Global Markets Turn Cautious as Uncertainty Around U.S. Trade Policies Grows

A key index that tracks uncertainty in trade policy has reached an all-time high, sending strong signals of concern across global markets. The increase comes just days before U.S. President Donald Trump is expected to announce a fresh round of trade tariffs. As businesses and investors try to prepare for what’s coming, many are remembering the turbulence of Trump’s earlier trade moves during his presidency from 2016 to 2020.

What Is the Trade Policy Uncertainty Index?

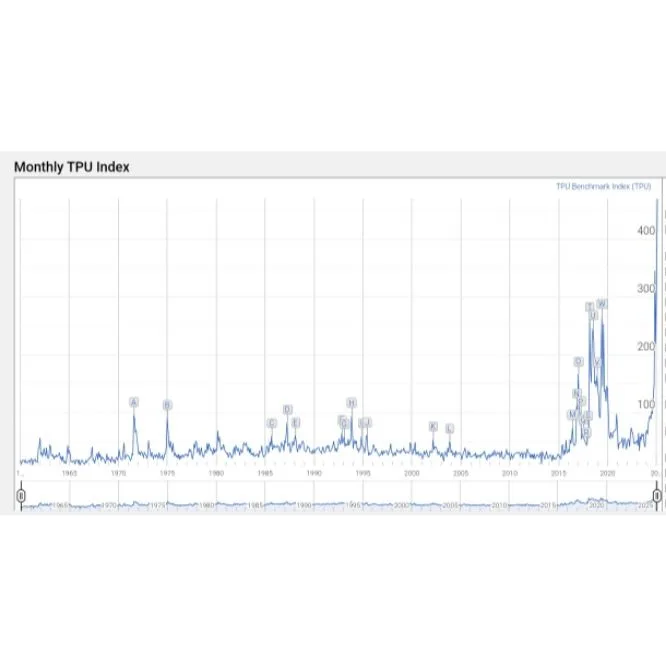

The Trade Policy Uncertainty (TPU) Index is a tool used by economists to measure how unclear or unpredictable a country’s trade policy is at a given time. When the index goes up, it means there is more confusion, doubt, or fear about how future trade policies might affect businesses, trade deals, and global supply chains.

In March, the TPU Index hit its highest level ever recorded, according to its official website. This spike reflects growing concern in the market as Trump has been giving mixed signals about what kinds of trade restrictions or tariffs he may impose if elected again.

Why Is the Index Rising Now?

The increase in the TPU Index can largely be linked to Trump’s recent public statements and media appearances. He has hinted at bringing back large-scale tariffs, especially targeting countries like China and Mexico. At the same time, he has made confusing remarks that suggest he may change or soften his stance — only to double down later. This back-and-forth has made it difficult for companies to plan for the future.

In addition, recent news suggests Trump will reveal new tariff plans on April 2 at 3:00 p.m. ET (7:00 p.m. GMT). This was confirmed by U.S. Treasury Secretary Scott Bessent in a recent interview. As the announcement nears, many companies are bracing for impact.

A Look Back: Trump’s First-Term Trade Wars

During Trump’s first term, from 2016 to 2020, his aggressive trade policies often caused market turmoil. One of the most notable events was the prolonged trade war with China. Starting in 2018, both the U.S. and China raised tariffs on each other’s goods, affecting billions of dollars in trade. Many businesses faced higher costs, and supply chains were badly hit.

The conflict continued for nearly two years before both sides agreed to a Phase One trade deal in 2019. However, many of the deeper issues remained unresolved, and trade tensions between the two countries still linger today.

Now, with Trump likely to run again in the 2024 election, and his campaign putting trade protectionism back in focus, investors are once again facing an uncertain road ahead.

How Does Trade Uncertainty Affect Businesses and the Economy?

Trade uncertainty can have serious effects on the economy. Here’s how:

Investment Slows Down: When companies don’t know what kind of trade rules they will face, they delay big investments in new projects or equipment.

Stock Markets React: Investors tend to move money out of stocks when policies are unclear, which can lead to sharp market drops.

Prices May Rise: If tariffs make it more expensive to import goods, the extra costs often get passed on to consumers.

Global Supply Chains Get Disrupted: Companies that rely on parts from different countries face delays and higher costs, which can affect product availability.

What to Expect Going Forward

With Trump expected to announce his new tariffs soon, all eyes are on how major economies like China and the European Union will respond. If new tariffs are harsh or widespread, there is a risk of renewed trade wars — which could again shake global markets and hurt economic growth.

On the other hand, if the tariffs are targeted or moderate, the market reaction may be more controlled. Much will depend on the details of Trump’s announcement and how other countries choose to reply.

Conclusion

The record-high Trade Policy Uncertainty index is a clear sign that businesses, investors, and even governments are nervous about what lies ahead. As Trump prepares to unveil a new round of tariffs, the global economy may once again face a period of instability. For now, caution remains the dominant mood in markets worldwide.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment