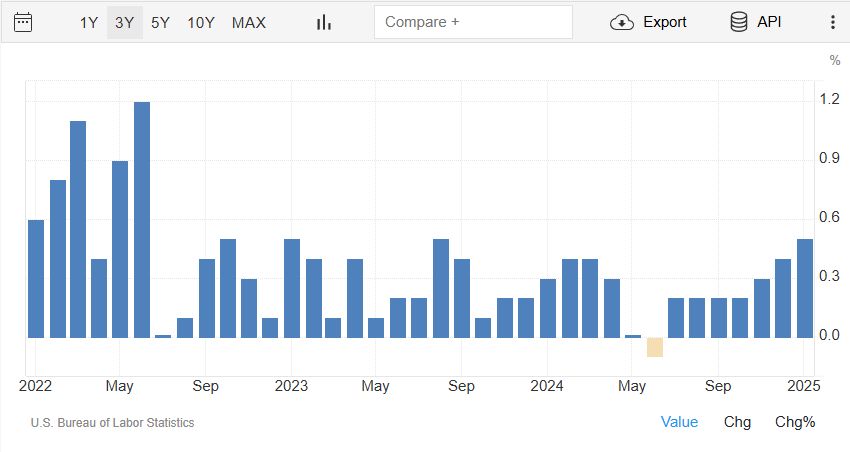

The United States’ inflation data for January shows higher-than-expected price increases. The Core Consumer Price Index (CPI), which excludes food and energy, rose by 0.4% in January compared to the previous month, surpassing the expected 0.3%. Year-over-year, the Core CPI grew by 3.3%, slightly above the expected 3.1%.

The overall CPI, which includes all goods and services, increased by 0.5% from December, also higher than the anticipated 0.3%. The CPI index, which measures the total price level, reached 317.67 in January, higher than the expected 317.46 and up from 315.61 in December.

U.S. consumer prices rose more than expected in January, sending a clear message from the Federal Reserve that it isn’t rushing to lower interest rates despite growing economic uncertainty.

The consumer price index (CPI) increased by 0.5% in January, following a 0.4% rise in December, according to the Labor Department’s Bureau of Labor Statistics (BLS). On a yearly basis, the CPI rose by 3.0%, up from 2.9% in December. Economists had predicted a smaller increase of 0.3% for the month and a 2.9% rise year-over-year.

To reflect price changes in 2024, the BLS updated its data models, including new weights and seasonal adjustments. This could have impacted the CPI’s rise, which may also reflect businesses raising prices at the start of the year, possibly in response to anticipated tariffs.

Earlier this month, President Donald Trump suspended a 25% tariff on goods from Canada and Mexico until March. However, a new 10% tariff on Chinese goods went into effect in January, and economists expect these tariffs to eventually drive inflation higher.

Despite recent progress in controlling inflation, Federal Reserve Chair Jerome Powell said inflation remains above the central bank’s 2% target. With continued uncertainty over the economic effects of the administration’s trade and fiscal policies, the likelihood of an interest rate cut this year seems to be fading.

The price of eggs rose over 15%, marking the largest increase since 2015.

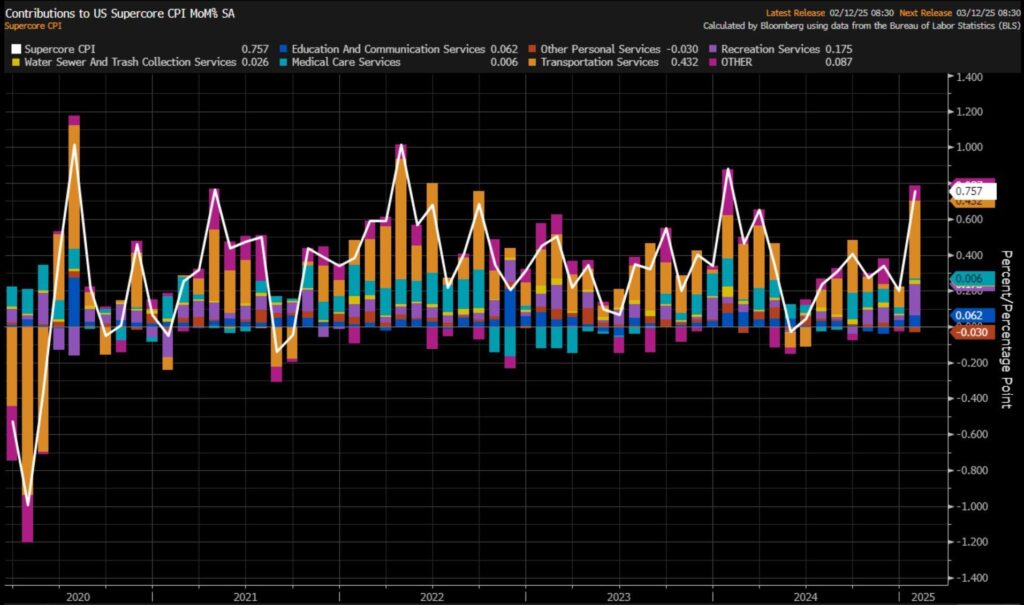

Supercore services increased by 0.76%, the biggest rise since last January. This indicates that wage increases from the jobs report are driving up service prices, challenging the idea that companies can’t pass on higher costs. This is bad news for both the Fed and consumers.

Trump Calls for Lower Interest Rates to Align with Upcoming Tariffs

President Donald Trump says interest rates should be lowered, aligning this move with his upcoming tariffs. Despite economists’ concerns that tariffs could drive up inflation and delay rate cuts, Trump believes they will work well together.

On Monday, Trump raised tariffs on steel and aluminum imports to 25%, with no exceptions, to support struggling U.S. industries. However, this decision also carries the risk of triggering a trade war. Trump shared his thoughts on his Truth Social platform, saying, “Interest rates should be lowered, which would go hand in hand with the upcoming tariffs!”

10-year U.S. Treasury yield climbed to 4.645%, while the two-year yield surged to 4.37%. In the forex market, the dollar index increased by 0.43%, and the euro dropped by 0.3%.

U.S. Inflation Soars in January, Surpassing Expectations and Impacting Consumer Prices

The latest inflation report shows a much higher-than-expected increase. Headline CPI inflation was expected to remain at 2.9%, and Core CPI was predicted to drop to 3.1%. However, inflation surged, hitting its highest levels in over six months. The headline CPI rose by 0.5% month-over-month, surpassing expectations of a 0.3% increase. This marks the first 0.5% rise since August 2023 and was the largest one-month jump seen so far this year.

U.S. consumers’ 12-month inflation expectations are now at 4.3%, the highest since November 2023. This is a significant jump of 1.7 percentage points over the past three months, the biggest rise since February 2020. The Core CPI also rose by 0.4%, doubling the 0.2% seen in December, which was above the forecast of 0.3%. These changes indicate that inflation is staying stubbornly high.

The data also doesn’t yet reflect the full impact of the newly imposed tariffs on China and other countries. As a result, the 10-year Treasury yield has risen above 4.64%, a jump of 20 basis points from recent lows. This sharp increase in bond yields shows just how hot the inflation data was.

The market now expects only one rate cut this year, likely in October 2025, and no further cuts until December 2026. This suggests that higher rates could persist for years. Additionally, used car and truck prices rose by 2.2% in January, the largest monthly jump since May 2023. Consumers will definitely feel the effects of these price increases.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment