In a major crackdown on stock market manipulation, the Securities and Exchange Board of India (SEBI) has barred Bollywood actor Arshad Warsi, his wife Maria Goretti, and 57 other individuals from the securities market for a period ranging from 1 to 5 years. The case involves the misuse of YouTube videos to artificially pump the stock price of Sadhna Broadcast Ltd, now known as Crystal Business Systems Ltd.

What is the Sadhna Broadcast Stock Manipulation Case?

SEBI’s investigation uncovered a well-planned “pump and dump” scheme involving misleading stock tips shared via popular YouTube channels. These videos presented Sadhna Broadcast as a multi-bagger stock opportunity, luring retail investors into buying the stock at inflated prices.

The videos were part of a larger conspiracy where insiders first artificially increased the stock price through low-volume trades and then dumped their holdings after creating fake market interest.

Why Arshad Warsi and Others Were Banned

SEBI found that Arshad Warsi and his wife Maria Goretti participated in the scheme by profiting from this manipulation:

Arshad Warsi made Rs 41.70 lakh in illegal gains

Maria Goretti made Rs 50.35 lakh

Both were fined Rs 5 lakh each

The total illegal gain across all 59 individuals was approximately Rs 58.01 crore, which now must be returned with 12% annual interest, as per SEBI’s final order.

Who Were the Masterminds?

According to SEBI’s detailed 109-page final report, the masterminds behind the scheme were:

Gaurav Gupta

Rakesh Kumar Gupta

Manish Mishra

Other Key Participants:

Subhash Aggarwal: Director at the registrar of Sadhna Broadcast, acted as a middleman

Peeyush Agarwal: Dealer at stockbroker ‘Choice’, allowed use of trading accounts

Lokesh Shah: Owner of Delhi franchise of a stockbroker, also allowed misuse of trading accounts

Jatin Shah: Played a leading role in executing the fraud

These individuals and their associates either carried out or facilitated the fake trades and misleading campaigns.

How Was the Fraud Executed?

SEBI explained the scam was carried out in two coordinated phases:

Phase 1: Inflating the Share Price

Promoter-linked entities traded shares among themselves

Due to low liquidity in Sadhna Broadcast stock, even small trades caused large price movements

This artificially boosted the price and gave a false sense of demand

Phase 2: YouTube Propaganda

Misleading videos were uploaded on YouTube channels like:

Moneywise

The Advisor

Profit Yatra

These channels were operated by Manish Mishra and promoted Sadhna Broadcast as a strong buy, claiming it would multiply investor wealth. These videos coincided with artificial price surges, encouraging public investment at inflated prices.

Timeline of Events and SEBI Action

March–November 2022: Period of manipulation

July–September 2022: SEBI received multiple complaints about fake YouTube videos and price manipulation

March 2, 2023: SEBI issued an interim order barring 31 individuals

May 29, 2025: Final order issued banning a total of 59 individuals

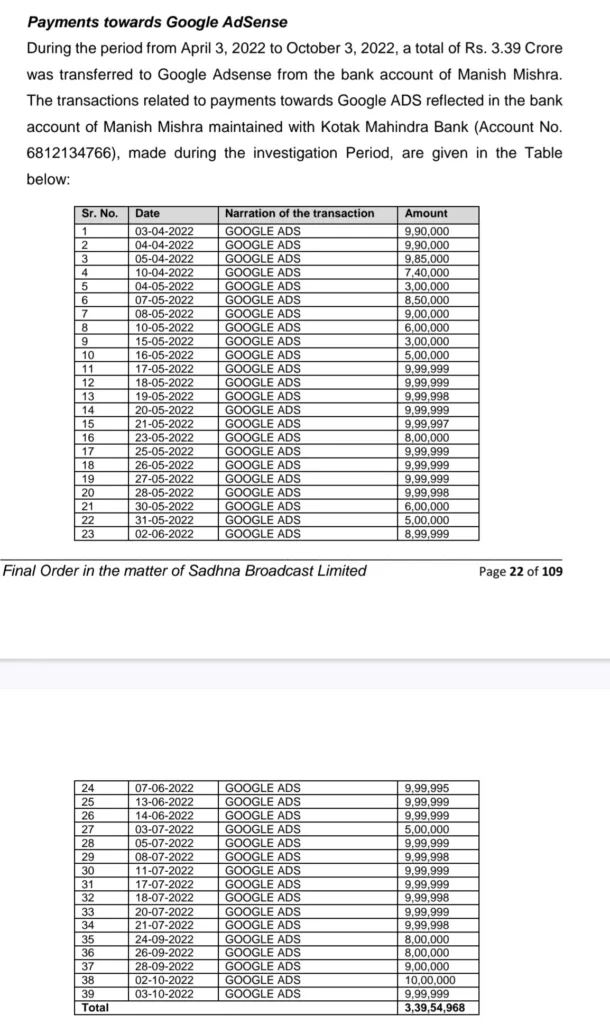

Summary of Transactions to Google AdSense (April 3, 2022 – October 3, 2022)

During the investigation period from April 3, 2022 to October 3, 2022, a total of Rs. 3.39 crore was transferred to Google AdSense from the Kotak Mahindra Bank account held by Manish Mishra. These transactions were related to payments made towards Google Ads, as reflected in the bank records.

What This Means for Investors and the Market

This case is a strong warning from SEBI against:

Stock manipulation via social media platforms

Misuse of celebrity influence in financial markets

Spreading false financial advice to trap retail investors

SEBI’s action highlights a growing trend where social media platforms like YouTube are being used to commit financial fraud, and it’s also a clear message that even celebrities will not be spared.

What Can Investors Learn?

1. Verify Before You Invest: Don’t rely solely on YouTube tips or celebrity endorsements

2. Check Stock Fundamentals: Analyze company earnings, revenue, and balance sheets

3. Look for Red Flags:

Sudden price spikes in low-volume stocks

Excessive online hype

Lack of institutional participation

4. Trust Registered Advisors Only: Always follow SEBI-registered advisors or research analysts

Conclusion

The Sadhna Broadcast scam is one of the most high-profile examples of how digital platforms can be misused for market manipulation. SEBI’s strong enforcement sends a clear message that no one is above the law, and efforts to mislead retail investors will be punished — whether you’re a promoter, broker, or Bollywood celebrity.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

One Comment