Hindenburg Research: Whistleblower Documents Expose SEBI Chairperson’s Investment in Lesser-Known Offshore Entities Connected to Adani Money Laundering Scandal

Background

18 Months of Inaction:

It has been nearly 18 months since Hindenburg report on the Adani Group exposed what we described as “the largest con in corporate history,” revealing a complex network of offshore shell entities, primarily based in Mauritius, used for billions in undisclosed transactions and stock manipulation. Despite this, over 40 independent media investigations that supported and expanded on our findings, the Indian securities regulator, SEBI, has not taken significant public action against Adani. Reports suggest that SEBI may impose only minor technical violations despite the severity of the issues.

SEBI’s Response:

On June 27, 2024, SEBI issued a ‘show cause’ notice to Hindenburg, not addressing any factual inaccuracies in our detailed 106-page analysis but criticizing the adequacy of our disclosure regarding our short position.

SEBI claimed our report was “reckless” for quoting a banned broker who alleged SEBI’s awareness of and involvement in Adani’s offshore schemes.

Hindenburg Reaction:

In our July 2024 response, we questioned SEBI’s lack of genuine interest in pursuing the parties behind the offshore shell network involved in undisclosed transactions and stock manipulation.

The Indian Supreme Court noted SEBI’s ineffective investigation of these shareholders, and Adani CFO Jugeshinder Singh dismissed the regulator’s notices as “trivial,” suggesting a lack of concern about their potential impact.

Our original Adani report revealed allegations from the Directorate of Revenue Intelligence (DRI) that Adani grossly overvalued power equipment imports to siphon and launder money. Adani Watch’s December 2023 investigation showed that offshore entities controlled by Vinod Adani received funds from this over-invoicing scheme.

One such entity, GDOF in Bermuda, invested in the IPE Plus Fund 1 in Mauritius. The IPE Plus Fund, with only $38.43 million in assets as of December 2017, had significant ties to Adani. By March 2017, Vinod Adani’s company, ATIL, had $40.38 million with GDOF. Additionally, Anil Ahuja, founder and CIO of IPE Plus Fund, was also a former director at Adani Enterprises and Adani Power.

Hindenburg discovered that SEBI Chairperson Madhabi Buch and her husband, Dhaval Buch, had undisclosed stakes in the same obscure Bermuda and Mauritius funds used by Vinod Adani. They first opened an account with IPE Plus Fund 1 on June 5, 2015, in Singapore. A declaration from IIFL states their investment source as “salary” and estimates their net worth at $10 million.

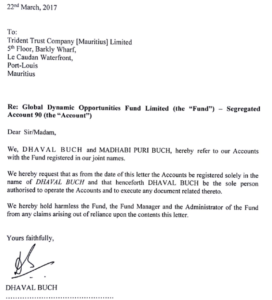

On March 22, 2017, just weeks before her politically sensitive SEBI appointment, Dhaval Buch, husband of SEBI Chairperson Madhabi Buch, sent an email to Mauritius fund administrator Trident Trust regarding their investment in the Global Dynamic Opportunities Fund (GDOF). He requested to be the sole authorized operator of the accounts, seemingly to transfer assets out of his wife’s name before her appointment.

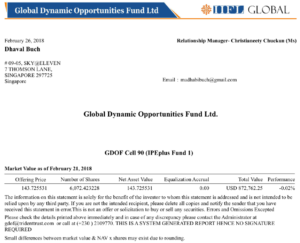

A subsequent account statement from February 26, 2018, sent to Madhabi Buch’s private email, detailed their investment in “GDOF Cell 90 (IPE Plus Fund 1),” the same Mauritius-registered fund involved in the Adani scandal. At the time, their stake was valued at $872,762.25.

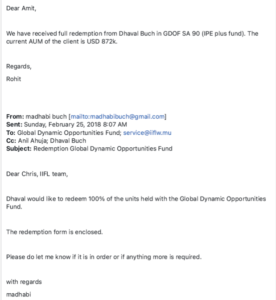

On February 25, 2018, during Madhabi Buch’s tenure as a Whole-Time Member of SEBI, she used her private Gmail account to redeem units in the fund through her husband’s name. Despite overseeing the Indian mutual fund industry, which has many reputable onshore products, documents show that the Buchs had investments in a complex offshore fund structure with minimal assets, spanning high-risk jurisdictions and linked to entities associated with the Wirecard scandal and Vinod Adani’s alleged money siphoning scheme.

SEBI’s reluctance to act against questionable offshore shareholders in the Adani Group might be linked to Chairperson Madhabi Buch’s involvement with the same funds used by Vinod Adani, Gautam Adani’s brother. To date, SEBI has not taken action against other suspect Adani shareholders managed by India Infoline, including the EM Resurgent Fund and Emerging India Focus Funds, says Hindenburg.

In our original report, we highlighted two Mauritius-based funds, EM Resurgent Fund and Emerging India Focus Funds, which were linked to India Infoline (now 360 One) and managed by its staff. We observed that these funds’ trading patterns might have artificially boosted the volume or price of some Adani stocks.

The Financial Times supported our concerns with its own investigation, revealing a “secret paper trail” at these funds. This raised questions about whether Adani used business associates to bypass rules meant to prevent share price manipulation.: Hindenburg

From April 2017 to March 2022, Madhabi Buch, while serving as a whole-time member and later Chairperson of SEBI, held a 100% stake in Agora Partners Pte Ltd, a Singaporean consulting firm. Agora Partners was registered in Singapore on March 27, 2013, and was listed as a “business and management consultancy” per Singaporean director searches. In the company’s 2014 annual return, Buch was disclosed as the sole shareholder.

On March 1, 2022, Buch became the Chairperson of SEBI. Just two weeks later, on March 16, 2022, she transferred her shares in Agora Partners to her husband, Dhaval Buch. This transfer was likely done to avoid potential conflicts of interest, given the sensitive nature of her role at SEBI.

Agora Partners is exempt from disclosing its financial statements, making it difficult to assess its revenue and business activities. This lack of transparency raises concerns, particularly in light of evidence showing Buch conducting business through private email linked to offshore fund entities.

During Madhabi Buch’s tenure as a SEBI whole-time member, her husband, Dhaval Buch, was appointed as a Senior Advisor at Blackstone in July 2019.

According to his LinkedIn profile, Dhaval Buch had no prior experience in funds, real estate, or capital markets, having spent most of his career at Unilever, where he became Chief Procurement Officer.

Despite his lack of experience in these areas, he joined the global private equity firm Blackstone, a major investor in India.

Blackstone, a major investor and sponsor of REITs in India, backed several key REITs during Dhaval Buch’s tenure as Senior Advisor, while his wife was a SEBI official.

Blackstone sponsored India’s first REIT, Embassy, which IPO’ed on April 1, 2019, just before Dhaval Buch joined the firm in July 2019. Later, in August 2020, Blackstone-sponsored Mindspace REIT became India’s second REIT to IPO.

Most recently, in May 2023, Blackstone backed Nexus Select Trust, India’s fourth publicly traded REIT. Blackstone remains a significant player in India’s real estate sector.

During Dhaval Buch’s tenure as Advisor to Blackstone, SEBI proposed, approved, and facilitated significant changes in REIT regulations. This included 7 consultation papers, 3 consolidated updates, 2 new regulatory frameworks, and nomination rights for units, favoring private equity firms like Blackstone.

Since Madhabi Buch became SEBI Chairperson in March 2022, SEBI has introduced several REIT legislations that notably benefit Blackstone, where her husband is employed.

Madhabi Buch currently holds a 99% stake in Agora Advisory, an Indian consulting firm where her husband, Dhaval Buch, is a director. Established on May 7, 2013, Agora Advisory reported $261,000 in revenue for 2022, which is 4.4 times Buch’s disclosed salary at SEBI.

The company’s business primarily involves consultancy. Unlike the Singaporean firm, Agora Advisory’s financial details are more transparent.

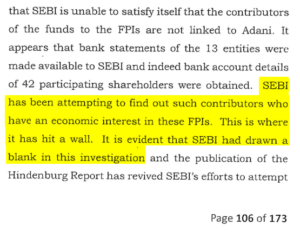

The Supreme Court remarked that SEBI had “hit a wall” in its investigation into the funding sources of Adani’s offshore shareholders. It appears SEBI struggled to uncover who funded these entities.

The Court observed that while SEBI acknowledged concerns about the origins of these offshore funds, “it is clear that SEBI has drawn a blank in this investigation.”

In light of this, it seems unsurprising that SEBI might have been hesitant to pursue a lead that could have implicated its own chairperson.

SEBI Chief Madhabi Puri Buch said:

“We strongly reject the false claims and implications made in the Hindenburg Report dated August 10, 2024. These allegations are completely untrue. Our financial records are transparent, and we’ve provided all required information to SEBI over the years. We are ready to share any and all financial documents with any authority that requests them, including those from when we were private citizens. We will release a detailed statement soon for full transparency. It’s disappointing that Hindenburg Research, which SEBI has already taken action against, is now trying to damage our reputation in response.”

Madhabi Puri Buch

Dhaval Buch

Adani Group Denounces Hindenburg’s Allegations as Malicious and Rehashed

The Adani Group has dismissed the latest allegations from Hindenburg Research as “malicious,” “mischievous,” and “manipulative.” The company criticized these claims as a rehash of previously debunked accusations that were thoroughly reviewed and rejected by the Supreme Court in March 2023.

In a statement released on August 11, an Adani Group spokesperson emphasized that their overseas holding structure is completely transparent, with all relevant details consistently disclosed in public documents. The spokesperson also clarified that Anil Ahuja, who was a nominee director for the 3i investment fund in Adani Power from 2007 to 2008 and served as a director of Adani Enterprises until 2017, currently has no commercial ties to the issues or individuals mentioned in Hindenburg’s report.

Blackstone Clarifies Dhaval Buch’s Role Excludes REITs and Capital Markets

Blackstone has issued a statement clarifying that Dhaval Buch, who has been a Senior Advisor to Blackstone Private Equity since 2019, is not associated with the firm’s Real Estate Investment Trusts (REITs) or any capital market activities.

The firm emphasized that Buch’s role, which began before his wife Madhabi Puri Buch became SEBI Chairperson, is strictly focused on advising private equity companies in Asia on procurement and supply chain matters. His involvement does not extend to real estate, REITs, or regulatory issues. Buch’s appointment was based on his extensive experience as the former Chief Procurement Officer at Unilever, following a series of interviews.

360 One WAM response to the Hindenburg Report is as follows:

The IPE-Plus Fund 1, which was fully compliant and regulated, was launched in October 2013 and operated until October 2019.

The fund did not invest in Adani Group shares, either directly or indirectly.

At its highest, the fund’s assets under management (AUM) reached approximately $48 million, with over 90% invested in bonds.

It was managed as a discretionary fund, meaning investors had no involvement in its operations.

Madhabi and Dhaval Buch’s holdings in the fund were under 1.5% of the total inflow.

The other claims made in the report are repetitive and have been adequately addressed previously.

All funds are fully compliant with applicable regulations.

AMFI Defends Buch and Reaffirms Confidence in India’s Financial System

AMFI responded to comments about Buch by saying these remarks are trying to undermine his contributions to India’s capital markets.

They warned that such statements, lacking proper context, could create distrust and slow down economic progress.

AMFI assured both local and international investors that India’s financial system is secure, transparent, and committed to growth and innovation.

They emphasized the strength of the market and encouraged everyone to stay confident and keep participating in India’s economic development.

Update

The Financial Services Commission of Mauritius clarified on Tuesday that the offshore funds named in Hindenburg Research’s August 10, 2024 report are not based in Mauritius.

The FSC stressed that it does not permit shell companies and emphasized that “IPE Plus Fund” and “IPE Plus Fund 1,” mentioned in the report, are neither registered with nor domiciled in Mauritius.

The FSC denied any links between the funds and the country.

Disclaimer: All information provided is derived from the Hindenburg report, which has been summarized here. For comprehensive details, please refer to the full report.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment