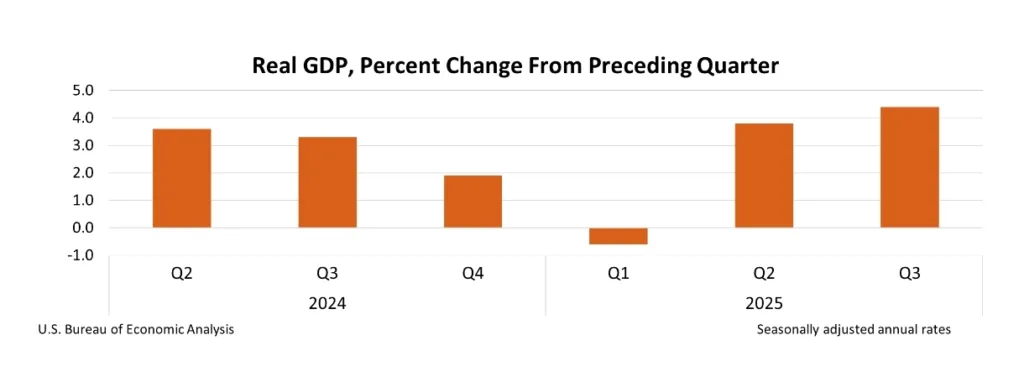

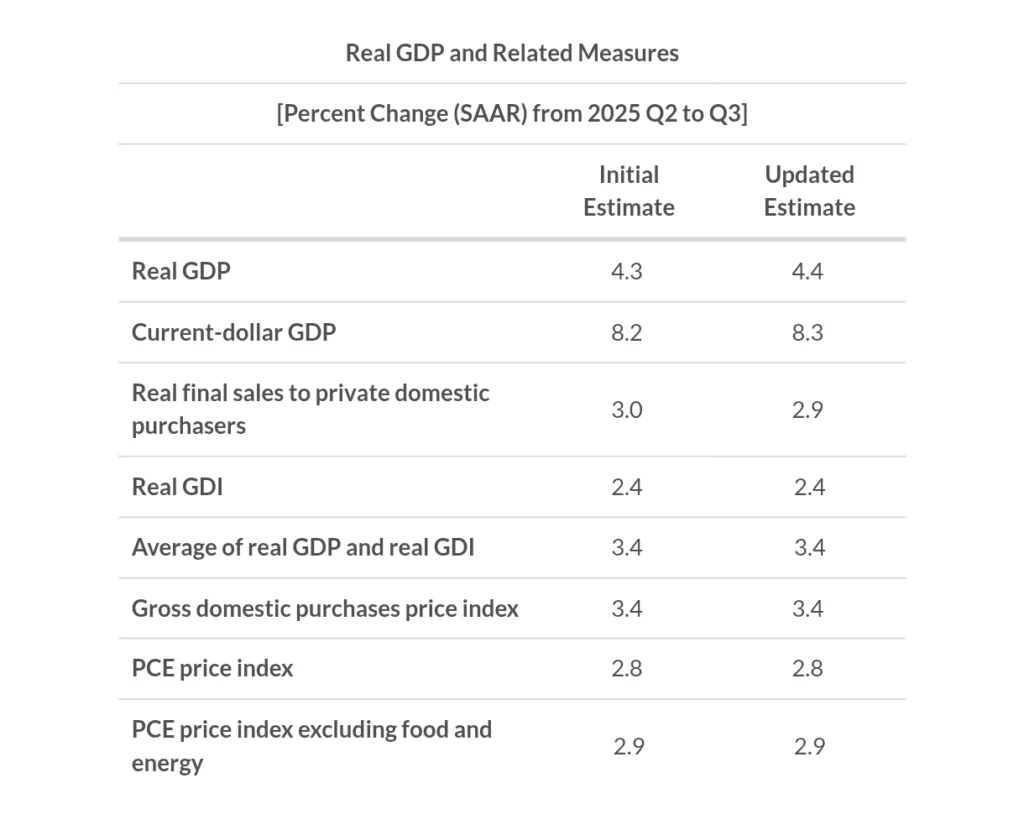

The US economy grew at a strong pace in the third quarter of 2025. According to the updated estimate released by the US Bureau of Economic Analysis (BEA), real Gross Domestic Product (GDP) increased at an annual rate of 4.4%, higher than the 3.8% growth seen in the second quarter.

This updated report replaces the third estimate that was originally scheduled for December 19, 2025, which was delayed due to a government shutdown.

What was the US GDP growth rate in Q3 2025?

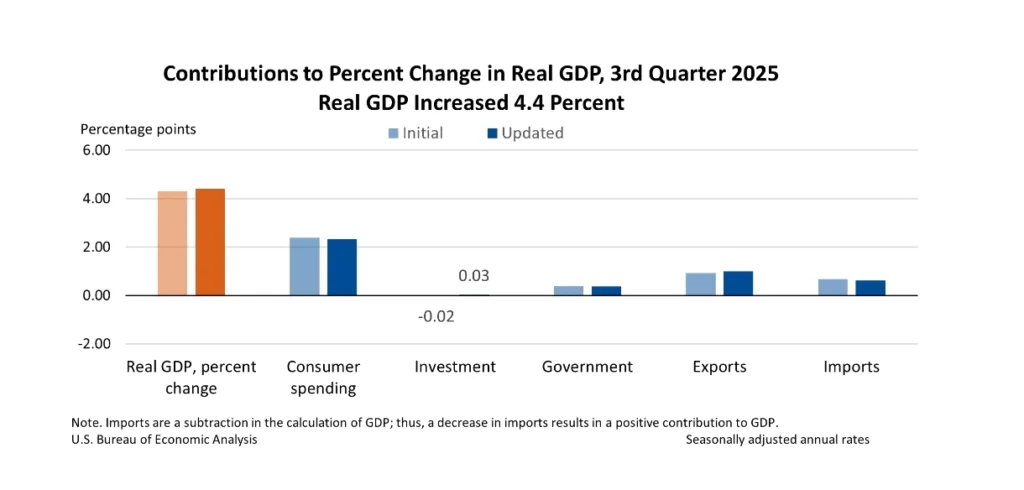

Real GDP grew at an annualized rate of 4.4% in the third quarter of 2025. This was a 0.1 percentage point upward revision from the initial estimate of 4.3%.

The revision mainly came from stronger exports and higher investment, while consumer spending was revised slightly lower.

What drove US economic growth in Q3 2025?

The increase in GDP was supported by multiple parts of the economy.

- Consumer spending increased, though at a slightly slower pace than first estimated

- Exports rose, adding to overall growth

- Business investment improved compared to the previous quarter

- Government spending increased

- Imports declined, which mechanically boosts GDP

Compared to the second quarter, growth accelerated due to a recovery in investment, stronger exports, and higher government spending.

How strong was domestic demand in the US economy?

Real final sales to private domestic purchasers, a key measure of underlying domestic demand, increased by 2.9% in Q3 2025. This measure excludes trade and inventories and focuses on consumer spending and private investment.

This figure was revised down slightly by 0.1 percentage point but still points to steady domestic economic momentum.

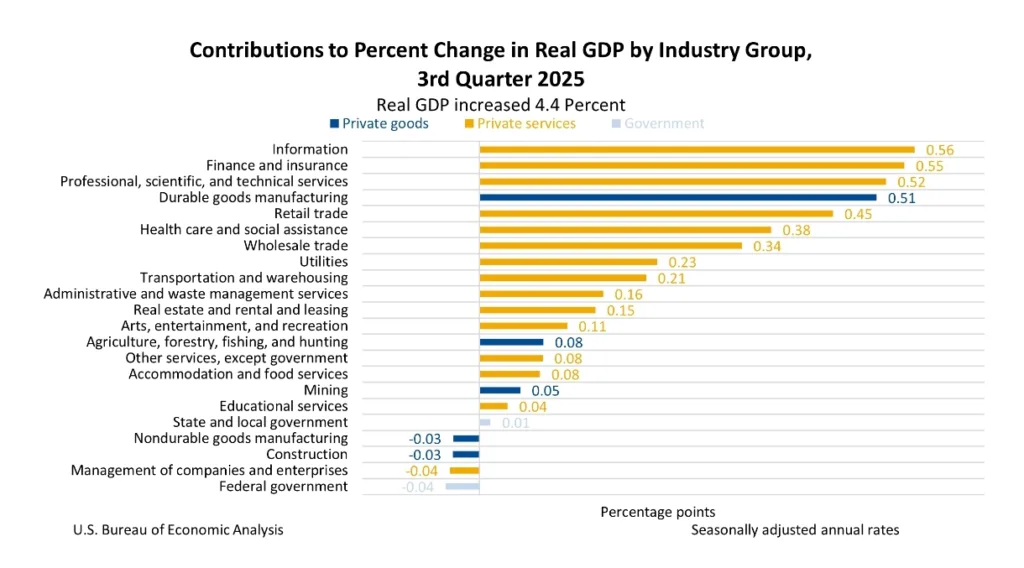

Which industries contributed most to GDP growth?

From an industry perspective, growth was mainly driven by the private sector.

- Private services producing industries grew by 5.3%

- Private goods producing industries grew by 3.6%

- Government value added declined by 0.3%

Overall real gross output increased by 3.2%, led by services and government output, while goods producing industries saw a small decline.

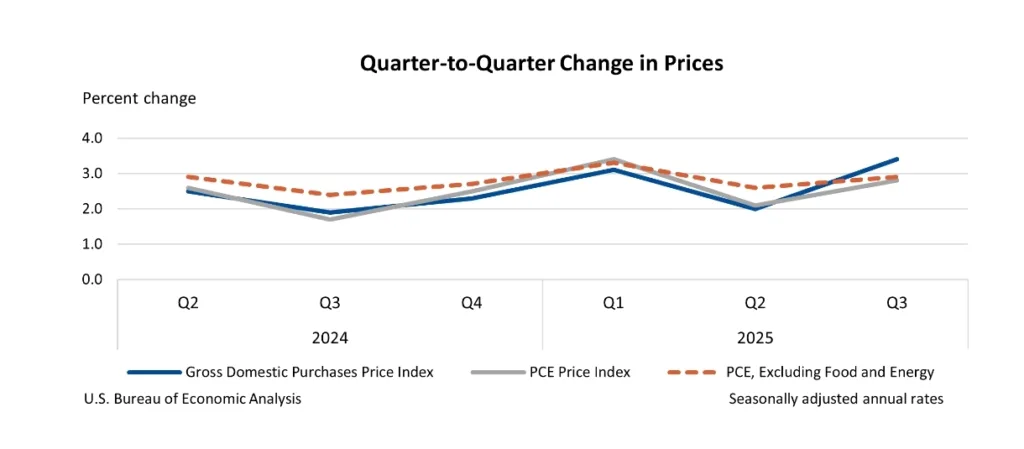

What happened to inflation in Q3 2025?

Inflation measures were unchanged from earlier estimates.

- Gross domestic purchases price index rose 3.4%

- PCE price index increased 2.8%

- Core PCE inflation excluding food and energy rose 2.9%

These figures suggest inflation remained elevated but stable during the quarter.

What does GDI say about income growth?

Real Gross Domestic Income (GDI) increased by 2.4% in the third quarter, unchanged from previous estimates.

The average of real GDP and real GDI, a measure often used to smooth volatility, rose by 3.4%, confirming solid overall economic growth.

How did corporate profits perform in Q3 2025?

Corporate profits from current production increased by $175.6 billion in the third quarter. This was revised up by $9.5 billion, reflecting stronger profitability than initially reported.

Rising profits suggest that businesses continued to benefit from strong demand and pricing power during the quarter.

Summary of key GDP data for Q3 2025

| Indicator | Updated Estimate |

|---|---|

| Real GDP growth | 4.4% |

| Current dollar GDP growth | 8.3% |

| Real final sales to private domestic purchasers | 2.9% |

| Real GDI growth | 2.4% |

| Average of GDP and GDI | 3.4% |

| PCE inflation | 2.8% |

| Core PCE inflation | 2.9% |

When is the next US GDP report?

The next GDP release will be the advance estimate for the fourth quarter of 2025, scheduled for February 20, 2026, at 8:30 a.m. EST.

What does this GDP report mean for the US economy?

The updated Q3 2025 GDP report shows that the US economy entered the second half of the year with strong momentum. Growth was broad based, inflation remained stable, and corporate profits improved.

While consumer spending growth moderated slightly, strength in exports and investment helped offset the slowdown, keeping overall economic expansion robust.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment