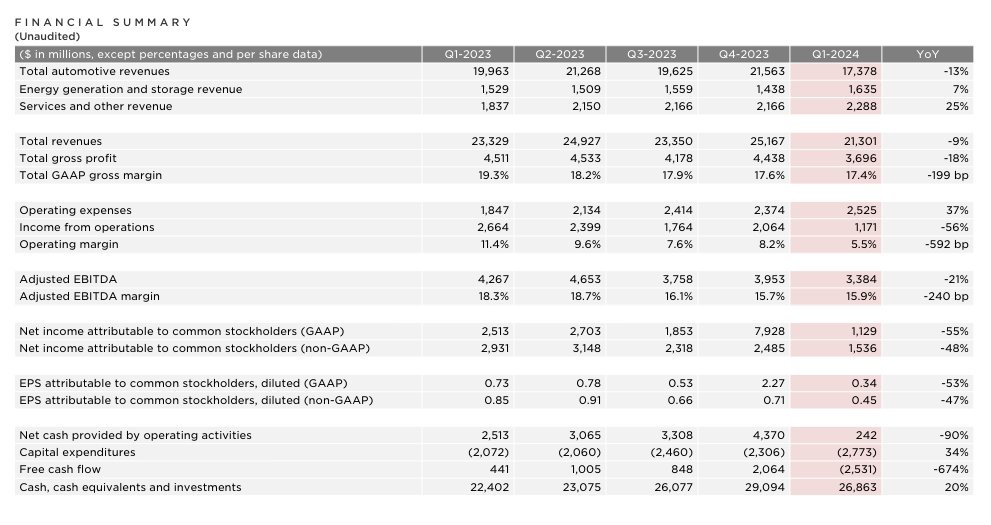

Tesla’s earnings for Q1 2024 show an EPS of $0.45, slightly below the estimated $0.51.

Revenue stood at $21.30 billion, Vs estimated $20.94 billion.

GAAP gross margin was 17.4%.

Operating margin was at 5%, down 6 percentage points from the previous year.

Free cash flow was at -$2.531 billion, significantly lower than the estimated $654 million.

Capital expenditures increased by 34% year-over-year to $2.8 billion.

Tesla, $TSLA, has revised its future vehicle lineup, aiming to expedite the introduction of new models ahead of the previously announced production start in the latter half of 2025.

Tesla states, “Our purpose-built $TSLA Robotaxi product will persist in pursuing an innovative ‘unboxed’ manufacturing approach.”

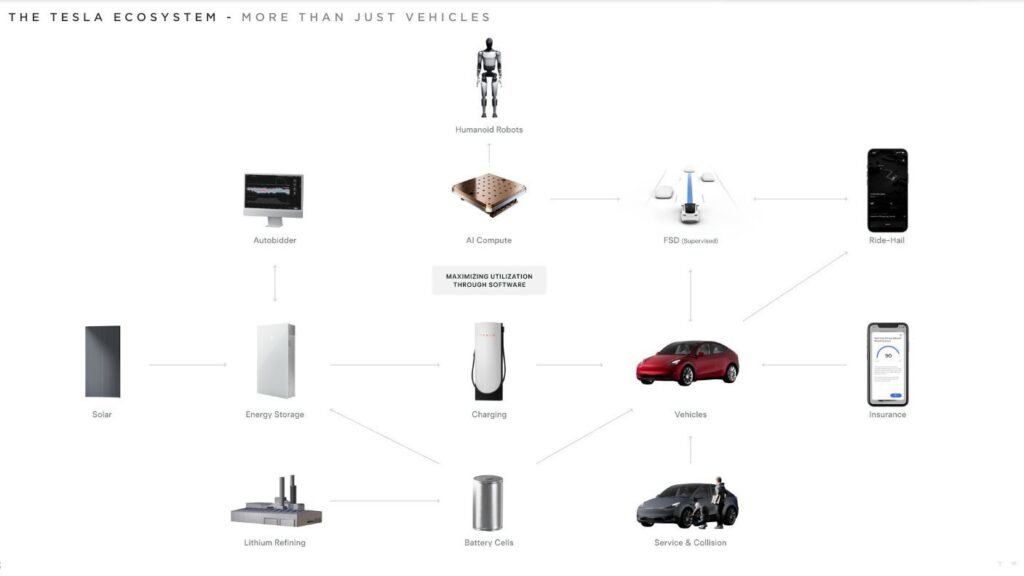

Tesla is managing two significant growth phases: one propelled by the worldwide expansion of the Model 3/Y, and the next anticipated from advancements in autonomy and new offerings on an upcoming vehicle platform.

Moreover, the company foresees a decrease in vehicle volume growth in 2024 as it readies for these debuts. Nevertheless, Tesla projects that its Energy Generation and Storage division will surpass Automotive in growth rates during this timeframe.

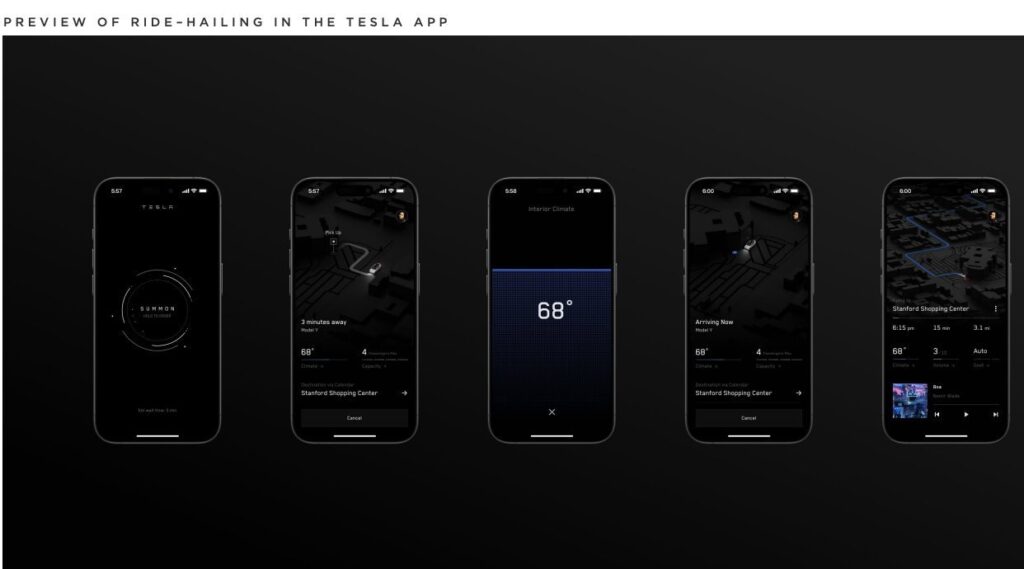

Tesla, has officially announced that it is actively developing ride-hailing functionality for future release.

Additionally, Tesla has achieved a milestone of surpassing 1.25 billion miles with its Full Self-Driving (FSD) technology.

Here’s a preview of what to expect from Tesla’s ride-hailing endeavors.

In Tesla’s Energy Generation and Storage segment:

Revenues experienced a 7% year-over-year increase, while gross profit surged by 140% year-over-year. This growth was propelled by heightened Megapack installations, albeit partially mitigated by a decline in solar deployments.

During the fourth quarter, Tesla deployed 41 megawatts of solar capacity.

Regarding the global electric vehicle (EV) landscape:

Tesla observes ongoing pressure on global EV sales as several automakers prioritize hybrids over EVs.

While this trend benefits Tesla’s regulatory credits business, the company expresses a preference for the industry to continue promoting EV adoption, aligning with its mission.

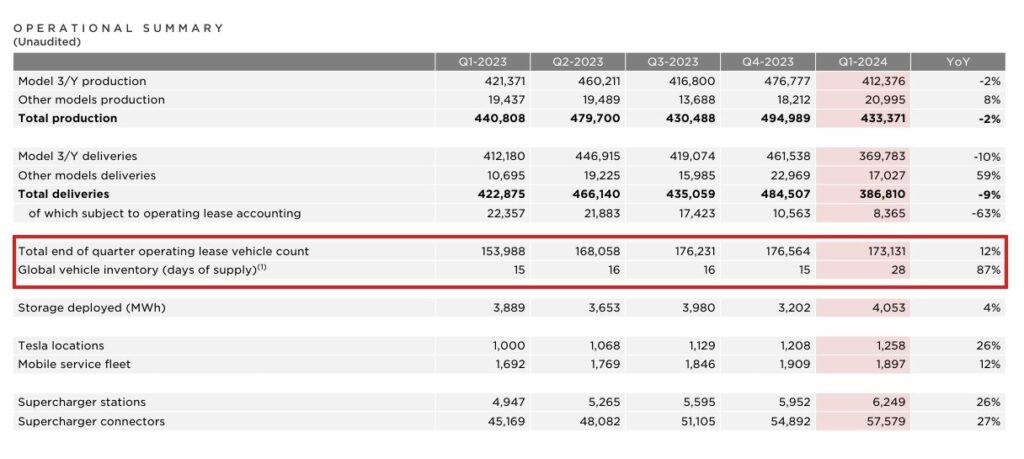

In Q1, Tesla’s global vehicle inventory surged to 28 days, marking a notable increase from the previous quarter’s 15 days.

Elon Musk, CEO of Tesla ($TSLA), announced plans for the company to utilize 85,000 Nvidia ($NVDA) H100 GPUs for AI training by the year’s end, which he described as significant.

He anticipates that “Optimus,” Tesla’s AI system, will commence factory tasks by the end of 2024.

Furthermore, Musk mentioned the possibility of selling Optimus externally by the end of 2025.

He expressed confidence that Optimus would hold greater value than the rest of Tesla’s business combined.

According to Tesla’s Q1 report, the company has retained all of its 9,720 Bitcoin during the first quarter of 2024, extending its streak of holding onto digital assets for seven consecutive quarters. This decision coincides with the surge in Bitcoin’s value in the previous quarter, attributed to the approval of a spot BTC ETF and the expected appreciation after the Bitcoin halving. Despite experiencing a decline in revenue for Q1, Tesla persists in maintaining its significant Bitcoin investment, having previously divested 75% of its holdings in Q2 2022.

Elon Musk at Q1 Call

Elon Musk, CEO of Tesla $TSLA, mentioned during the Q1 call that the launch of new low-cost vehicles is expected either by the end of this year or early next year.

Regarding Tesla’s Full Self-Driving (FSD) version 12, Musk stated that it has been expanded to 1.8 million vehicles, with 50% of those owners having utilized the feature thus far, and the usage rate is increasing. He emphasized the effectiveness of the vision-based self-driving approach and noted that Tesla is no longer limited by computational constraints, allowing for rapid improvement in autonomous driving technology.

Tesla’s Chief Financial Officer (CFO) expressed optimism about the company’s future, stating that the outlook is extremely bright. He also mentioned that free cash flow is expected to return to positive in Q2 as inventory is sold off.

Musk hinted at the possibility of incorporating an Amazon Web Services (AWS)-like element into Tesla’s business model, utilizing vehicles’ onboard computers for inference tasks.

When asked about his involvement in Tesla, Musk assured that he is committed to ensuring the company’s prosperity and indicated that Tesla constitutes the majority of his work time.

Musk reiterated his confidence in Tesla’s autonomy capabilities, stating that even in the event of his absence, the company would continue to advance in solving autonomy challenges.

Musk expressed optimism about Tesla’s sales performance, stating that he believes the company will achieve higher sales this year compared to the previous year. Q1 call that the launch of new low-cost vehicles is expected either by the end of this year or early next year.

Regarding FSD licensing, Musk suggested that Tesla may sign licensing deals for its Full Self-Driving technology within the year, although it may take around three years before vehicles equipped with this technology are commercially available.

Musk addressed concerns about his control over Tesla, stating that even if he were absent, the company would continue to advance in autonomy. However, he expressed discomfort with the idea of not having a significant influence on how autonomy technology is deployed, particularly if it involves sentient robots.

Musk projected that Q2 would be significantly better for Tesla.

Musk argued that Tesla should be valued as an AI robotics company rather than just an automotive company.

Musk acknowledged that Tesla’s sales process had become overly complex but stated that the company is streamlining it to allow customers to purchase a Tesla in under a minute.

Regarding Tesla’s 4680 battery cells, Musk stated that while they are expected to exceed the competitiveness of suppliers by the end of the year, he believes they are not critical for the near term.

Elon Musk revealed that Tesla intends to utilize 85,000 NVIDIA H100 GPUs to train AI by the end of the year.

Update:

Tesla cuts price of Model 3, Model Y in Japan by 300,000 yen.

Recently, Tesla China reduces prices for Model 3, Model Y, Model S, and Model X by 14,000 yuan ($1,971), following a $2,000 decrease in U.S. models, excluding Model 3.

Today, Tesla China unveiled a new policy offering zero down-payment along with preferential interest rates for certain Model 3 and Model Y vehicles.

China’s People’s Bank of China (PBOC) and the National Financial Regulatory Authority (NFRA) have eased loan ratios for vehicle purchases in a bid to stimulate consumption. Financial institutions will now have the autonomy to set the maximum disbursement ratio for loans used to purchase new energy or traditional fuel vehicles for personal use.

Update

Tesla short sellers are facing potential paper losses totaling $1.62 billion since Tuesday’s closing, based on the premarket price of $159.78, according to Ortex.

Update

Elon Musk’s xAI is in the process of raising $6 billion, potentially valuing it at over $18 billion. The deal is anticipated to be finalized within the next two weeks.

GrokAI, presently undergoing training, utilizes 20,000 Nvidia H100 GPUs. Its next version, Grok 3.0, will necessitate 100,000 GPUs for training.

Source: The Information

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment