The Japanese yen (JPY) is rising even though U.S. Treasury yields are also going up. This is unusual and could signal rising risks in the U.S. economy, according to Deutsche Bank strategist George Saravelos.

What Did George Saravelos Say?

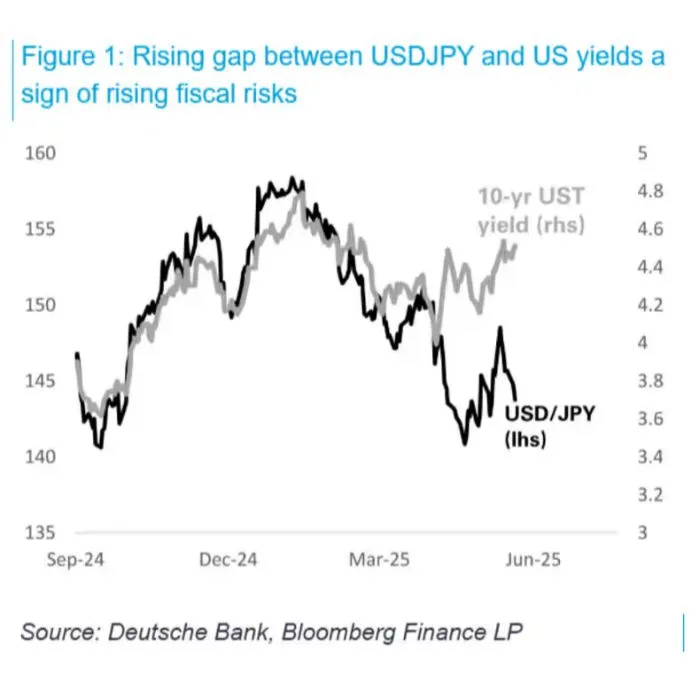

In a note sent on Wednesday, George Saravelos said the gap between U.S. Treasury yields and the USD/JPY exchange rate is now the most important market signal to watch. He believes this gap shows growing concerns about U.S. fiscal health.

> “The yen is strengthening even while U.S. yields are rising. This is not normal,” Saravelos explained.

Why Is This Important?

Normally, when U.S. Treasury yields rise, the U.S. dollar becomes stronger against the yen. But now, the yen is getting stronger even as U.S. yields climb. This change suggests something unusual is happening in global markets.

What About Japan’s Debt Concerns?

Some traders think rising Japanese bond yields—like the 30-year note reaching 3.19% (the highest in 25 years)—might mean investors are worried about Japan’s own debt. But Saravelos disagrees.

> “If investors were worried about Japan’s debt, the yen would be getting weaker—not stronger,” he said.

What Does This Mean for U.S. Treasuries?

Saravelos believes the close connection between USD/JPY and U.S. yields has broken. This could mean fewer foreign investors are buying U.S. government bonds.

> “We think this shows that foreign participation in the U.S. Treasury market is going down,” he said.

Conclusion

The strengthening of the yen despite rising U.S. yields could be a warning sign. It suggests that global investors may be losing confidence in U.S. fiscal policy. This shift in market behavior could have major effects on currencies, bonds, and investor sentiment going forward.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment