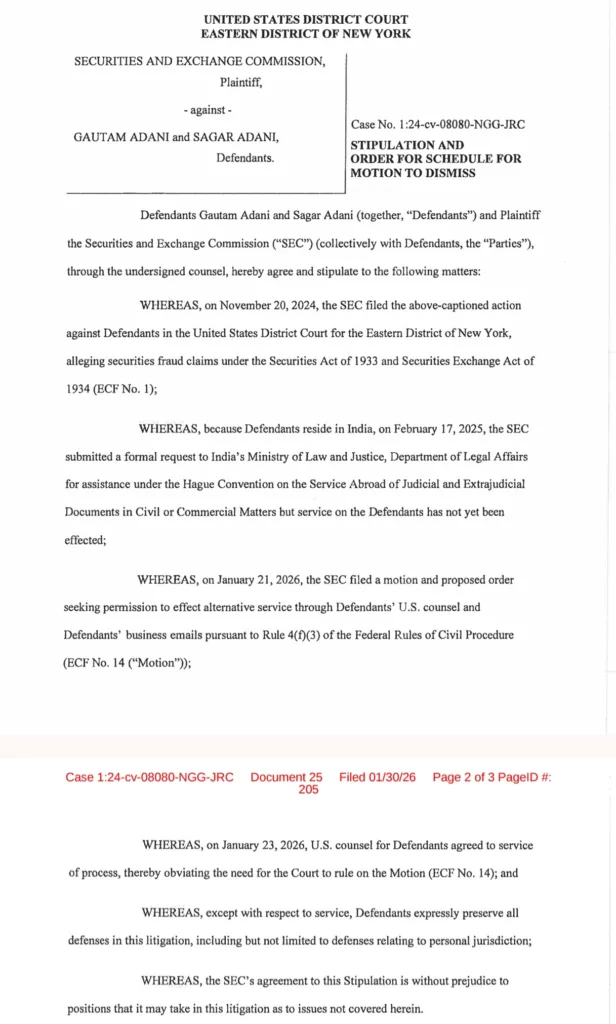

A US federal court has officially set the legal timeline in the securities fraud lawsuit filed by the US Securities and Exchange Commission against Gautam Adani and Sagar Adani. The latest filing does not decide the case but moves it into the next critical legal phase.

What happened in the Adani SEC case?

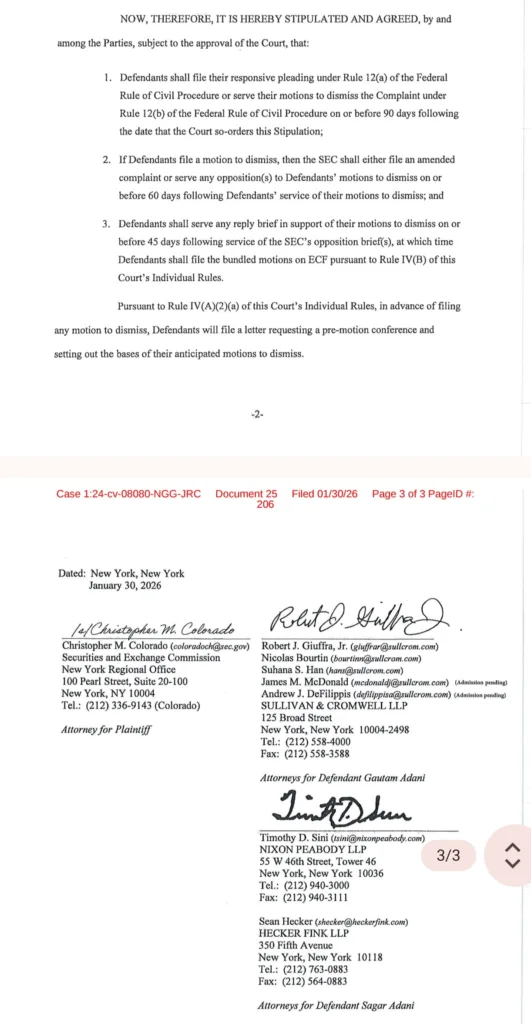

The SEC and lawyers for the Adani defendants submitted a joint agreement to the court that outlines how the case will proceed. This agreement mainly focuses on the schedule for a possible motion to dismiss, which is a legal request asking the judge to throw out the case before it goes to trial.

Why is this update important?

This step is important because it shows the case is now moving from procedural issues into legal arguments. Instead of debating service of documents or technical matters, both sides will now argue whether the lawsuit should continue at all.

What is a motion to dismiss?

A motion to dismiss is a formal request made by the defendants asking the court to end the case early. The defense usually argues that the complaint does not legally hold up, that the court does not have authority, or that the claims are insufficient under the law.

What timeline did the court set?

- The defendants have 90 days to either file a response to the complaint or submit a motion to dismiss.

- If a motion to dismiss is filed, the SEC gets 60 days to respond or update its complaint.

- The defense then gets 45 days to reply to the SEC’s response.

Did the defendants accept the lawsuit?

No. While their US lawyers agreed to accept official legal service, the defendants clearly stated they are not giving up any defenses. This includes arguments about whether the US court even has jurisdiction over them.

Does this mean Adani is guilty?

No. This document does not address guilt or innocence. It only sets the schedule for legal arguments. The case is still in an early stage, and no court decision has been made on the actual allegations.

What could happen next?

If the judge grants the motion to dismiss, the case could end or parts of it could be removed. If the motion is rejected, the lawsuit will move forward into evidence gathering, witness testimony, and possibly trial.

What does this mean for Adani stocks ?

Legal uncertainty remains. Court timelines like this often create periods of waiting where investors watch closely but receive no immediate verdict. Market reaction will depend on future court rulings, not this procedural update alone.

Key takeaway

The SEC lawsuit against Gautam Adani and Sagar Adani has entered a structured legal phase. The focus now shifts to whether the defense can convince the court to dismiss the case before it proceeds further.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment