United States Federal Reserve has decided to keep the interest rate unchanged at 4.50%, matching both the expected and previous rate.

Federal Reserve has opted to keep its key overnight interest rate unchanged in the 4.25-4.50% range, acknowledging that inflation is still “somewhat elevated” and expressing uncertainty about the economic outlook. The latest statement did not mention progress toward its 2% inflation target, a shift from December’s statement. The unemployment rate remains low, and labor market conditions are solid, replacing previous language that described easing conditions. The Fed emphasized that the risks to achieving its employment and inflation goals are now “roughly in balance.”

Economic activity continues to expand at a steady pace, and the Fed will maintain the pace of its balance sheet runoff. The decision to keep the interest rate steady was unanimously approved by the Federal Reserve.

Federal Reserve stated that inflation “remains somewhat elevated” and that unemployment has “stabilized at a low level.” The latest statement also removed any mention of progress toward the 2% inflation target, indicating that disinflation may have stalled. This suggests that the fight against inflation is still ongoing into 2025. Interest rate futures now suggest that the Fed is likely to pause rate cuts until June 2025. The decision to hold off on cuts seems to have widespread support among Fed officials.

Following the announcement, US Treasury yields rose. The 10-year Treasury yield increased to 4.581%, signaling that traders expect the Fed to wait until June before cutting rates. Additionally, the two-year Treasury yield rose to 4.249%, and the 2/10-year Treasury yield curve showed minimal change at 33 basis points.

Fed Chair Powell’s Press Conference: Key Highlights

Fed Chair Powell stated that the economy has made significant progress toward its goals, with inflation moving much closer to target, though still somewhat elevated. He noted that the labor market is not driving inflationary pressures and emphasized that the Fed is in no rush to adjust policy. The central bank will continue its meeting-by-meeting approach while maintaining its long-term 2% inflation target.

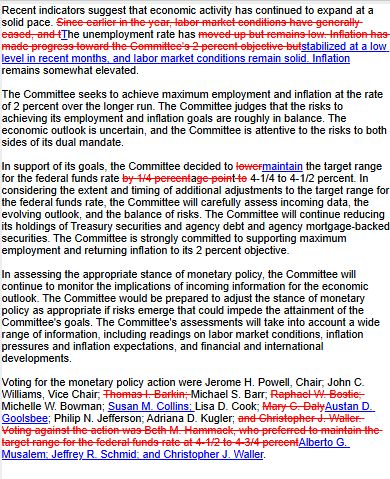

FOMC statement redline

Powell clarified that removing the “inflation” line was simply to shorten the sentence, not a signal that inflation is rising again.

Powell stated In 2024, the U.S. economy grew above 2%, although investment in equipment has slowed. Labor market conditions remain solid, with the unemployment rate staying low and stable. The labor market isn’t a significant source of inflationary pressures, and overall, the market is balanced. Personal consumption expenditures (PCE) rose by 2.6% over the year, while core PCE increased by 2.8%. The Federal Reserve sees risks to its goals as balanced and is being cautious about the potential impact of its policy decisions.

Federal Reserve Chairman Jerome Powell stated that there’s no need to rush into adjusting the policy rate. He explained that reducing policy restrictions too quickly could hinder economic progress, while doing it too slowly could negatively affect employment. Powell emphasized that the Fed is not on a preset course and will adjust its policy stance as necessary to achieve its goals of maintaining stable inflation and supporting employment.

Powell further mentioned that the Fed’s current policy is well-positioned to manage risks and uncertainties in the economy. Discussions regarding the Fed’s policy framework began at this meeting, with a review expected to conclude by late summer. The Federal Reserve remains committed to its 2% inflation target and will focus on its work without getting involved in political commentary. Powell reassured the public that the Fed is carefully assessing its stance, and no significant changes in policy have been made.

Powell acknowledged that forecasts are uncertain, especially due to significant policy shifts, but he expects this uncertainty to pass. Currently, the forecasts for policy are more of a placeholder, with the Fed closely monitoring data to guide its decisions. He feels that both the economy and the current policy are in a very good place, and he expects continued progress on controlling inflation.

Powell emphasized that there’s no rush to make adjustments to the policy right now. The Federal Reserve is reviewing the details of executive orders and working to align its policies with these orders while following applicable laws. The Fed’s staff is also examining a range of possible outcomes based on the potential impact of these policies.

Powell stated that they want to see more progress in controlling inflation and believe it’s possible. Shelter inflation is coming down steadily, and they are hopeful that further improvements will continue, but they still need to see more progress.

He also mentioned that there’s no need for the labor market to cool down any further, as it seems stable and balanced overall. Job creation has slowed down, and with fewer people crossing borders, this could help stabilize the unemployment rate.

Powell emphasized that current policies are having a meaningful effect on the economy and are bringing inflation under control. He stated the policies are meaningfully above the neutral rate and it’s appropriate not to be in a hurry to make further adjustments.

Regarding trade, Powell noted that the footprint of trade has changed and is not as concentrated in China as before. On tariffs, he explicitly stated that the range of possibilities is very wide, but he does not want to speculate about tariffs.

Fed Chair Powell said that banks have plenty of capital, and most households are in good financial shape. He believes the financial system is strong and stable overall. While the job market is good, lower-income households are struggling with high prices.

Powell also mentioned that if layoffs increase, unemployment could rise quickly because companies are not hiring as much. He noted that businesses relying on immigrant labor are finding it harder to hire workers, though this trend hasn’t yet shown up in the data.

Federal Reserve Chair Jerome Powell stated that the Fed’s decision on interest rates was not influenced by any specific framework but was instead driven by the need to control inflation. He emphasized that the central bank’s primary focus remains on stabilizing prices and managing economic conditions.

Regarding cryptocurrency, Powell said that banks are allowed to offer crypto-related services as long as they properly manage the risks involved. However, the regulatory standards for banks dealing with crypto are stricter. He clarified that the Fed does not want to pressure banks into cutting ties with legitimate customers. Powell also mentioned that stronger regulations for the crypto industry would be beneficial.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

One Comment