U.S. mortgage applications have decreased by 17.0% over the last week, marking the steepest decline since April 2020. This shows a sharp slowdown in home buying activity, driven by rising borrowing costs.

At the same time, the refinancing index fell by 26.3%, recording the biggest weekly decline since March 2020. Fewer homeowners are choosing to refinance their existing mortgages due to the increase in interest rates.

Mortgage rates have increased for the third straight week, with the 30-year fixed-rate mortgage reaching 6.52%. This is the highest rate since August, making home loans more expensive and discouraging potential buyers.

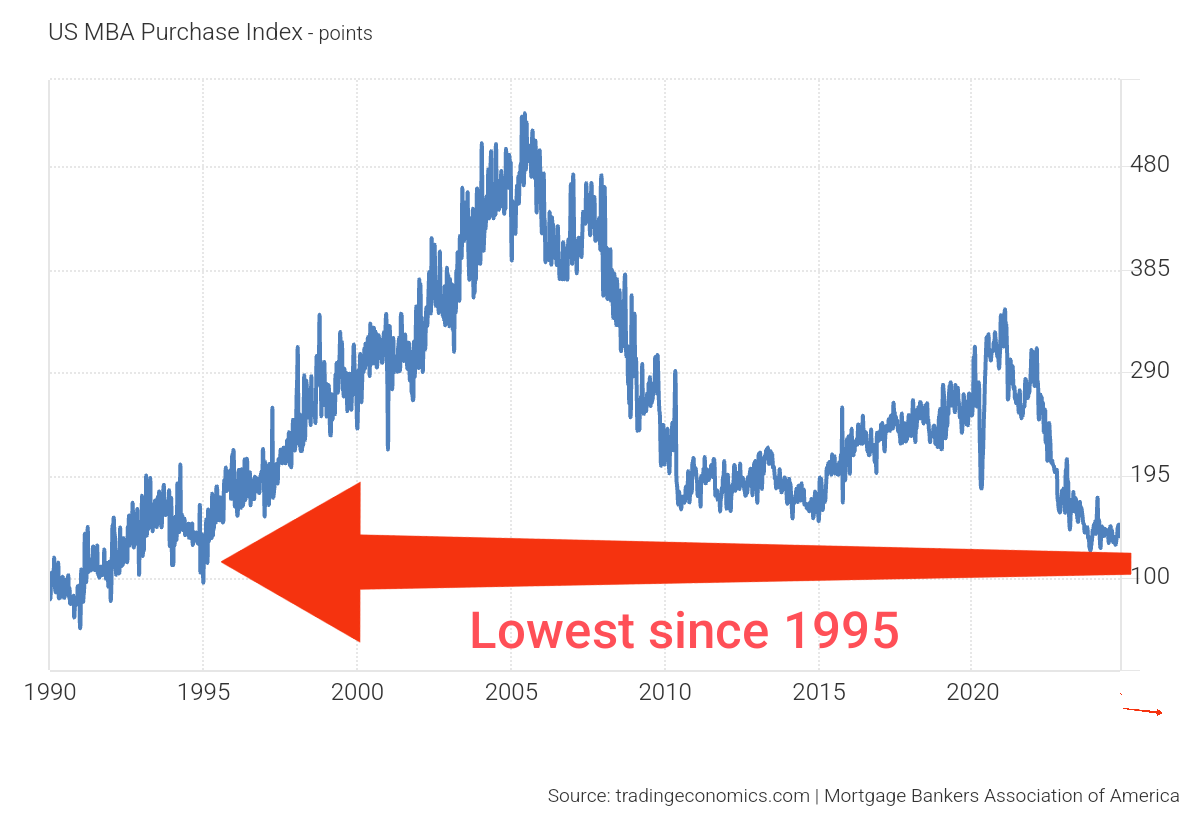

Mortgage purchase applications in September 2024 were at their lowest for the month since 1995. High rates and elevated home prices are deterring buyers, leading to weaker housing demand.

The overall mortgage demand index has fallen by roughly 60% since it peaked in January 2021. Currently, it is at its lowest point in almost 30 years, reflecting a prolonged decline in homebuyer interest due to rising costs.

Mortgage demand continues to drop sharply as high interest rates make buying or refinancing homes unaffordable for many Americans.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment