For the third time in a row, the U.S. Consumer Price Index (CPI) has exceeded expectations, propelled by surges in gasoline and energy prices, as well as housing costs. These two indices accounted for more than half of the monthly rise. Consequently, market sentiment now leans towards anticipating approximately 50 basis points of rate cuts in 2024, as indicated by Fed Swaps.

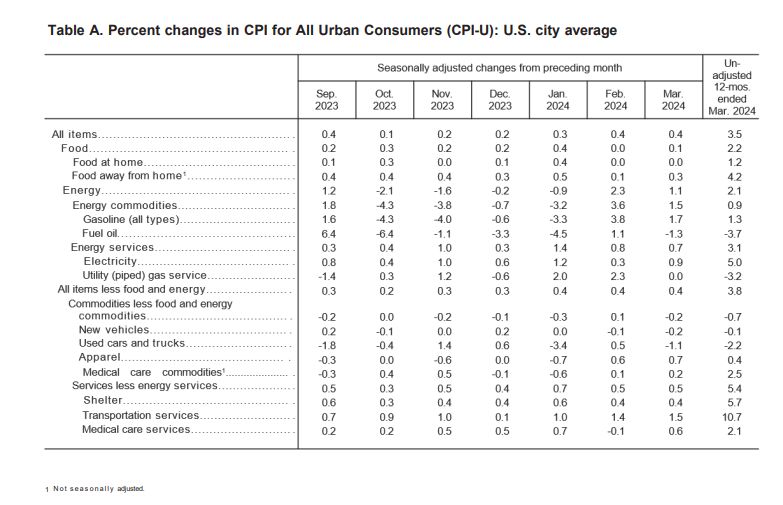

March U.S. inflation figures indicate a year-over-year increase of 3.5% for the Consumer Price Index (CPI), slightly surpassing expectations of 3.4%. On a monthly basis, CPI rose by 0.4%, exceeding the estimated 0.3%. Core CPI, which excludes volatile food and energy prices, saw a year-over-year uptick of 3.8%, in line with expectations, and a monthly increase of 0.4%, surpassing the anticipated 0.3%.

Traders are currently factoring in the likelihood of the initial rate cut occurring in November, shortly following the U.S. Presidential Election. Furthermore, they are now pricing in only two rate cuts, each at 50 basis points, for the year. Previously, the market had priced in three cuts, with the first anticipated in June.

If the first rate cut occurs after the U.S. Presidential Election in November, it would mark the lengthiest interval between the last interest rate hike and the initial cut.

Regional bank stocks are experiencing widespread declines today, in response to the persistent inflationary trends marked by the third consecutive month of hot CPI prints. The prevailing market sentiment suggests that the first Federal Reserve rate cut might occur after the U.S. Presidential Election, with concerns arising that there may be no cuts at all this year. Prolonged periods of higher interest rates are detrimental for regional banks and utilities.

Goldman Sachs has revised its forecast, now anticipating two rate cuts in 2024, with the initial rate reduction expected in July instead of June. Following this adjustment, they project further cuts to occur on a quarterly basis, indicating a total of two cuts for the year, set for July and November.

CEO of JPMorgan Chase has issued a warning regarding the possibility of increasing interest rates within the US economy. Dimon’s forecast, which has sparked worry among both the real estate sector and financial markets, holds substantial consequences for borrowers, investors, and the overall economy.

In a shareholder letter released on April 8, 2024, Dimon conveyed that JPMorgan is well-equipped to navigate various interest rate scenarios, spanning from 2% to 8% or potentially higher. While he acknowledged the potential for optimism regarding lower rates, Dimon also voiced apprehension about the enduring trajectory of inflation and its implications for interest rates in the long run.

Barclays predicts that the Fed will only cut rates once in 2024 following the CPI data. They anticipate rates to be at 4.00%-4.25% by the end of 2025.

Joe Biden says that rate cuts from the Fed might be delayed by a month after today’s inflation numbers. Additionally, he adds that there will be rate cuts before this year ends.

President Biden has called on companies to utilize their record profits by lowering their prices.

Update

GDP growth for the first quarter in the United States, as reported by the Atlanta Fed GDPNow, fell slightly below expectations at 2.4%, compared to the anticipated 2.5%.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment