Domestic institutional investors (DIIs) have aggressively bought shares in the stock market, investing over Rs 4,04,593 crore so far this year, hitting a record milestone as of October 16, 2024.

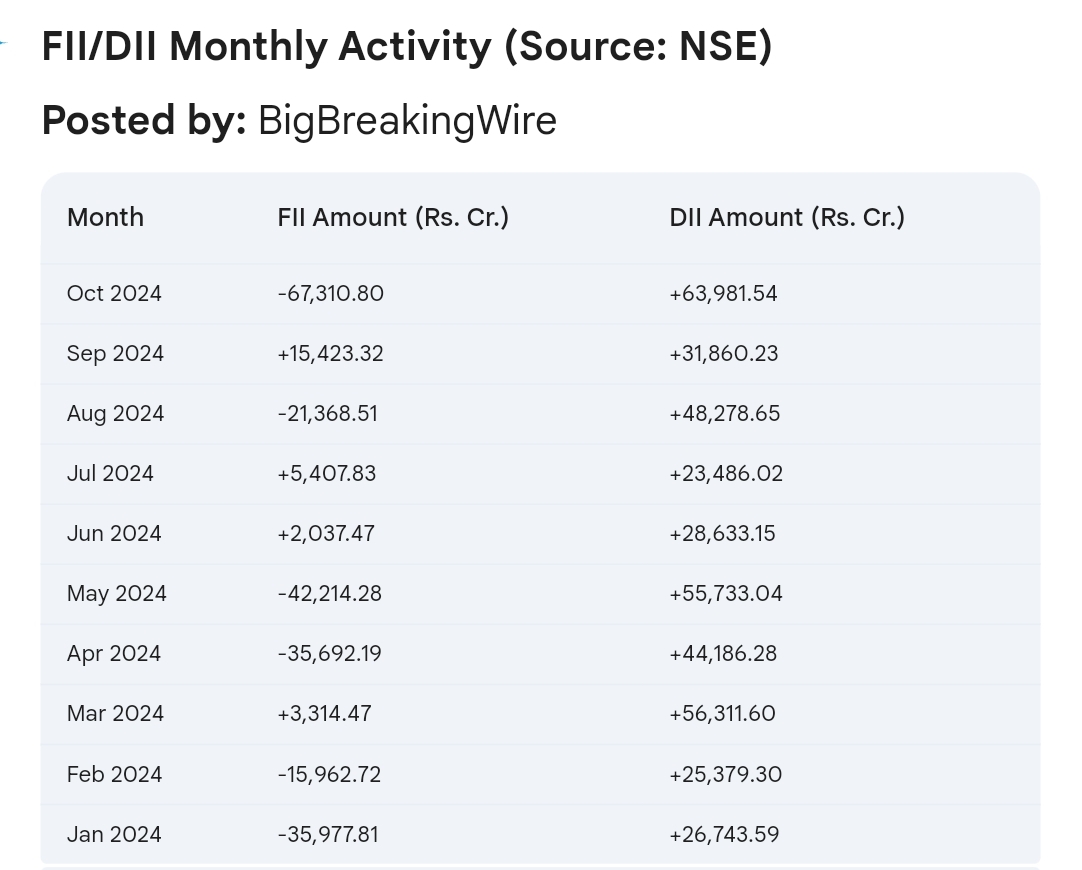

The first trillion rupees of DII investments was reached in 57 trading sessions, the second trillion in 40 sessions, the third trillion in 60 sessions, and the fourth trillion in just 31 sessions. In October, DIIs invested more than Rs 63,981 crore, marking the highest monthly inflow ever, even as foreign investors sold a similar amount of equities. So far in October, mutual funds have invested Rs 23,300 crore in equities, compared to DIIs’ investment of around Rs 63,981 crore. Meanwhile, foreign portfolio investors (FPIs) experienced a net outflow of over Rs 67,310 crore. This also represents the 15th consecutive month of net buying by DIIs.

In contrast, foreign institutional investors (FIIs) have sold around Rs 1,92,343 crore in Indian equities this year. In October, FIIs sold approximately Rs 67,310 crore due to geopolitical tensions and weak Q2 corporate earnings, leading some to speculate that they may continue to exit the Indian market as Chinese and Hong Kong stocks gain momentum following economic stimulus measures.

Additionally Reserve Bank of India’s Financial Markets Regulation Department (FMRD) has informally talked with banks, especially foreign ones, about ending their overseas trading positions in Indian debt markets.

From September 2023 to June 2024, $10 billion flowed into Indian debt, with 20-25% of that coming through Total Return Swap (TRS) instruments.

As of October 11, 2024, foreign portfolio investor (FPI) holdings in Foreign Currency Convertible Bonds (FAR) decreased by ₹1,675.25 crore to ₹2.48 lakh crore. There was only a slight increase of ₹47.5 crore from September 30 to October 15.

To match the $2-2.5 billion seen in the last three months, monthly inflows need to rise significantly over the remaining 11 trading days.

LIC plans to invest Rs 1.30 lakh crore in equities this financial year. In Q1 FY 2025, it invested Rs 38,000 crore in shares, up from Rs 23,300 crore last year. As of June 30, 2024, LIC’s AUM reached Rs 53.59 lakh crore.

Global P/E Ratios by Country, Indian market tops the rank with 26.85, China P/E at 10.

Update (October 17, 2024)

In the past 14 trading sessions, foreign investors have sold more than Rs 85,700 crore worth of Indian stocks, according to provisional data from the National Stock Exchange.

Meanwhile, domestic institutions are still buying stocks whenever foreign investors sell. Over the same period, domestic investors have purchased nearly Rs 82,500 crore worth of stocks.

So far this year, domestic institutions have invested over Rs 4 lakh crore into Indian stocks, setting a new record. This is much higher than the total inflow of Rs 1.73 lakh crore for the entire year of 2023.

Global investors have sold Rs 41,150.2 crore worth of stocks in the secondary market, but they’ve bought Rs 71,361.1 crore worth of stocks through IPOs, qualified institutional placements, and other primary market offerings.

Update (22nd October, 2024)

Foreign investors have withdrawn a record amount of money from the Indian stock market in October, continuing a streak of selling due to concerns about high stock valuations. Foreign institutional investors have sold for 16 consecutive days, offloading nearly ₹93,500 crore since September 27, according to provisional data from the NSE.

In October alone, global funds have sold nearly ₹82,500 crore, marking the highest outflow in a single month. The previous record for monthly outflows was ₹61,973 crore during the Covid-19 selloff in March 2020.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment