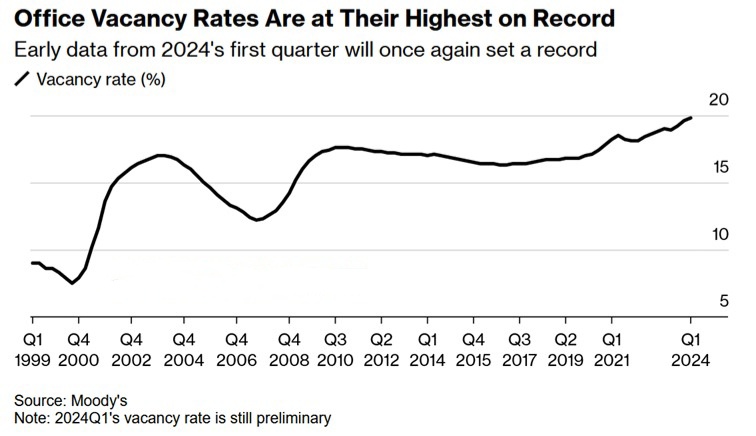

In Q1 2024, the office vacancy rates in the United States reached a historical high, as reported by Moody’s.

The vacancies rose to 19.8% from the previous quarter’s 19.6% in Q4 2023.

Many corporations continue to downsize their office spaces due to the growing prevalence of remote work.

Vacancy rates have surpassed the peaks recorded in 1986 and 1991, with office building prices declining by over 40%.

The Commercial Real Estate crisis remains a critical macroeconomic trend to monitor.

Weakness in commercial real estate is notably more pronounced in office buildings compared to other sectors.

Late payments on loans backed by office properties surged to 6.5% in Q4 2023.

Notably, a New York office building recently sold for a mere $1, indicating the severity of the market downturn.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment