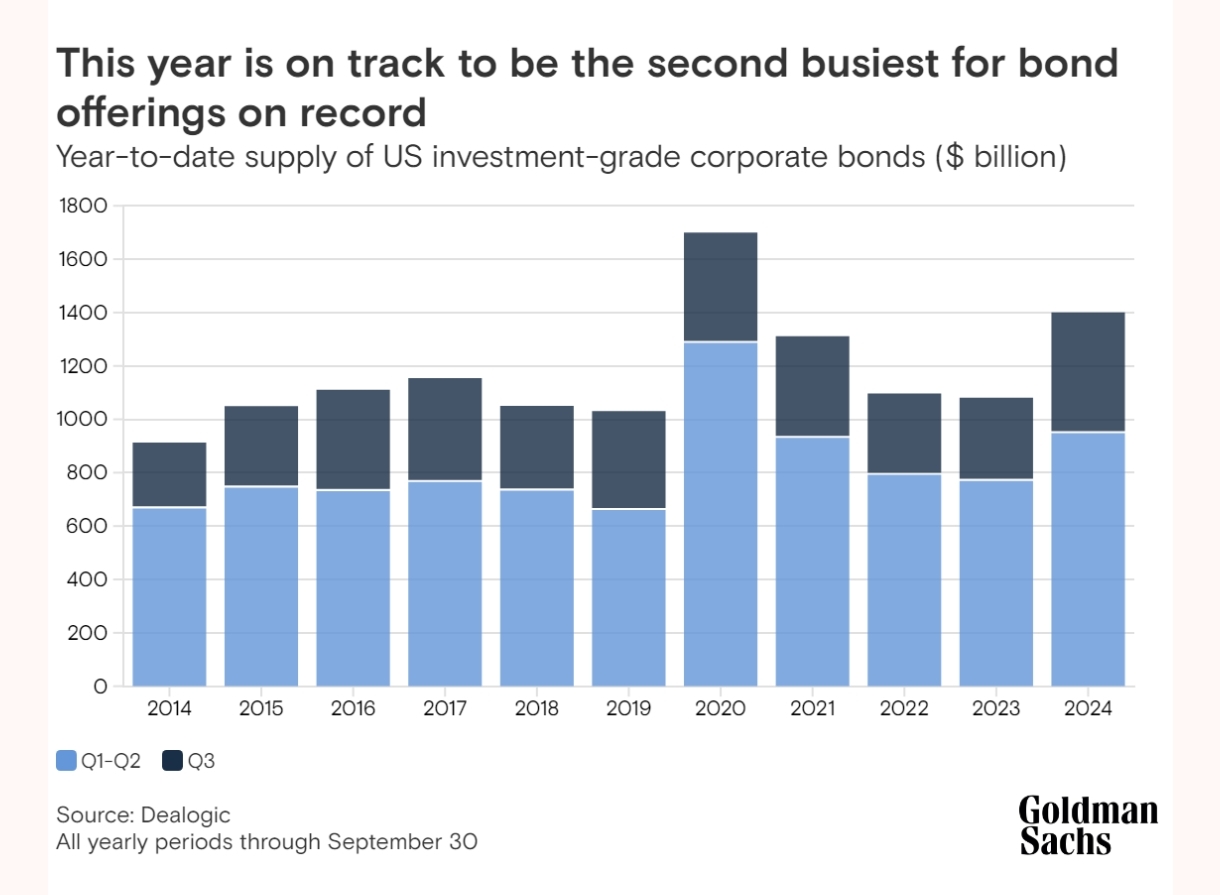

In 2025, companies may issue about $1.5 trillion in US bonds. This year, they’ve already issued over $1.4 trillion, breaking records for four months, making 2024 one of the busiest years for bond sales. John Sales, who works with bonds at Global Banking & Markets, thinks this trend will continue in 2025.

Right now, companies are paying less extra interest on their bonds compared to Treasury bonds, so many are rushing to borrow while rates are good. Bond sales connected to mergers and acquisitions (M&A) are at their highest level since 2019, especially in energy, healthcare, and consumer sectors.

Utility companies have also increased their bond sales by 18% this year to support demand from data centers and electrification projects.

Investors are focusing less on inflation and more on growth in the economy. Goldman Sachs recently reduced the chance of a US recession in the next year to 15%. Sales says the strong economy is one reason companies are issuing so many bonds: “As companies grow, they borrow money to keep expanding.”

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

One Comment