, who hinted at the possibility of the first interest rate cut in 4.5 years. This potential easing of monetary policy has further fueled optimism in the market.

Bitcoin prices have surged approximately 29% over the past three weeks, with the cryptocurrency currently trading around $64,000. This rally has been driven by a combination of factors, including increased institutional adoption, favorable regulatory developments, and positive market sentiment following Powell’s remarks.

Investors are closely watching these developments, as the continued flow of funds into Bitcoin ETFs suggests that the market may be gearing up for further gains in the coming weeks. The strong performance of Bitcoin and its ETFs highlights the growing acceptance of digital assets as a legitimate investment option in the broader financial landscape.

In summary, the recent $252 million net inflow into U.S. Bitcoin ETFs, along with a 29% rise in Bitcoin prices, underscores the bullish sentiment in the cryptocurrency market. With potential rate cuts on the horizon and increasing institutional interest, Bitcoin and its related investment vehicles may continue to see strong performance in the near future.

Disclaimer: This content is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment