The Securities and Exchange Board of India (SEBI) has temporarily stopped Pacheli Industrial Finance Ltd. (PIFL) and six other companies from accessing the securities market. This action follows concerns that PIFL’s stock price was artificially manipulated.

According to PIFL’s annual report, the company provides consultancy services for hotels, lodging, and other businesses. The six other entities involved were recipients of a preferential allotment of shares, which is currently being investigated by SEBI. These companies, along with PIFL, are under scrutiny for their role in what SEBI believes could be a “pump-and-dump” operation.

Explosive Stock Price Increase Raises Red Flags

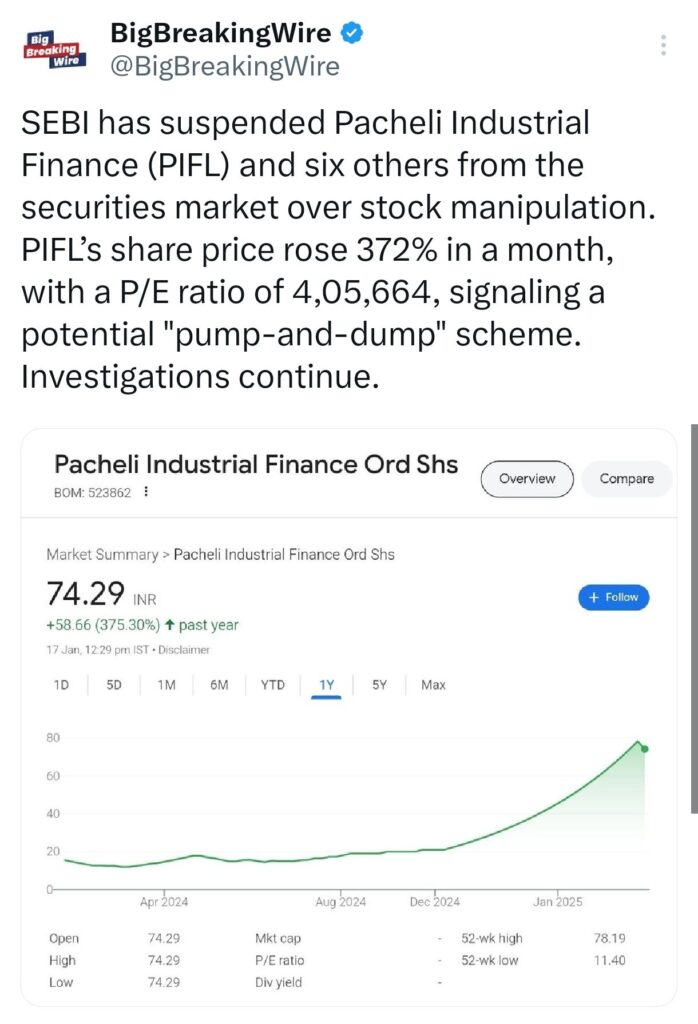

Between December 2, 2024, and January 16, 2025, the price of PIFL’s shares increased dramatically, going from ₹21 to ₹78. This represents a massive 380% increase in just over a month. SEBI raised concerns as this sudden price surge seemed suspicious, especially since the price-to-earnings (P/E) ratio of PIFL’s stock shot up to an extraordinary level of 4,05,664 by January 16, 2025.

A P/E ratio is a common metric used to evaluate a company’s stock price relative to its earnings, and such a high ratio is generally considered a warning sign of potential stock manipulation or an overvalued stock.

SEBI’s Interim Order and Further Investigation

In its interim order, SEBI pointed out that there were signs of a “pump-and-dump” scheme involving PIFL’s stock. This type of scheme involves artificially inflating the stock price before selling it off at a profit, leaving other investors with worthless shares. SEBI believes that PIFL’s management could be behind the scheme and that the stock price surge was planned.

Ashwani Bhatia, a member of SEBI, remarked that the actions of the company’s management suggested a deliberate effort to mislead investors and create an illusion of financial success. He also noted that PIFL’s statutory auditor, GSA and Associates LLP, might have been working with the management to carry out these actions. The role of the auditor is now under investigation by SEBI.

Conclusion and Next Steps

SEBI has ordered the suspension of PIFL and six other entities from participating in the securities market until further notice. The investigation into the stock price manipulation and the role of the auditor will continue, with further actions to be determined based on the findings. Investors are advised to stay informed about the situation as it develops, and to be cautious when dealing with stocks that show signs of unusual price movements.

This move by SEBI highlights its ongoing efforts to ensure fair practices in the Indian securities market and protect investors from potential fraud or manipulation.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment