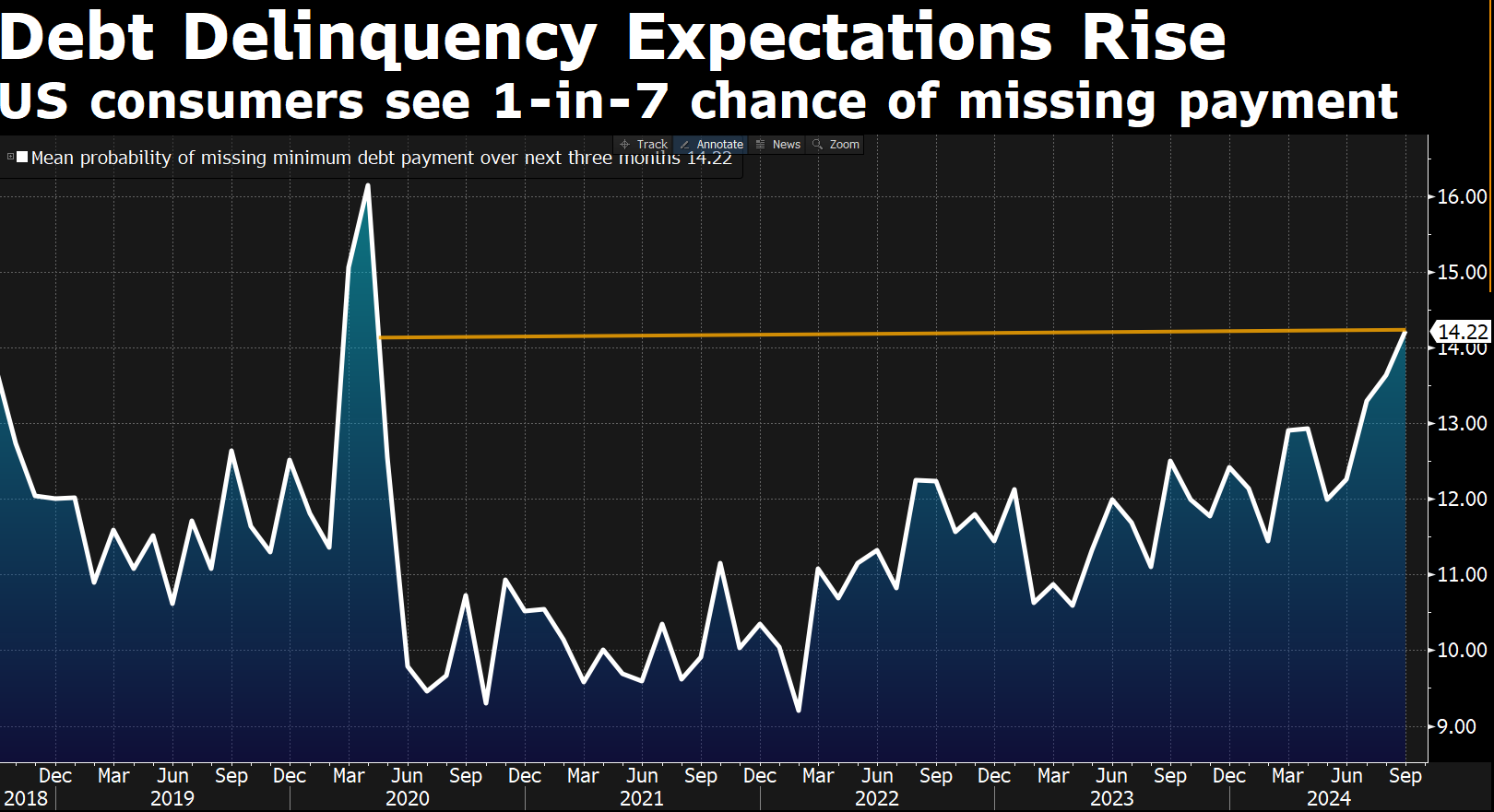

The Federal Reserve Bank of New York recently released its September 2024 survey, revealing that 1 in 7 American consumers expect to miss a debt payment within the next three months. This expectation for debt delinquency has risen to 14.2%, marking the fourth consecutive monthly increase. This level of delinquency is the highest recorded outside of the pandemic since January 2017.

The survey found that American consumers are more concerned about the risk of not being able to meet their debt obligations, with the average probability of missing a minimum debt payment climbing for the fourth month in a row. In September, this probability reached 14.2%, the highest since April 2020, when it was 16.1%.

While consumers’ short-term inflation expectations remained stable at 3%, longer-term expectations increased slightly. For the three-year outlook, inflation expectations rose from 2.5% to 2.7%, and for the five-year horizon, they went up from 2.8% to 2.9%.

In terms of employment, the likelihood of losing a job in the next year remained steady, but the probability of voluntarily leaving a job increased from 19.1% in August to 20.4% in September, the highest level since July. Meanwhile, expectations for the unemployment rate one year from now were slightly lower, with respondents estimating a 36.2% chance of an increase, just above February’s 36.1%.

Markets are currently anticipating a 25-basis-point rate cut by the Fed at its next meeting, which would lower the benchmark interest rate to a range of 4.5% to 4.75%. According to the CME FedWatch tool, there is a 94.1% probability of this rate cut next month, compared to a 5.9% chance that rates will remain unchanged.

Recent economic data, including consumer price index (CPI) figures and a stronger-than-expected jobs report for September, have tempered market expectations for more aggressive rate cuts at the Fed’s November meeting. Just a month ago, traders believed there was a 27% chance of rates being lowered by an additional 50 basis points in November, bringing the range down to 4.25% to 4.5%.

The Labor Department reported that the CPI, a key measure of inflation, slowed to 2.4% in September, moving closer to the Fed’s target of 2%. Although inflation has cooled gradually since peaking at a 40-year high of 9.1% in June 2022, it still exceeded economists’ expectations.

The Federal Reserve’s next policy meeting is scheduled for November 6-7, just after Election Day.

Inputs from Reuters

NY Fed’s latest survey shows a record high of 4.4% of people fearing unemployment in the next 4 months, up from 2.8% in March 2024.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment