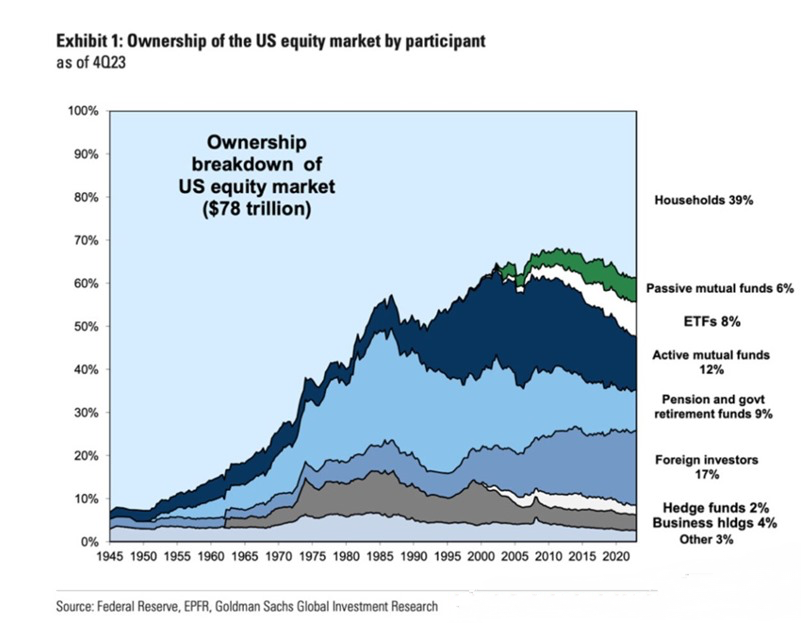

The ownership stake of US households in the equity market has surged to 39% of the total $78 trillion, a notable increase from approximately 30% recorded in 2010.

Three decades ago, US households held about 50% of the equity market share, but this figure has steadily declined over time, reaching its lowest point during the 2000 Dot-com bubble. However, recent trends show a resurgence, with the current household ownership at its highest since that period.

Concurrently, investment funds and foreign investors have also significantly ramped up their ownership of US stocks.

Over the past 25 years, foreign investors have expanded their share of US stock ownership by more than 10%, indicating a growing interest in American equities.

The collective involvement of households, investment funds, and foreign investors underscores a widespread enthusiasm for US equities.

The prevailing sentiment toward US stocks can be described as euphoric, with stakeholders across various sectors demonstrating heightened optimism.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment