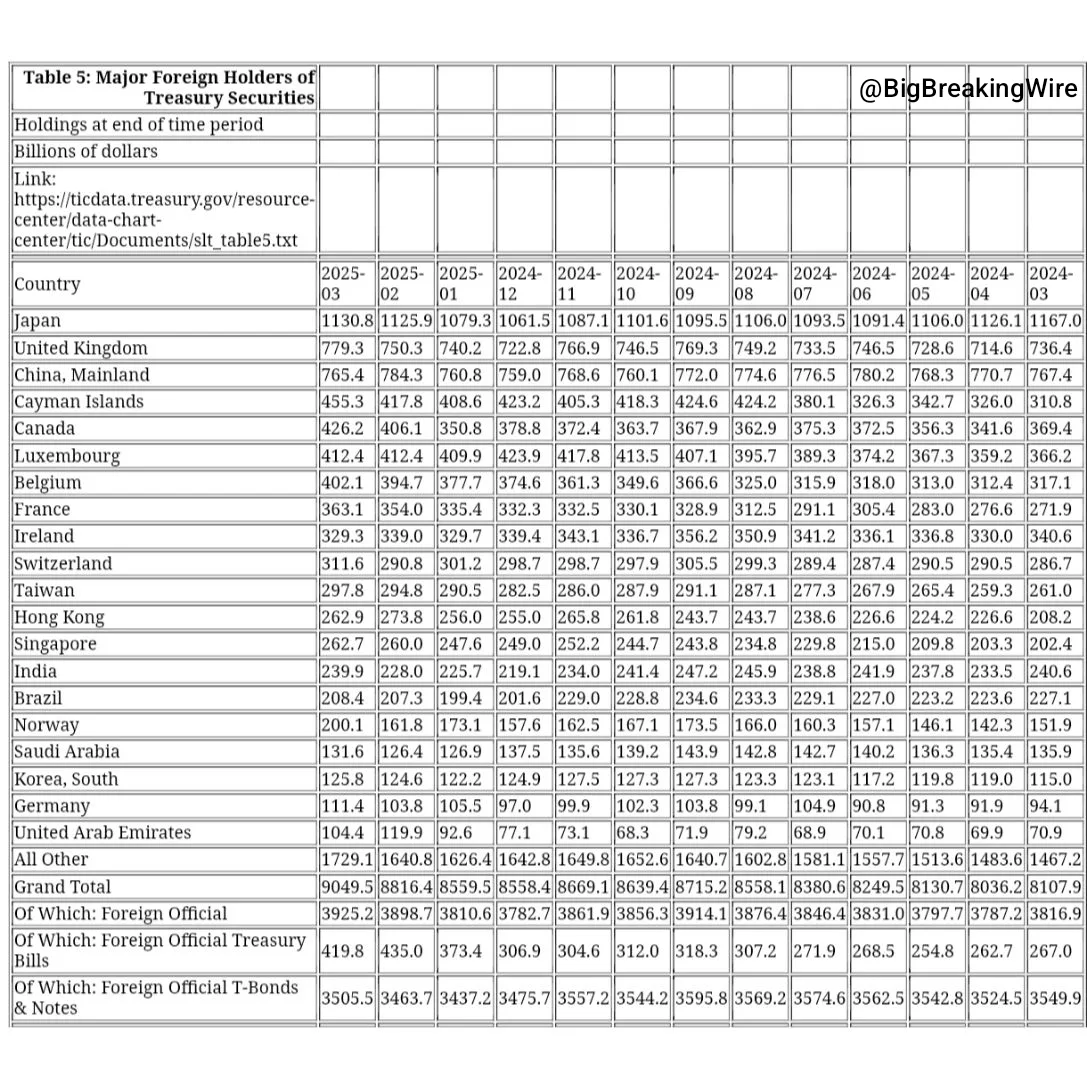

For the first time in more than two decades, the United Kingdom has surpassed China in holding U.S. Treasury securities. According to the latest data from the U.S. Treasury Department, China’s holdings fell to $765.4 billion in March 2025—down nearly $18.9 billion from February. In contrast, the UK increased its holdings by almost $29 billion, reaching $779.3 billion, making it the second-largest foreign holder of U.S. debt.

Earlier this month, the UK and US signed a new trade agreement to cut tariffs on British steel, aluminium, and cars, while allowing more US beef and ethanol into the UK market. Announced by Trump and Starmer, the deal aims to boost exports and deepen global trade ties.

Japan continues to lead globally, holding the largest share of U.S. Treasuries at $1.1308 trillion, reinforcing its long-standing position as America’s biggest creditor.

This change in global capital flows comes amid rising geopolitical tensions and concerns over U.S. fiscal policy. Experts believe this shift highlights changing investor strategies and growing caution over U.S. debt sustainability.

Top Countries Holding U.S. Treasury Securities in March 2025:

Japan: $1.1308 trillion

United Kingdom: $779.3 billion

China: $765.4 billion

Cayman Islands: $455.3 billion

Canada: $426.2 billion

Belgium: $402.1 billion

India: $239.9 billion

Earlier this month, the U.S. and China agreed to a 90-day suspension of the 24% tariffs, resume trade negotiations, and eliminate non-tariff barriers.

India slightly increased its holdings from $228 billion in January to $239.9 billion in March, showing continued interest in U.S. securities. Canada also raised its holdings to $426.2 billion, adding more than $20 billion since January.

Interestingly, Belgium, often viewed as a proxy for Chinese custodial accounts, added $7.4 billion, reaching $402.1 billion.

Despite concerns over U.S. debt levels, global demand for Treasuries remains strong. The total foreign holdings hit a record $9.05 trillion in March 2025. According to the Treasury’s TIC report, net foreign inflows into U.S. securities reached $254.3 billion, led mainly by private investors rather than official institutions.

Conclusion

The UK overtaking China in U.S. Treasury holdings marks a historic shift. With Japan, the UK, and Canada increasing their exposure to U.S. debt, the data suggests that despite rising global tensions and U.S. fiscal challenges, investors still see Treasuries as a safe and attractive asset.

Stay tuned to BigBreakingWire for more global finance updates.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment