Wedbush has increased its price target for Tesla stock from $300 to $400, believing that a win for Trump in the U.S. presidential election will significantly benefit Tesla’s self-driving (autonomous) and artificial intelligence (AI) technologies. The firm estimates that the AI and autonomous driving opportunity alone could be worth $1 trillion for Tesla. They expect that under a Trump administration, Tesla will face fewer regulatory hurdles, which will speed up progress in these areas. Wedbush also keeps an “OUTPERFORM” rating for Tesla.

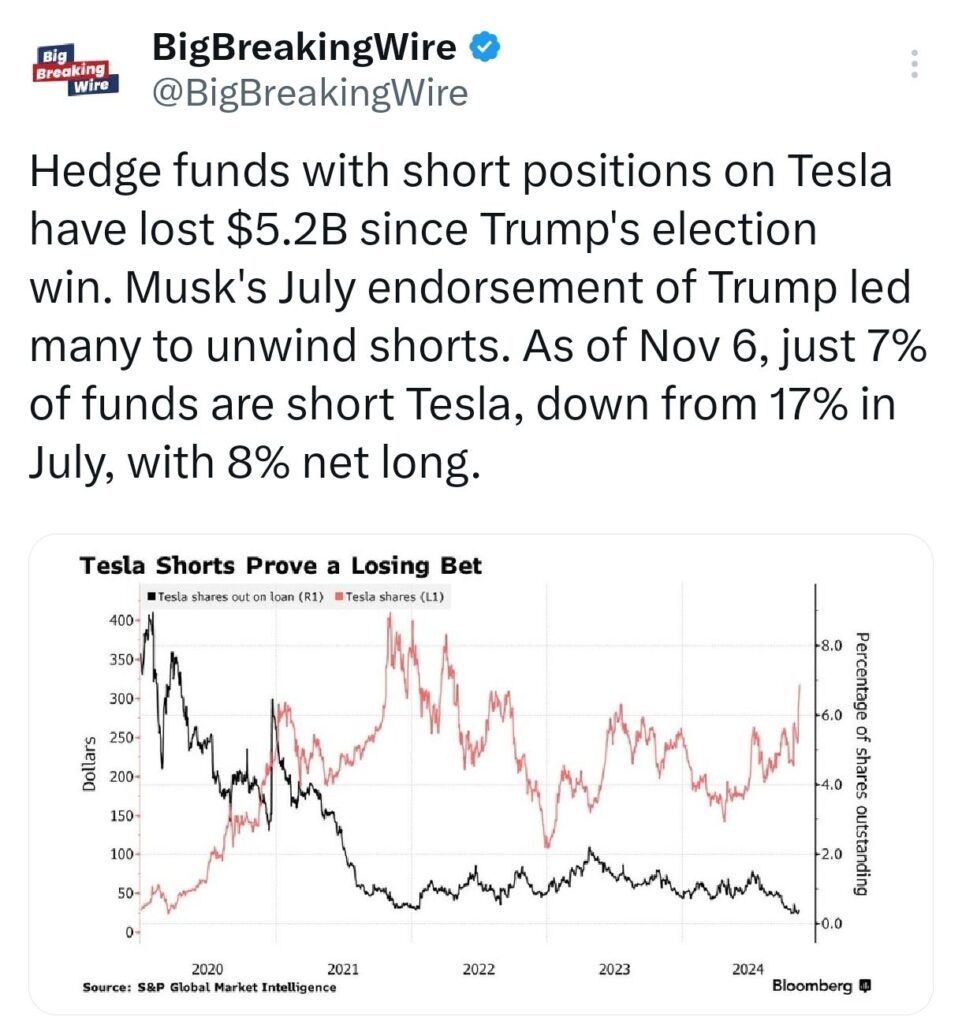

Since Trump’s election win, hedge funds with short positions on Tesla have lost a total of $5.2 billion. This is partly due to Elon Musk’s endorsement of Trump in July, which prompted many investors to close their short positions. As of November 6, only 7% of hedge funds are still short on Tesla, down from 17% in July. Meanwhile, 8% of funds have a net long position in Tesla.

On November 6, U.S. equity funds saw a massive inflow of $20 billion, the largest in five months, after Trump’s victory. Small-cap stocks were especially popular, with $3.8 billion flowing into them, their largest influx since March. The S&P 500 reached a new record high, partly driven by the election result and a Federal Reserve rate cut.

After Trump’s win, currency options trading reached new heights, with $160 billion in contracts traded in a single day, according to the DTCC. The U.S. dollar strengthened as options for the euro and Chinese renminbi surged, leading to $275 billion in foreign exchange (FX) trades on the CME. Analysts predict that the dollar will continue to strengthen due to ongoing trade tensions.

Hedge funds quickly bought bank stocks while betting against renewable energy companies after Trump’s election win, according to a Goldman Sachs note.

Financial stocks, especially banks and trading companies, were the most popular among investors, as they expect a lighter regulatory environment and tax reforms under Trump’s presidency.

Hedge funds favored U.S. banks and financial companies, including consumer finance and capital markets firms. In Europe, they shifted from short to long positions in stocks, while in Asia, they focused on rising markets. Utilities, especially renewable energy producers, saw the most short bets, with two shorts for every long position in U.S. utility stocks.

Trina Solar is selling its new Texas solar panel factory to FREYR Battery for $340 million. The factory, which just opened on November 1, will reach full production by 2025. FREYR, based in Norway and now headquartered in Georgia, will also have a minority stake in Trina. The deal comes as the US government is looking into Chinese companies benefiting from tax breaks for solar manufacturing, with new bills to limit these benefits.

Oppenheimer has raised its 2024 year-end price target to $6,200 from $5,900, while keeping its earnings estimate steady. With 453, or 90%, of S&P 500 companies reporting, the third-quarter results are strong.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

One Comment