Indian market regulator SEBI has issued a warning letter to IIFL Capital Services over concerns related to due diligence in debt securities. The company confirmed this in a regulatory filing, stating that SEBI sent the warning last week.

SEBI’s Concerns and Inspection Findings

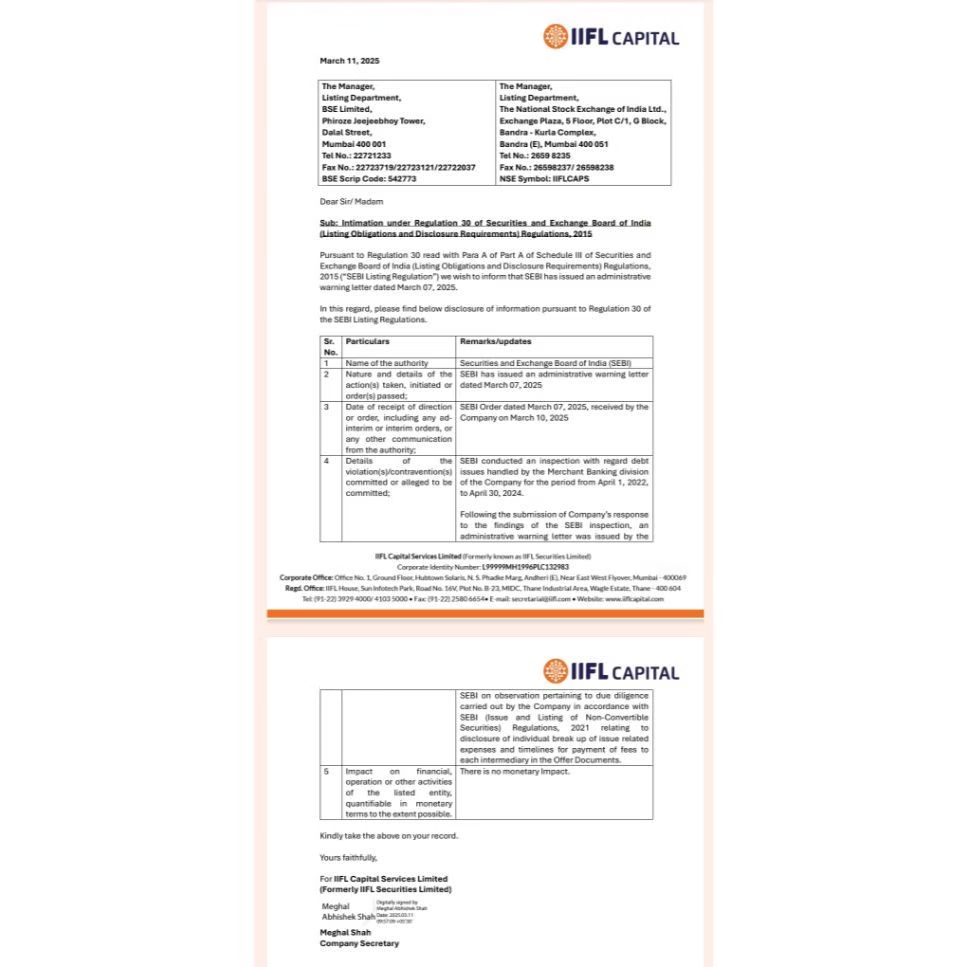

SEBI conducted an inspection of IIFL Capital’s merchant banking division, reviewing debt issuances managed by the company from April 1, 2022, to April 30, 2024. During this review, SEBI found discrepancies in how issue-related expenses and payment timelines for intermediaries were disclosed in offer documents. After considering IIFL Capital’s response, SEBI issued an administrative warning letter highlighting these concerns.

Market Reaction and Company’s Response

Despite SEBI’s warning, IIFL Capital’s stock price remained strong, rising 2.2% to ₹208.99. The company has stated that the warning will not significantly impact its business operations.

SEBI has taken strict action against other financial firms in the past for regulatory violations. Previously, Axis Capital and JM Financial faced bans on their debt merchant banking businesses due to non-compliance with SEBI regulations.

About IIFL Capital

IIFL Capital Services, previously known as India Infoline Limited, is a leading retail and institutional broking firm in India. It provides a wide range of financial services, making it one of the largest independent players in the market.

While SEBI’s warning highlights compliance issues, IIFL Capital remains confident that its business operations will continue as usual.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment