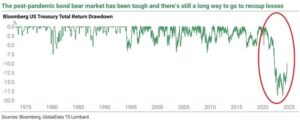

The Treasury market is facing its largest losses in history, with the Bloomberg Treasury total return index down 11.0% from its 2020 peak. This is the steepest decline recorded in over 100 years. The losses have been exacerbated by one of the most aggressive rate hiking cycles by the Federal Reserve, which raised rates by 525 basis points in just 16 months.

For context, the second largest drawdown in the Treasury market occurred in the late 1970s, when losses reached 7.5%. The current situation significantly surpasses that historical event, underscoring the severity of the current market conditions.

Interestingly, the $TLT ETF, which tracks long-term U.S. Treasury bonds, is now up 1% year-to-date, despite an earlier drop of 10%. This slight recovery suggests that while the market has faced substantial losses, there may be some resilience in specific segments.

These historic losses in the Treasury market have raised concerns among investors and market analysts, especially as the Federal Reserve continues to navigate the delicate balance between controlling inflation and maintaining economic stability. The unprecedented scale of the current drawdown highlights the impact of rapid policy changes on financial markets.

Investors are closely watching for any signs of stabilization or further volatility, particularly in light of ongoing economic uncertainties. The situation remains fluid, and the Treasury market’s performance will likely continue to be a key indicator of broader economic trends.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. The performance of the Treasury market and related investments can fluctuate, and past performance is not indicative of future results. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.

—

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment